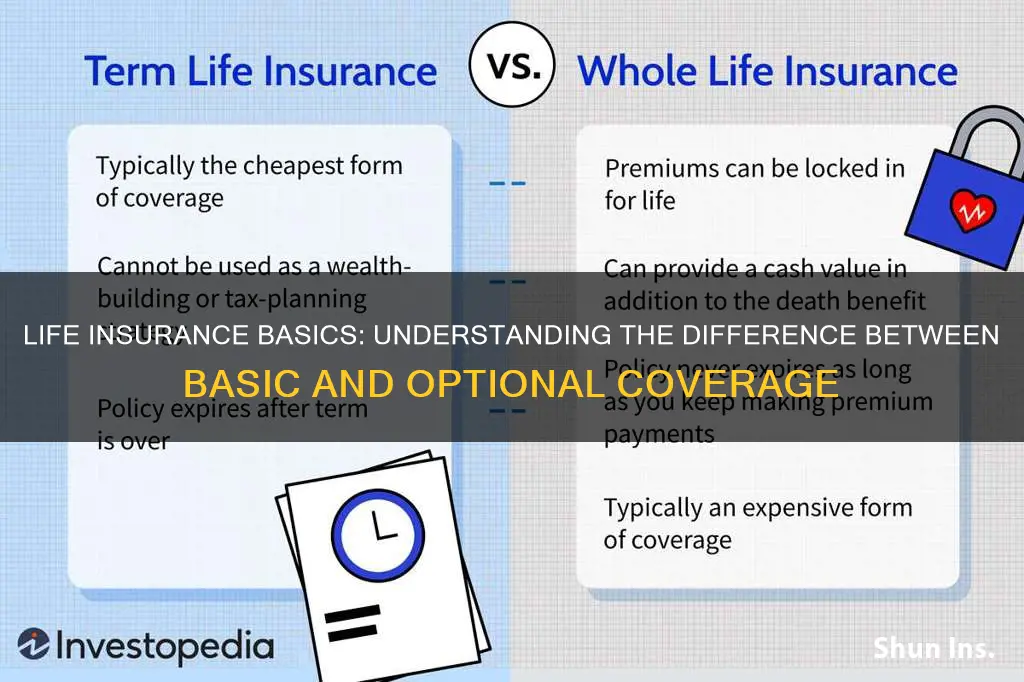

Life insurance is a crucial financial tool that provides financial security for loved ones in the event of the insured's death. When considering life insurance, it's essential to understand the difference between basic and optional coverage. Basic life insurance, also known as term life insurance, offers a straightforward and cost-effective solution for a specific period, typically 10, 20, or 30 years. It provides a fixed death benefit if the insured passes away during the term. On the other hand, optional life insurance, such as permanent life insurance (e.g., whole life or universal life), offers lifelong coverage and includes a cash value component that can be borrowed against or withdrawn. This type of policy provides a death benefit and a savings element, allowing policyholders to build equity over time. Understanding these differences is vital for individuals to choose the right insurance plan that aligns with their financial goals and long-term needs.

| Characteristics | Values |

|---|---|

| Definition | Basic life insurance provides a death benefit to the policyholder's beneficiaries upon their passing. It is a fundamental form of coverage that ensures financial security for loved ones. Optional life insurance, on the other hand, offers additional benefits and flexibility beyond the standard policy. |

| Coverage Amount | Typically, basic life insurance policies have a fixed coverage amount, which is agreed upon at the time of purchase. This amount is usually determined by the policyholder's needs and financial goals. Optional riders or riders can be added to increase the coverage amount, providing more comprehensive protection. |

| Flexibility | Basic life insurance plans are generally straightforward and standardized, with limited customization options. Optional life insurance, however, allows for more personalized coverage. This includes the ability to add or remove riders, adjust coverage amounts, and tailor the policy to specific needs. |

| Cost | The cost of basic life insurance is generally more affordable and consistent, as it follows a standard rate structure. Optional life insurance can be more expensive due to the additional benefits and customization, which may include higher premiums for increased coverage or rider benefits. |

| Riders | Basic policies do not typically include optional riders, which are additional benefits that can be added to enhance coverage. Optional life insurance policies often come with various riders, such as accidental death benefit riders, waiver of premium riders, or critical illness riders, providing extra financial protection. |

| Term Length | Basic life insurance is often offered in various term lengths, such as 10, 20, or 30 years, allowing policyholders to choose a duration that aligns with their financial goals. Optional life insurance may also offer flexible term lengths, and some riders can be added to extend the coverage period. |

| Investment Component | Basic life insurance policies may or may not include an investment component, allowing policyholders to grow their money over time. Optional life insurance, especially those offered by some insurance companies, may have integrated investment features, providing both insurance and investment benefits. |

| Tax Advantages | Both basic and optional life insurance policies offer tax advantages, such as tax-deductible premiums and tax-deferred growth of cash value (if applicable). However, the specific tax benefits may vary depending on the policy type and jurisdiction. |

| Medical Exam Requirements | Basic life insurance policies often require a standard medical exam, while optional life insurance may have more flexible underwriting, allowing for simplified or no medical exams in some cases. |

What You'll Learn

- Coverage Duration: Basic insurance offers long-term coverage, while optional plans may have shorter terms

- Cost: Basic policies are typically more affordable, with optional plans often being more expensive

- Flexibility: Optional insurance provides more customization options, allowing for tailored coverage

- Benefits: Basic plans offer standard benefits, whereas optional plans may include additional features

- Term Length: Basic insurance is usually for longer periods, while optional plans may be for shorter terms

Coverage Duration: Basic insurance offers long-term coverage, while optional plans may have shorter terms

When it comes to life insurance, understanding the difference between basic and optional coverage is crucial for making informed financial decisions. One of the key distinctions lies in the duration of coverage provided by these two types of insurance.

Basic life insurance is designed to offer long-term financial protection. This type of policy typically provides coverage for an extended period, often for the entire duration of the policyholder's life. The primary purpose is to ensure that the beneficiary receives a death benefit in the event of the insured individual's passing. Basic insurance is a fundamental safety net, providing peace of mind and financial security to the policyholder's family or designated recipients. It is a long-term commitment, often with a fixed premium and a guaranteed payout, making it a reliable choice for those seeking consistent coverage.

On the other hand, optional life insurance plans offer more flexibility in terms of coverage duration. These plans may have shorter-term coverage options, allowing policyholders to choose a period that aligns with their specific needs. Optional insurance can be tailored to provide coverage for a specific period, such as a certain number of years, and may include features like term life insurance or decreasing term insurance. This flexibility is advantageous for individuals who want more control over their insurance coverage and may not require long-term protection. For instance, a young professional might opt for a 10-year term life insurance policy to cover a specific financial responsibility, such as a mortgage, and then adjust their coverage as their circumstances change.

The choice between basic and optional life insurance depends on an individual's unique circumstances and financial goals. Basic insurance provides a solid foundation of long-term protection, ensuring that beneficiaries are cared for over an extended period. In contrast, optional plans offer customization, allowing policyholders to manage their coverage more proactively. Understanding these differences empowers individuals to make informed decisions about their life insurance needs, ensuring they have the right level of protection tailored to their specific requirements.

New York Life: Health Insurance Options and Availability

You may want to see also

Cost: Basic policies are typically more affordable, with optional plans often being more expensive

When considering life insurance, understanding the cost implications of basic and optional policies is crucial. Basic life insurance policies are generally more affordable and offer a straightforward approach to coverage. These policies provide a fixed amount of death benefit, ensuring that the beneficiary receives the insured amount upon the insured individual's passing. The simplicity of basic policies often translates to lower premiums, making them an attractive option for those seeking cost-effective coverage. This type of insurance is ideal for individuals who want a basic level of protection without the added complexity and potential costs associated with optional features.

In contrast, optional life insurance plans come with a range of additional benefits and features, which typically result in higher costs. These optional policies may include riders or add-ons that provide extra coverage, such as accelerated death benefits, long-term care, or critical illness insurance. While these optional features can provide enhanced protection and peace of mind, they also increase the overall price of the policy. The cost of optional life insurance is often significantly higher than basic policies, as it caters to a more personalized and comprehensive insurance experience.

The affordability of basic life insurance is a significant advantage, especially for those on a budget or with limited financial resources. These policies offer a simple and cost-effective way to secure financial protection for one's loved ones. With basic insurance, individuals can ensure that their family's financial needs are met without incurring substantial expenses. This makes it an excellent choice for young families, individuals starting their careers, or anyone seeking a basic safety net without breaking the bank.

On the other hand, optional life insurance is designed to cater to specific needs and preferences, often at a higher price point. The increased cost is justified by the additional benefits and flexibility it provides. For instance, an accelerated death benefit rider allows policyholders to access a portion of their death benefit early if they are diagnosed with a terminal illness, providing financial support during challenging times. Similarly, long-term care insurance can offer financial assistance for extended care needs, which may not be covered by basic policies. These optional features are valuable for individuals who want comprehensive coverage and are willing to invest more to ensure their insurance plan aligns with their unique circumstances.

In summary, the cost difference between basic and optional life insurance is a key factor in decision-making. Basic policies offer simplicity and affordability, making them accessible to a wide range of individuals. Optional plans, while providing enhanced coverage, come with a higher price tag, reflecting the additional benefits and customization they offer. Understanding these cost implications allows individuals to make informed choices, ensuring they select a life insurance policy that aligns with their financial goals and risk tolerance.

Whole Life Insurance: Guaranteed Issue, Explained

You may want to see also

Flexibility: Optional insurance provides more customization options, allowing for tailored coverage

When it comes to life insurance, there are two main types: basic and optional. While basic life insurance provides a standard level of coverage, optional insurance offers a higher degree of flexibility and customization. This means that policyholders can tailor their insurance plans to better suit their individual needs and circumstances.

One of the key advantages of optional insurance is the ability to customize the coverage amount. With basic life insurance, the coverage is typically fixed and predetermined by the insurance company. However, with optional insurance, policyholders can choose the exact amount of coverage they want. This allows individuals to ensure that their loved ones are adequately protected in the event of their passing, without paying for unnecessary coverage. For example, someone with a large family and significant financial responsibilities might opt for a higher coverage amount to provide comprehensive financial security.

In addition to coverage amount, optional insurance also offers flexibility in terms of policy duration. Basic life insurance plans often have standard term lengths, such as 10, 20, or 30 years. Optional insurance, on the other hand, allows policyholders to choose the term length that best fits their needs. This could mean selecting a longer term to provide coverage for a significant portion of one's life or opting for a shorter term if the individual believes they will have reduced financial obligations in the future.

Furthermore, optional insurance provides the option to add or remove riders and benefits. Riders are additional features or enhancements that can be attached to the base policy, providing extra coverage or benefits. For instance, a critical illness rider can provide financial assistance if the insured person is diagnosed with a serious illness, while a waiver of premium rider ensures that the policy remains in force even if the insured individual becomes unable to make payments. By customizing their policy with these riders, individuals can create a more comprehensive and personalized insurance plan.

The flexibility offered by optional insurance allows individuals to make informed decisions based on their unique circumstances. It empowers policyholders to take control of their financial security and ensure that their life insurance coverage is tailored to their specific needs. Whether it's adjusting the coverage amount, choosing the term length, or adding riders, optional insurance provides a level of customization that basic life insurance plans may not offer. This flexibility can result in a more satisfying and effective insurance experience for those seeking a more personalized approach to protecting their loved ones.

Whole Life Insurance: Beyond Accidental Death Benefits

You may want to see also

Benefits: Basic plans offer standard benefits, whereas optional plans may include additional features

When it comes to life insurance, understanding the differences between basic and optional plans is crucial for making an informed decision. One of the primary distinctions lies in the benefits provided by each type of policy. Basic life insurance plans typically offer standard coverage, which generally includes a death benefit payable to the policyholder's beneficiaries upon their passing. This standard benefit is designed to provide financial security to the loved ones left behind, ensuring they have the necessary support during a difficult time. The primary purpose of this coverage is to replace the income lost due to the policyholder's death and to cover any outstanding debts or expenses.

On the other hand, optional life insurance plans take the standard benefits a step further by offering additional features and customization options. These optional benefits can vary widely depending on the insurance provider and the specific policy chosen. For instance, some optional plans may include accelerated death benefits, allowing the policyholder to access a portion of the death benefit if they are diagnosed with a terminal illness, providing financial relief without having to endure the full course of a terminal condition. Other optional features could be waiver of premium, where the insurance company waives the policy premium payments if the insured becomes disabled, ensuring the policy remains in force even if the insured cannot work.

Optional plans may also offer critical illness insurance, which provides a lump-sum payment if the insured is diagnosed with a critical illness, such as cancer or a heart attack. This additional benefit can help cover medical expenses, lost income, and other related costs associated with a serious illness. Furthermore, some optional life insurance policies include long-term care benefits, which can be crucial for individuals who may require extended care in the future, ensuring they have the financial resources to access quality care.

The key advantage of optional life insurance is the flexibility it provides. Policyholders can tailor their coverage to their specific needs and preferences, ensuring they receive the benefits that matter most to them. This customization can be particularly valuable for individuals with unique financial goals or those who want to ensure their loved ones are adequately protected in various scenarios. By understanding the benefits of basic and optional life insurance plans, individuals can make a well-informed decision about which type of coverage best suits their circumstances and provides the necessary financial security for their future.

Life Insurance: Pre-Diagnosis Purchase Possibility

You may want to see also

Term Length: Basic insurance is usually for longer periods, while optional plans may be for shorter terms

When considering life insurance, understanding the term length is crucial as it determines the duration for which the policy provides coverage. Basic life insurance, often referred to as traditional or permanent life insurance, is typically designed to offer long-term financial protection. This type of insurance is structured to provide coverage for the entire life of the insured individual, hence the term "permanent." It ensures that beneficiaries receive a death benefit for as long as the policy remains in force, providing a sense of security and financial stability for the loved ones left behind.

On the other hand, optional life insurance plans, such as term life insurance, offer coverage for a specific period or "term." This term can vary widely, ranging from a few years to several decades. The beauty of term life insurance is its flexibility, allowing individuals to choose a term length that aligns with their specific needs and circumstances. For instance, a young professional might opt for a 10-year term to cover potential financial obligations like a mortgage or children's education, while a homeowner approaching retirement might choose a 20-year term to ensure long-term protection for their family.

The key difference in term length between basic and optional life insurance is that basic insurance, like permanent life insurance, provides coverage for the entire life of the insured, ensuring long-term financial security. In contrast, optional plans, particularly term life insurance, offer more flexibility in term length, allowing individuals to tailor the coverage to their unique situations and financial goals. This flexibility is a significant advantage, as it enables policyholders to adjust their insurance needs as their lives change over time.

When deciding on a life insurance policy, it's essential to consider your long-term financial goals and obligations. Basic life insurance, with its permanent coverage, is ideal for those seeking long-term financial protection and the peace of mind that comes with knowing their loved ones will be taken care of indefinitely. Optional plans, especially term life insurance, offer a more adaptable solution, providing coverage for specific periods to address immediate financial concerns.

In summary, the term length is a critical aspect that distinguishes basic from optional life insurance. Basic insurance provides long-term coverage, ensuring financial security for the entire life of the insured. Optional plans, particularly term life insurance, offer flexibility in term length, allowing individuals to choose coverage that aligns with their current and future needs. Understanding these differences can help individuals make informed decisions when selecting a life insurance policy that best suits their unique circumstances.

Uncover the Benefits: Understanding Employee Voluntary Life Insurance

You may want to see also

Frequently asked questions

Basic life insurance, also known as term life, provides coverage for a specific period, typically 10, 20, or 30 years. It offers a straightforward death benefit to the policyholder's beneficiaries if the insured person passes away during the term. Optional life insurance, on the other hand, is a type of permanent life insurance that provides coverage for the entire life of the insured individual. It offers a death benefit and also includes an investment component, allowing the policy to accumulate cash value over time.

The cost of basic life insurance is generally lower compared to optional life insurance. Term life insurance is designed for short-term needs and is often more affordable because it doesn't include the investment aspect. Optional life insurance, with its permanent nature and the potential for cash value accumulation, typically has higher premiums. The cost can vary based on factors like age, health, and the amount of coverage chosen.

Yes, many term life insurance policies offer conversion options. If you have a basic life insurance policy and decide you want the long-term benefits of optional life insurance, you can typically convert it. This process involves notifying your insurance provider and may require a medical examination, especially if you're converting to a higher coverage amount.

Basic life insurance policies generally do not offer tax-deductible premiums, but the death benefit received by beneficiaries is tax-free. Optional life insurance, being a permanent policy, may provide tax advantages. The cash value accumulation can grow tax-deferred, and withdrawals or loans against the policy's cash value may be tax-free if used for qualified expenses. However, it's essential to consult a tax advisor for specific guidance.

Basic life insurance is straightforward and focuses on providing financial protection to beneficiaries. Optional life insurance, in addition to the death benefit, offers features like flexible premium payments, the ability to increase coverage over time, and the potential for loan or withdrawal options. These policies may also include riders or additional benefits, such as critical illness coverage or accidental death benefits, depending on the provider and policy type.