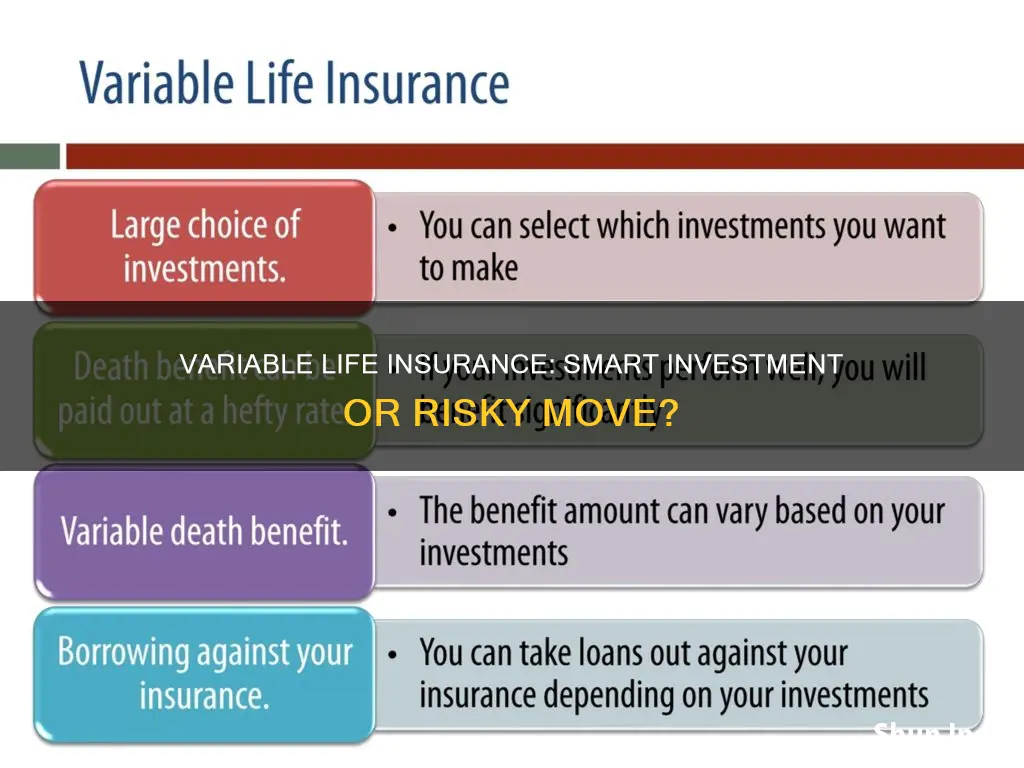

Variable life insurance is a permanent life insurance policy with a cash value account that you can decide how to invest. It is also called variable appreciable life insurance. Variable life insurance policies are permanent and have a higher potential for earning cash compared to traditional policies. This is because you get to decide how to invest the cash value. However, these policies are complex, require more attention, come with risk, and typically have higher premiums than other cash value life insurance policies.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance policy with a death benefit and cash value |

| Investment options | Mutual funds, bonds, stocks, fixed accounts |

| Risk | More volatile and higher risk compared to other life insurance policies |

| Tax advantages | Returns on variable policies are tax-free |

| Fees | Higher fees compared to other life insurance policies |

| Complexity | Requires active management and is more complex than other life insurance policies |

| Coverage | Lifelong coverage |

| Flexibility | Flexible premium and death benefit options |

| Cash value growth | Potential for higher cash value growth compared to other life insurance policies |

| Suitability | Best suited for those who want lifelong coverage and are willing to take on additional risk |

What You'll Learn

Variable life insurance: pros and cons

Variable life insurance, also called variable appreciable life insurance, is a type of permanent life insurance policy that provides lifelong coverage and a cash value account that the policyholder decides how to invest. Variable universal life insurance is a type of variable life insurance that offers some flexibility in premium payments.

Pros

Variable life insurance has several advantages:

- Death benefit: The death benefit is often income tax-free, allowing beneficiaries to receive a financial payout without incurring taxes.

- Tax-deferred growth: The cash value of the policy can grow tax-deferred, potentially resulting in greater returns over time.

- Flexible premium payments: Variable universal life insurance offers flexibility in adjusting the amount and timing of premium payments within certain limits.

- Adjustable coverage amount: The size of the death benefit may be adjustable, allowing policyholders to increase or decrease the coverage amount based on their needs and financial situation.

- Investment options: Variable life insurance provides a range of investment options, allowing policyholders to choose how to allocate their cash value, which can lead to higher returns compared to traditional policies.

Cons

Despite the benefits, variable life insurance also has several drawbacks:

- Complexity: Variable life insurance policies are more complex than term and whole life policies, requiring a deeper understanding of the product and financial advice to make informed decisions.

- Higher premiums: Variable life insurance policies typically have higher premiums than other types of life insurance, including whole life and term life policies.

- Long-term commitment: These policies are designed for long-term financial goals and may not be suitable for those who cannot commit to long-term funding.

- Market risk: The cash value of variable life insurance policies is subject to market risk. Poor investment performance can lead to a decrease in cash value and even a loss of the initial investment.

- Fees and charges: Variable life insurance policies tend to have higher fees and charges, including mortality and expense risk charges, sales and administrative fees, and investment management fees.

- Surrender charges: Withdrawing part of the cash value or surrendering the policy during the early years of the contract may result in surrender charges and fees.

Life Insurance for Parents: A Guide for Adult Children

You may want to see also

Variable universal life insurance: what it is and how it works

Variable universal life insurance is a type of permanent life insurance policy that offers lifelong coverage and a cash value account that can be invested to grow the value of the policy. It is a hybrid of traditional life insurance and an investment vehicle, providing both a death benefit and the potential for cash value growth through investments.

How It Works

Variable universal life insurance combines the features of a variable life policy with elements of a universal life insurance policy. It offers flexible premium payments and a death benefit that can be adjusted within certain limits. The policy includes a cash value component that can be invested in various options, such as mutual funds, stocks, or bonds. The performance of these investments will impact the value of the policy over time.

Key Elements

- Death Benefit: The death benefit amount can be changed throughout the policy, allowing for flexibility as life circumstances change. The policy premiums will adjust accordingly, becoming more expensive as the death benefit rises and less expensive as it decreases.

- Sub-accounts: The cash value of the policy can be invested in "sub-accounts," which are approved investment vehicles, typically mutual funds. Fixed sub-accounts provide a guaranteed rate of return for more risk-averse policyholders.

- Premium Payments: Variable universal life insurance allows for flexible premium payments. Paying a greater premium will increase the policy's cash value, while paying the minimum amount may lead to a decrease in cash value.

- Loans and Withdrawals: Policyholders can take out loans or withdrawals against the policy's cash value. These transactions are typically tax-free, but they can reduce the cash value and, if not repaid, may decrease the death benefit.

- Riders: Variable universal life insurance policies often offer optional riders, such as disability coverage or long-term care insurance, for an additional cost.

- Tax Implications: The cash value growth in a variable universal life insurance policy is tax-deferred, and withdrawals from the policy may be subject to income tax.

- Complexity and Risk: These policies are considered more complex than traditional life insurance and carry more risk due to the potential for investment losses. Policyholders need to actively manage their investments and monitor the policy to avoid lapses.

Who Is It Good For?

Variable universal life insurance is suitable for individuals who want lifelong coverage and are willing to take an active role in managing their life insurance investments. It is best suited for those who can afford to absorb potential losses and are comfortable with the associated risks.

Life Insurance Options for People with Ulcerative Colitis

You may want to see also

Who is variable universal life insurance best for?

Variable universal life insurance is best for those who want lifelong coverage and are willing to take an active role in their life insurance investments. It is also best for people who can afford to absorb losses if the underlying investments don't perform as expected, such as those with considerable wealth.

Variable universal life insurance is also best for those who want more potential growth in their cash value and are comfortable with risk. It is also suitable for those who want to use the policies to provide extra retirement income by taking out loans against the cash value.

Variable universal life insurance can be a good fit for those who want to take advantage of the tax benefits of the policy. The returns on variable policies can provide tax-free income, and the growth of the cash value account isn't taxable as ordinary income.

However, it's important to note that variable universal life insurance is not suitable for everyone. It carries more risk compared to other life insurance policies, and the fees tend to be higher. It is also more complex and requires hands-on attention. Therefore, it may not be the best option for those who want a life insurance policy that they don't have to actively manage.

Life Insurance and Age: Do Payouts Decrease Over Time?

You may want to see also

Variable universal life insurance: advantages and disadvantages

Variable universal life insurance is a type of permanent life insurance that offers lifelong coverage and a cash value account that can be invested to grow the value of the policy. It is a complex product that involves market risk and is generally designed for long-term financial goals. Here are some of the advantages and disadvantages of variable universal life insurance:

Advantages:

- Death benefit: Variable universal life insurance provides a death benefit that won't decrease as long as the policyholder continues to make their minimum premium payments on time. This benefit is often income tax-free and can help provide financial protection for loved ones.

- Flexible premium payments: Policyholders can adjust the timing and amount of their premium payments within certain limits, allowing for flexibility in managing their finances.

- Potential for higher returns: By investing the cash value component, variable universal life insurance offers the potential for higher returns compared to other types of permanent life insurance.

- Self-directed control: Policyholders can maintain a certain level of control over how their cash value is invested, allowing them to allocate their funds according to their individual risk tolerance.

Disadvantages:

- Risk of loss: The cash value of the policy can decrease due to poor investment performance, and policyholders may experience losses, including the principal amount invested.

- High fees: The fees associated with variable universal life insurance may be higher than those of other types of life insurance, such as universal life insurance.

- Complexity: Variable universal life insurance is more complex than most other forms of life insurance and requires close monitoring throughout the life of the policy.

- Surrender charges: These policies are typically subject to surrender charges for a period of up to 15 years, which can be very high in the early years of the policy.

- Long-term commitment: Variable universal life insurance is designed for long-term financial goals and may not be suitable for those who cannot commit to funding the policy over the long term.

Exchange IRA Money for Life Insurance: A Smart Move?

You may want to see also

Variable life insurance vs. variable universal life insurance

Variable life insurance and variable universal life insurance are types of permanent life insurance policies that offer lifelong coverage and a cash value account that can be invested. However, there are some key differences between the two.

Variable life insurance, also known as variable appreciable life insurance, has a fixed death benefit, which means that the amount paid out to beneficiaries when the policyholder dies is set and does not change. It also has fixed premium payments, which means that the cost of the policy remains the same over its life. Variable life insurance offers more death benefit guarantees than variable universal life insurance.

Variable universal life insurance, on the other hand, has a flexible death benefit and adjustable premium payments. This means that the death benefit can be increased or decreased, and the policyholder can choose to pay higher or lower premiums within certain limits. Variable universal life insurance is more popular than variable life insurance and offers more flexibility and control over the policy.

Both types of policies have their advantages and disadvantages. Variable life insurance may appeal to those who want the security of a fixed death benefit and regular premium payments, while variable universal life insurance may be preferable for those who want more control over their death benefit and premium payments and are comfortable with the associated risks.

Variable life insurance and variable universal life insurance are complex products that carry more risk than other types of life insurance policies. The cash value and death benefit can fluctuate depending on the performance of the underlying investments, and there may be high fees associated with these policies. It is important for potential buyers to carefully consider their options and understand the risks and benefits before purchasing either type of policy.

Whole Life Insurance: Are Payments Worth It?

You may want to see also