Life insurance companies set aside reserve funds to pay out customer claims. These reserves are meant to cover liabilities from claims made on policies that they underwrite. The reserves are based on an estimate of the losses an insurer may face over a period of time. Regulators require that insurance companies put a certain percentage of their total revenue into reserves, with the average being around 10%. This percentage can be higher or lower depending on the financial risk taken on by the company. The reserves are a liability on the balance sheet of the life insurance company owed to beneficiaries.

| Characteristics | Values |

|---|---|

| Whether reserves are needed | Yes |

| What reserves are used for | Paying life insurance claims |

| Whether reserves are a liability | Yes |

| Whether reserves are always paid out | No |

| Whether reserves are always adequate | No |

| Who decides how much is put into reserves | Regulators |

| What reserves are based on | Actuarial projections |

| What the average reserve ratio is | 10% |

What You'll Learn

- Life insurance companies are required to keep a minimum amount of funds to meet policyholders' needs

- Claims reserves are funds set aside for future payments of incurred claims that have not been settled

- Insurance companies set premiums based on risk and other factors, including, at times, gender

- The higher the ratio of loss and loss-adjustment reserves to policyholders' surplus, the more reliant the insurer is on policyholders' surplus to cover liabilities

- Life insurance companies need to be in business for hundreds of years to provide assurance that claims will be paid

Life insurance companies are required to keep a minimum amount of funds to meet policyholders' needs

The funds are usually held in cash or readily marketable securities that can be converted into cash reliably and on short notice. The amount of the reserve is determined by the state in which the insurance company operates, and it is based on a percentage of the potential claims that a company has underwritten. This is known as the reserve ratio. Most states' insurance legal minimum reserve requirements are between 8 and 12 per cent of anticipated claims.

The reserve system functions similarly to a personal savings account. While insurance companies make their profits by investing insureds' premium payments in the market, these investments may not be easily accessible to pay out claims. Therefore, a certain amount of funds must be kept in a more liquid form to ensure the insurance company can meet its obligations.

There are two main approaches to setting the level of statutory reserves: the rules-based approach and the principles-based approach. Under the rules-based approach, insurers are told how much of their premiums they must keep in reserve based on standardised formulas and assumptions. The principles-based approach gives insurers greater flexibility, allowing them to set reserves based on their own experience, such as actuarial statistics and past claims behaviour.

In addition to statutory reserves, insurance companies may also have actuarial reserves, which are reserve requirements based on the actuarial calculations of how likely the insurer is to have to pay out a significant number of claims at once. These are often higher than the state-mandated minimums.

Canceling AAA Life Insurance: A Step-by-Step Guide to Termination

You may want to see also

Claims reserves are funds set aside for future payments of incurred claims that have not been settled

Claims reserves are funds set aside for future payments of incurred claims that have not yet been settled. An insurance company uses these funds to pay out incurred claims that have yet to be settled.

The claims reserve is also known as the balance sheet reserve. It is recorded as a liability on a company's balance sheet, as it is a potential financial obligation to policyholders. The total amount of funds set aside for a claim is the sum of the expected settlement amount and any expenses incurred by the insurer during the settlement process, such as fees for claims adjusters, investigators, and legal assistance.

The amount of money in the claims reserve is based on an actuarial estimate, as the amounts liable on any given claim are not known until settlement. It is challenging for insurance companies to accurately determine the amount to set aside for claims, and regular reviews are necessary to ensure that adequate funds are allocated.

The money for the claims reserve comes from a portion of the premium payments made by policyholders over the course of their insurance contracts. By setting aside these funds, insurance companies can ensure they have sufficient financial resources to meet their obligations to policyholders.

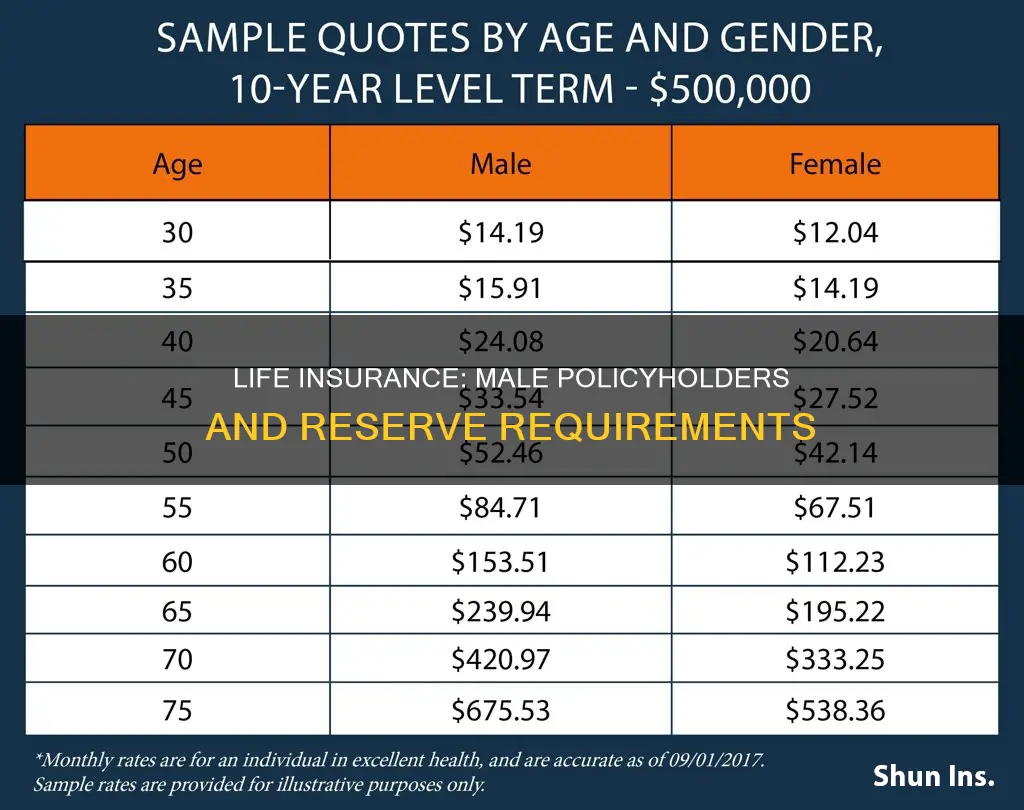

In the context of life insurance, it is worth noting that gender has traditionally been a factor in setting premiums, with men and women often paying different rates. However, this varies by country and state, with some places prohibiting insurers from factoring gender into health, life, and auto insurance premiums.

Level Term Insurance Conversion to Whole Life: Is it Worthwhile?

You may want to see also

Insurance companies set premiums based on risk and other factors, including, at times, gender

Not everyone thinks it is fair for an insurer to charge different prices based on a person's gender. Confronted by policymakers and consumer advocates, insurers of all types, not just auto insurers, have been dealing with this question for decades.

Here's how gender is currently considered for different types of insurance. Men and women tend to pay different rates for all types of insurance, whether regulations allow gender to be factored into premiums or not.

Insurance companies traditionally tie gender to an applicant's risk, so it is often a factor in setting premiums. However, when setting premiums, insurers don't only consider gender. Much depends on the particular type of insurance, past history with insurance companies, individual credit scores, and where the applicant lives.

On average, an individual's age is considered the most reliable predictor of how long they will live. Gender comes in second. Observations in every country going back to at least 1880 have shown that men typically die earlier than women for reasons largely related to genetics and hormones. You can see these differences today in Social Security Administration (SSA) actuarial life tables, which show that a woman who was 40 in 2019 was expected to live about four years longer than a man who was 40.

Life insurance companies look at a host of health factors when they decide whether to charge you their best (super-preferred) rate or a higher rate. Some of these factors are blood sugar levels, nicotine use, liver and kidney function, prescription medications, and medical history. However, life insurance companies sometimes apply different standards of health to male and female applicants when it comes to certain markers of health, particularly blood pressure, cholesterol, and body mass index. These differences can lead to different premiums.

Non-gender-inclusive life insurance pricing in most states can create confusion and anguish for transgender applicants and non-binary applicants who are asked to identify as men or women on an application. To date, insurers do not appear to have all gender identities available for applicants, but they could feasibly charge higher rates based on what is known about the mental and physical health challenges of transgender and non-binary individuals.

Since the end of 2012, European law has prohibited insurers in European Union (EU) member states from factoring gender into health, life, and auto insurance premiums. But this isn't the case in most of the United States, where insurance is largely regulated at the state level. Montana is the only state with a law as broad as the EU's, and it dates back to 1985.

An academic study exploring the impact of Europe's new gender-neutral pricing rules postulated that if 50% of a life insurance company's policyholders were women and 50% were men, the law would cause women to pay higher rates and men to pay lower rates. However, instead of being the average of the old man and woman rates, the new rates would really depend on the percentage of men and women in the life insurance company's portfolio.

The new rates would be adjusted to reflect that specific insurer's risk, given its clientele. Premiums would be higher at companies with more men than women as clients. Women will subsidize men in either case, but women will subsidize men more at some companies than others. Also, insurers might need to charge extra to account for the fact that new, lower rates for men could make life insurance more attractive to them and cause this riskier group to buy more. An insurer that just charged everyone the rate for men would likely lose women customers.

In addition to setting premiums, insurance companies are also required to set aside a certain amount of money as reserves to cover potential liabilities from claims made on policies that they underwrite. The reserves are based on an estimate of the losses an insurer may face over a period of time; this means that the reserves could be adequate, or the reserves may fall short of covering its liabilities. Estimating the amount of reserves that are necessary requires actuarial projections based on the types of policies underwritten.

Life Insurance: Are You Sure You're Covered?

You may want to see also

The higher the ratio of loss and loss-adjustment reserves to policyholders' surplus, the more reliant the insurer is on policyholders' surplus to cover liabilities

The loss and loss-adjustment reserves to policyholders' surplus ratio is a metric used in the insurance industry to assess an insurer's financial health and stability. This ratio indicates the extent to which an insurance company relies on its policyholders' surplus to cover potential liabilities from claims. The higher the ratio, the more reliant the insurer is on the policyholders' surplus, and consequently, the greater the risk of the insurer becoming insolvent.

Insurance companies set aside reserves to cover future liabilities arising from claims made on the policies they underwrite. These reserves are based on estimates of the losses the insurer may incur over a given period. The estimation process involves actuarial projections that take into account the types of policies underwritten. The reserves are intended to ensure that insurers can meet their contractual obligations outlined in the policies.

The loss and loss-adjustment reserves to policyholders' surplus ratio is calculated by dividing the insurer's reserves set aside for unpaid losses and the cost of investigating and adjusting losses by its assets after accounting for liabilities. This ratio is typically expressed as a percentage and helps determine how much risk each dollar of surplus can support.

A high ratio can be a cause for concern and may indicate that an insurer is heavily reliant on its policyholders' surplus to cover liabilities. In such cases, if the number and extent of filed claims exceed the estimated reserves, the insurer may have to utilize their profits or capital to pay out claims, potentially impacting their financial stability.

Regulators closely monitor this ratio as it serves as an indicator of potential solvency issues. According to the National Association of Insurance Commissioners (NAIC), a ratio of less than 200% is generally considered acceptable. However, it is important to note that these ratios can fluctuate significantly from year to year, and a high ratio does not necessarily indicate imminent insolvency.

Regarding the question of whether higher reserves are put in place for male life insurance policyholders, the answer is nuanced. While gender is often considered a factor in setting insurance premiums, it is not the sole determinant. Life insurance companies examine various health factors and apply different standards of health to male and female applicants. Additionally, age is typically considered the most reliable predictor of life expectancy, followed by gender. Men generally have shorter life expectancies than women, which can influence their insurance rates. However, it is worth noting that non-gender-inclusive life insurance pricing can create challenges for transgender and non-binary applicants.

QSuper: Life Insurance Coverage and Your Options

You may want to see also

Life insurance companies need to be in business for hundreds of years to provide assurance that claims will be paid

Life insurance is a contract between an insurance company and a policyholder, where the insurer promises to pay a sum of money to the policyholder's beneficiaries when the insured person dies. The policyholder pays a single premium upfront or regular premiums over time for the life insurance policy to remain in force. The best life insurance companies have good financial strength, low customer complaints, high customer satisfaction, a range of policy types, optional riders, and easy application processes.

Life insurance companies need to be in business for a long time to provide assurance that claims will be paid. Life insurance is valuable only if insurers can pay their commitments to policyholders. While it is not possible to guarantee that insurers will pay in all events, solvency regulation aims to ensure a high likelihood that they will make good on their promises. People purchase life insurance products to receive payment for events that may not occur until many years in the future. As a result, life insurance companies often receive premiums for 20 to 30 years before making payments to policyholders. During this time, they accumulate a large amount of assets.

To meet policyholders' needs, insurers are required to keep a minimum amount of funds, known as reserves. These reserves are a liability representing the value of expected future payments to policyholders. The funds associated with this liability are invested in assets, primarily fixed-income assets such as corporate bonds. The idea is that interest and principal payments on these assets will be timed to allow the insurer to pay policyholder claims. Due to the long time horizon over which life insurance payments are made, estimating reserves is challenging for insurers and regulators. For example, payments on life insurance policies depend on future mortality rates, which can vary depending on factors such as medical developments and epidemics.

Life insurance companies need to be in business for a long time to ensure they have sufficient reserves to meet future claims. Additionally, life insurance companies need to maintain strong financial strength to give confidence to policyholders that they will be able to pay claims many years into the future. This is especially important for permanent life insurance policies, which remain in force throughout the insured's entire life.

Life insurance companies also need to build a strong reputation and track record over time to gain the trust of policyholders. A long history of reliable performance can provide assurance to policyholders that the company will be able to meet its commitments. This is crucial given that life insurance policies are a significant expense and commitment for policyholders, who rely on the company to pay out claims when needed.

In summary, life insurance companies need to be in business for hundreds of years to build sufficient reserves, maintain strong financial strength, and establish a solid track record and reputation. These factors provide assurance to policyholders that the company will be able to pay claims when needed, even many decades into the future.

How to Cancel Your Life Insurance Policy Legally

You may want to see also

Frequently asked questions

Insurance companies set premiums based on risk and other factors that they're legally allowed to consider. These factors include the applicant's age, health, credit score, and location.

On average, an individual's age is the most reliable predictor of their life expectancy, followed by gender. Observations since at least 1880 have shown that men tend to die earlier than women due to genetics and hormones. As a result, men are often considered higher-risk applicants and charged higher premiums.

Reserves refer to the funds that insurance companies set aside to pay out future claims. These reserves are a liability on the balance sheet of the life insurance company, owed to beneficiaries.