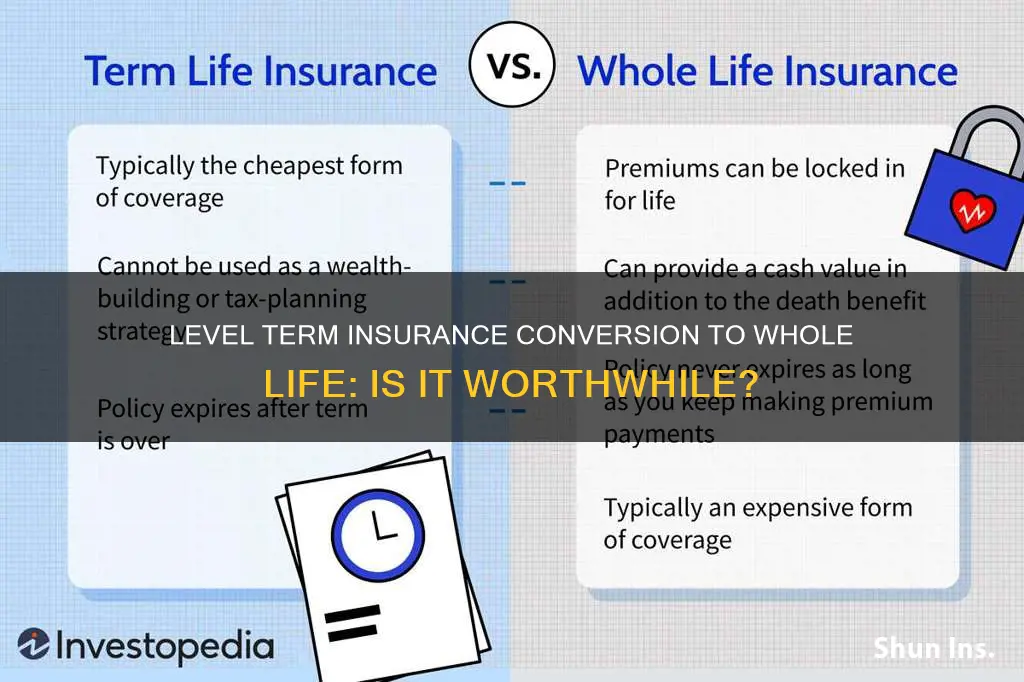

Converting term life insurance to whole life insurance is a viable option for those who want lifelong coverage and access to a cash value component. Term life insurance is a temporary solution, often taken to cover a specific period, such as 10, 20, or 30 years. Whole life insurance, on the other hand, offers permanent coverage for as long as the premiums are paid, and it can also be used as an investment tool. While converting from term to whole life insurance, individuals can benefit from no medical exam requirements and lower premiums compared to buying a new whole life policy. However, it's important to consider the higher costs, potential limitations, and the possibility of weak investment returns associated with whole life policies.

What You'll Learn

Accumulating cash value

When you pay your premiums on a cash value life insurance policy, your payments are split into three categories. A portion of your premium goes towards the policy's death benefit, which is based on your age, health, and other underwriting factors. Another portion covers the insurance company's operating costs and profits. The remaining part of your premium contributes to the policy's cash value.

In the early years of the policy, a higher percentage of your premium is allocated to the cash value account, allowing this balance to grow quickly. As you get older, more of the premium is applied to the cost of insurance, and the cash value accumulation slows. The cash value balance also grows based on the return offered by your policy type, with larger balances earning more.

The cash value of life insurance earns interest, and taxes on the accumulated earnings are deferred. The cash value can be accessed for various purposes during the insured's lifetime. You can borrow against the cash value, withdraw cash from the policy (which will reduce the death benefit), or use it to pay policy premiums.

Whole life insurance policies provide "guaranteed" fixed cash value accounts that grow according to a formula determined by the insurance company. The cash value in these policies grows at a fixed rate and is not influenced by market conditions. On the other hand, universal life policies accumulate cash value based on current interest rates and investments, while variable life policies invest funds in subaccounts that operate like mutual funds, with cash value fluctuating based on performance.

When considering the accumulation of cash value, it's important to understand the different levels of risk associated with each type of policy. Whole life policies generally carry the least risk due to their guaranteed cash value accumulation, while variable life policies, which depend on the performance of an asset, may be more risky but could produce greater cash value over time.

Manhattan Life Supplemental Insurance: Silver Sneakers Access?

You may want to see also

Estate planning

Life insurance can play a significant role in estate planning by providing financial support to beneficiaries and helping with immediate expenses such as funeral costs and debts. It can also aid in passing on assets more efficiently and establishing succession plans for business owners. When incorporating life insurance into estate planning, it is essential to choose the best policy type for your specific needs and circumstances.

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years, and is ideal for short-term needs. On the other hand, whole life insurance offers permanent coverage with level premiums for life and includes a cash value component that grows over time. This type of insurance is suitable for long-term needs and transferring wealth.

When considering estate planning, it is important to evaluate your life insurance coverage regularly and adjust it based on changing life circumstances. Additionally, seek advice from qualified professionals to ensure that your life insurance aligns with your overall estate plan. By combining life insurance with estate planning, individuals can gain peace of mind, knowing that their wishes will be fulfilled and their beneficiaries will receive the intended financial support.

Life Insurance: A Charitable Legacy Tool

You may want to see also

No medical exam required

No medical exam life insurance is a great option for those who want to skip the hassle of a medical exam or are in a rush to get insured. This type of insurance does not require potential policyholders to undergo any medical exams before getting a policy, speeding up the process as a whole. While some life insurance companies require a medical assessment, it isn't always necessary.

No medical exam life insurance is available in term or whole life insurance policies, each with its own strengths and weaknesses. Term life insurance provides coverage for a specific period, usually with lower premiums than whole life insurance, making it a good choice for younger families or seniors on a budget. However, the policyholder must pass during the term for the beneficiary to receive the death benefit. Whole life insurance, on the other hand, provides coverage for the entire life of the policyholder, with a guaranteed death benefit but at a higher cost.

When applying for no medical exam insurance, you will be asked questions about your health and medical history, which will determine your eligibility for coverage. It's important to be honest, as insurers can cancel your policy if they find any misrepresentation. They can verify your information through prescription databases, motor vehicle records, physician statements, and more.

No medical exam term life insurance is typically offered up to age 75, with lengths up to 30 years. Look for policies described as "level term" or with guaranteed level premiums to ensure consistent pricing throughout the term. Simplified issue term life insurance may offer renewable policies with increasing premiums as you age, making them more expensive over time.

No medical exam whole life insurance is commonly used as final expense insurance, with death benefits covering funeral costs and other end-of-life expenses. The coverage is lifelong, but the benefits are generally capped at a lower amount compared to term life insurance without an exam.

No medical exam life insurance is best suited for individuals in excellent health, typically in their 50s or younger. It offers a convenient, quick, and competitively priced option for those who qualify. However, it may not be the best choice if you would likely qualify for traditional coverage, as it tends to be more expensive and provides fewer options for customisation.

If you have pre-existing medical conditions, a high-risk job, or other factors that may impact your insurability, a no-medical exam policy can be a good alternative. It's also useful for securing instant coverage for personal or business loans, after which you can apply for a fully underwritten policy to minimise long-term costs.

In summary, no medical exam life insurance provides a simplified and accelerated path to obtaining life insurance coverage. It offers flexibility and peace of mind, especially for those with health concerns or time constraints, but it may come with higher costs and limited benefits.

Pregnancy and Health Insurance: Qualifying Life Events Explained

You may want to see also

Affordability

The affordability of converting level term insurance to whole life insurance is a key consideration when deciding whether to make the switch. Term life insurance is generally more affordable than whole life insurance, as it provides coverage for a specific term, usually between 10 and 30 years, and the premiums remain fixed during that period. Whole life insurance, on the other hand, is permanent and provides coverage for life as long as the premiums are paid.

When considering affordability, it's important to note that the premiums for whole life insurance are typically higher than those for term life insurance. This is because whole life insurance not only provides a death benefit but also includes an investment component. Part of the premium goes towards building cash value, which grows over time on a tax-deferred basis. This cash value can be borrowed against, withdrawn, or used to purchase more insurance. However, it's important to note that accessing the cash value will reduce the death benefit.

When deciding whether to convert to whole life insurance, it's crucial to evaluate your financial situation and ensure that you can afford the higher premiums. Converting to whole life insurance may be a good option if your budget has increased and you can now accommodate higher premiums. Additionally, converting term life insurance to whole life insurance can provide long-term peace of mind, as you won't have to worry about the expiration of your policy or substantial increases in premiums.

It's worth noting that the cost of converting term life insurance to whole life insurance may vary depending on the insurance company and the specific policy. In some cases, adding a conversion rider to your term policy may increase your term life premium. However, converting term life insurance to whole life insurance typically does not require a fee, and the premiums after conversion are generally determined by the rate class from when the original term policy was purchased. This means that converting an existing term policy may result in lower premiums compared to purchasing a new whole life policy at an older age.

Before making any decisions, it's recommended to consult with a financial professional or insurance agent to discuss your options and ensure that converting to whole life insurance aligns with your financial goals and budget.

Life Insurance: Age is Just a Number

You may want to see also

Peace of mind

With term life insurance, there is a sense of uncertainty as the coverage has an end date. While it may be sufficient if you have short-term obligations, such as paying off a mortgage or supporting children through college, it may not provide the same level of reassurance for lifelong commitments. Whole life insurance, on the other hand, offers the security of knowing that your family will always be taken care of, regardless of when your death occurs. This can be especially important if you have a spouse or children who depend on your financial support indefinitely.

Additionally, whole life insurance provides the opportunity to accumulate cash value within the policy. This means that you can borrow against the policy or withdraw money from the accumulated cash value to help with major expenses such as college tuition or a down payment on a house. This feature adds financial flexibility and can further contribute to your peace of mind, knowing that you have access to funds during your lifetime.

It's important to note that converting from term to whole life insurance will result in higher premiums. However, the peace of mind that comes with permanent coverage and the potential for cash value accumulation may outweigh the increased cost for some individuals. Ultimately, the decision to convert should be made based on your financial situation, long-term goals, and the level of reassurance you seek for yourself and your loved ones.

Mental Health: Life Insurance Premium's Unseen Influence

You may want to see also

Frequently asked questions

Some term life insurance policies can be converted to whole life insurance before the end of the policy term. Check your policy to see if it includes the option to convert. If not, you may be able to add a term conversion rider, which gives you the option to convert some or all of your term life policy to a permanent one.

A conversion clause is a section of a life insurance contract that allows policyholders to convert their term life insurance policy to a permanent form of life insurance without having to requalify or undergo medical examinations.

Converting to whole life insurance gives you the ability to obtain permanent coverage, often at a cheaper rate than if you purchased a new whole life policy when you’re older. Medical exams aren’t generally required when you convert term to whole life insurance. On the other hand, your whole policy will cost more than your term policy once you convert, and you may be limited in the types of policies you can convert to.