Life insurance can be used as a charitable gift, allowing donors to make substantial contributions to organisations they care about. This can be done in several ways, including naming a charity as the beneficiary of a policy, donating an existing policy, or purchasing a new policy with a charity as the owner and beneficiary. Donors can also add a charitable giving rider to their policy, which pays a percentage of the policy's face value to a qualified charity. Gifting a life insurance policy can also reduce the donor's taxable estate.

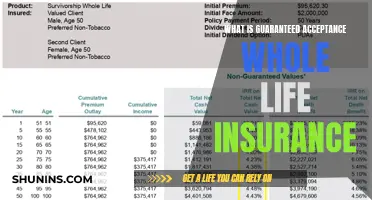

| Characteristics | Values |

|---|---|

| Donor's choice of charity | Any qualified 501(c)(3) charity that meets the Internal Revenue Service (IRS) definition of a nonprofit organization |

| Donor's choice of insurance policy | Term life insurance, permanent life insurance, whole life insurance |

| Donor's financial situation | Donors who can't afford a large lump-sum payment can make smaller monthly or annual premium payments |

| Donor's tax situation | Gifting a life insurance policy can cut the donor's taxable estate; donors can take a tax deduction for donating life insurance dividends; donors can take an immediate charitable contribution tax deduction for transferring ownership to a charity |

| Charity's financial situation | The charity can surrender the policy for cash; the charity can elect to place the policy on reduced paid-up status; the charity can take out a loan against the policy's cash value |

| Charity's administrative capabilities | The donor can choose a charity that does not have to administer the policy and instead donates it to a specific 501(c)(3) nonprofit charity that manages a portfolio of life insurance policies |

What You'll Learn

Naming a charity as a beneficiary

There are a few ways to go about this. Firstly, you can name a charity as the beneficiary of a life insurance policy you already own. This is a straightforward approach where the donor retains ownership of the policy and has continued access to the policy's cash value. Secondly, you can apply for a new life insurance policy and name a charity as the owner and beneficiary. This typically involves a limited payment policy, where premiums are paid for a set period. The insurer may limit the amount of insurance based on the donor's giving history or charitable obligations.

It is important to note that naming a charity as a beneficiary does not offer the same income tax advantages as gifting a policy. However, it still reduces the donor's estate by the amount of the death benefit. Additionally, the death benefit that is made as a charitable donation can be excluded from a taxable estate.

Before naming a charity as a beneficiary, donors should ensure that the charity will accept the life insurance policy. Some types of policies, such as term policies, may not be accepted by charitable organizations. Donors should also ensure that the charity meets the Internal Revenue Service (IRS) definition of a nonprofit organization.

McDonald's Life Insurance: Cash Value for Franchise Owners?

You may want to see also

Gifting an existing policy

Gifting an existing life insurance policy to a charity is a great way to make an immediate contribution. This can be done by changing the ownership and beneficiary of the policy to the charity of your choice.

If you have a permanent life insurance policy that is no longer needed, you can transfer ownership to a charitable organization. This gives the charity immediate control of the contract, allowing them to name themselves as the beneficiary and receive a tax-free payout when you pass away. This option provides the charity with flexibility, as they can choose to surrender the policy for its cash value, place it on a reduced paid-up status, or take out a loan against its cash value.

As the donor, you can also make annual cash contributions to the charity to continue the policy until the death benefit is received. By transferring ownership, you may be eligible for a tax deduction for the current year, provided the gift is made to a qualified charity. It is important to consult a tax advisor before making such a decision, as the eligibility for a tax deduction depends on individual circumstances.

Another option is to purchase a new policy and designate the charity as the owner and beneficiary. This typically involves a limited payment policy, where premiums are paid for a set period, and the insurer may limit the amount of insurance based on the donor's giving history or charitable obligations.

Gifting an existing life insurance policy allows you to make a substantial donation to a charitable cause while also providing potential tax benefits. It is a great way to leverage your charitable giving and make a lasting impact on a cause you believe in.

Liver Donation: Impact on Life Insurance Policies

You may want to see also

Purchasing a new policy

If you don't have an existing life insurance policy, you can buy a new one and designate a charity as the owner and beneficiary. This strategy typically involves a limited-payment policy, where premiums are paid for a set period. The insurer may limit the amount of insurance based on your giving history or charitable obligations.

You can make annual cash contributions so that the charity can pay the premiums. You will usually be entitled to an income tax deduction for any such contributions, subject to IRS limits. The charity can use the cash contributions or other funds to pay premiums on the policy.

It's important to note that the income tax deduction is only allowed if the transfer is "complete". This means the charity must be the sole beneficiary and owner of the policy, with no rights or incidents of ownership retained by the donor.

If the policy is brand new and will be purchased by the charity, your deduction will be for any premiums you pay. If you contribute a policy that is fully paid up, then the deduction is the smaller of your basis or the policy's replacement value.

There are limits on claiming the income tax deduction. Once the amount of the deduction is determined, another calculation needs to be done to figure out how much can be claimed during the year of the gift, and whether any of the deductions need to be carried forward to future tax years.

If the policy is fully paid up, your deduction is deductible against 30% of your adjusted gross income (AGI). If the claimed deduction exceeds $5,000, you will need a "Qualified Appraisal" of the insurance policy.

Additionally, if you pay the annual premiums directly to the insurance company on a policy that is not yet fully paid up, those premiums are fully deductible against 30% of your AGI. However, if you write a cheque to the charity and they use the contribution to pay the premium, your cash gift to the charity is deductible against 50% of your AGI. Therefore, for those making large charitable gifts, the structure of the premium payments can be critical.

Term Life Insurance: Residual Value and Its Benefits

You may want to see also

Gifting policy dividends

Gifting life insurance policy dividends to charity is a way to make charitable donations without impacting your family's budget. It is a good option for those who want to get a charitable contribution tax deduction but do not want to transfer ownership of their life insurance policy.

If you have a permanent life insurance policy, you may be receiving dividends from the insurance company. You can choose to receive these dividends as cash and then donate them to a charity of your choice. The dividends donated are deductible in the same way as premiums paid on a gifted policy, and this strategy does not require any additional cash outlay from the donor.

The benefits of this method include the ability to take a tax deduction for donating life insurance dividends and the ability to maintain ownership of the policy. However, it is important to note that the dividend pool is usually tied to the death benefit, so donating the dividends will reduce the death benefit.

While policy dividends can be a great way to make recurring donations, it is important not to rely solely on them as they are not guaranteed and can vary from year to year. Before implementing this strategy, it is recommended to consult a tax professional or financial planner to ensure it aligns with your financial situation. Additionally, reach out to the charity you wish to support to ensure they can effectively utilise your donation.

Life Insurance: Pre-Death Benefits and Payouts Explained

You may want to see also

Gifting a policy's death benefit

Gifting a life insurance policy to a charity is a great way to make a substantial donation as part of your estate plan. There are several ways to go about this, each with its own advantages and disadvantages. Here is a detailed explanation of the process and its implications.

Naming a Charity as the Beneficiary

One simple way to gift a life insurance policy's death benefit to a charity is by naming a charitable organization as the beneficiary of the policy. This method allows the donor to retain ownership and control of the policy, which provides access to the policy's cash value. Additionally, the donor can choose to divide the death benefit among multiple beneficiaries, including loved ones and the charity of their choice. It is important to note that this method does not offer income tax advantages, and the policy could be counted in the owner's estate for estate tax purposes. However, it provides flexibility as the donor can change the beneficiary if their financial situation or priorities change.

Transferring Ownership of a Policy to a Charity

Another approach is to transfer ownership of an existing policy to a charity, giving the organization immediate control of the contract. The donor can take an immediate charitable contribution tax deduction for transferring ownership and, if they continue paying premiums, can claim additional tax deductions. This method removes the policy from the donor's estate for estate tax purposes. However, it is important to note that this decision is irrevocable, and the charity gains the right to change the beneficiary.

Donating an Existing Policy

If a donor has a permanent life insurance policy that is no longer needed, they can choose to donate it to a charity. This involves changing the ownership and beneficiary to the charity. The donor may also make annual cash contributions to the charity to continue the policy until the death benefit is received. Alternatively, the charity can choose to surrender the policy for its cash value or take out a loan against it. This method can provide a tax deduction for the donor, depending on individual circumstances, and it ensures that the charity receives the benefit during the donor's lifetime.

Purchasing a New Policy for a Charity

If a donor does not have an existing policy, they can purchase a new life insurance policy and designate the charity as the owner and beneficiary. This strategy often involves a limited payment policy, where premiums are paid for a set period. The donor can make annual cash contributions to the charity to help pay the premiums and can usually claim income tax deductions for these contributions. This approach allows the charity to have immediate control over the contract and the ability to name itself as the beneficiary.

Life Insurance for Army Personnel: What You Need to Know

You may want to see also

Frequently asked questions

Life insurance can be an effective way to give to charity as it allows donors to give more than they would be able to with a simple cash donation. It also has tax advantages, such as reducing the donor's taxable estate, which can save thousands in estate taxes.

There are a few ways to do this. One way is to name a charity as the beneficiary of your policy. Another way is to transfer ownership of the policy to the charity. A third way is to buy a new policy and name the charity as the owner and beneficiary.

Donating a life insurance policy to charity can have several tax implications. For example, the donation may be tax-deductible and the death benefit may be excluded from the donor's taxable estate. However, it's important to note that premium payments made during the donor's lifetime are generally not tax-deductible. It's always best to consult a tax professional to understand the specific implications for your situation.