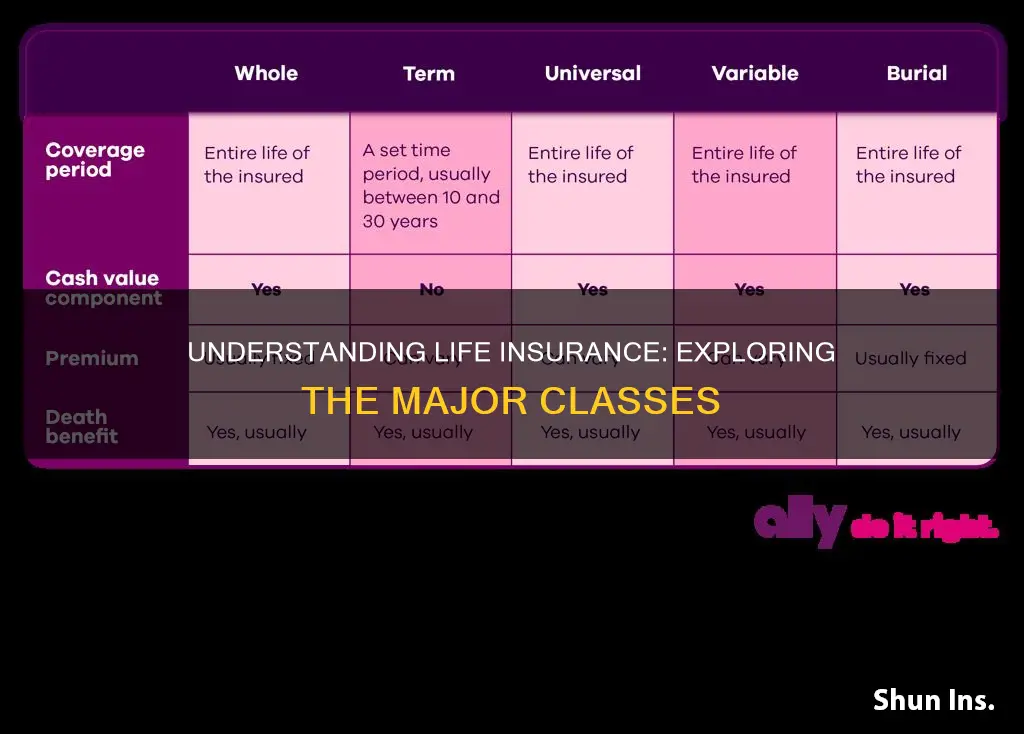

Life insurance is a crucial financial tool that provides financial security for individuals and their families. There are several types of life insurance policies, each with distinct features and benefits. However, when discussing the major classes of life insurance, it's important to note that some types may not fall into the same category as the more commonly recognized ones. For instance, one such class that might not be considered a major type is term life insurance. This type of policy provides coverage for a specific period, typically 10, 20, or 30 years, and is often more affordable than permanent life insurance. While it offers valuable protection during a defined period, it may not be the primary choice for long-term financial security, as it does not accumulate cash value or provide a death benefit for the entire life of the insured.

What You'll Learn

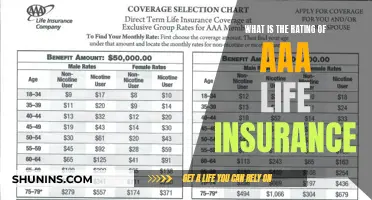

- Term Life: A temporary policy with fixed premiums and coverage duration

- Whole Life: Permanent coverage with a cash value component and guaranteed death benefit

- Universal Life: Flexible premiums and death benefits, with investment options

- Variable Life: Offers investment options and potential for higher returns

- Annuities: Income-generating contracts with guaranteed payments for life

Term Life: A temporary policy with fixed premiums and coverage duration

Term life insurance is a type of coverage that provides a specific period of protection, offering a straightforward and cost-effective solution for individuals seeking insurance. This policy is designed to be a temporary measure, providing financial security for a defined duration, typically ranging from 10 to 30 years. During this term, the insurance company promises to pay out a predetermined death benefit if the insured individual passes away. The key advantage of term life insurance is its predictability; the premiums remain consistent throughout the policy term, ensuring that the insured individual's loved ones receive a guaranteed amount if the worst happens.

What sets term life insurance apart is its simplicity and focus. Unlike other types of insurance, it does not offer investment components or long-term savings accounts. Instead, it is a pure protection policy, providing a safety net for a specific period. This simplicity makes it an attractive option for those seeking affordable coverage without the complexities of other insurance products. The fixed nature of term life insurance premiums means that the insured individual can budget effectively, knowing exactly what they will pay each year.

The coverage duration is a critical aspect of term life insurance. It allows individuals to choose a term length that aligns with their specific needs and circumstances. For instance, a young professional might opt for a 20-year term to cover their children's education, while a homeowner with a mortgage might select a 15-year term to ensure their family's financial stability during that period. This flexibility ensures that the insurance policy is tailored to the individual's unique requirements.

When considering term life insurance, it is essential to understand that it does not accumulate cash value over time, unlike permanent life insurance policies. This means that the primary purpose of term life insurance is to provide financial protection, and any unused premiums are not returned to the policyholder. However, this feature also contributes to its affordability, making it an excellent choice for those seeking high coverage amounts without the long-term financial commitments of other insurance types.

In summary, term life insurance is a temporary policy with fixed premiums and a defined coverage duration, making it a popular choice for individuals seeking affordable and straightforward life insurance. Its simplicity, predictability, and flexibility in coverage terms make it an ideal solution for various life stages and financial goals. By understanding the unique features of term life insurance, individuals can make informed decisions about their insurance needs, ensuring their loved ones are protected during the specified period.

Life Insurance: Accidental Death Benefits Explained

You may want to see also

Whole Life: Permanent coverage with a cash value component and guaranteed death benefit

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It is a popular choice for those seeking long-term financial security and peace of mind. One of the key features of whole life insurance is its guaranteed death benefit, which means that the insurance company will pay out a specified amount to the beneficiary upon the insured's death. This feature ensures that the loved ones of the insured individual will receive financial support during a difficult time.

In addition to the guaranteed death benefit, whole life insurance also includes a cash value component. This is a unique aspect that sets it apart from other types of insurance. As the insured individual makes regular premium payments, a portion of these payments goes towards building up a cash value. This cash value grows over time and can be used for various purposes. For instance, policyholders can borrow against the cash value or even withdraw funds (though withdrawals may incur fees and penalties). The cash value can also be used to pay for future premiums, ensuring that the policy remains in force even if the insured individual faces financial challenges.

The permanent nature of whole life insurance is another significant advantage. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in effect for the insured's entire life. This means that the coverage is not limited to a certain number of years and will continue to provide financial protection even as the insured ages. This is particularly valuable for individuals who want long-term financial security and want to ensure that their loved ones are protected, regardless of future changes in their lives.

Furthermore, whole life insurance offers a level of predictability and stability. The premiums for this type of insurance are typically fixed, meaning they will remain the same over the life of the policy. This predictability allows individuals to plan their finances more effectively and ensures that the cost of insurance remains consistent, providing a sense of financial control.

In summary, whole life insurance is a comprehensive and reliable form of permanent coverage. Its guaranteed death benefit and cash value component provide financial security and flexibility. The permanent nature of the policy ensures long-term protection, while the fixed premiums offer stability and predictability. For those seeking a major class of life insurance that provides both coverage and financial benefits, whole life insurance is an excellent option to consider.

Critical Illness Cover: Enhancing Your Life Insurance

You may want to see also

Universal Life: Flexible premiums and death benefits, with investment options

Universal life insurance offers a unique and flexible approach to life coverage, providing policyholders with a range of features that set it apart from other life insurance types. One of its key advantages is the adaptability it offers in terms of premiums and death benefits. Unlike traditional term life insurance, where premiums are fixed for a specified period, universal life insurance allows policyholders to adjust their premiums over time. This flexibility is particularly beneficial for individuals who may experience changes in their financial situation or income levels. For instance, a policyholder might opt for lower premiums during their early years, when they are more financially stable, and then increase the payments as they approach retirement or when they want to ensure a higher death benefit.

The death benefit in universal life insurance is also customizable. Policyholders can choose the amount of coverage they desire, ensuring that their loved ones receive the financial support they need in the event of the insured's passing. This level of control empowers individuals to tailor the policy to their specific needs and preferences. Moreover, universal life insurance often incorporates investment options, allowing policyholders to grow their money and potentially increase the cash value of their policy. This investment component can be a powerful tool for those seeking to maximize their insurance benefits while also building a financial asset.

Under the investment options, policyholders can allocate a portion of their premiums to various investment accounts, such as mutual funds or stocks. These investments can offer the potential for higher returns compared to traditional savings accounts, which can, in turn, increase the cash value of the policy. The cash value can be used to pay future premiums, providing financial security and flexibility. Additionally, the investment aspect of universal life insurance can be particularly attractive to those who are already familiar with investing and wish to integrate their insurance strategy with their overall financial plan.

The flexibility of universal life insurance extends beyond premium payments and death benefits. Policyholders often have the freedom to make additional payments, known as "extra payments" or "surrenders," which can further enhance the policy's value. These extra payments can be used to increase the death benefit, accelerate the growth of the cash value, or even provide loan options, allowing policyholders to access funds without surrendering the policy. This level of control and customization is a significant advantage for those seeking a comprehensive and adaptable life insurance solution.

In summary, universal life insurance stands out as a major class of life insurance due to its flexibility in premium payments and death benefits, along with its investment options. This combination of features allows individuals to create a tailored insurance plan that aligns with their financial goals and circumstances. By offering policyholders the ability to adjust and customize their coverage, universal life insurance provides a valuable and versatile tool for managing risk and ensuring financial security for oneself and one's loved ones.

Term Life Insurance: Annual Renewable Coverage Explained

You may want to see also

Variable Life: Offers investment options and potential for higher returns

Variable life insurance is a unique and often overlooked type of life insurance that offers a combination of insurance protection and investment opportunities. Unlike traditional life insurance, which primarily provides a death benefit to beneficiaries, variable life insurance allows policyholders to invest a portion of their premium payments in various investment options. This feature sets it apart from other forms of life insurance and makes it an attractive choice for those seeking both financial security and the potential for higher returns.

One of the key advantages of variable life insurance is the flexibility it provides in terms of investment. Policyholders can choose from a range of investment options, such as stocks, bonds, and mutual funds, allowing them to tailor their investment strategy according to their financial goals and risk tolerance. This level of customization is not typically found in other classes of life insurance, making variable life an appealing option for those who want to actively manage their investments.

The investment aspect of variable life insurance is what sets it apart and provides the potential for higher returns. Policyholders can allocate a portion of their premium to an investment account, which grows based on the performance of the chosen investment options. This means that instead of solely providing a fixed death benefit, variable life insurance can offer a growing cash value that can be borrowed against or withdrawn, providing financial flexibility during the policyholder's lifetime. The potential for higher returns is particularly attractive to those who want to maximize their long-term financial growth while still having the insurance coverage they need.

When considering variable life insurance, it is essential to understand the associated risks and fees. The investment options within the policy may be subject to market volatility, and there is a possibility of losing some or all of the invested amount. Additionally, variable life insurance policies often come with higher fees compared to traditional life insurance due to the investment management and administrative costs. Policyholders should carefully review the investment options, fees, and potential risks before making a decision to ensure it aligns with their financial objectives.

In summary, variable life insurance offers a distinctive approach to life insurance by combining insurance protection with investment opportunities. It provides policyholders with the ability to invest a portion of their premium, offering the potential for higher returns and financial growth. While it may come with certain risks and fees, variable life insurance can be a valuable tool for those seeking both insurance coverage and the chance to actively manage their investments. Understanding the investment options and associated costs is crucial for making an informed decision regarding this unique class of life insurance.

Life Insurance Cash Withdrawals: Are They Taxable?

You may want to see also

Annuities: Income-generating contracts with guaranteed payments for life

Annuities are a unique financial product that falls outside the traditional categories of life insurance. They are structured as income-generating contracts, offering individuals a steady stream of guaranteed payments for life. This feature sets annuities apart from other insurance products, as they provide a reliable source of income during retirement or for other long-term financial goals.

In simple terms, an annuity is a financial agreement between an individual and an insurance company. The individual invests a sum of money, which can be a lump sum or a series of payments, and in return, the insurance company makes regular payments to the annuitant (the person who purchased the annuity) for a specified period or for life. These payments can be made as a fixed amount or an adjustable sum based on market performance.

The beauty of annuities lies in their guarantee. Unlike other investment vehicles, annuities offer a level of security that is particularly appealing to those seeking stable and predictable income. The insurance company is obligated to make these payments, ensuring that the annuitant receives a consistent income stream, especially during retirement when other sources of income may be uncertain. This guarantee is a significant advantage, providing individuals with a sense of financial security and peace of mind.

There are different types of annuities, each with its own characteristics. Fixed annuities offer a consistent payment amount, typically based on the interest rate guaranteed by the insurance company. Variable annuities, on the other hand, offer more flexibility, allowing investors to choose from various investment options and potentially earn higher returns. Annuities can also be categorized as immediate or deferred, depending on when the payments begin.

Annuities are an essential tool for retirement planning and wealth management. They provide a way to convert a portion of one's savings into a steady income stream, ensuring financial stability in the later years. Additionally, annuities can be used to provide income for other long-term financial goals, such as education funds or a comfortable lifestyle during retirement. Understanding the mechanics of annuities and their benefits can empower individuals to make informed financial decisions and secure their financial future.

How to Sell Your Life Insurance Policy?

You may want to see also

Frequently asked questions

Life insurance can be broadly categorized into three main types: Term Life Insurance, Permanent (Whole Life) Insurance, and Universal Life Insurance. Each type has unique features and benefits, catering to different financial needs and goals.

Term life insurance provides coverage for a specified period, or 'term', such as 10, 20, or 30 years. It offers a death benefit if the insured individual passes away during this term. It is a cost-effective way to secure financial protection for a family during a specific period.

Whole life insurance is a permanent policy with a guaranteed death benefit and fixed premiums. It accumulates cash value over time, which can be borrowed against. Universal life insurance, on the other hand, offers flexibility in premium payments and death benefit amounts, allowing policyholders to adjust these based on their financial situation.

Yes, many term life insurance policies offer conversion options, allowing policyholders to switch to a permanent policy without a medical examination. This provides an opportunity to enhance coverage and build long-term financial security.

While the three main types mentioned above are the most common, other forms of insurance, such as variable life insurance, indexed universal life, and limited payment whole life, are not typically classified as major classes. These policies have unique features and may be more specialized, catering to specific financial needs.