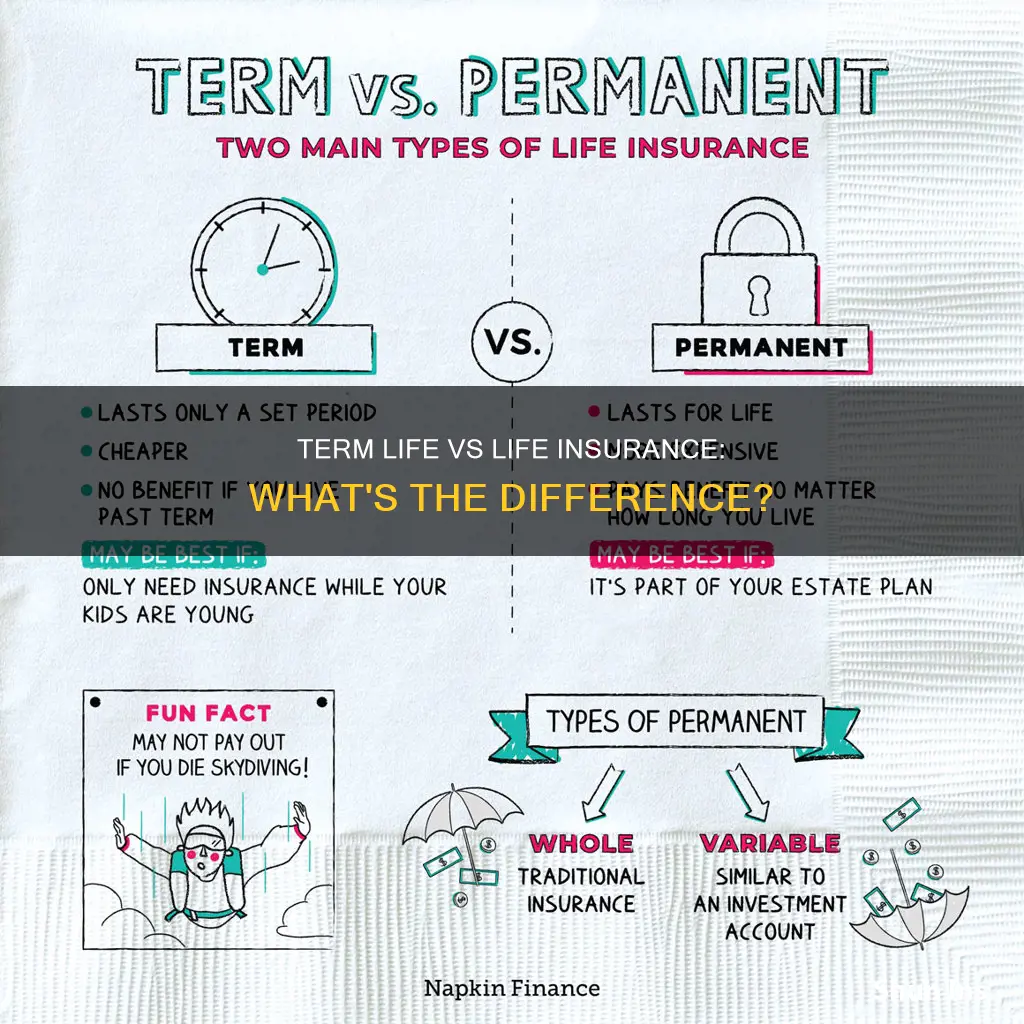

Term life insurance and life insurance are two different types of insurance policies with distinct features and benefits. Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years, and pays out a death benefit if the insured person passes away during that term. On the other hand, life insurance, often referred to as whole life insurance, offers coverage for an individual's entire life, providing a guaranteed death benefit whenever they die. While term life insurance is generally more affordable, life insurance tends to be more expensive due to its lifelong coverage and additional features.

| Characteristics | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Length | Coverage for a set number of years, e.g. 10, 20, or 30 years | Lifelong coverage |

| Cost | Cheaper than whole life insurance | More expensive than term life insurance |

| Cash Value | No cash value | Accrues cash value over time |

| Complexity | Easier to understand than whole life insurance | More complex than term life insurance |

| Conversion Options | May be converted to whole life insurance | May be converted to term life insurance |

| Premium Changes | Premium rates may change | Premium rates are locked in |

| Renewal Options | May be renewed at the end of the term | N/A |

| Payout | Payout only if the insured dies during the term | Payout regardless of when the insured dies |

What You'll Learn

- Term life insurance is cheaper but only covers you for a set number of years

- Whole life insurance is more expensive but lasts your entire life

- Whole life insurance has a cash value component that can be borrowed against

- Term life insurance is straightforward insurance without a savings component

- Whole life insurance is a good option for parents with disabled children

Term life insurance is cheaper but only covers you for a set number of years

Term life insurance is a more affordable option than whole life insurance, but it only covers you for a set number of years. This type of insurance is ideal for those who want substantial coverage at a low cost. It's a straightforward option without the savings or investment components that are found in whole life insurance.

Term life insurance policies are available in varying lengths, typically ranging from 10 to 30 years, with some companies offering terms of up to 40 years. The length of the term depends on the financial obligations you're looking to cover. For example, new parents might opt for a 20-year policy to ensure coverage until their child is financially independent.

The premiums for term life insurance are based on factors such as age, health, and life expectancy. The insurance company will also consider business expenses, investment earnings, and mortality rates when determining the premium. While term life insurance is generally the cheapest option, the cost will vary depending on the length of the term and the payout amount.

One of the drawbacks of term life insurance is that it expires, and if you outlive the term, your coverage ends without any benefits or returns. Additionally, term life insurance cannot be used as a wealth-building or tax-planning strategy. However, it's a good option for those who want to ensure their loved ones are financially protected in the event of their death during the specified term.

Key Man Insurance: Tax Benefits and Financial Security

You may want to see also

Whole life insurance is more expensive but lasts your entire life

Whole life insurance is a form of permanent life insurance that covers the policyholder for their entire life, rather than a fixed period of time. It is more expensive than term life insurance, but it comes with additional benefits that make it a more comprehensive and appealing option for those who can afford it.

Whole life insurance policies have guaranteed premiums that remain locked in and do not increase over the life of the policy. The premium amount depends on the death benefit, with higher benefits resulting in greater premiums. Whole life insurance also includes a cash value component that grows over time as the policyholder pays their premiums. This cash value can be borrowed against or withdrawn under certain conditions, providing financial flexibility.

The cash value of whole life insurance policies grows at a guaranteed interest rate, which is often tax-deferred. This allows the policyholder to accumulate wealth over time in a tax-efficient manner. Additionally, some whole life insurance policies pay dividends, providing an opportunity for even greater returns.

While whole life insurance is more expensive than term life insurance, it offers permanent coverage and a savings component that can be utilised for various financial needs. It is a good option for those who want lifelong protection and the ability to build cash value. However, it is important to consider the complexity of whole life insurance policies and the potential for higher costs.

In summary, whole life insurance is a comprehensive and permanent solution for individuals seeking lifelong coverage and a way to build cash value over time. While it comes at a higher cost, the additional benefits of whole life insurance make it a valuable option for those who can afford it and are seeking long-term financial security.

IRS and Key Life Insurance: What's the Jurisdiction?

You may want to see also

Whole life insurance has a cash value component that can be borrowed against

Whole life insurance is a form of permanent life insurance that covers the policyholder for their entire life, rather than a fixed period of time. It has a cash value component that grows over time as the policyholder pays their premiums. This cash value can be borrowed against or withdrawn under certain conditions.

The cash value of a whole life insurance policy grows at a guaranteed rate set by the insurer. A portion of the premium goes towards the cash value, which can be used to take out a loan or withdrawn as cash. The policyholder may also be able to surrender the policy for cash. However, if the policyholder dies before the loan is repaid in full, the death benefit will be reduced by the amount still owed.

Whole life insurance policies offer guaranteed premiums that remain locked in and do not increase during the life of the policy. The higher the death benefit, the greater the premium will be. Whole life insurance policies may also pay dividends, although these are not guaranteed and are based on the profits generated by the company.

The cash value component of whole life insurance makes it a more complex and expensive product than term life insurance. Whole life insurance premiums can cost up to 17 times more than term policies with the same death benefit. However, the cash value component provides financial flexibility and can be used as a savings vehicle for retirement or to meet other financial needs.

Life Insurance 101: Understanding Term 80 Policies

You may want to see also

Term life insurance is straightforward insurance without a savings component

Term life insurance is a straightforward insurance policy without a savings component. It provides coverage for a set period, typically ranging from 10 to 30 years, and pays out a death benefit to the policyholder's beneficiaries if the insured person passes away during the term. Term life insurance is often chosen by young families as it offers a cost-effective way to ensure financial protection for loved ones.

Term life insurance premiums are based on factors such as age, health, and life expectancy. The insurance company will consider an individual's driving record, current medications, smoking status, occupation, hobbies, and family history when determining the premium. In some cases, a medical exam may be required. While term life insurance is generally the most affordable option, the premium can be higher for older individuals or those with health complications.

Unlike whole life insurance, term life insurance does not accumulate cash value over time. It is purely insurance, providing a death benefit with no additional features. This means that if the policyholder outlives the term, there is no payout, and the money spent on premiums is not returned. However, term life insurance can be a good option for those who cannot afford the higher premiums of whole life insurance or those who only need coverage for a specific period.

Term life insurance is straightforward in its purpose and function. It offers a guaranteed death benefit without the complexity of investment or savings components. This simplicity makes it easier to understand and apply for compared to permanent life insurance policies. While it may not offer the same long-term financial benefits as whole life insurance, term life insurance can provide peace of mind and financial security for families during the covered term.

Life Insurance: Choosing the Right Policy for You

You may want to see also

Whole life insurance is a good option for parents with disabled children

Term life insurance and whole life insurance are two of the most common types of life insurance available. Term life insurance offers coverage for a fixed period, such as 10, 20, or 30 years, and is generally the most affordable option. Whole life insurance, on the other hand, is a form of permanent life insurance that lasts as long as the policyholder continues to pay the premiums. It tends to be significantly more expensive than term life insurance but offers additional benefits, such as a cash value component that can be borrowed against or withdrawn.

For parents with disabled children, whole life insurance can be a good option to consider. The permanent coverage provided by whole life insurance ensures that the child will receive the death benefit, regardless of when the policyholder passes away, as long as the premiums are paid. This can be especially important if the child's disabilities will remain with them for life and they will require lifelong care and support. Additionally, the cash value component of whole life insurance can be useful for parents who want the flexibility to access or borrow against the policy's cash value in the future.

When considering whole life insurance for a disabled child, it is essential to calculate the child's long-term care costs, including medical expenses, therapy, transportation, education, and adaptive equipment. It is also crucial to explore other financial planning tools, such as special needs trusts, which can help preserve the child's eligibility for government benefits. Consulting with attorneys, financial advisors, or life insurance experts who specialize in this area can be beneficial in creating a comprehensive plan that meets the unique needs of the child.

While whole life insurance can provide valuable coverage for parents with disabled children, it is important to carefully consider the family's financial situation, budget, and long-term goals. Term life insurance may be a more suitable option if the child is expected to outgrow their need for extended care or if the family prefers a more affordable coverage option.

Life Insurance: Passing Outside of the Estate?

You may want to see also

Frequently asked questions

Term life insurance offers coverage for a set number of years, such as 10, 20 or 30 years. Whole life insurance, on the other hand, lasts your entire life and has an added cash value component that earns interest over time.

Term life insurance is a good option for those who want affordable coverage for a specific period, such as the length of their mortgage. It's also straightforward and easy to understand. However, term life insurance doesn't offer lifelong coverage and doesn't accumulate cash value like an investment account.

Whole life insurance offers permanent coverage and the premiums remain the same throughout. It also has a cash value component that can be borrowed against or withdrawn. However, whole life insurance is typically more expensive than term life insurance and can be more complex and difficult to evaluate.

There is no one-size-fits-all answer. Term life insurance is ideal for those who want substantial coverage at a low cost, while whole life insurance is suitable for those who want permanent coverage and are willing to pay higher premiums.