Life insurance is a contract between an insurance company and a policy owner in which the insurer agrees to pay a sum of money to one or more named beneficiaries when the insured person dies. The policyholder must pay a single premium upfront or regular premiums over time for the life insurance policy to remain in force.

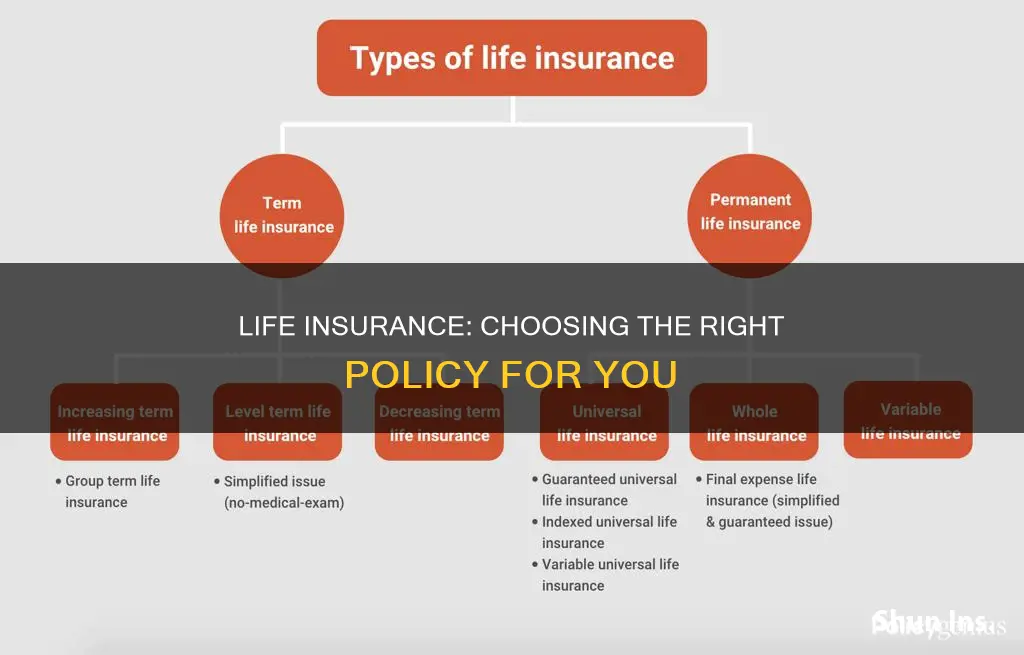

There are two main types of life insurance: permanent and term. Permanent life insurance policies do not have an expiration date, meaning you’re covered for life as long as your premiums are paid. Term life insurance, on the other hand, only covers you for a set number of years and does not accumulate cash value.

The type of life insurance you need depends on your financial goals and family situation. If you have loved ones who depend on your income, life insurance can help cover funeral and burial expenses, pay off remaining debts, and make managing day-to-day living expenses less burdensome for those you leave behind.

| Characteristics | Values |

|---|---|

| Purpose | Provide financial support to beneficiaries after the policyholder's death |

| Policy Types | Term life insurance, permanent life insurance, whole life insurance, universal life insurance, variable universal life insurance |

| Factors Affecting Premium | Age, gender, health, lifestyle, family medical history, driving record |

| Factors Affecting Need | Dependents, income, debts, mortgage, education costs, final expenses, business, investments |

What You'll Learn

How much life insurance do I need?

There are several methods to calculate how much life insurance you need. However, it's important to note that there is no one-size-fits-all solution, and the amount of coverage you require will depend on your unique financial situation and goals. Here are some ways to estimate your life insurance needs:

- Multiply Your Salary: This is a straightforward method recommended by some insurers, where you multiply your current salary by 10 to 15 times to get a quick estimate of your coverage needs. For example, if you earn $50,000 per year, you would need $500,000 to $750,000 in coverage. If you have children, you may want to add an additional $100,000 to $150,000 to cover the cost of their college education.

- DIME Method: This is a more detailed approach that considers your Debt, Income, Mortgage, and Education expenses. Add up all your debts, including car payments, credit cards, and student loans; calculate your income for the total number of years you need coverage; include your outstanding mortgage or home equity loan balance; and estimate the cost of your children's education if applicable.

- Income Replacement: Calculate your annual income and multiply it by the number of years you want to replace that income. This ensures that your dependents will have the financial resources to maintain their standard of living.

- Mortgage and Debt Coverage: If you have a mortgage or other significant debts, you can include these amounts in your life insurance calculation. This will ensure that your beneficiaries can pay off these debts and maintain their home.

- Future Needs and Expenses: Consider any future needs and expenses, such as college fees for your children or funeral and burial costs. You can include these amounts in your life insurance calculation to ensure that your loved ones have the financial support they need.

- Life Insurance Calculator: You can use an online life insurance calculator, which will take into account various factors and provide you with an estimate of your coverage needs.

It's important to remember that life insurance needs vary from person to person, and it's always a good idea to consult a financial advisor or insurance professional to determine the appropriate amount of coverage for your specific situation. Additionally, when deciding on the amount of coverage, consider the type of life insurance you need, such as term life insurance or permanent life insurance, as this will impact the cost and duration of your policy.

Nationwide Insurance: Drug Testing for Life Insurance Policies

You may want to see also

What types of life insurance are there?

There are two main types of life insurance: term life and permanent life. However, there are several subtypes of permanent life insurance, and other types of life insurance that don't fall into either of these categories. Here is an overview of the different types of life insurance policies available.

Term Life Insurance

Term life insurance is temporary and usually lasts for a set number of years, such as 5, 10, or 20 years. It is the cheapest way to buy life insurance because it does not include a cash value component. Term life insurance is ideal for people who want coverage for a specific period, such as the years of a mortgage or their working life.

Permanent Life Insurance

Permanent life insurance typically lasts for the duration of your life and includes a cash value component. There are several subtypes of permanent life insurance:

- Whole life insurance provides coverage for your entire life and has fixed premiums and a guaranteed rate of return on the policy's cash value. It is one of the more expensive ways to buy life insurance.

- Universal life insurance can be cheaper than whole life insurance because it does not offer the same guarantees. It allows you to adjust your premiums and death benefit (within limits) and often includes a cash value component.

- Variable life insurance is a riskier type of permanent life insurance as it is tied to investment accounts. It offers the potential for considerable gains but also carries a higher risk.

- Final expense life insurance, also known as funeral or burial insurance, is a small whole life insurance policy designed to cover end-of-life expenses such as funeral costs and medical bills.

Other Types of Life Insurance

- Group life insurance is typically offered by employers as a workplace benefit and is often provided at low or no cost to the employee.

- Mortgage life insurance covers the current balance of your mortgage and pays out to the lender, not your family, if you die.

- Credit life insurance pays off the remaining debt to the lender and is usually offered when you take out a loan.

- Supplemental life insurance can be purchased in addition to your main policy to provide extra coverage.

Life Insurance: Asset or Liability?

You may want to see also

Who needs life insurance?

Life insurance is a contract between you and an insurance company. You pay insurance premiums in exchange for coverage. If you die while the policy is in effect, the insurer pays out a life insurance death benefit to your beneficiaries.

Spouse or partner

If your spouse or partner relies on your income to survive, your death could leave them without a way to support themselves. The payout for a life insurance policy can help them cover living expenses and pay off debts like a mortgage so they can maintain the lifestyle they’ve become accustomed to.

Stay-at-home parents or spouses

Even if you don’t earn a traditional salary, you may still need coverage. Stay-at-home parents and spouses provide services that can be costly to replace, such as cleaning, cooking and childcare. A life insurance payout can help your partner cover the costs of these services during a difficult time.

Parents or grandparents with dependents

Minor children, unable to provide for themselves, could be put at a major disadvantage if your income disappeared. The same is true if you help cover college costs or provide support for someone with a disability. A life insurance policy can help cover these costs during the years that your dependents rely on you.

Small-business owners

Your business might struggle if you were to die, especially if you’re integral to its daily operations. A life insurance payout can help your business partners or heirs cover a variety of expenses, such as buying out your share of the company, covering office rent and employing additional help in your absence.

People who want to cover their final expenses

The median cost of a funeral with viewing and burial is $8,300, according to the latest data from the National Funeral Directors Association. Depending on your wishes for your funeral, it could cost more. With a burial life insurance policy, you could pay your own way, so to speak, keeping the burden off those tasked with executing your final wishes.

Co-signers or co-owners of debt

In most cases, debt does not pass to other people. However, if another person co-owns or co-signs the debt, they could be left holding the bill. Spouses in community property states such as California and Texas may also be responsible for outstanding debts, even if they’re not co-owners or co-signers. You can use life insurance to cover your debts if other people would be responsible for them, helping to pay them off in your absence.

People who don't need life insurance

If no one in your life would be financially burdened by your death, you can likely put off buying a life insurance policy. For now, you may find that saving and investing your money in other assets is a better move.

Life Insurance and Market Investment: What's the Connection?

You may want to see also

Who doesn't need life insurance?

Life insurance is designed to provide financial protection for your loved ones after your death. However, not everyone needs life insurance. Here are some scenarios where individuals may not need life insurance coverage:

- No Dependents or Financial Dependents: If you are single, have no dependents, and no one relies on your financial support, you may not need life insurance. In this case, your death is unlikely to cause financial hardship for anyone else, so insurance is not necessary.

- Sufficient Wealth and Assets: If you have accumulated enough wealth and assets to cover your final expenses, such as funeral costs and outstanding debts, and you have no dependents, then life insurance may not be necessary. This is because your passing would not create a financial burden for your loved ones.

- No Outstanding Debt: If you have no outstanding debt, such as a mortgage, student loans, or other financial liabilities, then life insurance may not be a requirement. However, if you have co-signers or co-owners of debt, they could be left with the bills, so it is still worth considering.

- Alternative Coverage: If you already have sufficient coverage through other means, such as employer-provided group life insurance or alternative investments, you may not need additional life insurance. It is important to review the details of your existing coverage to ensure it meets your needs.

- Young and Single: If you are young, single, and have no financial obligations or dependents, the need for life insurance is less urgent. However, if your employer offers free or low-cost group life insurance, it may still be beneficial to enrol as it can provide coverage in case of unexpected life changes.

While these scenarios describe individuals who may not need life insurance, it is important to note that life circumstances can change over time. It is always a good idea to periodically review your financial situation and assess whether life insurance is needed to protect your loved ones. Additionally, life insurance may still be beneficial even in these cases to provide additional financial security or to leave a financial legacy.

Life Insurance: Haven Life's Gender Gap Study

You may want to see also

How much does life insurance cost?

The cost of life insurance depends on a variety of factors, including age, gender, health, lifestyle, and the type of policy chosen. Generally, the younger and healthier you are, the lower your premiums will be. Let's take a closer look at the factors that influence the cost of life insurance and how much you can expect to pay.

Factors Affecting the Cost of Life Insurance

Age and gender are two of the biggest factors affecting life insurance rates. Younger individuals tend to pay less for life insurance because they are less likely to have health problems, and their life expectancy is higher. Men typically pay more than women due to shorter lifespans and more dangerous jobs or lifestyles.

Your health is another critical factor. Insurers consider your height and weight, medical history, and any pre-existing conditions. If you have chronic illnesses or serious health issues, your premiums may be higher. Tobacco use, risky hobbies, criminal history, and a hazardous occupation can also increase your rates.

The type of life insurance policy you choose also impacts the cost. Term life insurance, which covers a specific period, is generally more affordable than permanent life insurance, which lasts a lifetime and includes a cash value component. The longer the term and the higher the coverage amount, the more you'll pay for life insurance.

Average Cost of Life Insurance

According to sources, the average cost of life insurance is around $26 per month for a 40-year-old purchasing a 20-year, $500,000 term life policy. However, rates can vary significantly depending on the factors mentioned above. For example, a healthy 30-year-old woman can expect to pay approximately $8 per month for a $20,000 term life insurance policy, while a 55-year-old woman might pay around $25.50 per month for the same coverage.

It's important to note that life insurance rates are highly personalized, and the best way to determine your rates is to get a quote from an insurance provider. By comparing quotes from multiple insurers, you can find the most affordable option that meets your needs.

Shelter Insurance: Life Insurance Options and Availability

You may want to see also