Life insurance is an important financial tool that ensures your loved ones are taken care of in the event of your death. It can help cover funeral expenses, pay off debts, and make day-to-day living more manageable for those left behind. When it comes to calculating life insurance relief, there are several methods and factors to consider. One common approach is to multiply your annual income by 10, which serves as a starting point for estimating the necessary coverage amount. However, this method may not account for various factors such as debts, mortgage, and future educational needs. A more comprehensive approach is the DIME (Debt, Income, Mortgage, Education) method, which takes into account these additional factors to determine the coverage needed to maintain your dependents' standard of living. Other factors to consider include your age, health, occupation, and hobbies, as these can impact the cost of your insurance premiums. Additionally, tax relief is often available for life insurance premiums, providing an opportunity for tax savings. Calculating life insurance relief involves assessing your financial obligations, such as mortgage payments and future expenses, and subtracting your assets to determine the coverage gap that needs to be filled.

What You'll Learn

Calculating life insurance relief for life insurance premiums

Step 1: Understand Your Financial Obligations and Goals

Start by assessing your financial situation, including your income, debts, future costs, and savings. Consider your long-term financial obligations such as mortgage payments, college fees for your children, and funeral expenses. Think about why you need life insurance—is it to replace your income, pay off debts, or leave a financial gift? Your reason for purchasing coverage will impact the amount of insurance you need.

Step 2: Calculate Your Annual Income and Years of Coverage

Multiply your annual income by the number of years you want to replace that income. For example, if you earn $50,000 annually and want to provide income replacement for 10 years, the calculation would be $50,000 x 10 = $500,000. This is the basic foundation for determining your life insurance coverage needs.

Step 3: Add Up Your Debts and Future Costs

Determine the total amount of your debts, such as mortgage balance, credit card debt, loans, and any anticipated future costs like college tuition for your children or funeral expenses. Let's say you have a $200,000 mortgage, $25,000 in student loans, and expect to spend $20,000 on funeral costs. The calculation would be $200,000 + $25,000 + $20,000 = $245,000.

Step 4: Assess Your Savings and Existing Coverage

Now, consider your existing assets and any current life insurance policies. Add up your savings, investments, and the total coverage amount of your existing life insurance plans. Let's assume you have $50,000 in savings and a life insurance policy with a $100,000 coverage amount. The calculation would be $50,000 + $100,000 = $150,000.

Step 5: Calculate the Life Insurance Coverage Needed

To find the amount of life insurance coverage you need, take the total from Step 3 (financial obligations) and subtract the total from Step 4 (assets and existing coverage). Using the previous examples, it would be $245,000 - $150,000 = $95,000. This means you would need an additional $95,000 in life insurance coverage to meet your financial goals.

Step 6: Research Tax Relief Opportunities

Depending on your location, you may be eligible for tax relief on life insurance premiums. For example, in Malaysia, individuals can claim tax relief of up to a certain amount on life insurance premiums paid. Be sure to consult with a tax professional or refer to the guidelines provided by your local tax authorities to understand the specific conditions and limits for claiming tax relief on life insurance premiums.

Is California's Life Insurance Exam a Breeze?

You may want to see also

Calculating life insurance relief for education insurance

When it comes to insurance policies, there are several claimable tax reliefs offered for personal income tax in Malaysia.

For education insurance, a tax relief of up to RM3,000 is available for policies purchased for yourself, your spouse, or your child. The beneficiary of the insurance policy must be your child. You can claim this tax relief even if the premiums are paid through a salary deduction.

Calculating Life Insurance Relief for Life Insurance

For life insurance, pensionable public servants are entitled to up to RM7,000 in tax relief, while others are entitled to tax relief up to RM3,000 for life insurance and RM4,000 for the Employees Provident Fund (EPF).

Calculating Life Insurance Relief for Medical Insurance

For medical insurance, a tax relief of up to RM3,000 is available. You can apply for 100% of the premium or rider premium for stand-alone policies and riders to life insurance policies. However, you can only claim up to 60% of your premiums for critical illness coverage that is part of your term life or personal accident insurance policy. To claim tax relief for medical insurance, the policy coverage must be for 12 months or more.

Calculating Life Insurance Relief for Deferred Annuities

Deferred annuities are contracts where income payments are postponed to a future date, such as retirement age. Tax relief of up to RM3,000 is available for deferred annuity and the Personal Retirement Scheme (PRS).

General Tips for Filing Tax Reliefs in Malaysia

- Understand and familiarise yourself with the various tax reliefs available.

- Keep documentation: Maintain records and supporting documents for expenses you want to claim as tax reliefs, such as invoices, receipts, payment vouchers, and other proof of expenditures.

- Complete the tax return form or online submission: Ensure that you accurately report your income and claim any eligible tax reliefs.

- Enter reliefs in the appropriate sections: Provide necessary information, such as the type of relief, amount claimed, and supporting documentation reference numbers.

- Calculate the total relief amount: Sum up the total amount that can be claimed, adhering to the maximum allowable limits for each relief.

- Review and submit: Carefully check all the information for accuracy to avoid errors, then submit the tax return online or by mail.

- Retain proof of submission: Keep a copy of the submitted tax return for your records.

Family Life Insurance: Do Children Get Covered for Free?

You may want to see also

Calculating life insurance relief for medical insurance

When it comes to medical insurance, it's important to understand how to calculate life insurance relief, especially when it comes to tax benefits. Here are some detailed instructions to help you with the calculation process:

Understanding the Basics

Firstly, it's important to note that the calculations may vary based on your location. For instance, in Malaysia, individuals can claim tax relief for life insurance premiums they've paid. This relief is up to a certain limit, and it's essential to refer to the guidelines provided by the local revenue board for the most accurate and up-to-date information.

Now, let's delve into the steps to calculate life insurance relief for medical insurance:

- Determine the Type of Relief: Different types of tax relief mechanisms exist, including deductions, credits, and exemptions. Understand which type of relief applies to your medical insurance premiums.

- Identify the Eligible Amount: In the context of medical insurance, you can typically claim tax relief on a certain percentage of the premium. For example, in Malaysia, you can claim 100% of the premium for a standalone medical insurance policy or a rider to a life insurance policy. However, for critical illness coverage that is part of a term life or personal accident insurance policy, you may only be able to claim a lower percentage, such as 60%.

- Calculate the Premium Amount: Gather all the invoices, receipts, or payment vouchers related to your medical insurance premiums. Calculate the total amount you have paid for the year for which you are seeking tax relief.

- Apply the Relief Percentage: Multiply the total premium amount by the applicable relief percentage to determine the amount of relief you can claim. For instance, if you have paid $5,000 in medical insurance premiums and are eligible for 60% relief, your calculation would be $5,000 X 0.6 = $3,000.

- Consider Any Limits: Keep in mind that there might be limits set by the tax authorities on the maximum amount of relief you can claim. For example, in Malaysia, the relief for medical insurance is limited to RM3,000. Ensure you refer to the latest guidelines to understand any applicable limits.

- Complete the Necessary Forms: Fill out the required tax forms accurately, reporting your income and claiming any eligible tax reliefs. Provide all the necessary information, such as the type of relief, the amount claimed, and any supporting documentation.

- Calculate the Total Relief Amount: If you have multiple sources of tax relief, sum up the total amount of relief you can claim across all categories. Ensure that you adhere to the maximum allowable limits for each relief type.

- Submit the Forms: Once you've completed the forms and calculated the total relief amount, carefully review the information for accuracy and submit the tax forms by the required deadline.

- Retain Proof of Submission: Keep a copy of the submitted tax forms for your records. This will be helpful for any future reference or audit purposes.

By following these steps and staying informed about the applicable tax laws, you can effectively calculate and claim life insurance relief for your medical insurance premiums. Remember to consult official sources or seek professional advice for the most accurate and up-to-date information regarding tax relief calculations in your specific location.

Life Insurance Options for Ulcerative Colitis Patients

You may want to see also

Calculating life insurance relief for deferred annuities

Deferred annuities are contracts that postpone income payments to a future date, such as retirement age. In Malaysia, individuals can claim tax relief of up to RM3,000 for deferred annuity and Personal Retirement Schemes (PRS). This is part of the country's income tax relief measures, which aim to lower the amount of income tax an individual or business has to pay to the government.

To calculate and file for tax relief on a deferred annuity in Malaysia, follow these steps:

- Understand the various tax reliefs available and determine your eligibility.

- Keep records and supporting documents for expenses, such as invoices, receipts, and payment vouchers.

- Complete the tax return form or submit it online, accurately reporting your income and claiming any eligible tax reliefs.

- Enter the details of each relief you wish to claim, including the type of relief, amount claimed, and supporting documentation references.

- Calculate the total relief amount, ensuring you adhere to the maximum allowable limits.

- Review and submit the tax return online or by mail, retaining a copy for your records.

In addition to Malaysia, other countries may offer tax benefits for insurance policyholders, including tax relief on premiums paid. It is important to consult with a financial professional or refer to the relevant government guidelines to understand the specific tax laws and reliefs applicable to your situation.

How to Boost Your Life Insurance Coverage

You may want to see also

Calculating life insurance relief for Takaful contributions

Takaful is a form of co-operative insurance that has existed in the Islamic world for centuries. It is based on a system of reimbursement or repayment in case of loss. People and companies make small contributions to a mutual pool of funds, from which they are compensated in the event of a loss. Takaful does not aim to make a profit but instead seeks to ease the risk faced by contributors.

In Malaysia, individuals can claim tax relief on their Takaful contributions. The amount of relief available depends on whether you are a public servant or not. Public servants are entitled to up to RM7,000 in tax relief, while others are entitled to up to RM3,000 in relief for life insurance and RM4,000 for EPF contributions.

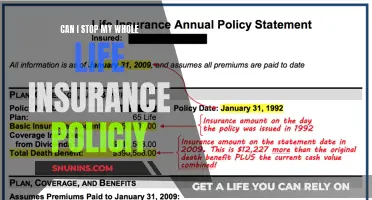

To calculate the amount of relief you can claim, you will need to refer to your annual insurance statement, which will list your insurance plans, the amount of premium paid for the year, and the types of coverage you are entitled to. You can then fill in the relevant sections of your income tax return form, ensuring that you do not exceed the maximum allowable limits for each relief type.

For example, let's say an individual has three insurance plans, with the following annual premiums:

- Life insurance premium: RM1,565.10

- Education and medical insurance premium: RM1,824.05

- Critical illness insurance premium: RM234.90

The individual can claim 100% of the life insurance premium and the education and medical insurance premium, but only 60% of the critical illness insurance premium. So, the calculation for tax relief claims would look like this:

- Life insurance premium: RM1,565.10

- Education and medical insurance premium: RM1,824.05

- Critical illness insurance premium: RM140.94 (60% of RM234.90)

The total amount of relief claimed would be RM3,520.09. However, as mentioned earlier, there is a maximum limit of RM3,000 for life insurance relief and RM4,000 for education and medical insurance relief. Therefore, the final insurance tax reliefs would look like this:

- Life insurance relief: RM3,000

- Education and medical insurance relief: RM1,824.05

In this case, the individual has maximised their claims for both life insurance and education and medical insurance relief.

Health and Life Insurance: Understanding the Connection

You may want to see also

Frequently asked questions

This depends on your financial goals and needs. You should consider your annual income, the number of years your dependents will need financial support, your debt, future college costs, funeral expenses, savings, and any other life insurance coverage. You can use a life insurance calculator to get an estimate of your needs.

There is no exact formula, but one way to estimate is to multiply your salary by the number of years until retirement. This will not take into account any debts, gifts to charities, or one-time costs such as college tuition.

DIME stands for Debt, Income, Mortgage, and Education. With this method, you calculate your coverage by adding up your debts (excluding your mortgage), your annual income multiplied by the number of years you want to replace that income, your mortgage balance, and any future education costs.

First, familiarize yourself with the various tax reliefs available. Keep records and supporting documents for the expenses you want to claim. Complete the tax return form or online submission, reporting your income accurately and claiming any eligible tax reliefs. Enter the details of each relief you wish to claim, including the type of relief, amount claimed, and supporting documentation reference numbers. Calculate the total relief amount, ensuring you adhere to the maximum allowable limits. Finally, review and submit the tax return online or by mail, retaining a copy for your records.