AAA Life Insurance is a reputable insurance provider known for its comprehensive coverage options. When it comes to rating, AAA Life Insurance has consistently received high ratings from independent agencies. These ratings assess the financial strength and stability of the company, indicating its ability to fulfill its financial obligations to policyholders. The AAA rating, in particular, signifies an exceptional level of financial strength and stability, making AAA Life Insurance a trusted choice for individuals seeking reliable and secure life insurance coverage.

What You'll Learn

- Financial Strength: AAA Life Insurance has an A++ financial strength rating from A.M. Best

- Customer Service: Known for excellent customer service and claims processing

- Product Offerings: Provides a range of life insurance products, including term and permanent

- Market Reputation: Established reputation as a trusted and reliable insurance provider

- Regulatory Compliance: Adheres to industry regulations and standards for ethical business practices

Financial Strength: AAA Life Insurance has an A++ financial strength rating from A.M. Best

AAA Life Insurance has been recognized for its exceptional financial stability and strength by A.M. Best, one of the leading credit rating agencies. A.M. Best's financial strength rating of A++ is a testament to the company's ability to meet its financial obligations and provide long-term value to its policyholders. This rating indicates an extremely strong ability to fulfill its financial commitments and is a highly sought-after attribute in the insurance industry.

The A++ rating signifies that AAA Life Insurance has a superior ability to pay claims and maintain a strong financial position over the long term. It reflects the company's robust capital resources, consistent profitability, and effective risk management strategies. With this high rating, AAA Life Insurance can offer its customers a sense of security, knowing that their insurance provider is financially secure and capable of honoring its promises.

A.M. Best's assessment takes into account various factors, including the company's financial performance, management quality, business profile, and corporate governance. AAA Life Insurance's A++ rating is a result of its commitment to maintaining a strong financial foundation, which is crucial for the stability and growth of any insurance company. This rating also highlights the company's ability to navigate economic challenges and maintain its financial strength, ensuring that policyholders' interests are protected.

For investors and policyholders, AAA Life Insurance's A++ financial strength rating is a significant advantage. It indicates a low-risk investment opportunity, as the company is well-positioned to meet its financial obligations. This rating can also impact the company's ability to attract and retain customers, as many individuals and businesses prioritize financial stability when choosing an insurance provider.

In summary, AAA Life Insurance's A++ financial strength rating from A.M. Best is a strong indicator of the company's financial health and reliability. This rating provides assurance to policyholders and investors alike, demonstrating AAA Life Insurance's commitment to maintaining a robust financial position and delivering on its promises.

Canceling Lumico Life Insurance: A Step-by-Step Guide

You may want to see also

Customer Service: Known for excellent customer service and claims processing

AAA Life Insurance is renowned for its exceptional customer service, which is a key factor in its positive reputation and high ratings. The company understands that customer satisfaction goes beyond just providing insurance policies; it involves building trust, offering support, and ensuring a seamless experience throughout the entire journey.

When it comes to customer service, AAA Life Insurance excels in multiple areas. Firstly, their representatives are highly trained and knowledgeable, equipped with the skills to handle a wide range of inquiries and concerns. Whether it's explaining complex insurance terms, providing personalized recommendations, or assisting with policy changes, the customer service team is dedicated to ensuring that clients receive the information and support they need. This level of expertise and professionalism is a significant contributor to the company's high ratings.

Another aspect that sets AAA Life Insurance apart is their efficient and transparent claims processing system. Filing a claim can be a stressful experience, but AAA ensures that the process is as smooth as possible. Their streamlined approach includes quick response times, clear communication, and a dedicated team to guide policyholders through the necessary steps. The company understands the importance of timely payouts and strives to resolve claims efficiently, often exceeding customer expectations. This commitment to efficient claims handling has earned AAA Life Insurance a stellar reputation in the industry.

Furthermore, AAA Life Insurance goes above and beyond by offering additional resources and support to its customers. They provide comprehensive online resources, including educational materials, policy documents, and a customer portal, allowing clients to access information at their convenience. Additionally, the company offers a 24/7 customer support hotline, ensuring that assistance is always available, even outside of regular business hours. This level of accessibility and responsiveness further enhances the overall customer experience.

In summary, AAA Life Insurance's commitment to excellent customer service and efficient claims processing is a significant reason for its high ratings. By providing knowledgeable representatives, a streamlined claims process, and additional support resources, the company ensures that policyholders receive the care and assistance they deserve. This dedication to customer satisfaction has solidified AAA Life Insurance's position as a trusted and reliable insurance provider.

Life Insurance and Taxes: What's the Connection?

You may want to see also

Product Offerings: Provides a range of life insurance products, including term and permanent

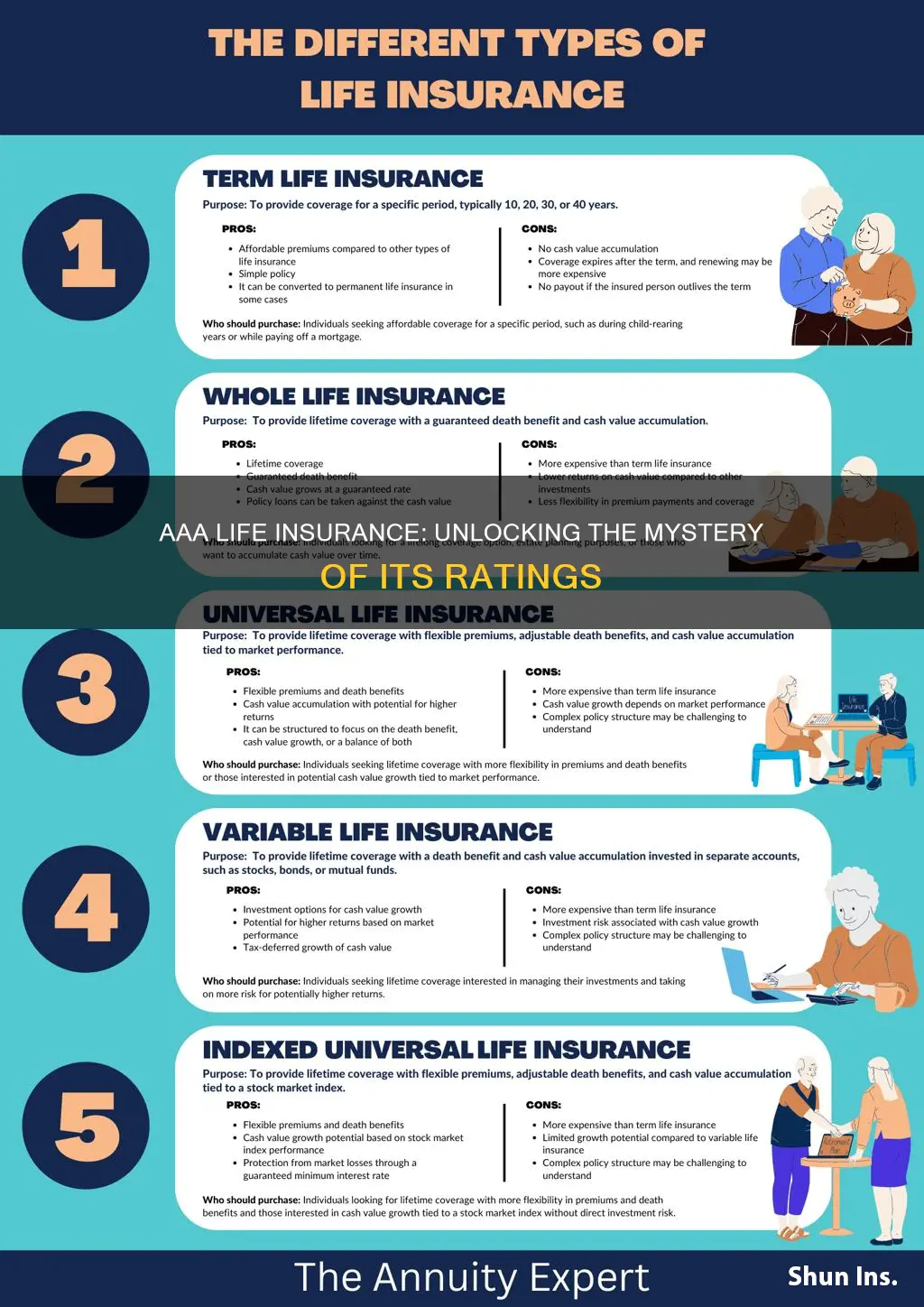

When considering life insurance, it's essential to understand the various products available to ensure you choose the right coverage for your needs. AAA Life Insurance offers a comprehensive range of options, catering to different financial goals and risk profiles. Their product offerings include both term and permanent life insurance, each with its unique features and benefits.

Term Life Insurance:

This type of coverage provides a specified death benefit for a predetermined period, known as the 'term'. It is an excellent choice for individuals seeking affordable and straightforward protection for a particular duration. For example, if you have a 20-year mortgage and want to ensure your family is financially secure in case of your untimely passing, a 20-year term life policy could be ideal. The simplicity of term life insurance lies in its fixed premiums and clear coverage period, making it easy to understand and budget for.

Permanent Life Insurance:

In contrast, permanent life insurance offers lifelong coverage, providing a death benefit and a cash value component. This product is designed to be a long-term financial tool, offering both protection and an investment opportunity. Permanent life insurance policies, such as whole life or universal life, accumulate cash value over time, which can be borrowed against or withdrawn. This feature makes it a versatile choice, allowing policyholders to build a substantial financial asset while also ensuring their loved ones are protected.

AAA Life Insurance's product range caters to various life stages and financial objectives. Whether you're a young professional seeking affordable term coverage or an individual looking for a long-term financial strategy, AAA offers tailored solutions. The company's commitment to providing a diverse portfolio of life insurance products ensures that customers can find the right fit for their specific needs.

When evaluating AAA Life Insurance's offerings, it's crucial to consider your personal circumstances, financial goals, and risk tolerance. The company's website and customer service team can provide valuable guidance in selecting the appropriate policy. Understanding the differences between term and permanent life insurance is the first step towards making an informed decision about your life insurance needs.

Life Insurance and Pre-Existing Conditions: What They Can Discover?

You may want to see also

Market Reputation: Established reputation as a trusted and reliable insurance provider

When considering the market reputation of AAA Life Insurance, it's important to understand the company's established position as a trusted and reliable insurance provider. AAA Life Insurance has a long history in the industry, dating back to its founding in 1904. Over the years, the company has built a strong reputation for its commitment to customer service and financial stability. This has led to a high level of trust and confidence among policyholders and industry professionals alike.

One of the key factors contributing to AAA Life Insurance's market reputation is its financial strength. The company has consistently maintained a strong financial position, which is a crucial aspect for any insurance provider. AAA Life Insurance has received excellent ratings from reputable credit rating agencies, such as A.M. Best and Standard & Poor's. These ratings reflect the company's ability to meet its financial obligations and provide long-term stability to its policyholders. For instance, A.M. Best has assigned AAA Life Insurance a 'A++' rating, indicating an exceptional financial strength and a very low risk of default.

In addition to financial stability, AAA Life Insurance's market reputation is also built on its commitment to customer satisfaction. The company has received numerous accolades and awards for its exceptional customer service. Many policyholders appreciate the personalized attention and support they receive from AAA Life Insurance representatives. The company's focus on building long-term relationships with its customers has resulted in a loyal customer base and positive word-of-mouth recommendations.

Furthermore, AAA Life Insurance's market reputation is enhanced by its involvement in community initiatives and corporate social responsibility. The company actively supports various charitable organizations and community programs, demonstrating its dedication to making a positive impact beyond the insurance industry. This commitment to social responsibility further solidifies AAA Life Insurance's position as a trusted and ethical insurance provider.

In summary, AAA Life Insurance's market reputation as a trusted and reliable insurance provider is well-established. Its strong financial position, as evidenced by high ratings from credit rating agencies, and its commitment to customer satisfaction and social responsibility contribute to its positive image in the market. When considering life insurance options, AAA Life Insurance's established reputation can provide policyholders with a sense of security and confidence in their insurance provider.

Hep C and Life Insurance: Perduntal's Approval Process

You may want to see also

Regulatory Compliance: Adheres to industry regulations and standards for ethical business practices

In the context of the insurance industry, regulatory compliance is a critical aspect of ethical business practices. It ensures that companies adhere to the legal and ethical standards set by relevant authorities, which is especially important for life insurance providers. When assessing the rating of AAA life insurance, one must consider the company's commitment to regulatory compliance as a key factor.

AAA life insurance companies are subject to strict regulations to protect consumers and maintain market integrity. These regulations often include requirements for financial stability, transparency, and fair treatment of policyholders. For instance, insurance regulators mandate that companies maintain sufficient capital to meet their obligations, disclose relevant information in a timely manner, and provide accurate and clear communication to policyholders. By adhering to these standards, AAA-rated life insurance providers demonstrate their dedication to ethical practices and consumer protection.

Regulatory compliance also involves staying up-to-date with industry standards and best practices. Insurance associations and regulatory bodies often publish guidelines and codes of conduct that companies must follow. These standards cover various aspects, such as underwriting practices, policy administration, and customer service. AAA-rated insurers are expected to implement robust processes that meet or exceed these industry standards, ensuring that their operations are consistent, fair, and transparent.

Moreover, regulatory compliance plays a vital role in risk management. Insurance companies must adhere to regulations that govern the assessment and management of risks. This includes accurate risk evaluation, appropriate pricing of policies, and effective risk mitigation strategies. By complying with these regulations, AAA-rated life insurance providers can maintain their financial stability and ensure that they can fulfill their obligations to policyholders over the long term.

In summary, regulatory compliance is an essential aspect of AAA life insurance ratings. It reflects the company's commitment to ethical business practices, consumer protection, and adherence to industry standards. When evaluating the rating of AAA life insurance, investors and consumers should consider the company's track record in regulatory compliance, as it directly impacts the reliability and trustworthiness of the insurer.

Understanding Blended Term Life Insurance: Pros and Cons

You may want to see also

Frequently asked questions

AAA Life Insurance is a term life insurance policy offered by the American Automobile Association (AAA). It is designed to provide financial protection to individuals and their families in the event of the insured's death. The policy offers a death benefit, which is a lump sum payment made to the designated beneficiaries upon the insured's passing.

The rating of AAA Life Insurance is typically determined by insurance rating agencies, such as A.M. Best, Moody's, or Standard & Poor's. These agencies assess the financial strength and stability of insurance companies, including their ability to meet financial obligations and pay claims. AAA Life Insurance's rating may vary depending on the specific policy and the insurance company's overall financial health.

AAA Life Insurance offers several benefits, including financial security for your loved ones, tax-free death benefits, and potential investment opportunities. The policy provides a fixed death benefit, ensuring a guaranteed payout to beneficiaries. Additionally, some policies may offer an additional feature like an investment account, allowing policyholders to grow their money over time.

While AAA Life Insurance can be a valuable financial tool, there are a few considerations. The policy may have limitations or exclusions, and the investment component, if available, may be subject to market risks. It is essential to carefully review the policy terms, understand the coverage, and consider consulting a financial advisor to ensure it aligns with your specific needs and goals.