People with Hepatitis C can get life insurance, but it depends on several factors. For instance, Prudential Life Insurance offers customizable term and universal life insurance options, but it's unclear if they cover people with Hepatitis C. On the other hand, John Hancock offers life insurance policies to people with HIV, but they require the applicant to be negative for Hepatitis B and C. Additionally, American National Life Insurance Company has specific requirements for HIV patients, but it's uncertain if they cover Hepatitis C patients. Therefore, it's best to consult an independent insurance agent to find the right company for your needs.

| Characteristics | Values |

|---|---|

| Company | Prudential |

| Hepatitis C approval | Not approved if Hepatitis C is present |

What You'll Learn

- People with Hep C can be approved for life insurance, but it depends on their medical history

- You must not have Hepatitis B or C to be approved for life insurance

- You will need to show a favourable treatment response for at least six months

- Most companies will want at least one year, if not five years, to pass since your diagnosis

- You will need to provide full lab work, including a drug screen and hepatitis panel

People with Hep C can be approved for life insurance, but it depends on their medical history

People with Hepatitis C can be approved for life insurance, but it depends on the insurance company and the individual's medical history. Hepatitis C is a viral infection that affects the liver and can lead to advanced liver disease, liver cancer, and death if left untreated. While it is curable in most cases, the high cost of treatment, which can range from $23,600 to $84,000, often poses a barrier to accessing treatment.

The implementation of the Affordable Care Act (ACA) has provided greater access to insurance for people with pre-existing conditions, including those with chronic viral hepatitis. Under the ACA, insurance companies cannot deny coverage to people with diagnosed chronic viral hepatitis, and they are prohibited from dropping coverage when a customer falls ill. The ACA has also expanded Medicaid eligibility, making viral hepatitis prevention, screening, and care services more accessible to low-income individuals.

However, many insurance providers still have restrictions in place that prevent people with Hepatitis C from accessing treatment. For example, some insurers require that the patient has liver damage or that the prescribing doctor is a liver disease or infectious disease specialist. Additionally, the high cost of treatment can result in hefty co-pays, even with insurance coverage.

When applying for life insurance, individuals with Hepatitis C may need to disclose their medical history, including their Hepatitis C diagnosis and any associated liver damage. The insurance company will then assess the individual's health status and determine their eligibility for coverage. It is important to note that each insurance company has its own underwriting guidelines, and the approval process may vary.

In summary, while people with Hepatitis C can be approved for life insurance, the outcome depends on their medical history and the specific policies of the insurance company they are applying to. It is advisable for individuals with Hepatitis C to carefully review the terms and conditions of different insurance providers and seek advice from a financial professional to find the right coverage for their needs.

New York Life Insurance: Felon-Friendly or Not?

You may want to see also

You must not have Hepatitis B or C to be approved for life insurance

Life insurance companies are generally interested in monitoring customers with hepatitis B and C. This is because hepatitis is an indication of an inflamed liver, and types B and C can lead to serious liver complications.

Hepatitis B is transmitted through bodily fluids and can be spread from a mother to a child at birth, or by adults who share intravenous needles or engage in unprotected sex. Unfortunately, hepatitis B is not curable, but it is also not a critical illness.

Hepatitis C is primarily spread through contact with the blood of an infected person, such as through sharing needles or other equipment used to inject drugs. There is no vaccine for hepatitis C, and it can cause serious liver damage, including cirrhosis and liver cancer.

If you have hepatitis B or C, it is unlikely that you will be approved for life insurance. However, there are some insurance companies that offer guaranteed issue life insurance or simplified issue life insurance, which may be more accessible for individuals with pre-existing conditions. These types of policies typically have less stringent medical underwriting requirements but may have limitations on coverage amounts or higher premiums.

Crohn's Impact: Life Insurance and Your Health

You may want to see also

You will need to show a favourable treatment response for at least six months

To be approved for life insurance, people with Hepatitis C will need to show a favourable treatment response for at least six months. This means that the virus is no longer detectable in their blood, indicating that they have achieved a sustained virologic response (SVR). SVR is typically achieved within 12 weeks of starting treatment with direct-acting antiviral medications, which directly target the Hepatitis C virus. These medications include daclatasvir, elbasvir and grazoprevir, glecaprevir and pibrentasvir, ledipasvir and sofosbuvir, ombitasvir, paritaprevir, and ritonavir with dasabuvir, simeprevir and sofosbuvir, sofosbuvir and velpatasvir, and sofosbuvir, velpatasvir, and voxilaprevir.

The duration of treatment can vary from 8 to 24 weeks, depending on the specific medication and the individual's response. It is important to note that not all medications work for all genotypes of Hepatitis C, with Type 1 being the most common. Additionally, the presence and extent of liver scarring (cirrhosis) can influence the choice of medication.

By achieving SVR and maintaining it for at least six months, individuals with Hepatitis C can demonstrate a favourable treatment response and increase their chances of being approved for life insurance. This process may involve regular medical assessments and monitoring to ensure the virus remains undetectable.

Life Insurance and Hot Air Balloon Deaths: What's Covered?

You may want to see also

Most companies will want at least one year, if not five years, to pass since your diagnosis

When it comes to life insurance for people with Hepatitis C, timing can be a crucial factor in the approval process. Most companies will want to see a period of time, often a year or more, pass since the initial diagnosis before providing coverage. This waiting period allows insurers to assess the progression of the condition and any potential complications that may arise. Here are some reasons why a year or more may be required:

Disease Progression and Treatment:

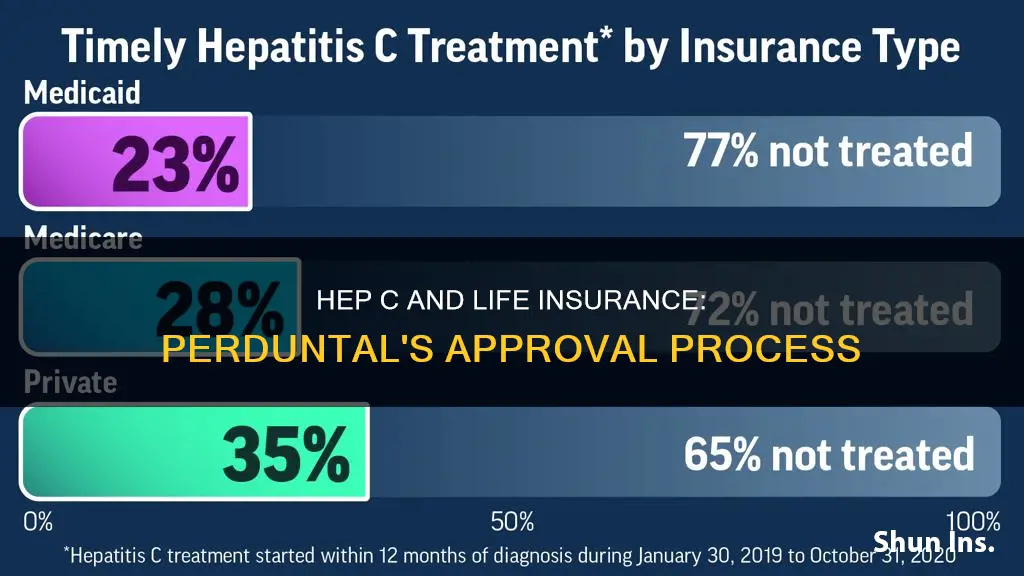

Hepatitis C (Hep C) is a viral infection that affects the liver and can lead to severe complications. While some cases of acute Hep C resolve on their own, chronic cases can cause liver damage, cirrhosis, and even liver cancer. The progression of the disease varies from person to person, and insurers want to understand the trajectory of the condition before offering coverage. During this waiting period, effective treatments can make a significant difference. Direct-acting antiviral (DAA) medications have been available since 2014, with a cure rate of over 95%. However, only about 1 in 3 people with insurance receive timely treatment within the first year of diagnosis. This delay in treatment can impact the prognosis and the insurer's assessment of risk.

Assessing Risk and Long-Term Prognosis:

Insurers often consider the long-term prognosis of Hep C when determining eligibility and premiums for life insurance. They may want to see if the condition is well-managed and if there are any signs of liver damage or other complications. The severity of liver damage and the response to early treatment play a crucial role in the outlook for people with chronic Hep C. Insurers typically assess risk based on the likelihood of future claims, and a longer period of stability after diagnosis can provide them with more data to make an informed decision.

Underwriting Criteria and Exclusions:

Life insurance companies have specific underwriting criteria and exclusions for pre-existing conditions like Hep C. They may require a minimum amount of time to pass since diagnosis to better understand the applicant's health status. This waiting period allows them to assess the applicant's overall health, treatment response, and any potential long-term complications. By waiting a year or more, insurers can gain a clearer picture of the applicant's health and the effectiveness of their treatment.

Impact on Premiums:

The length of time since diagnosis can also impact the cost of life insurance premiums. Insurers may offer more competitive rates if the applicant's condition is well-managed and there are no significant complications. Waiting for a year or more provides data on the applicant's health trajectory, allowing insurers to assess the risk more accurately and potentially offer more affordable premiums.

In summary, the one-year or five-year waiting period allows insurers to gather critical information about the progression of Hep C, the effectiveness of treatment, and the long-term prognosis. This information helps them assess the level of risk and determine eligibility and premium costs for life insurance coverage. During this waiting period, it is essential for individuals with Hep C to seek timely treatment, manage their condition effectively, and work towards achieving sustained virologic response (SVR), which indicates that the virus is unlikely to return.

Life Insurance and Suicide: What Coverage Entails

You may want to see also

You will need to provide full lab work, including a drug screen and hepatitis panel

To apply for life insurance with Prudential, you will need to provide full lab work, including a drug screen and hepatitis panel. This is to ensure that the insurance company has a comprehensive overview of your health and can determine the appropriate coverage for your needs.

A hepatitis panel is a group of blood tests that check for a current or past viral hepatitis infection. It screens for the three most common types of viral hepatitis: hepatitis A, hepatitis B, and hepatitis C. These tests can detect antigens and antibodies in your blood, which are indicators of a hepatitis infection. Antigens are foreign substances, such as proteins of the virus itself, while antibodies are substances produced by your immune system to fight the infection.

The process of drawing blood for a hepatitis panel is straightforward and usually takes less than five minutes. A health care professional will clean the area, typically the inside of your elbow or the back of your hand, and apply a tourniquet to make your veins more visible. They will then insert a small needle attached to a collection vial to draw the blood. You may feel a slight sting, and there may be some temporary discomfort during the procedure.

The blood sample will be sent to a laboratory for analysis, and you can expect to receive the results within a few business days. It's important to note that a hepatitis panel cannot differentiate between acute and chronic hepatitis C infections. If you test positive for hepatitis C, further testing will be required to determine the type of infection.

In addition to the hepatitis panel, a drug screen will also be conducted as part of the full lab work. This will involve analyzing your blood or urine sample for the presence of any illegal or prescription drugs. The drug screen helps the insurance company assess your overall health and identify any potential risks or concerns.

By providing full lab work, including a drug screen and hepatitis panel, you can ensure that Prudential has the necessary information to make an informed decision about your life insurance application.

Life Insurance Annual Charges: What You Need to Know

You may want to see also

Frequently asked questions

Yes, Prudential offers life insurance to people with Hepatitis C. However, there are specific requirements that need to be met, such as being between the ages of 30 and 60, residing in the United States (excluding Vermont and Hawaii), and not having acquired HIV through intravenous drug use or blood transfusions.

The chances of getting approved for life insurance with Hepatitis C depend on several factors, including the severity of the disease, the applicant's overall health, and the treatment plan. It is recommended to work with an experienced life insurance broker who can help navigate the different requirements of various insurance companies.

If you don't meet the strict underwriting requirements, there are still options available. Guaranteed issue life insurance is a type of policy that does not require a medical exam or health questions, and it is offered to individuals within a certain age range. However, the death benefits for these policies are typically lower, ranging from $5,000 to $25,000.