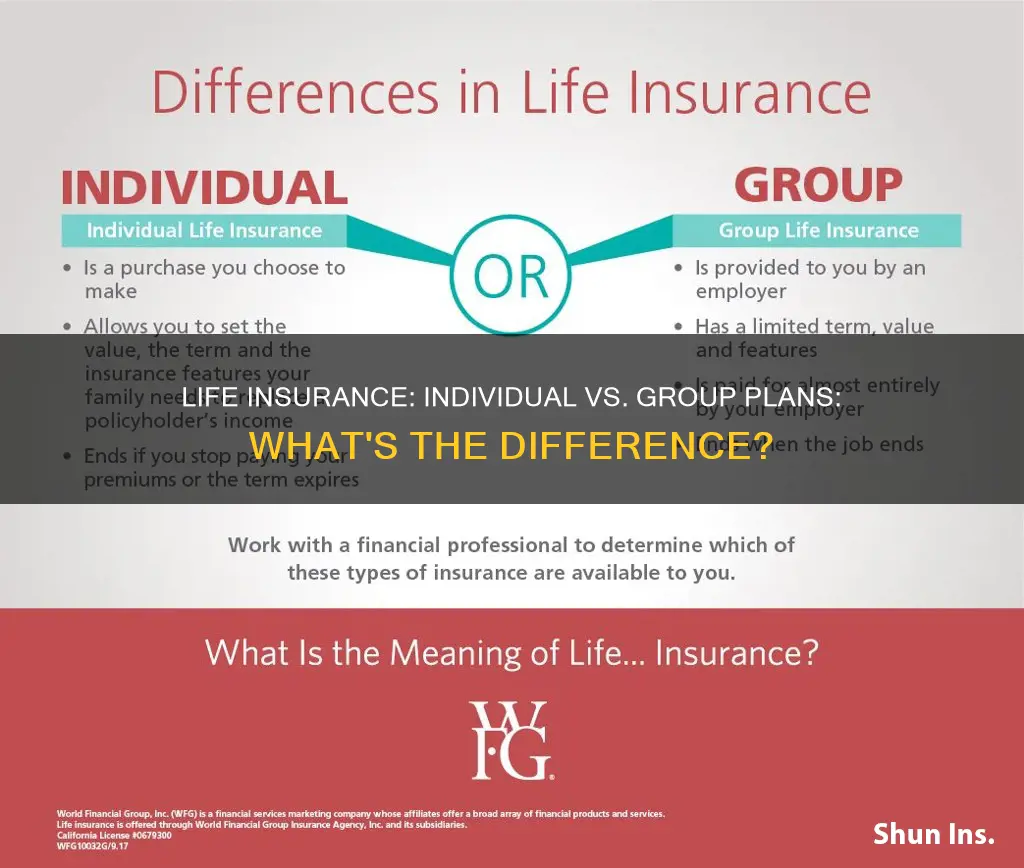

Understanding the differences between individual and group life insurance is essential for making informed decisions about your financial security. Individual life insurance is a personal policy tailored to an individual's needs, offering coverage for a specific amount of time or until a certain age. It provides financial protection to the policyholder's beneficiaries in the event of death, with the premium typically paid by the individual. On the other hand, group life insurance is a policy purchased by an employer or an association for a group of people, usually employees or members. This type of insurance provides coverage to the entire group, and the premiums are often split between the employer and the policyholders, making it more affordable for individuals. The key difference lies in the level of customization and the cost, as group policies may offer lower premiums due to the collective risk pooling, while individual policies provide more personalized coverage options.

| Characteristics | Values |

|---|---|

| Definition | Individual life insurance is a personal policy purchased by an individual to provide financial protection for their family or beneficiaries. Group life insurance, on the other hand, is a policy taken out by an employer to cover the lives of their employees. |

| Cost | Generally, individual life insurance policies tend to be more expensive as they are tailored to the specific needs and health of the individual. Group life insurance can be more affordable due to the larger pool of insured individuals. |

| Coverage Amount | The death benefit in individual life insurance can vary widely based on the policyholder's preferences and needs. Group life insurance often provides a set amount per employee, which may be standardized. |

| Term Length | Individual policies can be term life (for a specific period) or permanent (lasting for the individual's lifetime). Group life insurance is typically term-based and may be renewable. |

| Underwriting Process | Individual life insurance requires a thorough medical examination and assessment of the applicant's health. Group life insurance may have a simpler underwriting process, sometimes based on the average health of the group. |

| Portability | Individual life insurance policies are portable, meaning they can be transferred or converted if the individual leaves their employer. Group life insurance coverage may end if the individual leaves the company. |

| Tax Implications | Proceeds from individual life insurance are generally tax-free. Group life insurance benefits may be subject to income tax for the beneficiary. |

| Flexibility | Individual policies offer more flexibility in terms of coverage options, riders, and policy customization. Group life insurance plans may have limited customization. |

| Renewal Options | Individual life insurance policies can be renewed annually or at specific intervals. Group life insurance may offer automatic renewals or the option to renew individually. |

| Exclusions | Both types of insurance may have exclusions, but individual policies often have more specific and personalized exclusions based on the individual's health and lifestyle. |

What You'll Learn

- Coverage: Individual insurance covers one person, while group insurance covers multiple individuals

- Cost: Group policies are often more affordable due to shared risk

- Flexibility: Individual plans offer more customization and control over coverage

- Term: Group insurance typically has shorter terms, while individual plans can be longer

- Benefits: Group policies may include additional perks like retirement plans

Coverage: Individual insurance covers one person, while group insurance covers multiple individuals

When it comes to life insurance, understanding the coverage options available is crucial for making an informed decision. One of the primary differences between individual and group life insurance lies in the scope of coverage.

Individual life insurance, as the name suggests, provides coverage specifically for one person. This type of policy is tailored to the individual's needs and offers a personalized level of protection. With individual insurance, the policyholder is the sole beneficiary, and the death benefit is paid out to the designated recipient upon the insured's passing. This ensures that the financial security of a single individual or their family is addressed.

On the other hand, group life insurance is designed to cover multiple individuals within a specific group or organization. This type of insurance is often offered by employers as a benefit to their employees. In a group policy, the coverage extends to all members of the group, and the death benefit is paid out to the group as a whole. Group insurance can provide a safety net for entire teams, departments, or even an entire company, ensuring that the financial well-being of multiple individuals is protected.

The key distinction here is that individual life insurance focuses on personal coverage, offering a customized solution for an individual's unique circumstances. It provides a dedicated safety net for the insured and their beneficiaries. In contrast, group insurance takes a broader approach, covering a collective group of people and providing a comprehensive solution for organizations to protect their workforce.

Understanding this coverage difference is essential when choosing the right insurance plan. Whether it's individual coverage for personalized protection or group insurance for collective security, each option has its advantages and is suited to different situations.

Life Insurance Payments: Tax Deductions and Benefits

You may want to see also

Cost: Group policies are often more affordable due to shared risk

When it comes to life insurance, one of the key differences between individual and group policies is the cost. Group life insurance is often more affordable for employees because the risk is shared among a larger pool of people. This shared risk model is a fundamental aspect of group insurance and significantly impacts the overall cost for policyholders.

In an individual policy, the insurance company assesses the risk based on the specific characteristics of the policyholder, such as age, health, lifestyle, and occupation. This personalized assessment can lead to higher premiums, especially for those with higher-risk profiles. For instance, a 40-year-old non-smoker with a healthy lifestyle might pay a lower premium for individual life insurance compared to a 55-year-old smoker with pre-existing health conditions.

In contrast, group life insurance policies are designed to cover a large group of people, such as employees of a company. By pooling the risks of many individuals, the insurance company can offer coverage at a lower cost to each member of the group. This is because the collective risk is more predictable and manageable, allowing the insurer to set premiums that are generally more affordable for everyone. For example, a tech company might offer group life insurance to its employees, and the cost of the policy would be distributed among all the covered individuals, making it more accessible and cost-effective for each employee.

The shared risk aspect of group insurance is a result of the larger pool of policyholders. When more people are insured under a group policy, the potential for adverse events (like deaths or critical illnesses) is spread out, reducing the financial impact on any single insurer. This shared risk model is particularly beneficial for high-risk individuals who might struggle to find affordable coverage through individual policies.

Additionally, group life insurance often provides a more straightforward and efficient claims process. Since the risk is shared, the administration and processing of claims can be more streamlined, benefiting both the employees and the insurance company. This efficiency can further contribute to the overall cost-effectiveness of group life insurance.

Specialty Life Insurance: Legit or a Scam?

You may want to see also

Flexibility: Individual plans offer more customization and control over coverage

When it comes to life insurance, one of the key differences between individual and group plans lies in the level of flexibility and control that each offers. Individual life insurance policies provide policyholders with a high degree of customization, allowing them to tailor the coverage to their specific needs and preferences. This flexibility is a significant advantage for those who want to ensure that their insurance policy aligns perfectly with their unique circumstances.

With an individual plan, you have the freedom to choose the amount of coverage that suits your financial goals and risk assessment. This level of customization is particularly beneficial for those with specific requirements, such as high-risk professions or unique health conditions. For instance, a person working in a dangerous profession might opt for a higher death benefit to provide comprehensive financial protection for their loved ones. Similarly, an individual with a pre-existing health condition can adjust the coverage to account for potential medical expenses.

The customization options in individual life insurance extend beyond the death benefit. Policyholders can also select the duration of the policy, known as the term length. This choice allows individuals to decide how long they want the coverage to last, whether it's for a specific period, such as 10 or 20 years, or even indefinitely. Additionally, individuals can choose the payment frequency, whether it's annually, semi-annually, or monthly, to fit their budget and financial preferences.

Another aspect of flexibility in individual plans is the ability to add or remove riders and endorsements. Riders are optional features that enhance the policy's benefits, such as an accelerated death benefit rider, which allows the policyholder to access a portion of the death benefit if they are diagnosed with a terminal illness. Endorsements, on the other hand, provide additional coverage or changes to the policy, such as increasing the death benefit or converting the policy to an annuity. These options give individuals the power to adapt their insurance plan as their life circumstances change.

In contrast, group life insurance plans typically offer less customization. These plans are usually provided by employers as a benefit to their employees, and the coverage is standardized for the entire group. While group plans can provide a convenient and cost-effective way to obtain life insurance, they may not cater to the specific needs of each individual within the group. Therefore, for those seeking a more personalized and flexible insurance solution, individual life insurance plans are the preferred choice.

Unraveling the Mystery: Group Life and Accidental Death & Dismemberment Insurance Explained

You may want to see also

Term: Group insurance typically has shorter terms, while individual plans can be longer

When it comes to life insurance, understanding the differences between individual and group policies is crucial for making an informed decision. One significant aspect to consider is the term length, which varies between these two types of insurance.

Group insurance, as the name suggests, is designed to cover a group of people, often employees of a company or members of an organization. This type of coverage is typically offered as a benefit by employers or associations. The terms for group insurance plans are generally shorter, often ranging from one to five years. This shorter duration is advantageous for employers as it provides a cost-effective way to offer insurance to their workforce. For employees, it means they can access insurance coverage relatively quickly and at a potentially lower cost compared to individual plans. However, the shorter term may not provide long-term financial security, and individuals might need to consider other options to ensure coverage beyond the group policy's term.

On the other hand, individual life insurance plans are tailored to meet the specific needs of an individual. These policies can have longer terms, sometimes extending to 30 years or more. The extended term allows for more comprehensive coverage, ensuring financial protection for the policyholder and their beneficiaries over an extended period. With individual plans, policyholders have the flexibility to choose the duration that best suits their long-term goals and financial obligations. This flexibility is particularly beneficial for those who want to ensure their loved ones' financial security for an extended duration, such as until their children are financially independent or specific financial goals are achieved.

The difference in term length between group and individual insurance is a key factor in choosing the right coverage. While group insurance provides immediate access to insurance with shorter terms, individual plans offer more customization and longer-term financial protection. Understanding these variations will enable individuals to make informed decisions regarding their insurance needs and ensure they have the appropriate coverage for their specific circumstances.

Gerber Life Insurance: Adult Coverage Options Explored

You may want to see also

Benefits: Group policies may include additional perks like retirement plans

When considering life insurance, individuals often have the option to choose between individual and group policies. While individual life insurance is tailored to the specific needs of a single person, group life insurance is designed to provide coverage for a group of people, typically within an organization or community. One of the key advantages of group life insurance is the potential for additional benefits and perks that can enhance the overall value of the policy.

One of the most significant benefits of group life insurance is the inclusion of retirement plans. Many employers offer group life insurance policies as part of their employee benefits package, recognizing the importance of financial security for their workforce. These retirement plans can provide a steady income stream for the insured individual during their retirement years, ensuring a more comfortable and secure lifestyle. By offering retirement plans, group life insurance policies not only provide coverage for the present but also contribute to the long-term financial well-being of the policyholder.

The retirement plans associated with group life insurance can vary in structure and benefits. Some plans may offer a fixed pension, providing a regular income at retirement. Others might include a defined contribution plan, where the employer and/or employee contribute a certain amount, and the retirement benefits are based on the total contributions over time. These plans can be particularly attractive as they often have lower costs compared to individual retirement accounts, making it an affordable and comprehensive way to plan for the future.

Furthermore, group life insurance policies often have the advantage of lower premiums due to the collective risk pooling. When multiple individuals are covered under a group policy, the insurance company can spread the risk, resulting in more competitive pricing. This cost-effectiveness can make it more accessible for individuals to secure financial protection for themselves and their loved ones without incurring significant financial burdens.

In summary, group life insurance offers a range of benefits, including the inclusion of retirement plans, which can provide long-term financial security. The lower premiums and additional perks make group life insurance an attractive option for individuals seeking comprehensive coverage and a more affordable way to plan for their future. Understanding the differences and advantages of group life insurance can help individuals make informed decisions about their insurance needs.

Term Life Insurance: Does GEICO Offer This?

You may want to see also

Frequently asked questions

Individual life insurance is a personal policy taken out by an individual to provide financial protection for their loved ones in the event of their death. It is tailored to the specific needs and circumstances of the policyholder. On the other hand, group life insurance is a policy taken out by an employer or an association to provide coverage for a group of people, typically employees or members. It offers a convenient and often more affordable option for coverage, as the risk is shared among the group.

The cost of individual life insurance policies can vary significantly based on factors like age, health, lifestyle, and the amount of coverage chosen. Younger and healthier individuals typically pay lower premiums. Group life insurance, however, is usually more affordable because the premiums are often split among the group members, and the risk is diversified. Additionally, group policies may have lower administrative costs due to the efficiency of group underwriting.

Individual life insurance offers the advantage of customization, allowing policyholders to choose the coverage amount, term length, and riders (optional benefits) that best suit their needs. It provides financial security to the beneficiaries, ensuring they receive a tax-free death benefit. Group life insurance, on the other hand, often includes features like term life coverage, accidental death benefits, and in some cases, critical illness coverage. It provides a safety net for the group members and their families, and it can also be a valuable employee benefit, enhancing employee satisfaction and retention.

Individual life insurance policies can offer tax advantages, as the premiums may be tax-deductible in certain circumstances, and the death benefit is generally tax-free for the beneficiaries. Group life insurance, when provided by an employer, may also be tax-advantaged for the employee. However, the tax treatment can vary based on the jurisdiction and the specific policy details. It is essential to consult tax professionals to understand the tax implications for each type of policy.

The underwriting process for individual life insurance involves a more detailed assessment of the applicant's health, lifestyle, and financial situation. Underwriters may request medical exams, ask for extensive medical history, and consider various risk factors. Group life insurance, due to the larger pool of applicants, often has a simpler underwriting process. The risk is assessed based on the group's overall health and demographics, and individual health declarations may be sufficient for coverage.