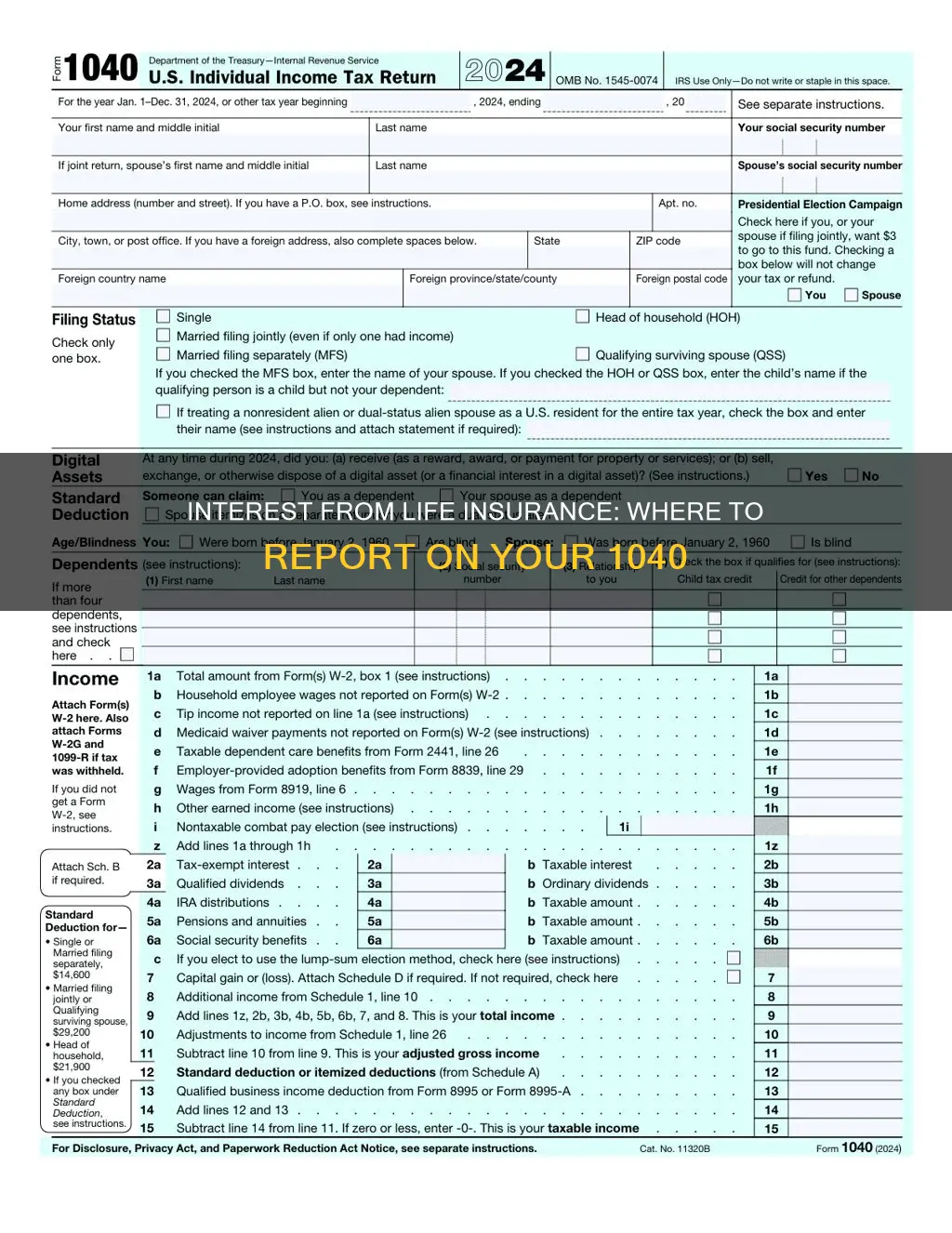

When filing your taxes, it's important to know where to report interest earned from life insurance policies on your 1040 form. Interest from life insurance can be a significant source of income, and understanding how to properly report it is crucial for accurate tax compliance. This guide will provide an overview of the specific section on the 1040 form where you should enter this interest, ensuring you stay organized and compliant with tax regulations.

What You'll Learn

- Interest Income: Enter interest earned from life insurance policies on line 8a of Form 1040

- Policy Proceeds: Report proceeds from life insurance on line 21 of Form 1040

- Exempt Amounts: Interest under $1,000 is exempt; report on Schedule B

- State Taxes: Interest may be reported differently in state returns

- Capital Gains: Proceeds from life insurance sales may be treated as capital gains

Interest Income: Enter interest earned from life insurance policies on line 8a of Form 1040

If you've received interest income from life insurance policies, you'll need to report this on your U.S. federal tax return, specifically on Form 1040. The line you need to fill in is 8a, which is part of the 'Interest and Ordinary Dividends' section. This section allows you to report various types of interest income, including that from life insurance.

When reporting interest from life insurance, it's important to understand the difference between the interest earned and the death benefit received upon the insured individual's passing. The interest income is the amount you've earned from the investment of your life insurance policy, while the death benefit is the payout received when the insured person dies. Only the interest earned should be reported on line 8a.

To calculate the interest income, you'll need to know the total interest earned during the tax year and the specific details of your life insurance policy. This includes the initial investment amount, the interest rate, and the time period over which the interest was earned. You can find this information in your policy documents or by reviewing your annual statements from the insurance company.

Here's a step-by-step guide to filling in line 8a:

- Determine the total interest earned from your life insurance policies during the tax year.

- Add up all the interest income from each policy to get the total interest earned.

- Enter this total interest amount on line 8a of Form 1040.

- If you have multiple life insurance policies, you may need to provide a breakdown of interest from each policy, ensuring you only report the interest earned and not the death benefit.

It's crucial to accurately report interest income from life insurance to ensure compliance with tax regulations. Failing to report this income could result in penalties and interest charges. Additionally, proper reporting helps in maintaining transparency and ensures that you're only taxed on the actual earnings from your investments.

Life Insurance and Inheritance Tax in PA: What's the Deal?

You may want to see also

Policy Proceeds: Report proceeds from life insurance on line 21 of Form 1040

If you've received proceeds from a life insurance policy, it's important to know how to report this income on your tax return. When you receive a payout from a life insurance policy, it's considered taxable income, and you'll need to include it on your annual tax return, specifically on Form 1040. The relevant line for reporting life insurance proceeds is Line 21 of Form 1040.

Line 21 is part of the 'Other Income' section of the form. This section is used to report various types of income that may not fall under specific categories like wages, salaries, or business income. It's crucial to accurately report life insurance proceeds here to ensure compliance with tax regulations.

To find Line 21, you'll typically see it near the bottom of the Form 1040. It's a simple line item where you'll enter the total amount of life insurance proceeds received during the tax year. This includes any lump-sum payments or regular installments you received from the insurance company.

Reporting life insurance proceeds is essential because it ensures that you're paying the correct amount of tax on the income generated by the policy. Failure to report this income can result in penalties and interest charges. When filling out Line 21, be sure to provide the exact amount received, and consider consulting a tax professional if you have any doubts or complex situations to ensure accurate reporting.

Remember, proper tax reporting is a fundamental aspect of financial responsibility, and it's always best to stay informed about the specific lines and sections of tax forms to ensure you're meeting your tax obligations accurately and on time.

Social Security and Life Insurance: What's the Connection?

You may want to see also

Exempt Amounts: Interest under $1,000 is exempt; report on Schedule B

When it comes to reporting interest from life insurance on your tax return, it's important to understand the rules and guidelines set by the IRS. One key aspect to consider is the amount of interest earned, as there are specific regulations regarding exempt and reportable interest.

According to the IRS, interest under $1,000 is generally exempt from reporting on your tax return. This means that if you earn less than $1,000 in interest from life insurance or other sources, you don't need to include it in your taxable income. However, it's essential to keep records of this interest, especially if you anticipate that the amount might exceed the exempt threshold in future years.

If you have interest earnings above the exempt amount, you will need to report it on Schedule B of Form 1040. Schedule B is a supplementary form used to report various types of income, including interest, dividends, and other sources of revenue. When filling out Schedule B, you'll need to provide details about the interest earned, including the source and the amount. This information is crucial for accurately calculating your taxable income and ensuring compliance with tax regulations.

It's worth noting that the rules regarding exempt interest may vary depending on your tax situation and the specific policies you hold. If you have multiple life insurance policies or diverse investment accounts, it's advisable to consult a tax professional or refer to the IRS guidelines to ensure accurate reporting. They can provide personalized advice based on your circumstances, helping you navigate the complexities of tax regulations and maximize your compliance.

In summary, understanding the exempt amount for interest from life insurance is essential for proper tax reporting. Interest under $1,000 is generally exempt, but you should retain records for future reference. If you exceed this threshold, Schedule B of Form 1040 is used to report the interest, ensuring transparency and accuracy in your tax obligations.

Haven Life Insurance: Exciting Career Opportunities and Benefits

You may want to see also

State Taxes: Interest may be reported differently in state returns

When it comes to filing your state taxes, it's important to understand that the reporting of interest from life insurance can vary depending on the jurisdiction. While the federal tax return (Form 1040) provides a general framework, state tax returns may have their own specific requirements and categories for reporting this type of income.

In some states, interest earned from life insurance policies is treated as ordinary income and reported on the state tax return similarly to other sources of income. This means that you would typically include the interest income in the appropriate income category on your state tax form. For example, if your state tax return has a section for "Wages, Salaries, and Tips" or "Other Income," you would report the interest from life insurance in that section. It's crucial to consult your state's tax instructions or guidelines to determine the precise category and reporting method.

However, other states may have different approaches. Some states might exempt interest from life insurance policies from taxation, considering it a form of savings or investment. In these cases, you may not need to report the interest income on your state tax return at all. Alternatively, certain states might require a separate schedule or form to report interest from life insurance, even if it is not taxable. This could be a result of specific state tax laws or regulations.

To ensure compliance with state tax requirements, it is essential to review the instructions provided by your state's tax authority. These instructions will guide you on how to report interest from life insurance on your state tax return accurately. Additionally, if you have any doubts or complex situations, consulting a tax professional or accountant who is familiar with state tax laws can provide valuable assistance.

Remember, understanding the nuances of state tax laws is crucial to ensure you are meeting all your tax obligations. By being aware of how different states handle the reporting of interest from life insurance, you can accurately complete your state tax return and avoid any potential issues or penalties.

Supplemental Life Insurance: Can You Take It With You?

You may want to see also

Capital Gains: Proceeds from life insurance sales may be treated as capital gains

When it comes to reporting proceeds from life insurance sales on your tax return, it's important to understand the tax implications, especially if these proceeds are considered capital gains. Here's a detailed guide on how to handle this situation:

Understanding Capital Gains: Capital gains are the profits realized from the sale of assets, including investments and, in this case, life insurance policies. When you sell a life insurance policy for a higher price than its original purchase price, the difference is typically treated as a capital gain. This is a significant consideration for tax purposes.

Tax Treatment of Life Insurance Proceeds: The tax rules regarding life insurance proceeds can vary depending on the circumstances. If you sell a life insurance policy for a gain, you must report this transaction on your annual tax return, specifically on Form 1040, the US Individual Income Tax Return. The proceeds from the sale should be reported in the appropriate section related to capital gains or other income.

Reporting on Form 1040: On your Form 1040, you will typically find a section for reporting "Capital Gains and Losses." Here, you need to provide details about the sale of the life insurance policy, including the sale price, the original purchase price, and the profit or loss realized. This information is crucial for calculating your taxable income. For example, if you sold a policy for $15,000 and your original purchase price was $10,000, the $5,000 gain would be reported here.

Deductions and Exclusions: It's worth noting that certain exclusions and deductions might apply to life insurance proceeds. For instance, if you sell a life insurance policy for a gain and then use those proceeds to purchase another policy, you may be able to exclude a portion of the gain from taxation. Additionally, if the life insurance policy was used for business purposes, there could be specific tax treatments and deductions available.

Consultation with a Tax Professional: Given the complexity of tax laws, especially regarding capital gains and life insurance, it is highly recommended to consult a tax professional or accountant. They can provide personalized advice based on your specific situation, ensuring that you comply with all tax regulations and take advantage of any applicable deductions or exclusions.

Life Insurance Proceeds: Taxable Income or Not?

You may want to see also

Frequently asked questions

You should report the interest income from life insurance on line 8 of Form 1040. This line is specifically for reporting other income, which includes interest, dividends, and other types of earnings.

Yes, you'll need to provide the total amount of interest received from your life insurance policy. This information is typically found on a 1099-INT form, which you should receive from the insurance company. Make sure to include the form number and any relevant details in the "Other" section of line 8.

The interest amount should be entered in the "Other income" box on line 8. You can also use the "Additional income" column if the interest is from multiple sources. Ensure you provide the total interest received for the tax year.

If you have multiple policies, you can report the interest from each policy separately. List the interest from each policy on line 8, ensuring you provide the total interest received. You can also use the "Additional income" column to provide details for each policy.

No, the interest from life insurance is generally not deductible on your 1040 return. However, if you have any other deductions or credits that might be relevant, you can claim them in the appropriate sections of the tax form.