Term 100 life insurance is a type of life insurance policy that provides coverage for a specific period, typically 100 years. It is a term life insurance policy, which means it offers coverage for a defined term, in this case, 100 years. This type of insurance is often chosen by individuals who want to ensure their loved ones are financially protected for an extended period. The policy provides a death benefit to the policyholder's beneficiaries if the insured individual passes away during the term. It is a straightforward and cost-effective way to secure financial protection for a long duration, offering peace of mind and financial security to individuals and their families.

What You'll Learn

- Definition: 100 life insurance provides a death benefit of $100,000 upon the insured's passing

- Benefits: It offers financial security for beneficiaries, covering essential expenses like mortgage and funeral costs

- Cost: Premiums vary based on age, health, and coverage amount, typically ranging from $10 to $50 per month

- Types: Term life insurance can be level term (fixed premiums) or decreasing term (premiums decrease over time)

- Comparison: Compare 100 life insurance with whole life for long-term coverage and investment potential

Definition: 100 life insurance provides a death benefit of $100,000 upon the insured's passing

100 life insurance, also known as level term life insurance, is a type of term life insurance policy that offers a fixed death benefit of $100,000 upon the insured's passing. This policy is designed to provide financial security and peace of mind to the policyholder's loved ones in the event of their untimely death. The term "100" in 100 life insurance refers to the specific amount of coverage, which is $100,000 in this case. This coverage amount is predetermined and remains constant throughout the policy's term, typically ranging from 10 to 30 years.

When purchasing 100 life insurance, the insured individual agrees to pay a premium, which is a regular payment made to the insurance company. The premium is calculated based on various factors, including the insured's age, health, lifestyle, and the desired coverage amount. By paying the premium, the insured individual ensures that the policy remains in force and that the death benefit will be paid out to the designated beneficiaries upon their passing.

One of the key advantages of 100 life insurance is its simplicity and predictability. Since the death benefit is fixed at $100,000, the insured and their beneficiaries know exactly what financial support they can rely on in the event of an unforeseen death. This predictability can provide valuable financial security, especially for those who have financial dependents or specific financial goals that need to be met.

This type of insurance is often chosen by individuals who want to provide a substantial financial safety net for their families without the complexity of permanent life insurance policies. It is a straightforward and cost-effective way to ensure that a loved one's financial obligations are covered, such as mortgage payments, children's education expenses, or daily living costs. Additionally, the term nature of the policy allows individuals to reassess their insurance needs periodically and adjust their coverage accordingly.

In summary, 100 life insurance is a term life insurance policy offering a fixed death benefit of $100,000. It provides financial security and peace of mind to the insured's beneficiaries, ensuring that a specific financial safety net is in place. With its simplicity and predictable coverage, 100 life insurance is an attractive option for individuals seeking affordable and reliable life insurance coverage.

Physician Life Insurance: A Necessary Safety Net

You may want to see also

Benefits: It offers financial security for beneficiaries, covering essential expenses like mortgage and funeral costs

Term 100 life insurance is a type of life insurance that provides coverage for a specific period, typically 100 years, or until the insured individual reaches a certain age. It is a straightforward and cost-effective way to secure financial protection for your loved ones during a defined period. This insurance product is particularly appealing to those seeking a simple and affordable way to ensure their family's financial well-being.

One of the key benefits of Term 100 life insurance is its ability to offer financial security to beneficiaries. In the event of the insured individual's death during the policy term, the insurance company pays out a death benefit to the designated beneficiaries. This financial support can be a lifeline for the family, helping them cover various essential expenses that arise after the insured's passing. These expenses often include mortgage payments, which can be a significant burden for families, especially if the primary income earner is no longer contributing. The death benefit can provide the necessary funds to keep the mortgage current, ensuring that the family's home remains in their possession.

Funeral costs are another critical aspect of life that can be financially challenging for families. The sudden loss of a loved one often leads to unexpected expenses related to funeral arrangements, which can be emotionally and financially draining. Term 100 life insurance can alleviate this burden by providing a predetermined amount to cover these costs, ensuring that the family can honor their loved one's memory without the added stress of financial strain.

Moreover, this type of insurance is versatile and can be tailored to individual needs. Policyholders can choose the coverage amount based on their family's specific requirements. For instance, those with larger families or higher mortgage balances might opt for a higher death benefit to ensure comprehensive financial security. Additionally, the term length of 100 years provides a long-term safety net, allowing individuals to plan for their family's future needs over an extended period.

In summary, Term 100 life insurance is a valuable tool for providing financial security and peace of mind. It ensures that beneficiaries are protected against the financial impact of unexpected events, such as mortgage payments and funeral expenses. With its straightforward nature and customizable options, this insurance product empowers individuals to take control of their family's financial future, offering a reliable safety net for the long term.

Life Insurance, Immigration Status, and Material Misstatement

You may want to see also

Cost: Premiums vary based on age, health, and coverage amount, typically ranging from $10 to $50 per month

Term 100 life insurance is a type of temporary life insurance policy that provides coverage for a specific period, typically 100 years. It is designed to offer financial protection during a defined term, often used as a tool for short-term financial goals or to secure a family's financial future. This type of insurance is straightforward and offers a fixed death benefit if the insured person passes away during the term.

The cost of Term 100 life insurance is a critical factor for potential policyholders. Premiums can vary significantly depending on several factors, including the policyholder's age, health, and the coverage amount desired. Generally, younger individuals with good health will pay lower premiums compared to older adults or those with pre-existing medical conditions. This is because younger individuals have a lower risk of developing health issues that could lead to higher insurance costs.

Age is a significant determinant of premium rates. As individuals get older, the risk of mortality increases, and insurance companies adjust the premiums accordingly. For instance, a 30-year-old in excellent health might pay around $10 per month for a $100,000 coverage term, while a 60-year-old with a similar coverage amount could pay upwards of $50 per month. These variations ensure that the insurance company can adequately assess and manage the risk associated with insuring an individual for a specific period.

Health status also plays a pivotal role in determining premium costs. Insurance companies often conduct medical exams or ask for health-related information to assess the risk of insuring a potential policyholder. A person with a history of smoking, obesity, or chronic illnesses may be considered a higher-risk individual and could face higher premiums or even be denied coverage. Conversely, a healthy lifestyle with regular exercise and a balanced diet can lead to lower premiums.

The coverage amount, or the death benefit, is another factor influencing premium costs. A higher coverage amount indicates a larger financial payout if the insured person passes away during the term. As a result, the premium will be more expensive to reflect the increased risk and potential payout. For example, a $250,000 coverage term for a 30-year-old might cost significantly more than a $100,000 term.

In summary, Term 100 life insurance offers a temporary financial safety net with premiums that can vary widely based on age, health, and desired coverage. Understanding these factors is essential for individuals seeking to purchase this type of insurance, as it ensures they can make informed decisions and find a policy that aligns with their financial needs and budget.

Service-Disabled Life Insurance: Applying for Peace of Mind

You may want to see also

Types: Term life insurance can be level term (fixed premiums) or decreasing term (premiums decrease over time)

Term life insurance is a type of coverage that provides a specific period of protection, offering financial security to individuals and their families. It is a straightforward and cost-effective way to ensure that your loved ones are financially protected during a defined period, typically 10, 20, or 30 years. This type of insurance is particularly popular due to its simplicity and the fact that it offers a clear and defined benefit.

The two main types of term life insurance are level term and decreasing term, each with its own unique characteristics.

Level Term Life Insurance: This type of policy provides a fixed amount of coverage for a predetermined period. The most significant advantage of level term insurance is the stability it offers. With this plan, the premium remains constant throughout the entire term. For example, if you purchase a $100,000 level term policy for 20 years and pay a fixed premium each month, the amount you pay will not change over the 20-year period. This predictability is beneficial for budgeting and financial planning, as you know exactly how much you will spend on insurance each year. Level term insurance is ideal for those who want long-term protection without the worry of increasing costs. It is a popular choice for individuals who have financial obligations or dependants that they want to provide for over a specific period.

Decreasing Term Life Insurance: In contrast, decreasing term insurance has premiums that decrease over time. This type of policy is often chosen by those who want to ensure that their coverage matches their changing financial needs. As the name suggests, the death benefit amount decreases as the term progresses. For instance, if you opt for a $100,000 decreasing term policy for 10 years, the death benefit will reduce by a certain percentage each year. This type of insurance is particularly useful for those who want to gradually reduce their coverage as their financial obligations or assets change. For example, a young professional might choose a decreasing term policy to cover mortgage payments and then reduce the coverage as they pay off the mortgage over time.

Understanding the difference between these two types of term life insurance is essential when choosing a policy that best suits your needs. Level term provides consistent coverage and premiums, while decreasing term allows for flexibility and potential cost savings over time. Both options are valuable tools in financial planning, offering protection and peace of mind during specific life stages.

Uncover the Benefits: IDBI Federal Life Insurance Explained

You may want to see also

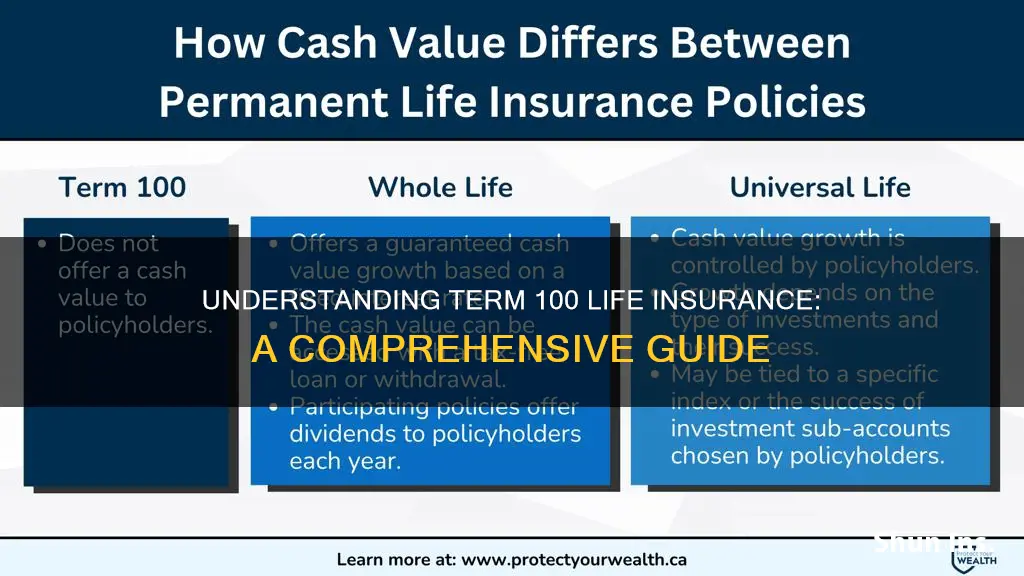

Comparison: Compare 100 life insurance with whole life for long-term coverage and investment potential

Term 100 life insurance is a type of life insurance that provides coverage for a specific period, typically 100 years. It is a pure risk policy, meaning it offers protection against the risk of death during the term, with no investment component. This type of insurance is often more affordable and straightforward compared to other life insurance policies. It is ideal for individuals who want coverage for a defined period, such as those seeking protection for a mortgage, a business venture, or a specific financial goal.

On the other hand, whole life insurance is a permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. It offers both death benefit coverage and an investment component, where a portion of the premiums paid is invested in an investment account. The investment aspect of whole life insurance allows for potential long-term growth and accumulation of cash value, which can be borrowed against or withdrawn. This feature makes it an attractive option for those seeking both insurance protection and an investment vehicle.

When comparing term 100 life insurance and whole life insurance, the primary difference lies in their duration and features. Term 100 life insurance is designed for a specific period, offering a simple and cost-effective solution for temporary coverage needs. It is a good choice for individuals who want coverage for a particular period, such as until a child's education is funded or a mortgage is paid off. In contrast, whole life insurance provides long-term coverage and a built-in investment, making it suitable for those seeking a more comprehensive financial strategy.

One advantage of term 100 life insurance is its affordability, especially for younger individuals. Since the coverage is limited to a specific term, the premiums are generally lower compared to whole life insurance. This makes it an attractive option for those on a budget or who prioritize temporary coverage. However, it's important to note that term life insurance does not accumulate cash value, and the policy ends at the end of the term, requiring the individual to potentially purchase a new policy or find alternative coverage.

Whole life insurance, with its investment component, offers a more comprehensive approach to long-term financial planning. The cash value accumulation can provide a source of funds for various purposes, such as retirement planning or funding education expenses. Additionally, the death benefit in whole life insurance is typically guaranteed, providing a fixed amount of coverage for the insured's beneficiaries. This predictability and the potential for long-term growth make whole life insurance an appealing choice for those seeking a more permanent and comprehensive solution.

In summary, the choice between term 100 life insurance and whole life insurance depends on individual needs and financial goals. Term 100 life insurance is ideal for temporary coverage and those seeking a straightforward, affordable solution. In contrast, whole life insurance offers long-term coverage and investment potential, making it suitable for individuals who want a more permanent financial strategy. Understanding the differences and benefits of each type of policy is essential in making an informed decision regarding life insurance coverage.

Does Life Insurance Blood Test Check for Marijuana?

You may want to see also

Frequently asked questions

Term 100 Life Insurance is a type of term life insurance policy that provides coverage for a specific period, typically 100 years. It is designed to offer financial protection to individuals and their families during this extended period, ensuring that their loved ones are taken care of in the long term. This policy is often chosen by those seeking long-term coverage without the need for permanent insurance, as it offers a straightforward and cost-effective solution.

The key difference lies in the duration of coverage. While most term life insurance policies offer coverage for a set number of years (e.g., 10, 20, or 30 years), Term 100 Life Insurance provides coverage for a century. This extended coverage period can be particularly beneficial for individuals who want to ensure their family's financial security over a more extended timeframe, especially for those with long-term financial goals or responsibilities.

This type of policy offers several advantages. Firstly, it provides a guaranteed death benefit, meaning the insurance company will pay out a specified amount if the insured individual passes away during the term. Secondly, it is generally more affordable than permanent life insurance, making it an attractive option for those on a budget. Additionally, Term 100 Life Insurance can be a valuable tool for estate planning, as it can help ensure that beneficiaries receive the intended financial support over a more extended period.