Life insurance is a crucial aspect of financial planning that provides a safety net for individuals and their families. It offers financial protection by ensuring that loved ones are taken care of in the event of the insured's death. With various types of life insurance policies available, such as term life, whole life, and universal life, individuals can choose the coverage that best suits their needs and budget. Understanding the different features and benefits of life insurance is essential to making an informed decision and ensuring long-term financial security.

What You'll Learn

- Coverage Options: Different types of coverage available, from term to permanent life insurance

- Cost Factors: Premiums, age, health, and coverage amount influence life insurance costs

- Benefits: Life insurance provides financial support to beneficiaries in the event of the insured's death

- Policy Types: Term, whole life, universal life, and variable life insurance offer distinct features

- Claims Process: Understanding the steps to file a claim and receive benefits efficiently

Coverage Options: Different types of coverage available, from term to permanent life insurance

When it comes to life insurance, understanding the various coverage options is crucial to making an informed decision. Life insurance provides financial protection and peace of mind, ensuring that your loved ones are taken care of in the event of your passing. Here's an overview of the different types of coverage available:

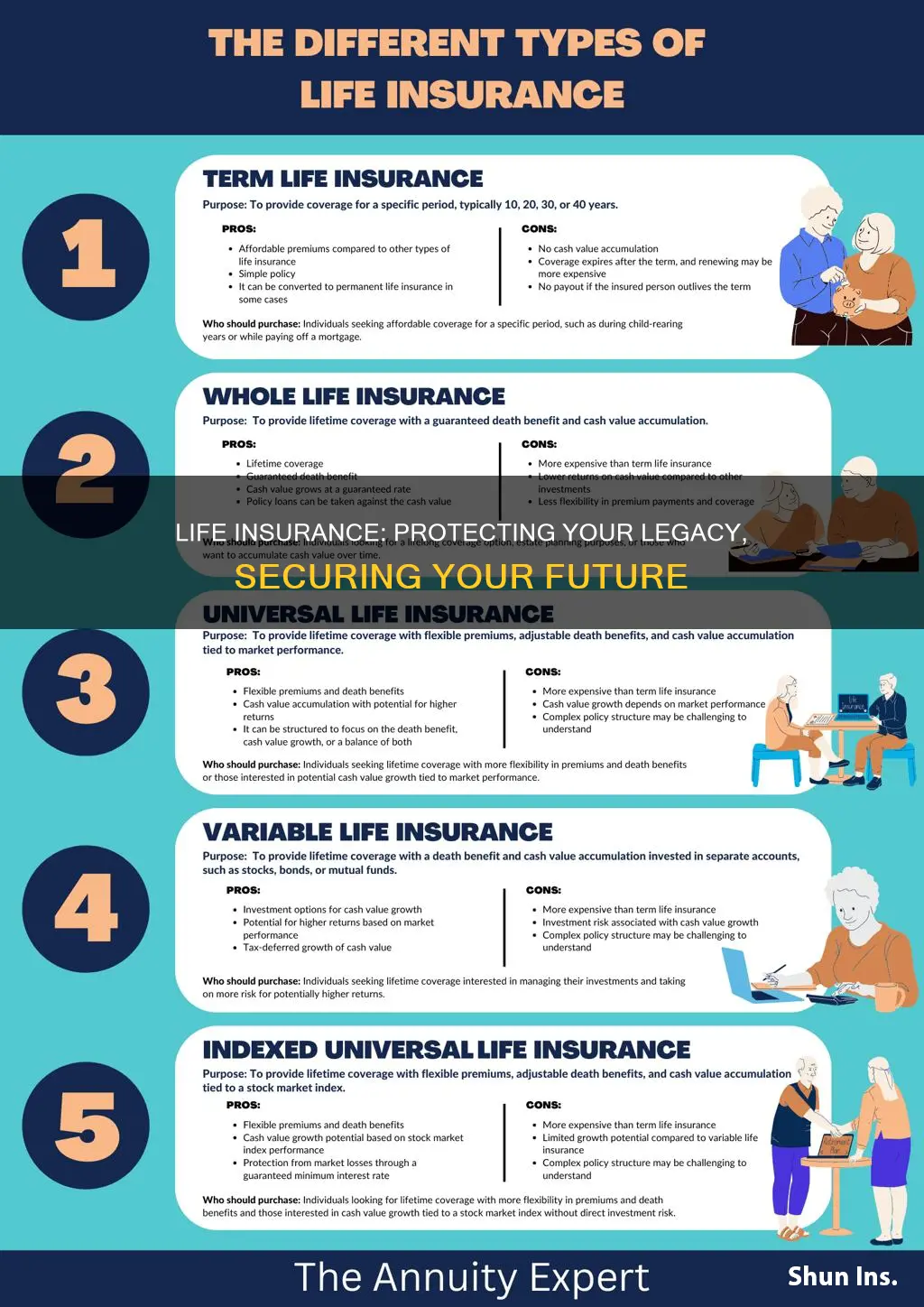

Term Life Insurance: This is a popular and straightforward option, offering coverage for a specific period, typically 10, 20, or 30 years. It provides a death benefit if the insured individual passes away during the term. Term life insurance is often more affordable compared to permanent policies, making it an excellent choice for those seeking temporary coverage or a budget-friendly solution. It's ideal for individuals who want to ensure their family's financial stability during a particular life stage, such as when raising children or paying off a mortgage.

Permanent Life Insurance: In contrast, permanent life insurance provides coverage for the entire lifetime of the insured individual. This type of policy offers a cash value component that grows over time, allowing policyholders to accumulate savings. Permanent life insurance includes various types, such as whole life and universal life. Whole life insurance guarantees a death benefit and premium payments, while universal life insurance offers flexibility in premium payments and death benefit amounts. This option is suitable for those seeking long-term financial security and the potential for tax-advantaged savings.

Universal Life Insurance: As a type of permanent life insurance, universal life provides flexibility in premium payments and death benefit adjustments. Policyholders can increase or decrease the death benefit and premium payments according to their financial needs. This policy also accumulates cash value, which can be borrowed against or withdrawn. Universal life insurance is an attractive choice for those who want the security of permanent coverage with the adaptability to manage their finances effectively.

Variable Life Insurance: This type of policy combines life insurance with an investment component. It allows policyholders to invest a portion of their premiums in various investment options, such as stocks or bonds. The death benefit and investment returns can vary based on the performance of these investments. Variable life insurance is suitable for individuals who are comfortable with market-related risks and seek the potential for higher returns.

Understanding these coverage options is essential to choosing the right life insurance policy. Whether you opt for term life, permanent life, universal life, or variable life insurance, each type offers unique advantages and considerations. It's recommended to assess your financial goals, risk tolerance, and long-term needs to determine the most appropriate coverage for your situation.

Life Insurance and Bankruptcy: What's the Verdict?

You may want to see also

Cost Factors: Premiums, age, health, and coverage amount influence life insurance costs

Life insurance is a crucial financial tool that provides a safety net for individuals and their families. When considering life insurance, understanding the various cost factors that influence its price is essential. These factors play a significant role in determining the amount you'll pay for coverage and can vary depending on your personal circumstances.

One of the primary cost factors is the premium. Premiums are the regular payments made by the policyholder to the insurance company to maintain the life insurance policy. The premium amount is typically calculated based on several variables. Younger individuals often pay lower premiums compared to older adults because they are considered less risky to insure. This is because younger people generally have a longer life expectancy, and the insurance company may incur fewer claims during this period. Additionally, the amount of coverage you choose directly impacts the premium. Higher coverage amounts result in higher premiums as the insurance company needs to compensate for the increased financial risk.

Age is a critical determinant of life insurance costs. As you age, your risk profile changes, and so do your insurance rates. Younger individuals typically have lower life insurance rates because they are considered healthier and have more years of potential life ahead. Insurance companies often offer lower premiums for younger people as they are less likely to require frequent payouts. Conversely, as you get older, your life insurance premiums tend to increase. This is because the risk of death or illness increases with age, and the insurance company may need to account for potential health issues.

Health is another significant factor affecting life insurance costs. Insurance companies assess your health to determine the likelihood of future claims. A good health status, including regular exercise, a balanced diet, and no significant medical conditions, can lead to lower premiums. On the other hand, individuals with pre-existing health conditions or those who smoke, drink excessively, or engage in dangerous activities may face higher insurance rates. Medical history, such as previous illnesses or surgeries, can also impact the cost of life insurance.

The coverage amount you choose is directly proportional to the cost of your life insurance policy. A higher coverage amount means a larger financial payout if something happens to the insured individual. As a result, the insurance company may charge a higher premium to compensate for the increased risk. Conversely, lower coverage amounts typically result in lower premiums. It's essential to strike a balance between the desired coverage and the associated costs.

In summary, life insurance costs are influenced by various factors, including premiums, age, health, and coverage amount. Younger individuals and those in good health may benefit from lower premiums, while older adults and those with health concerns might face higher rates. Additionally, the amount of coverage you select will directly impact the overall cost. Understanding these cost factors can help individuals make informed decisions when choosing life insurance, ensuring they receive appropriate coverage at a manageable price.

Husband's Life Insurance: Impact on Your Coverage

You may want to see also

Benefits: Life insurance provides financial support to beneficiaries in the event of the insured's death

Life insurance is a crucial financial tool that offers a safety net for individuals and their loved ones. When you purchase a life insurance policy, you are essentially making a promise to provide financial security to your beneficiaries in the event of your untimely death. This promise is a powerful benefit that can significantly impact the lives of those you care about. Here's a detailed breakdown of how life insurance provides this essential support:

Financial Security for Dependents: One of the primary benefits of life insurance is its ability to ensure financial stability for your family, especially if you are the primary breadwinner. In the unfortunate event of your passing, the life insurance policy will pay out a lump sum or regular payments to your designated beneficiaries. This financial support can cover various expenses, such as mortgage or rent, utility bills, groceries, and other daily living costs, ensuring that your dependents can maintain their standard of living and have the necessary resources to get by.

Debt Management: Life insurance proceeds can be a valuable asset in managing debts. If you have outstanding loans, such as a mortgage, car loan, or student loans, the insurance payout can help clear these debts, preventing financial strain on your beneficiaries. By covering these obligations, life insurance ensures that your loved ones are not burdened with additional financial responsibilities during a difficult time.

Education Funding: For families with children, life insurance can be a powerful tool for securing their educational future. The policy's death benefit can be used to fund their college education, ensuring they have the financial means to pursue their academic goals. This is particularly important if you want to provide opportunities for your children that you may not have had, creating a legacy of financial security.

Medical Expenses and Funeral Costs: In the event of a tragic death, medical expenses and funeral arrangements can be overwhelming for the bereaved. Life insurance can cover these costs, ensuring that your family is not burdened with significant financial obligations during their time of grief. This aspect of life insurance provides peace of mind, knowing that practical matters are taken care of.

Long-Term Care and Retirement Planning: Some life insurance policies offer long-term care benefits, which can be crucial for individuals who require extended medical care or assistance as they age. Additionally, life insurance can be a part of a comprehensive retirement plan, providing financial security for your beneficiaries during your retirement years. This ensures that your loved ones can maintain their lifestyle and have the resources to enjoy their later years.

In summary, life insurance is a vital financial strategy that offers peace of mind and security. It provides a safety net for your beneficiaries, ensuring they can cope with financial challenges and maintain their standard of living in your absence. By understanding the benefits and exploring different policy options, individuals can make informed decisions to protect their loved ones and create a lasting legacy.

Life-Health Insurance: Am Best's Comprehensive Report

You may want to see also

Policy Types: Term, whole life, universal life, and variable life insurance offer distinct features

When considering life insurance, it's essential to understand the various policy types available to ensure you choose the right coverage for your needs. Here's an overview of the four primary policy types: Term, Whole Life, Universal Life, and Variable Life Insurance, each offering unique features and benefits.

Term Life Insurance: This is a straightforward and affordable type of coverage that provides a death benefit for a specified term, typically 10, 20, or 30 years. It is ideal for individuals seeking temporary protection, especially those with short-term financial obligations or a limited budget. Term life insurance is a pure risk policy, meaning it only pays out if the insured person dies during the specified term. It offers a simple and cost-effective solution for those who want coverage without the long-term financial commitment associated with permanent policies.

Whole Life Insurance: In contrast, whole life insurance provides permanent coverage for the entire lifetime of the insured individual. It offers a guaranteed death benefit and a fixed premium that remains the same over the policy's life. This type of policy builds cash value over time, which can be borrowed against or withdrawn. Whole life insurance is suitable for those seeking long-term financial security and a consistent premium payment. It provides a sense of stability and ensures that beneficiaries receive the death benefit regardless of market fluctuations.

Universal Life Insurance: This policy offers flexibility in premium payments and death benefit amounts. It provides permanent coverage and allows policyholders to adjust their premiums and death benefits over time. Universal life insurance also accumulates cash value, which can be used to pay premiums or taken out as a loan. This type of policy is ideal for those who want the security of permanent coverage but prefer the adaptability of adjusting their policy as their financial situation changes. It offers a good balance between long-term protection and the ability to customize the policy.

Variable Life Insurance: Variable life insurance combines the features of permanent coverage with an investment component. It offers a death benefit and allows policyholders to invest a portion of the premium in various investment options. These investments can grow over time, and the policy's cash value can be used to pay premiums or taken out as loans. Variable life insurance is suitable for individuals who want both insurance protection and the potential for investment growth. It provides a level of customization and flexibility, allowing policyholders to tailor their coverage to their investment goals.

Each of these policy types has its advantages and is suited to different life stages and financial goals. Understanding the distinct features of term, whole life, universal life, and variable life insurance will help individuals make informed decisions when selecting the right life insurance policy for their needs.

Life Insurance for Children: Is It Worth It?

You may want to see also

Claims Process: Understanding the steps to file a claim and receive benefits efficiently

The claims process for life insurance is a crucial aspect of ensuring that beneficiaries receive the financial support they are entitled to after the insured individual's passing. It can be a complex and often emotional journey, but understanding the steps involved can help streamline the process and provide peace of mind. Here's a comprehensive guide to navigating the claims process efficiently:

- Notify the Insurance Company: Upon the insured's passing, the first step is to promptly inform the life insurance company. This can typically be done by contacting the insurance provider's customer service or claims department. Provide them with the necessary details, including the insured's name, policy number, date of death, and contact information for the beneficiaries. Quick notification ensures that the claims process can begin without unnecessary delays.

- Gather Required Documents: The insurance company will request specific documents to process the claim. These may include a certified copy of the death certificate, the original life insurance policy document, and any additional paperwork related to the insured's health or medical history, especially if the cause of death is under review. Organizing these documents in advance can expedite the process.

- File the Claim: The insurance company will guide you through the claim filing process. This often involves completing a claim form, providing detailed information about the insured's life, the policy, and the circumstances surrounding their passing. Be accurate and thorough in your responses, as any discrepancies may lead to delays or potential issues with the claim.

- Underwriting and Investigation (if applicable): In some cases, especially if the death is unexpected or involves a review of the insured's health, the insurance company may conduct an underwriting review. This process assesses the insured's eligibility for the policy and ensures that all necessary information was provided accurately. The underwriting team may also investigate the cause of death, which can involve medical professionals or experts.

- Claim Approval and Payout: Once the claim is approved, the insurance company will process the payout according to the policy's terms. This may involve paying out a lump sum, periodic payments, or a combination of both, depending on the policy type. The beneficiaries will receive the agreed-upon benefits, providing financial support as per the insured's wishes.

- Communication and Support: Throughout the claims process, maintain open communication with the insurance company. They should provide regular updates and be available to answer any questions or concerns. If you encounter any delays or issues, don't hesitate to reach out and seek clarification. Efficient communication ensures that the process remains on track.

Understanding the claims process is essential for beneficiaries to navigate the administrative tasks associated with life insurance efficiently. By following these steps, individuals can ensure that the insured's beneficiaries receive the intended financial support during a challenging time. Remember, each insurance company may have specific procedures, so familiarizing yourself with your policy's terms and conditions is crucial.

Life Insurance: First Group's Offerings and Benefits Explored

You may want to see also

Frequently asked questions

Life insurance is a financial protection tool that provides a monetary benefit to your beneficiaries when you pass away. It works by allowing you to purchase a policy from an insurance company, where you pay regular premiums in exchange for a guaranteed death benefit. Upon your death, the insurance company pays out the specified amount to your chosen recipients, providing financial security for your loved ones.

Life insurance offers several advantages. Firstly, it ensures financial stability for your family, covering expenses like mortgage, education, and daily living costs. It also helps replace lost income if you're the primary breadwinner. Additionally, life insurance can be used to pay for funeral expenses and outstanding debts, providing peace of mind during a difficult time.

Yes, there are various types of life insurance policies to suit different needs. Term life insurance provides coverage for a specified period, offering a fixed premium and death benefit. Permanent life insurance, on the other hand, provides lifelong coverage and includes an investment component, allowing your policy to accumulate cash value over time. Universal life insurance offers flexibility in premium payments and death benefit amounts, while whole life insurance provides consistent coverage and a guaranteed death benefit.

Selecting the appropriate life insurance policy depends on your individual circumstances and goals. Consider factors such as your age, health, income, and the number of dependents you have. Evaluate your financial obligations and determine the coverage amount needed to support your family. It's advisable to consult with a financial advisor or insurance professional who can help you assess your needs and recommend suitable options based on your preferences and budget.