Life insurance is a financial tool that provides peace of mind and financial protection for loved ones after the policyholder's death. It is a contract between the insured and the insurance company, where the latter agrees to pay a specified amount, known as a death benefit, upon the insured's death, provided that the premiums are paid. The topic of whether individuals need to keep paying for life insurance is an important one, as it can have financial implications for both the policyholder and their beneficiaries.

| Characteristics | Values |

|---|---|

| Payment frequency | Monthly, quarterly, semi-annually, annually |

| Payment methods | Autopay, financial institution's bill payment service, lump-sum payment |

| Missed payments | Grace period, policy lapse, cash out, non-forfeiture options, reinstatement |

| Policy types | Term, permanent, whole life, universal life, variable universal life, final expense insurance |

| Policy uses | Income replacement, debt repayment, funeral costs, investment, estate planning |

| Policy considerations | Age, health, financial situation, number of dependents, retirement status |

What You'll Learn

- Permanent life insurance policies do not expire, but they require premium payments to remain active

- Term life insurance policies lapse if you miss a payment

- Permanent life insurance policies can be cashed out, but you will no longer be covered

- You may be able to reinstate a lapsed policy within five years, but you will likely need to pass a physical examination

- Permanent life insurance policies can be converted to term coverage if you stop paying premiums

Permanent life insurance policies do not expire, but they require premium payments to remain active

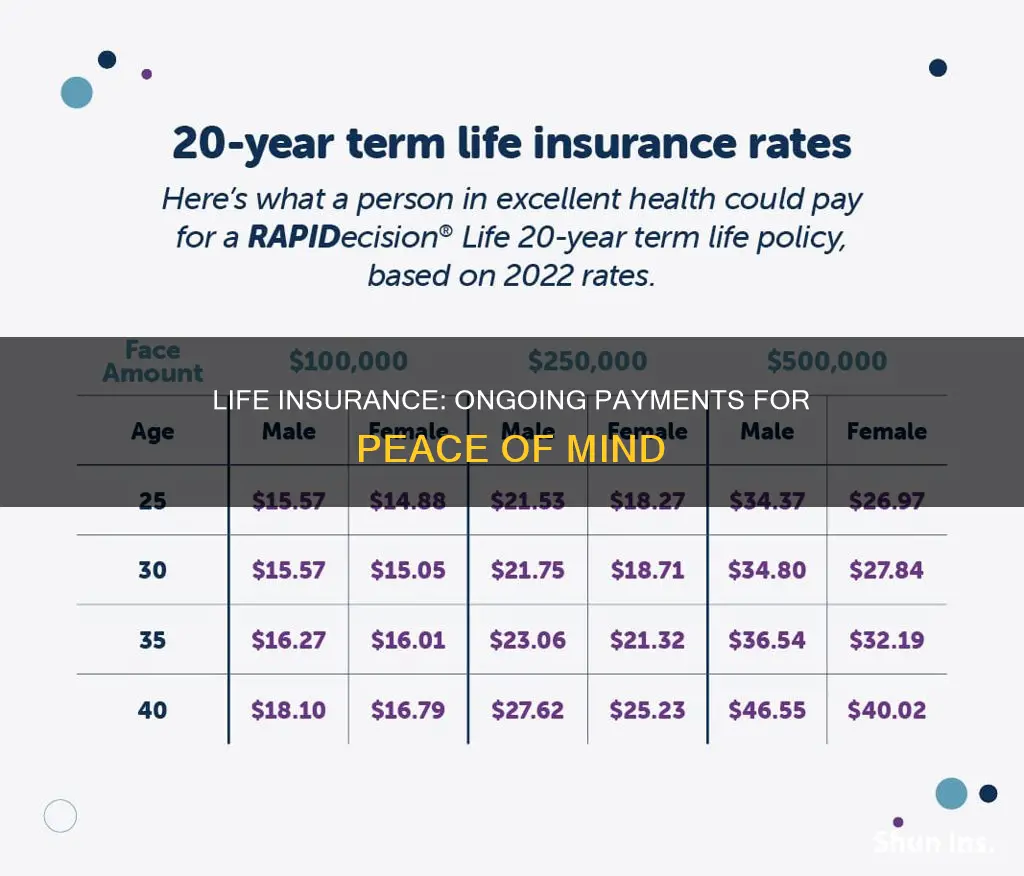

Permanent life insurance policies, unlike term life insurance, do not have an expiration date, meaning you are covered for life as long as you keep paying premiums. However, permanent life insurance policies require premium payments to remain active. The frequency of premium payments depends on the agreement with the insurance provider and can be monthly, quarterly, semi-annually, or annually. The cost of premiums depends on the policy selected.

Permanent life insurance policies often have a cash value that may grow over time. If you stop making payments but have built up sufficient cash value, it could be used to cover the cost of premiums to keep the policy active. If the cash value is not sufficient, the policy will lapse, and the life insurance benefit will end.

If you miss a premium payment, some insurance providers offer a grace period to bring the account back into good standing, typically for 30 days. After this period, the policy will lapse, and you may have to pay back premiums with interest to reinstate the policy. Some insurers may allow reinstatement within five years of lapsing, which may require passing a physical examination.

Permanent life insurance policies offer an investment component that allows you to build cash value by investing a portion of the premiums. This cash value can be used as collateral for a loan or withdrawn. However, withdrawals may reduce the death benefit.

Trusts: Can They Be Life Insurance Beneficiaries?

You may want to see also

Term life insurance policies lapse if you miss a payment

Term life insurance policies are a type of life insurance that only covers the policyholder for a set number of years and does not accumulate cash value over time. This means that, unlike permanent life insurance, term life insurance policies will lapse if the premium is overdue and the grace period expires.

The grace period is a safety net that exists to help policyholders preserve their coverage. This period usually lasts for 30 days from the payment due date, during which time the policyholder can make the payment without losing coverage. If the policyholder dies during the grace period, the insurance company will still pay out the death benefit to the beneficiaries after deducting the owed premium amount.

However, if the grace period passes and the premium remains unpaid, the term life insurance policy will lapse and is no longer active. This means that beneficiaries will not receive a death benefit if the policyholder passes away, and the insurer will not refund any premiums paid in the past.

If a term life insurance policy has lapsed, it may be possible to reinstate it. Each insurance company has different guidelines for reinstatement, but most will allow reinstatement applications for up to five years from the end of the grace period. Reinstating a policy may require the policyholder to complete a new application, undergo a medical exam, and pay outstanding premiums.

Banner Life Insurance: Is It Worth the Hype?

You may want to see also

Permanent life insurance policies can be cashed out, but you will no longer be covered

Permanent life insurance policies, such as whole life and universal life, are designed to cover you for the rest of your life. They are typically more expensive than term life insurance policies as they provide coverage for your entire life and can build cash value. This cash value can be used to supplement income in retirement, cover college tuition, or make large purchases.

If you have a permanent life insurance policy, you can cash it out, but you will no longer be covered. There are a few options for cashing out your policy:

Surrender the Policy

You can cancel the policy and take the surrender value in cash. This option typically requires you to pay surrender charges and income taxes on the money. You will also no longer have life insurance coverage.

Withdraw the Entire Cash Value

You can withdraw the entire cash value of your policy, but you will need to surrender your policy, and your coverage will end. You will likely have to pay surrender charges and income taxes on the money.

Make a Partial Withdrawal

You can choose to take some but not all of the cash value of your policy. This option allows you to keep your policy active, but the death benefit will likely be reduced. You may need to check if the money you receive will be taxable.

Borrow Money from the Policy

If you've had your policy for several years, you may be able to borrow from its cash value. You won't have to pay taxes on the money you borrow, but the insurance company will deduct interest payments from your cash value balance. This option allows you to keep your coverage while accessing cash.

It's important to note that cashing out your permanent life insurance policy may have unintended consequences. For example, you may face higher tax liabilities, and your beneficiaries may receive a reduced payout. Additionally, if you stop making premium payments and your policy has insufficient cash value, it will lapse, and your coverage will end. Therefore, it's essential to carefully consider your options and consult with a financial professional before making any decisions.

How to Exchange Life Insurance for an Annuity

You may want to see also

You may be able to reinstate a lapsed policy within five years, but you will likely need to pass a physical examination

If you miss a premium payment on a term life insurance policy, the grace period to bring your account back into good standing begins—after which the policy will lapse. However, you may be able to reinstate a lapsed policy.

The right to ask your insurer to reinstate a life insurance policy is often included in life insurance policies when you've missed a payment. But the opportunity to reinstate is limited by time. So, it's important to familiarize yourself with this option in case your coverage ends when premiums are not paid. Many insurance providers are willing to work with you to catch up on payments and bring your policy back into good standing.

Some insurers may allow reinstatement within five years of the policy lapsing. You will most likely have to pass a physical examination for the reinstated policy and pay back the premiums you would have paid, plus interest. Annual premiums for the reinstated policy may be lower than those for a new, comparable policy.

In some cases, it’s as simple as filling out a reinstatement application and paying the difference in premium since your policy lapsed. In others, you may have to undergo a medical exam to ensure your health condition hasn’t changed dramatically since you purchased the policy.

Life Insurance Options for People with Crohn's Disease

You may want to see also

Permanent life insurance policies can be converted to term coverage if you stop paying premiums

Permanent life insurance policies are designed to provide coverage for the entirety of the insured person's life, as long as the premiums are paid. However, if you stop paying premiums, your permanent life insurance policy will lapse, and your coverage will end.

There are a few options available to you if you can no longer afford the premiums on your permanent life insurance policy. Firstly, you could cash out the policy. This means that you stop paying the premium and collect the available cash savings. You will no longer have life insurance coverage, but you will receive some of the proceeds of the policy. Note that you may have to pay taxes on some of the cash value if the sum exceeds what you have paid in premiums.

Another option is to explore non-forfeiture choices. There may be a "reduced paid-up" option, which means you can stop paying premiums entirely in exchange for a reduced death benefit and no cash savings. You may also be able to convert your permanent policy to an extended term policy for a period based on the accumulated cash savings in the policy.

Finally, if your permanent life insurance policy has built up sufficient cash value, this may be used to cover the cost of your premiums to keep the policy active. If the cash value is insufficient to provide a benefit for your whole life, your policy will lapse, and your life insurance coverage will end.

It is important to note that the specific options available to you will depend on the terms and conditions of your policy. You should carefully review your policy documents or consult with your insurance provider's customer service department to understand your rights and choices.

Life Insurance: Can Pre-Existing Conditions Increase Your Premiums?

You may want to see also

Frequently asked questions

This depends on the type of policy and the terms and conditions set by your insurance provider. If you have term life insurance, your coverage will likely lapse. If you have permanent life insurance, you may be able to cash out the policy, agree to a reduced benefit, or convert to term coverage.

Your grace period is the amount of time you have to make a payment after the due date and bring your life insurance policy back to good standing. This is usually 30 days, but it depends on your policy and insurance provider.

If your policy lapses, contact your insurance provider promptly to ask about reinstatement. Depending on how much time has passed, you may be able to simply make premium payments to bring the policy current. Even if you've missed several payments, your policy may be eligible for reinstatement, but a medical examination may be required.

Enrolling in autopay through your insurance provider or using your bank's bill payment service can help ensure you don't miss payments. If these methods don't work for you, schedule your premium payments at the beginning of the month, several days before the due date. For large annual or semi-annual payments, set up an automatic transfer to a separate savings account to help you budget.

Whether or not you need life insurance in retirement depends on several factors, including whether you still have income, debt, or dependents, and whether you want to leave an inheritance or cover final expenses. If you no longer have income to replace, very little debt, financially independent children, and no concerns about settling your estate, you may not need life insurance after you retire.