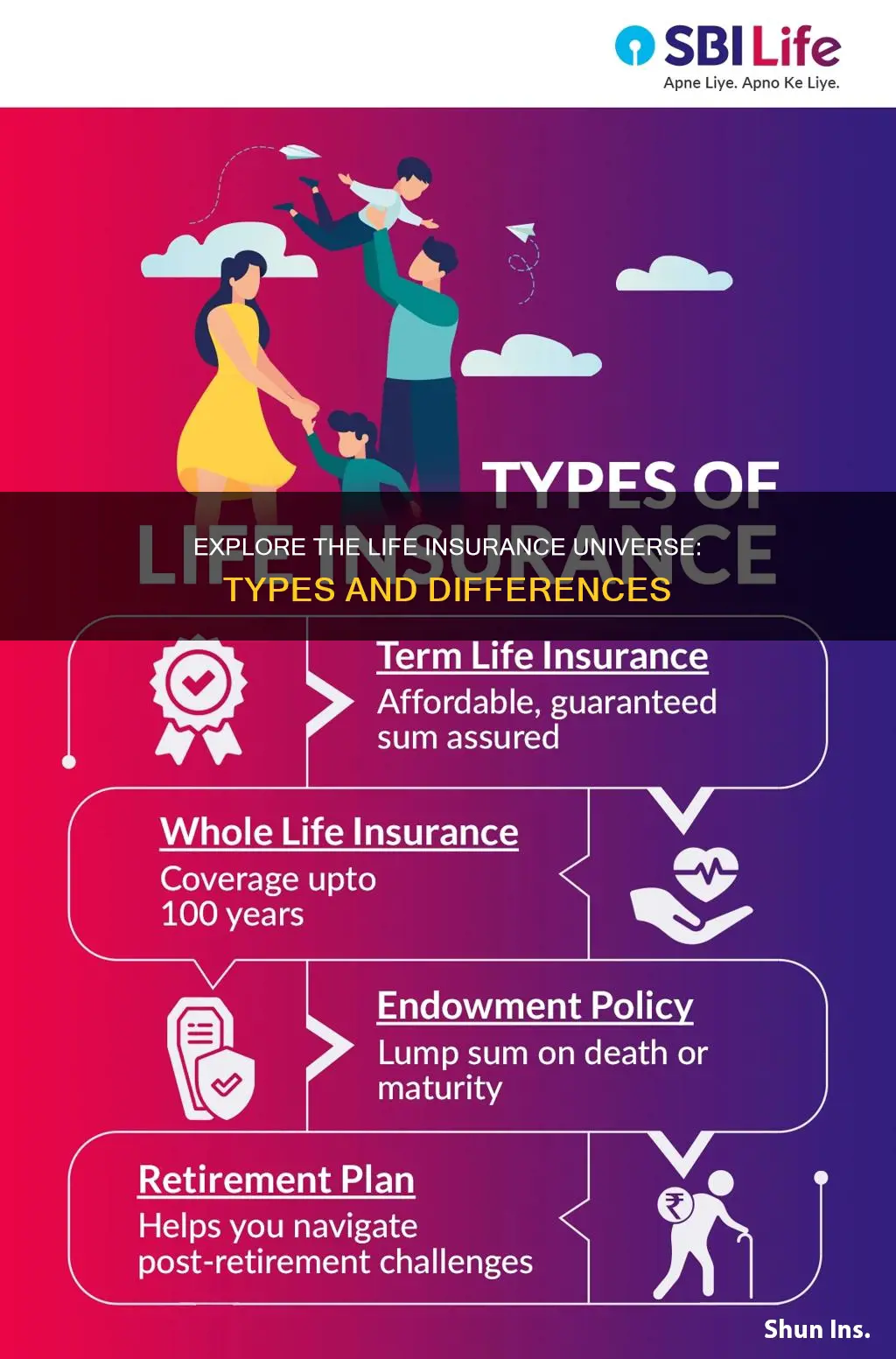

There are two basic types of life insurance: term life insurance and permanent life insurance. Term life insurance is a low-cost policy that replaces your income when you die. Permanent life insurance, on the other hand, refers to any policy that doesn't expire. Whole life insurance is a common type of permanent life insurance, which lasts your entire life and pays out to your beneficiaries when you die.

| Characteristics | Values |

|---|---|

| Type of life insurance | Universal life insurance |

| Variable life insurance | |

| Indexed universal life insurance | |

| Final expense insurance | |

| Whole life insurance |

What You'll Learn

Universal life insurance

Life insurance is a policy that provides a death benefit payout to beneficiaries if the policyholder passes away while it’s active. There are several types of life insurance, including whole life insurance, final expense insurance, universal life insurance, variable life insurance, and indexed universal life insurance.

Indexed universal life insurance is a specific type of universal life insurance where the cash value grows based on a stock market index such as the S&P 500 or the NASDAQ. This can be a good option for those who want the potential for higher returns on their cash value but are willing to accept the risk that comes with investing in the stock market.

Variable life insurance is another type of permanent life insurance that is considered riskier than other types of universal life insurance. It offers the potential for higher returns but also comes with the risk of losing money if the investments don't perform well. Variable life insurance policies typically invest in a mix of stocks, bonds, and other securities, and the policyholder has some control over how their money is invested.

Globe Life Insurance: Payouts and Policy Promises

You may want to see also

Variable life insurance

Because the cash value component of variable life insurance is invested in assets, it may rise or fall in value. Poor market performance may require additional premiums. You can choose from a variety of assets that offer different levels of risk and growth potential, all of which are subject to market fluctuation.

Ohio Life and Health Insurance Exam: How Tough?

You may want to see also

Indexed universal life insurance

Like with all universal life policies, once you've built up enough cash value, you can use it to lower or potentially fully pay for your premium without lowering your death benefit. IUL policies have adjustable premiums, so you can underpay or skip premiums, and you may be able to adjust your death benefit.

Employee Life Insurance: Tax Implications When Paid by Employer

You may want to see also

Final expense insurance

While final expense insurance is a type of whole life insurance, there are also different types of life insurance riders that can be added to a policy to change how it works under certain circumstances. For example, some life insurance plans offer benefits that can be used while the policyholder is still alive, such as a cash value component that can be used to help cover medical expenses or everyday costs of living.

Becoming a Life Insurance Agent in Alabama: A Guide

You may want to see also

Whole life insurance

Life insurance is a policy that provides a death benefit payout to beneficiaries if the policyholder passes away while it's active. There are several different types of life insurance, including whole life insurance, which is a permanent coverage type that lasts your entire life.

Final expense insurance is a type of whole life insurance that is specifically designed to cover end-of-life expenses. It offers a smaller and more affordable death benefit, making it a good option for older individuals or those with health issues who may have difficulty qualifying for other types of life insurance.

Additionally, whole life insurance policies may offer the option to borrow against the cash value of the policy. This can provide flexibility and access to funds in case of unexpected expenses or financial needs. However, it's important to note that borrowing against the policy's cash value may reduce the death benefit payout and should be carefully considered.

Life Insurance: A Generational Inheritance?

You may want to see also

Frequently asked questions

There are five main types of life insurance: term life insurance, whole life, universal life, variable life, and final expense life insurance.

Term life insurance is only active for a certain time period. If you die during this period, your beneficiaries will receive a cash payout. If you live past the term, your coverage ends, and you get nothing back.

Whole life insurance is a permanent coverage type that lasts your entire life. It is designed for those who need straightforward, lifelong coverage.

Final expense life insurance, also known as funeral or burial insurance, is a type of whole life insurance that offers a smaller and more affordable death benefit to cover end-of-life expenses such as funeral costs, medical bills, or outstanding debt.