Understanding the cost of insurance for a specific vehicle model, such as the 2004 Nissan Maxima, is crucial for car owners and buyers alike. The insurance rates for this particular model can vary significantly based on several factors, including the vehicle's age, condition, and usage. This paragraph aims to explore these factors and provide insights into the potential insurance costs for the 2004 Nissan Maxima, offering a comprehensive overview to help readers make informed decisions about their insurance coverage.

What You'll Learn

- Age & Usage: Age, driving record, and usage impact 2004 Maxima insurance rates

- Location: Urban areas often have higher premiums due to accident risks

- Coverage Options: Liability, collision, and comprehensive coverage affect costs

- Deductibles: Higher deductibles lower premiums, but increase out-of-pocket expenses

- Discounts: Good driver, multi-policy, and safety discounts can reduce insurance costs

Age & Usage: Age, driving record, and usage impact 2004 Maxima insurance rates

The cost of insuring a 2004 Nissan Maxima can vary significantly based on several factors, primarily your age and driving habits. Younger drivers, especially those under 25, often face higher insurance premiums due to their lack of driving experience and higher risk profile. Insurance companies consider this age group as statistically more likely to be involved in accidents, which can lead to increased insurance rates.

Age is a critical factor in determining insurance rates. As you get older, your insurance premiums tend to decrease. This is because older drivers are generally considered more responsible and less likely to file claims. For a 2004 Maxima, a 30-year-old driver might expect to pay less than a 20-year-old for the same coverage. Additionally, maintaining a clean driving record can further reduce insurance costs. A history of traffic violations, accidents, or claims will likely result in higher premiums.

Driving record is another crucial element. Insurance companies review your driving history to assess your risk. A good driving record, free of accidents and violations, can lead to significant savings on your insurance premiums. Conversely, a history of speeding tickets, DUIs, or at-fault accidents will likely increase your insurance costs. For instance, a 25-year-old with a clean record might pay less than a 35-year-old with multiple traffic violations.

Usage also plays a significant role in determining insurance rates. The more you drive, the higher the risk of accidents and, consequently, the higher the insurance premium. If you primarily use your 2004 Maxima for short daily commutes, you might qualify for lower rates compared to someone who drives long distances or uses the vehicle for business purposes. Additionally, the type of coverage you choose, such as liability-only or comprehensive and collision, will also impact your premium.

In summary, the insurance rates for a 2004 Nissan Maxima can vary widely based on age, driving record, and usage. Younger drivers with less experience and a history of violations may face higher premiums, while older, more experienced drivers with a clean record can expect lower rates. Usage patterns, such as the frequency and purpose of driving, also contribute to the overall cost of insurance. Understanding these factors can help you make informed decisions to manage your insurance expenses effectively.

Hard Inquiry: What Auto Insurance Companies Really See

You may want to see also

Location: Urban areas often have higher premiums due to accident risks

In urban areas, the insurance rates for a 2004 Nissan Maxima can be significantly higher compared to rural regions. This is primarily due to the increased risk of accidents and the higher density of vehicles on the roads. Urban environments often experience more traffic congestion, which leads to a higher likelihood of collisions and other road incidents. The frequency of accidents in these areas is a major factor that insurance companies consider when determining premiums.

The dense population and heavy traffic in cities contribute to a higher number of potential hazards. With more vehicles sharing the road, the chances of accidents, especially at intersections and during rush hours, are greater. Insurance providers often use statistical data to assess the risk, and urban areas typically show higher accident rates, which directly impact the cost of insurance.

Another aspect is the higher cost of living and medical expenses in urban centers. When accidents occur, the financial burden on insurance companies can be substantial, and they often reflect this in the premium rates. Additionally, the availability of emergency services and medical facilities in urban areas might influence the assessment of risk, as quicker response times can potentially reduce the severity of accidents.

Furthermore, the type of coverage and the specific location within the urban area can also play a role. For instance, comprehensive insurance might be more expensive in certain neighborhoods due to the higher risk of theft or vandalism. Insurance companies often use mapping and data analysis to identify high-risk zones, which can further contribute to the variation in premiums across different parts of a city.

Understanding these factors can help drivers in urban areas prepare for the potential higher costs of insuring their 2004 Nissan Maxima. It is essential to consider the unique characteristics of the location when assessing insurance options to ensure adequate coverage and manage expenses effectively.

Combining Auto and Rental Insurance: Is It Possible?

You may want to see also

Coverage Options: Liability, collision, and comprehensive coverage affect costs

When it comes to insuring your 2004 Nissan Maxima, understanding the various coverage options and their impact on costs is crucial. Insurance rates can vary significantly based on the type of coverage you choose, and it's essential to make informed decisions to ensure you're adequately protected while keeping expenses manageable. Here's a breakdown of the key coverage options and how they influence your insurance premiums:

Liability Coverage: This is a fundamental component of auto insurance and is typically required by law. Liability coverage protects you in case you're at fault for an accident, covering the damages and injuries you cause to others. The cost of liability insurance is calculated based on the coverage limits you select. Higher limits mean more comprehensive protection but will also result in higher premiums. For a 2004 Maxima, liability coverage might be priced based on factors like your driving record, location, and the vehicle's value. It's important to choose liability limits that align with your financial situation and the potential risks associated with your driving.

Collision Coverage: This type of insurance pays for repairs or replacement of your vehicle if it's damaged in a collision, regardless of fault. Collision coverage is particularly relevant for older cars like the 2004 Maxima, as the vehicle's value might be lower than the cost of comprehensive repairs. The premium for collision insurance is influenced by factors such as the car's age, make, model, and your driving history. If you have a higher-risk profile or live in an area with a high accident rate, expect collision coverage to be more expensive. However, it can provide peace of mind, especially if you're concerned about potential accidents.

Comprehensive Coverage: This coverage protects against non-collision-related incidents, such as theft, vandalism, natural disasters, and animal collisions. For a 2004 Maxima, comprehensive insurance can be especially useful if you live in an area prone to theft or natural calamities. The cost of comprehensive coverage is determined by the vehicle's value, your location, and the specific perils covered. While it provides extensive protection, comprehensive insurance might not be as critical as liability or collision coverage for older vehicles, as the car's value may not justify the higher premium.

The interplay between these coverage options directly affects your insurance costs. For instance, increasing your liability limits will likely raise your premium, but it provides more financial security. Similarly, comprehensive and collision coverage can significantly impact your rates, especially for older cars, but they offer valuable protection. It's essential to assess your risk tolerance, the vehicle's value, and your financial capabilities to determine the optimal coverage mix for your 2004 Nissan Maxima.

Remember, insurance rates are not one-size-fits-all, and various factors influence the final cost. It's advisable to obtain quotes from multiple insurance providers to compare coverage options and prices, ensuring you get the best value for your money while adequately protecting your vehicle.

Auto Insurance and Windshield Replacement: Understanding Your Coverage

You may want to see also

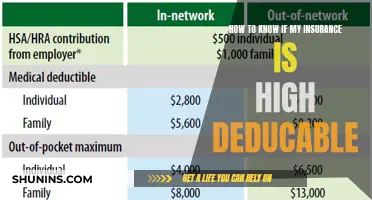

Deductibles: Higher deductibles lower premiums, but increase out-of-pocket expenses

When it comes to car insurance, one of the key factors that can significantly impact your premiums is the deductible you choose. A deductible is the amount you agree to pay out of pocket when you file a claim. By opting for a higher deductible, you can lower your monthly insurance premiums, but it's important to understand the trade-off.

Choosing a higher deductible means you're taking on more financial responsibility upfront. If you have a minor accident or damage to your 2004 Nissan Maxima, you'll need to pay the deductible amount before your insurance coverage kicks in. For example, if you select a $1,000 deductible and your car sustains $2,000 worth of damage, you'll have to pay the first $1,000, and then your insurance will cover the remaining $1,000. This can be a substantial amount, especially if you don't have a large emergency fund.

On the other hand, lower deductibles result in higher premiums. This is because the insurance company is taking on more risk by paying out smaller claims more frequently. With a lower deductible, you're essentially paying a smaller portion of the claim, which can be more affordable in the short term. However, this also means that your insurance policy will be less comprehensive, and you might need to pay more out of pocket in the event of a major accident.

It's a delicate balance that many car owners face. If you're considering a higher deductible, it's crucial to ensure that you have the financial means to cover the deductible amount. This might involve building an emergency fund or exploring other financial options to ensure you're prepared for any unexpected costs. Additionally, it's worth comparing quotes from different insurance providers to find the best rates for your specific situation.

In summary, when determining the insurance coverage for your 2004 Nissan Maxima, consider the impact of deductibles. Higher deductibles can lead to lower premiums but require more financial responsibility. Lower deductibles offer more immediate affordability but may result in higher overall costs. Finding the right balance will ensure you have adequate coverage while managing your insurance expenses effectively.

Auto Insurance Cancelled: Steps to Take Now

You may want to see also

Discounts: Good driver, multi-policy, and safety discounts can reduce insurance costs

When it comes to insuring your 2004 Nissan Maxima, you might be surprised to learn that there are several ways to potentially lower your insurance costs. One of the most effective methods is to take advantage of various discounts offered by insurance companies. These discounts can significantly reduce the overall price of your insurance policy, making it more affordable and cost-effective. Here's a breakdown of the key discounts you should consider:

Good Driver Discounts: Insurance companies often reward safe and responsible drivers with lower premiums. If you have a clean driving record without any accidents or violations, you may qualify for a good driver discount. This discount can vary depending on the insurance provider, but it typically applies to a percentage reduction on your premium. Maintaining a safe driving history is crucial to unlocking this benefit.

Multi-Policy Discounts: Insuring multiple vehicles or having other insurance policies with the same company can lead to substantial savings. If you have a car insurance policy with the same insurer and also carry homeowners or renters insurance, you might be eligible for a multi-policy discount. This discount encourages customers to consolidate their insurance needs, often resulting in a lower overall cost.

Safety Feature Discounts: Modern vehicles are equipped with advanced safety features, and insurance companies recognize the value of these enhancements. If your 2004 Nissan Maxima has safety features like anti-lock brakes, airbags, traction control, or a theft prevention system, you may be entitled to a safety discount. These features not only enhance the vehicle's performance but also reduce the risk of accidents and theft, thus lowering insurance premiums.

Additionally, some insurance providers offer loyalty discounts to long-term customers. If you've been with the same insurance company for several years, inquire about potential discounts to show your loyalty. Furthermore, consider taking a defensive driving course, as it can lead to reduced premiums by demonstrating your commitment to safe driving practices.

By exploring these discounts and understanding the criteria for eligibility, you can take control of your insurance expenses. Remember, insurance companies often have specific requirements for each discount, so it's essential to review the terms and conditions carefully. With the right combination of discounts, you can significantly lower the insurance costs for your 2004 Nissan Maxima while still enjoying comprehensive coverage.

Warning Tickets: Impact on Insurance Premiums and Coverage

You may want to see also

Frequently asked questions

The insurance rate for a 2004 Nissan Maxima can vary based on several factors. These include the vehicle's age, make and model, trim level, safety features, driving history, coverage options, and the driver's age and location. Older vehicles like the 2004 Maxima might have higher insurance rates due to potential mechanical issues and lower resale value.

Obtaining an exact cost for full coverage insurance requires providing specific details to an insurance provider or agent. However, as a general estimate, full coverage for a 2004 Maxima could range from $1,200 to $2,500 per year, depending on the factors mentioned above. This estimate includes liability, collision, comprehensive, and other essential coverages.

Yes, there are several discounts that can help reduce insurance costs for a 2004 Maxima. Common discounts include those for safe driving records, multiple policy discounts ( bundling car and home insurance), anti-theft devices, good student discounts, and loyalty discounts for customers with the same insurance company. It's advisable to inquire with insurance companies about available discounts to find the best deal.

Insurance rates can vary significantly by region and state. For instance, in the United States, the average annual premium for a 2004 Maxima might range from $1,000 to $1,800, but this can be higher or lower depending on the state and local factors. It's essential to get quotes from local insurance providers to get an accurate estimate for your specific location.