Navigating the world of insurance can be complex, and understanding the different coverage options is crucial for making informed decisions. When considering insurance plans, one important aspect to evaluate is the deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. A high deductible means you'll pay more upfront but could save on premiums. Knowing if your insurance has a high deductible is essential to ensure you're prepared for potential medical expenses and to make the most of your coverage. This guide will provide insights into identifying and managing high-deductible insurance plans, helping you make the right choice for your healthcare needs.

What You'll Learn

- Understanding Deductibles: Know what a deductible is and how it affects your insurance costs

- Review Policy Documents: Check your insurance policy for deductible information and coverage details

- Compare Plans: Compare different insurance plans to find the best deductible for your needs

- Estimate Costs: Calculate potential out-of-pocket expenses based on deductible amounts

- Consult an Agent: Seek advice from an insurance agent to understand deductible implications

Understanding Deductibles: Know what a deductible is and how it affects your insurance costs

A deductible is a crucial component of your insurance policy, representing the amount you agree to pay out of pocket before your insurance coverage kicks in. When you file a claim, the insurance company will only cover the costs above the deductible amount. Understanding deductibles is essential as they directly impact your insurance costs and the overall financial responsibility you bear.

In the context of health insurance, for instance, a higher deductible often means lower monthly premiums. This is because the insurance company expects you to pay more upfront when you need to file a claim, reducing their financial risk. Conversely, a lower deductible typically results in higher monthly premiums, as the insurance provider assumes a larger portion of the potential costs. For example, if you choose a health plan with a $1,000 deductible, you'll pay that amount yourself when you file a claim, and then the insurance will cover the remaining expenses.

The impact of deductibles extends beyond health insurance. In auto insurance, a higher deductible can lead to lower premiums, but it means you'll have to pay more out of pocket if you're involved in an accident. Homeowners' insurance also often includes deductibles, where the policyholder pays a certain amount before the insurance coverage begins. Understanding these deductibles is vital to ensure you're adequately prepared for potential financial burdens.

When assessing your insurance policies, it's important to consider your financial situation and risk tolerance. If you have a higher deductible, you might save on premiums, but you'll need to ensure you can afford the out-of-pocket expense in the event of a claim. Conversely, a lower deductible may provide more immediate financial relief but could result in higher overall costs.

In summary, deductibles are a critical aspect of insurance policies, influencing both the cost and the level of financial protection you receive. By comprehending the deductible amount and its implications, you can make informed decisions about your insurance coverage, ensuring it aligns with your financial goals and risk management strategies.

Auto Insurance and Accidental Death: Understanding the Coverage

You may want to see also

Review Policy Documents: Check your insurance policy for deductible information and coverage details

Reviewing your insurance policy documents is a crucial step in understanding your coverage and identifying any potential high-deductible plans. Deductibles are a fundamental part of insurance policies, representing the amount you agree to pay out of pocket before your insurance coverage kicks in. Here's a guide on how to review your policy documents to find this information:

Start by locating your insurance policy documents, which should include a summary of your coverage and a detailed policy statement. These documents are typically provided by your insurance company and may be available online or as a physical copy. Look for sections that outline the terms and conditions of your policy. The deductible amount is usually specified in the 'Coverage' or 'Benefits' section, where it might be listed as 'Annual Deductible' or 'Out-of-Pocket Maximum'. It is essential to read the fine print to ensure you understand the policy's specific terms.

Pay close attention to the policy's definition of a deductible. Some policies may have a single deductible for all covered services, while others might have separate deductibles for different types of services, such as medical, dental, or vision care. Understanding these distinctions is vital to accurately assessing your potential out-of-pocket costs.

Additionally, review the coverage limits and any exclusions. Deductibles often apply after you meet the policy's coverage limits, and understanding these limits will help you gauge the financial impact of your insurance plan. Exclusions are services or events that your insurance may not cover, and knowing these can also help you prepare for potential high-deductible scenarios.

If you have any doubts or questions about the information in your policy documents, don't hesitate to contact your insurance provider. They can provide clarification and ensure you have a comprehensive understanding of your coverage. Remember, being well-informed about your insurance policy is essential to making the right choices for your healthcare needs.

Navigating the Claims Process: Taking on Progressive Auto Insurance

You may want to see also

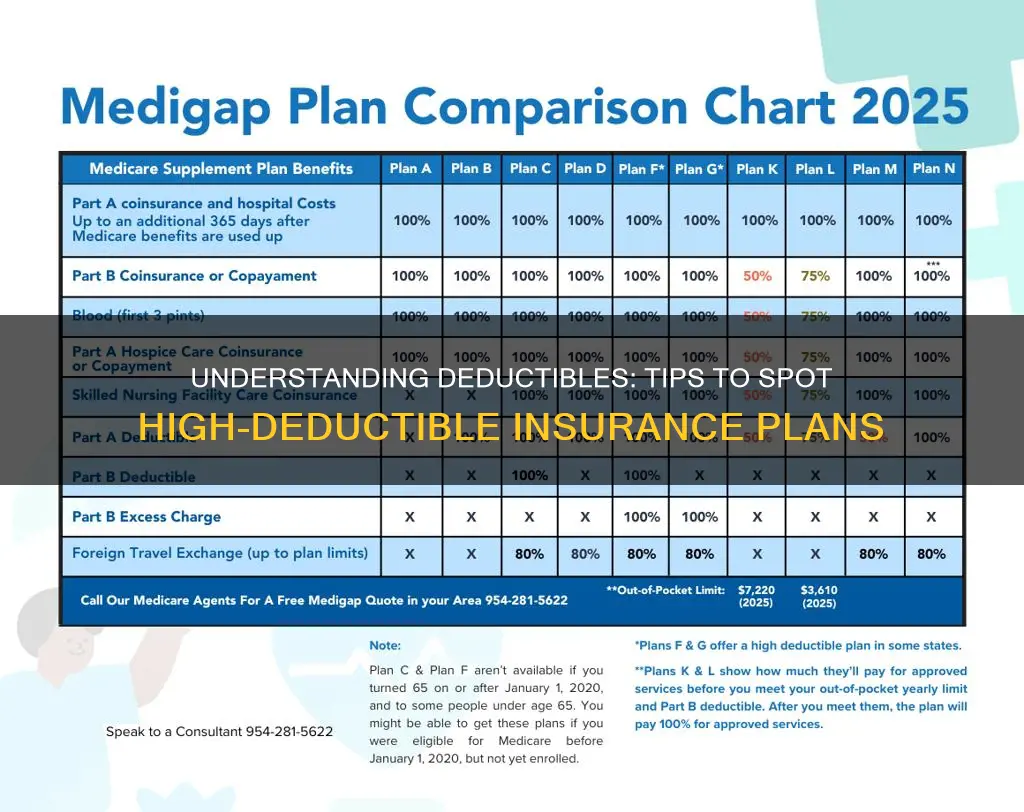

Compare Plans: Compare different insurance plans to find the best deductible for your needs

When comparing insurance plans, it's crucial to understand the concept of deductibles and how they impact your coverage. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower monthly premiums, but they also mean you'll have to pay more upfront when you file a claim. So, how do you determine if a plan has a high deductible?

Start by reviewing the policy documents provided by the insurance company. Look for the term "deductible" and understand the specific amount associated with each plan. For instance, if a plan has a $1,000 deductible, it means you'll pay $1,000 out of pocket for covered expenses before the insurance benefits apply. Plans with higher deductibles will have lower premium costs, but you should be aware of the potential financial burden if you need to make a claim.

Comparing plans from different insurance providers is essential to finding the right balance. Consider the following factors:

- Annual Premium Cost: Calculate the total annual cost of each plan, including the deductible. Lower monthly premiums might be attractive, but they could be offset by a higher deductible.

- Out-of-Pocket Maximum: Look for the out-of-pocket maximum, which is the maximum amount you'll pay in a year for deductibles, copayments, and coinsurance. Plans with lower out-of-pocket maximums provide better protection against high medical expenses.

- Coverage Limits: Evaluate the coverage limits for various services, such as doctor visits, hospital stays, and prescription drugs. Ensure that the plan meets your expected healthcare needs.

- Network and Provider Options: Check the insurance company's network of doctors, hospitals, and other healthcare providers. A larger network can offer more choices and potentially lower costs.

To find the best deductible, consider your financial situation and healthcare usage. If you tend to have minor medical expenses and prefer lower monthly payments, a higher deductible might be suitable. However, if you anticipate significant healthcare costs or have a history of frequent claims, a lower deductible plan could provide better value. It's a delicate balance between saving on premiums and ensuring adequate coverage.

Additionally, consider the following tips:

- Review your past medical records and expenses to estimate potential future costs.

- Understand the difference between a high-deductible health plan (HDHP) and a traditional plan. HDHPs often have lower premiums but higher deductibles.

- Don't be afraid to ask insurance agents or brokers for clarification and guidance based on your specific circumstances.

U.S. Auto Association: Insurance Dividends Explained

You may want to see also

Estimate Costs: Calculate potential out-of-pocket expenses based on deductible amounts

To determine if your insurance policy has a high deductible, it's essential to understand the financial implications and estimate your potential out-of-pocket expenses. Here's a step-by-step guide to help you calculate these costs:

Understand Deductible and Copay: Start by comprehending the difference between a deductible and copay. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. For example, if your policy has a $1,000 deductible, you'll be responsible for this amount when filing a claim. Copays, on the other hand, are fixed amounts you pay at the time of service for specific medical procedures or visits. Knowing both these terms is crucial for estimating costs.

Review Your Policy Documents: Obtain your insurance policy documents, which should provide detailed information about coverage, deductibles, and copays. Look for sections related to 'Out-of-Pocket Maximum' or 'Annual Deductible.' These sections will specify the deductible amount for your policy. If you have multiple coverage options, compare them to identify the one with a higher deductible.

Estimate Potential Medical Expenses: To estimate your out-of-pocket expenses, consider various medical scenarios. Start by identifying the likelihood and potential costs of different medical events, such as minor injuries, major surgeries, or routine check-ups. Multiply the estimated costs by the corresponding deductible or copay to get an idea of the financial impact. For instance, if a minor injury typically costs $500 and your deductible is $1,000, you'll pay the full $500 out of pocket.

Consider Annual Limits: Insurance policies often have annual limits for out-of-pocket expenses. Once you reach this limit, the insurance company will cover the remaining costs. Calculate your potential annual expenses by summing up the estimated costs for various medical events and then subtracting the annual out-of-pocket maximum. This will give you an idea of how much you might pay before your insurance coverage fully kicks in.

By following these steps, you can gain a clear understanding of the financial implications of your insurance policy's deductible. It empowers you to make informed decisions about your healthcare and insurance coverage, ensuring you are prepared for potential out-of-pocket expenses.

Eviction History: A Surprising Factor in Auto Insurance Rates

You may want to see also

Consult an Agent: Seek advice from an insurance agent to understand deductible implications

When it comes to understanding the implications of a high deductible on your insurance policy, consulting an insurance agent is an invaluable step. These professionals are experts in deciphering the complex world of insurance and can provide tailored advice based on your specific circumstances. Here's why seeking their guidance is essential:

Insurance agents have an in-depth understanding of various insurance products and their associated terms. They can explain the concept of deductibles and how they impact your coverage. Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. A high deductible means you'll pay more initially but could benefit from lower monthly premiums. Agents can clarify these points and help you grasp the trade-offs involved.

During your consultation, an agent will assess your current insurance policy and financial situation. They will consider factors such as your age, health, occupation, and any existing claims history. This personalized evaluation allows them to recommend the most suitable deductible for your needs. For instance, if you have a stable health condition and a reasonable financial cushion, a higher deductible might be appropriate. Conversely, if you have a history of frequent medical issues, a lower deductible could provide better protection.

Furthermore, insurance agents can provide practical insights into how different deductibles affect your overall insurance experience. They can explain the potential savings or increased costs associated with various deductible options. This knowledge empowers you to make an informed decision, ensuring you choose a deductible that aligns with your financial goals and risk tolerance.

By consulting an agent, you gain access to their expertise and resources. They can provide comparisons between different insurance providers and policies, helping you find the best value for your deductible. Additionally, agents can assist with any policy adjustments or recommendations to optimize your coverage, ensuring you have a comprehensive understanding of your insurance choices.

In summary, seeking advice from an insurance agent is a crucial step in comprehending the implications of a high deductible. Their expertise, personalized assessments, and practical insights will enable you to make an informed decision, ensuring your insurance policy meets your specific requirements. Remember, a well-informed choice today can lead to better financial protection and peace of mind in the long run.

Understanding Auto Insurance Loss Ratios: Claims and Costs

You may want to see also

Frequently asked questions

A high deductible is typically a significant amount that you agree to pay out of pocket before your insurance coverage kicks in. To check, review your insurance policy documents or contact your insurance provider directly. They will provide you with the specific deductible amount for your plan.

High deductible plans often come with lower monthly premiums, which can be beneficial if you prefer to save on regular payments. However, it's important to ensure that you can afford the higher deductible amount in case of a claim. These plans usually offer better coverage and more comprehensive benefits once the deductible is met.

Yes, there are a few strategies to consider. Firstly, you can try to save money in other areas to build up a personal fund for potential medical expenses. Secondly, consider using a health savings account (HSA) to set aside pre-tax dollars for medical costs, which can help manage the impact of the high deductible. Additionally, some insurance providers offer tools and resources to help you understand and manage your out-of-pocket costs.