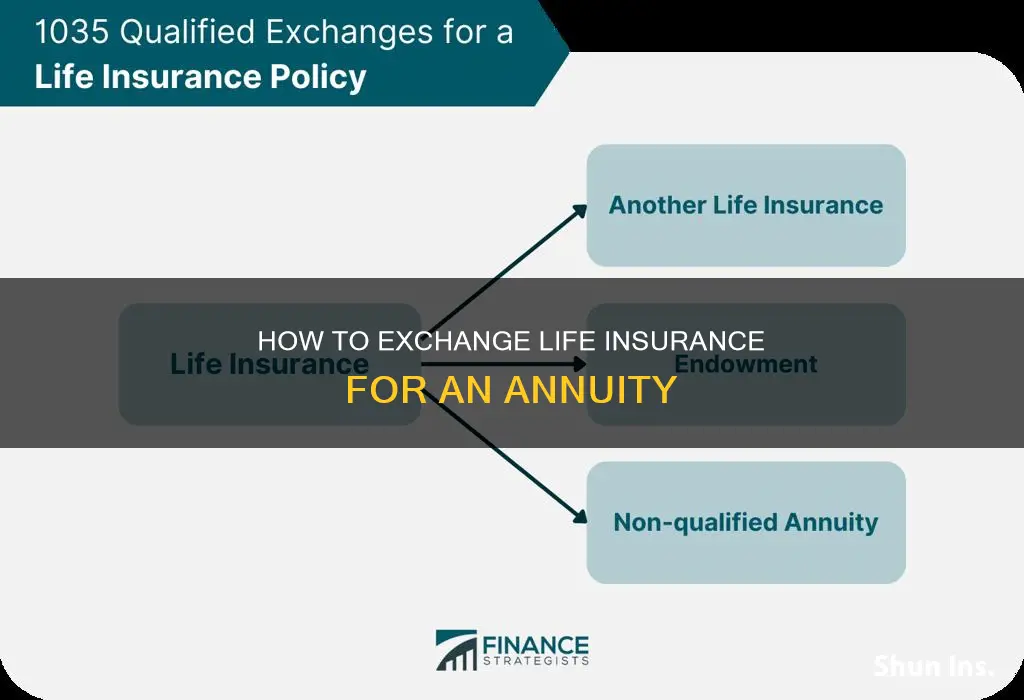

Life insurance and annuities are great ways to stretch your income and ensure your money grows and benefits your loved ones even after you're gone. However, as your family grows, your needs may change, and your previous insurance investments may no longer be ideal. In such cases, you can consider a 1035 exchange, which is a provision in the Internal Revenue Service (IRS) code that allows for a tax-free transfer of an existing annuity contract, life insurance policy, long-term care product, or endowment for another of like kind. This means you can exchange your life insurance policy for an annuity, but not the other way around. A 1035 exchange allows you to defer taxes on any gains, preserve the original cost basis, and potentially find better benefits and terms. However, there may be potential exchange fees, higher costs, and tax non-compliance if the IRS rules are not followed.

| Characteristics | Values |

|---|---|

| What is a 1035 exchange? | A provision in the Internal Revenue Service (IRS) code allowing for a tax-free transfer of an existing annuity contract, life insurance policy, long-term care product, or endowment for another of like kind. |

| What is allowed in a 1035 exchange? | A life insurance policy can be exchanged for an annuity, but an annuity cannot be exchanged for a life insurance policy. |

| Who can benefit from a 1035 exchange? | Individuals who want to transfer their life insurance, annuities, and endowments to a similar vehicle tax-free. |

| What are the rules of a 1035 exchange? | 1. Exchanges must be in-kind or eligible. 2. The contract holder doesn't change. 3. Institutions handle the transaction directly. |

| How does a 1035 exchange work? | An individual informs their current and new insurance providers that they'd like to do a 1035 exchange, and the two companies then work together to handle the transfer details. |

| What are the pros and cons of a 1035 exchange? | Pros: Tax-deferral continuity, preserving cost basis, and better benefits and terms. Cons: Potential exchange fees, higher costs, and tax noncompliance. |

| What is the tax reporting requirement for a 1035 exchange? | A 1035 exchange must be reported on a tax return using form 1099-R, unless the exchange occurs in-house. |

What You'll Learn

- A 1035 exchange allows you to transfer your life insurance policy to an annuity without paying taxes on any gains

- You can't exchange an annuity for a life insurance policy

- The contract holder cannot change during a 1035 exchange

- The exchange must go directly from one institution to another

- A 1035 exchange must be reported on a tax return

A 1035 exchange allows you to transfer your life insurance policy to an annuity without paying taxes on any gains

A 1035 exchange is a provision in the Internal Revenue Service (IRS) code that allows for a tax-free transfer of an existing annuity contract, life insurance policy, long-term care product, or endowment for another of like kind. It is a replacement, but not all replacements qualify as a 1035 exchange. When an annuity or life insurance policy is exchanged for another annuity, it is a replacement and a 1035 exchange. However, exchanging an annuity contract for a life insurance policy is characterised as a replacement but does not qualify as a 1035 exchange and is taxable.

Section 1035 of the tax code allows for tax-free exchanges of certain insurance products. Life insurance policyholders can use a section 1035 exchange to trade an old policy for a new one with better features. The 2006 Pension Protection Act allows exchanges into long-term care products.

A 1035 exchange allows individuals to transfer life insurance, annuities, and endowments to a similar vehicle tax-free. These transfers must be between similar products, such as life insurance for life insurance or a non-qualified annuity for a non-qualified annuity. The 2006 Pension Protection Act (PPA) modified the tax code to include exchanges from life insurance policies and non-qualified annuities into traditional and hybrid qualified long-term care products.

The primary benefit of a Section 1035 exchange is that it lets the contract or policy owner trade one product for another without tax consequences. Outdated and underperforming products can be switched to newer products with more attractive features, such as better investment options and less restrictive provisions.

There are three main rules to a 1035 exchange:

- Exchanges must be in-kind or eligible: The assets being traded must be the same kind of product or be one of the allowable exceptions. For example, a life insurance contract can be exchanged for a non-qualified annuity, endowment, or long-term care life insurance. However, an endowment can only be swapped for another endowment, a non-qualified annuity, or long-term care insurance.

- The contract holder doesn't change: Transferring ownership during the transaction would nullify eligibility for the 1035 tax benefits.

- Institutions handle the transaction directly: The exchange must go straight from one institution to another to avoid incurring income taxes.

A 1035 exchange can offer major tax benefits if you need to swap your life insurance or annuity for products that better meet your needs. However, it may not be suitable for everyone. There are some potential drawbacks to consider, such as potential exchange fees, higher costs, and tax noncompliance if IRS rules are not followed.

Life Insurance Proceeds: Maryland's Tax Laws Explained

You may want to see also

You can't exchange an annuity for a life insurance policy

While a 1035 exchange allows you to swap your life insurance policy for an annuity, the reverse is not possible. In other words, you cannot exchange an annuity contract for a life insurance policy. This is because a 1035 exchange specifically refers to the tax-free transfer of certain insurance products, as outlined in Section 1035 of the Internal Revenue Code.

Section 1035 permits the non-taxable exchange of specific insurance products, including life insurance policies and annuities, but the transfer must be between similar products. For example, you can exchange a life insurance policy for another life insurance policy or a non-qualified annuity for a non-qualified annuity. However, you cannot exchange an annuity for a life insurance policy as they are not considered like-kind products.

The primary benefit of a 1035 exchange is that it allows the contract or policy owner to trade one product for another without facing tax consequences. This means that outdated or underperforming insurance products can be switched for newer, more attractive options without incurring taxes on the investment gains. However, it's important to note that a 1035 exchange does not release the owner from their obligations under the original contract, and there may still be associated fees or charges.

Before proceeding with a 1035 exchange, it is essential to carefully evaluate your options and consider seeking professional advice. Compare the features and costs of the new and old policies, conduct a cost-benefit analysis, and ensure that the new policy aligns with your investment goals. Additionally, be mindful that the annuitant or policyholder must remain the same in a 1035 exchange, and the funds must be transferred directly between the insurance companies.

New York Life Insurance: Felon-Friendly or Not?

You may want to see also

The contract holder cannot change during a 1035 exchange

A 1035 exchange is a provision in the Internal Revenue Service (IRS) code that allows for a tax-free transfer of an existing annuity contract, life insurance policy, long-term care product, or endowment for another of like kind. It is a valuable tool for those who want to switch to a newer product with more attractive features without facing tax consequences.

However, it is important to note that during a 1035 exchange, the contract holder cannot change. This means that the annuitant or policyholder must remain the same. For example, if an annuity is owned by Joe, it cannot be exchanged for an annuity owned by Jane or a joint annuity owned by Joe and Jane. The contract or policy owner also cannot take the funds and purchase a new policy; instead, the money must be transferred directly.

This restriction is in place to ensure that the exchange is reported correctly on the individual's annual tax return using Form 1099-R. By keeping the contract holder the same, the IRS can accurately track the transaction and ensure that it meets the criteria for a tax-free exchange. It is a crucial aspect of the 1035 exchange process and must be considered when planning such a transaction.

While the contract holder cannot change during a 1035 exchange, there are some exceptions and special cases to be aware of. In certain situations, the policyholder of a life insurance policy can change, such as when the survivor in a second-to-die policy transfers into single-person coverage. Additionally, once the exchange is complete, the owner and annuitant on the new contract can be modified. It is important to consult with a financial professional to understand the specific rules and regulations that apply to your situation.

Life Insurance Proceeds: Protected from Creditors in Missouri?

You may want to see also

The exchange must go directly from one institution to another

When it comes to exchanging a life insurance policy for an annuity, it's essential to understand the intricacies of the process, especially the requirement that the exchange must go directly from one institution to another. This means that if you're considering a 1035 exchange, you can't simply cash out your life insurance policy and use the proceeds to purchase an annuity. The transaction has to be a direct transfer between the two financial institutions involved.

The reason for this restriction is to maintain the tax-advantaged nature of the 1035 exchange. By requiring a direct transfer, the Internal Revenue Service (IRS) ensures that the exchange is not treated as a taxable event. This is a significant benefit of a 1035 exchange, as it allows you to move your money without incurring tax liabilities on any investment gains made in the original contract.

To illustrate this with an example, let's say you have a life insurance policy with Company A and you want to exchange it for an annuity with Company B. The correct procedure is not to withdraw funds from your life insurance policy and then use that money to buy the annuity. Instead, you would initiate a direct transfer from Company A to Company B, ensuring that the funds never pass through your hands.

It's also important to remember that the 1035 exchange only applies to certain types of insurance products. In this case, you can exchange a life insurance policy for a non-qualified annuity, but not for a qualified annuity or other types of investment products. Additionally, the annuitant or policyholder must remain the same during the exchange.

While the direct transfer requirement may seem restrictive, it's designed to protect your financial interests by providing a tax-efficient way to adjust your insurance and retirement planning strategies. As always, it's advisable to consult with a qualified financial advisor or tax professional before proceeding with any significant financial transactions, including a 1035 exchange. They can help you navigate the rules and regulations to ensure your exchange is compliant and aligns with your overall financial goals.

Life Insurance Proceeds: Community Property in Texas?

You may want to see also

A 1035 exchange must be reported on a tax return

A 1035 exchange is a provision in the Internal Revenue Service (IRS) code that allows for a tax-free transfer of an existing annuity contract, life insurance policy, long-term care product, or endowment for another of like kind. It is a replacement, but not every replacement qualifies as a 1035 exchange. An exchange of an annuity contract for a life insurance policy, for example, can be characterized as a replacement but does not qualify as a 1035 exchange. Such transactions are taxable, with gains and losses recognized.

To report a 1035 exchange on a tax return, you will need to use Form 1099-R. This form will include the amount transferred in box 1, with $0 or blank in box 2a, and a code of 6 in box 7 to indicate a 1035 exchange. It is important to note that the transaction is only non-taxable if it meets certain criteria. The exchange must be between similar products, such as life insurance for life insurance or a non-qualified annuity for a non-qualified annuity. The contract holder cannot change during the transaction, and the funds must be transferred directly between institutions without being cashed out.

There are a few other important considerations when it comes to 1035 exchanges and tax reporting. Firstly, if the exchange occurs within the same company, the financial institution may not be required to issue a 1099-R form. In this case, the exchange may not need to be reported on the tax return. Secondly, it is important to ensure that the 1099-R form is completed accurately. If the code in box 7 is not 6, it may indicate that the transaction is taxable. Finally, it is worth noting that not all transfers qualify as 1035 exchanges. Transfers between qualified accounts, such as IRAs and 401(k)s, are not considered 1035 exchanges and may have different tax implications.

U.S. Veterans: Life Insurance Options via USAA

You may want to see also

Frequently asked questions

There is only one reason to 1035 exchange your policy: if the new policy is better contractually than the old one.

A 1035 exchange is a provision in the Internal Revenue Service (IRS) code that allows for a tax-free transfer of an existing annuity contract, life insurance policy, long-term care product, or endowment for another of like kind.

A 1035 exchange offers major tax benefits, allowing you to transfer funds from one contract to another without paying taxes on any gains. It also lets you preserve the cost basis of the original contract if it has underperformed and dropped in value. Finally, it lets you find a more desirable life insurance or annuity contract, such as one with more insurance coverage or a better-performing annuity with lower fees.

There may be expenses associated with your new contract, including a broker commission, that can eat into its value. You may also have to pay a surrender charge on your old contract. If you're exchanging for a new life insurance contract, it can be more expensive based on your age and health, or you may not be eligible at all.

The assets being traded must be the same kind of product or be one of the allowable exceptions. For example, you can exchange a life insurance contract for a non-qualified annuity, but not the other way around. The contract holder cannot change during the transaction, and the transaction must be handled directly by the institutions without the contract holder cashing out.