Military life insurance is a specialized type of life insurance designed to provide financial protection and peace of mind to members of the armed forces and their families. It is tailored to the unique needs and circumstances of military personnel, offering coverage that can be adapted to their service obligations and the potential risks associated with their line of work. This insurance typically includes coverage for the insured's death, with benefits paid out to designated beneficiaries, and may also offer additional benefits such as critical illness or disability coverage. Understanding the details and benefits of military life insurance is essential for service members and their families to ensure they have the necessary financial security and support during their military careers and beyond.

What You'll Learn

- Military Life Insurance (MLI) Overview: A state-sponsored insurance program for military personnel and their families

- Benefits and Coverage: Provides financial protection for military members and their dependents in the event of death

- Premiums and Rates: Offers affordable rates based on military rank and service branch

- Claims Process: Details the steps for filing a claim and receiving benefits

- Policy Variations: Includes different coverage options and riders for personalized protection

Military Life Insurance (MLI) Overview: A state-sponsored insurance program for military personnel and their families

Military Life Insurance (MLI) is a comprehensive and essential benefit provided to active duty military personnel and their families. It is a state-sponsored program designed to offer financial protection and peace of mind to those who serve in the armed forces. MLI is a valuable component of the military's comprehensive benefits package, ensuring that service members and their loved ones are safeguarded against the financial impacts of death, disability, or critical illness.

The primary purpose of MLI is to provide financial security to the beneficiaries of active-duty military personnel in the event of the insured's death or disability. When a service member enlists, they automatically become eligible for this insurance, which is funded by a small deduction from their pay. This deduction is a small price to pay for the extensive coverage it provides. The insurance policy covers the insured's death, with benefits paid out to the designated beneficiaries, which can include a spouse, children, or other dependents. In the event of the insured's death, the beneficiaries receive a lump sum payment, ensuring financial stability and peace of mind during a difficult time.

One of the key advantages of MLI is its comprehensive nature. It offers more than just death coverage; it also includes benefits for permanent and total disability. If the insured becomes permanently disabled, the policy provides income replacement benefits, ensuring that the service member's income is protected. This aspect of MLI is particularly crucial as it allows service members to focus on their recovery and rehabilitation without the added stress of financial instability. Additionally, MLI may also cover critical illness, providing financial support for serious medical conditions, further enhancing the overall protection for military personnel and their families.

MLI is a valuable resource for military families, offering financial security and support during challenging times. The insurance program is designed to complement other military benefits, such as the Servicemembers' Group Life Insurance (SGLI) program, which provides additional life insurance coverage. Together, these programs ensure that military personnel and their families have access to comprehensive financial protection. The state-sponsored nature of MLI means that it is a reliable and trusted source of insurance, tailored specifically to the needs of those who serve their country.

In summary, Military Life Insurance is a vital benefit for active-duty military personnel and their families, offering financial security and peace of mind. With its comprehensive coverage, including death, disability, and critical illness benefits, MLI ensures that service members can focus on their duty with the knowledge that their loved ones are protected. This state-sponsored insurance program is a testament to the military's commitment to supporting its personnel and their families, providing a valuable safety net during their service and beyond.

VA Employees: Are They Covered by Life Insurance?

You may want to see also

Benefits and Coverage: Provides financial protection for military members and their dependents in the event of death

Military Life Insurance (MLI) is a comprehensive benefits program designed to provide financial security and peace of mind to active-duty military personnel and their families. This insurance policy is a valuable asset for those serving in the armed forces, offering a range of coverage options tailored to the unique needs of military life. The primary purpose of MLI is to ensure that military members and their dependents are financially protected in the event of the insured's death.

When it comes to benefits and coverage, MLI offers a robust financial safety net. The policy provides a death benefit, which is a lump sum payment made to the beneficiary(ies) upon the insured's passing. This benefit is a crucial financial resource for the family, helping to cover various expenses and provide for the well-being of the dependents. The amount of the death benefit is typically based on the insured's age, rank, and other factors, ensuring that the coverage is proportional to the individual's contribution to the military.

One of the key advantages of MLI is its flexibility in choosing beneficiaries. Military members can select primary and contingent beneficiaries, ensuring that the financial protection is directed to the intended recipients. This feature allows for a more personalized approach to coverage, accommodating the unique family structures and relationships within the military community. Additionally, MLI often includes a waiver of premium clause, which temporarily suspends the payment of insurance premiums if the insured becomes disabled or is unable to work due to an injury or illness.

The coverage provided by MLI extends beyond the death benefit. It may also include options for critical illness, disability, and accidental death benefits, offering a comprehensive approach to military life insurance. These additional benefits can provide financial assistance during challenging times, such as extended medical treatments or the loss of income due to injury or illness. By combining these features, MLI ensures that military members and their families are protected from a wide range of potential financial setbacks.

In summary, Military Life Insurance is a vital component of the benefits package for active-duty personnel. It offers a tailored and comprehensive approach to financial protection, ensuring that military members and their dependents are safeguarded against the financial impact of death or critical illnesses. With its customizable benefits and coverage options, MLI provides a sense of security and peace of mind, allowing military families to focus on their service and the well-being of their loved ones.

Life Insurance Bond: What You Need to Know

You may want to see also

Premiums and Rates: Offers affordable rates based on military rank and service branch

Military Life Insurance (MLI) is a unique and valuable benefit offered to active-duty service members and their families. One of its key advantages is the affordable and competitive rates it provides, tailored specifically to the military community. The premiums for MLI are structured to consider the individual's military rank and the specific service branch they belong to, ensuring a fair and personalized pricing system.

The rates are designed to be cost-effective, taking into account the risks and responsibilities associated with military service. For instance, the higher the rank, the more responsibility and potential risks, which are reflected in the insurance premiums. Similarly, different service branches may have varying levels of risk and duty, influencing the cost of coverage. This customization ensures that the insurance remains accessible and affordable for all military personnel, regardless of their position or branch.

When it comes to MLI, the focus is on providing comprehensive coverage at a reasonable cost. The insurance company takes into account the unique circumstances of military life, including deployment, training, and the potential risks associated with service. By offering affordable rates, MLI ensures that service members can secure financial protection for their loved ones without incurring significant financial burdens.

The premium structure is transparent and straightforward, allowing service members to understand the cost of their insurance. It is calculated based on the individual's age, health, and the level of coverage chosen. Additionally, the insurance company may offer various payment options, making it convenient for service members to manage their premiums effectively.

In summary, Military Life Insurance provides affordable rates that are directly linked to military rank and service branch. This tailored approach ensures that the insurance remains accessible and cost-effective for all military personnel, offering them a sense of security and peace of mind. Understanding the premium structure is essential for service members to make informed decisions about their insurance coverage.

Group Term Life Insurance: What You Need to Know

You may want to see also

Claims Process: Details the steps for filing a claim and receiving benefits

The claims process for military life insurance is a structured procedure designed to ensure that beneficiaries receive their rightful benefits promptly and efficiently. When a covered individual's death is confirmed, the designated beneficiary should initiate the claim by contacting the insurance provider or the military's designated representative. This initial step is crucial, as it triggers the benefit distribution process.

The first step in the claims process is to provide the insurance company with the necessary documentation. This includes a completed claim form, which typically requires personal and financial information about the deceased, as well as details of the policy, such as the policy number and beneficiary designation. Along with the form, you will need to submit a certified copy of the death certificate, which serves as official proof of the individual's passing. In some cases, additional documentation, such as a military discharge paper or a recent medical report, might be requested to verify the circumstances of the death.

Once the insurance provider receives the initial claim, they will review the submitted documents to ensure all information is accurate and complete. This step may involve verifying the policyholder's military status and the beneficiary's relationship to the deceased. If the claim is approved, the insurance company will initiate the benefit payment process. The payment amount will depend on the policy's terms and the beneficiary's status (e.g., spouse, child, or dependent).

Beneficiaries should be aware that the claims process may take some time, and the duration can vary depending on the complexity of the case and the insurance provider's procedures. During this period, it is essential to maintain open communication with the insurance company to address any additional questions or requirements. In some instances, the insurance provider might request further information or documentation to support the claim, especially if there are unusual circumstances surrounding the death.

After the claim is approved and all necessary documentation is provided, the insurance company will disburse the benefits according to the policy's terms. This could involve a lump-sum payment or periodic payments, depending on the policy type and the beneficiary's needs. It is advisable for beneficiaries to carefully review the policy documents to understand the specific benefits and any associated conditions or restrictions.

Employee Life Insurance: Taxable or Not?

You may want to see also

Policy Variations: Includes different coverage options and riders for personalized protection

Military life insurance offers a range of policy variations to ensure that service members and their families receive the protection they need. These variations allow individuals to customize their coverage based on their unique circumstances and preferences. Here's an overview of the policy variations and how they contribute to personalized protection:

Coverage Options:

- Basic Term Life Insurance: This is the most straightforward option, providing a fixed amount of coverage for a specified term, typically 10, 20, or 30 years. It offers a simple and cost-effective way to secure financial protection for a defined period.

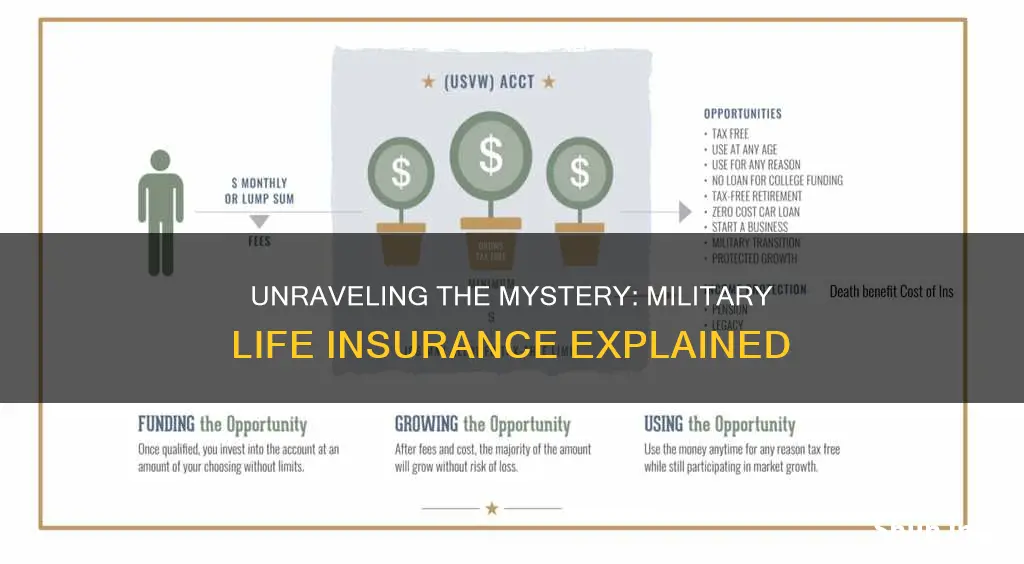

- Permanent Life Insurance: Unlike term life, permanent insurance provides coverage for the entire lifetime of the insured individual. It offers a combination of death benefit and a cash value component, allowing policyholders to build savings over time. This option is ideal for those seeking long-term financial security.

- Whole Life Insurance: A type of permanent life insurance, whole life offers level premiums and guaranteed death benefits. It provides consistent coverage and builds cash value, making it a popular choice for long-term financial planning.

Riders and Add-Ons:

- Additional Riders: Military life insurance policies often include various riders that can be added to enhance coverage. For instance, the "Accidental Death Benefit" rider provides an additional payout if the insured's death is a result of an accident. Other riders might include waiver of premium, which ensures that premiums are waived if the insured becomes disabled, and a critical illness rider, offering financial assistance for serious medical conditions.

- Customizable Benefits: Some policies allow policyholders to choose the death benefit amount, providing flexibility. This customization ensures that the coverage aligns with the individual's financial goals and the needs of their beneficiaries.

By offering these policy variations, military life insurance ensures that service members can select the coverage that best suits their situation. Whether it's a short-term term life policy for active duty personnel or a permanent life insurance plan for long-term financial security, these variations cater to diverse needs. Additionally, the inclusion of riders and add-ons allows for further personalization, ensuring that the insurance policy adapts to the unique requirements of military personnel and their families. This level of customization is essential in providing comprehensive protection and peace of mind.

Life Insurance and THC: What You Need to Know

You may want to see also

Frequently asked questions

Military Life Insurance is a program designed to provide affordable term life insurance coverage to eligible members of the U.S. Armed Forces and their beneficiaries. It offers financial protection to service members and their families in the event of death, ensuring that their loved ones are financially secure during challenging times.

MLI is specifically tailored to the needs of military personnel and their families. It offers competitive rates, simplified underwriting processes, and coverage options that align with the unique circumstances of military life, including deployment and frequent relocations. The policy also provides additional benefits like waiver of premium and accelerated death benefits.

Active-duty members of the U.S. Army, Navy, Air Force, Marine Corps, and Coast Guard, as well as members of the National Guard and Reserve, are eligible to enroll in MLI. Spouses and dependent children of eligible service members can also be covered under the policy.

In the event of the insured service member's death, MLI provides a tax-free death benefit to the designated beneficiaries. This financial support can help cover funeral expenses, outstanding debts, and daily living costs, ensuring that the family's financial stability is maintained during a difficult period.