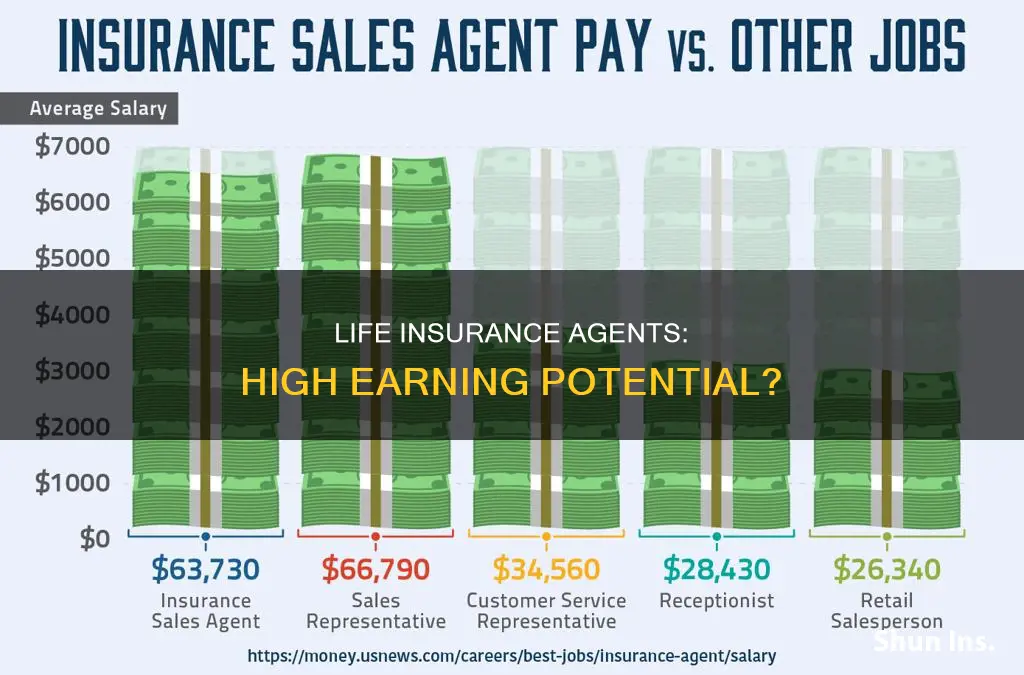

Life insurance agents are paid in a variety of ways, including salary, commission, or a combination of the two. While some sources claim that life insurance agents can make good money, others argue that it is challenging to earn a high income in this profession due to the difficulties in finding clients and the competitive nature of the industry. The average annual salary for life insurance agents in the United States ranges from $62,000 to $83,442, with the median income being $49,840 per year. However, it is important to note that income can vary widely depending on factors such as location, experience, and sales numbers.

| Characteristics | Values |

|---|---|

| Average annual salary | $62,000 to $76,000 |

| Salary range | $28,000 to $125,000 |

| Median salary | $59,000 |

| Top-paying cities | District of Columbia, New York, Massachusetts, Georgia, New Jersey |

| Commission range | 40% to 115% |

| Commission for whole life insurance | >100% |

| Commission for universal life insurance | 100% |

| Commission for term life insurance | 30% to 80% |

| Salary for entry-level insurance agent | $76,493 |

| Salary for senior insurance agent | $52,778 |

What You'll Learn

Life insurance agents are paid via commission

Life insurance agents are typically paid via commission, which can vary from 40% to 115% of the policy's first-year premiums. This means that their income is directly tied to their sales performance, and they only earn money when they make a sale. While this can provide the opportunity for high earnings, it also comes with financial instability, especially when first starting out.

The commission structure for life insurance agents can be front-loaded, with higher commissions in the first year and lower commissions for renewals in subsequent years. Some agents may even stop receiving commissions after the third year of the policy. The type of life insurance policy also impacts commission rates, with whole life insurance plans offering the highest commission rates, followed by universal life insurance, and then term life insurance plans, which offer the lowest commissions.

Life insurance agents face challenges in building a client base and often have to cold-call and door-knock to find leads. The product itself can also be difficult to sell, as people are reluctant to discuss their own mortality and the policy does not provide instant gratification. Additionally, life insurance agents may have to compete with other agents who have already contacted the same leads.

Despite the challenges, a career as a life insurance agent can offer advantages such as flexible working hours, strong earning potential for those with a good work ethic, and the opportunity to work with well-known brands. However, it is important to note that independent life insurance agents are often responsible for their own business expenses, and the demanding nature of the job, combined with the pressure to meet sales targets, can lead to burnout and high attrition rates.

Life Insurance Agent: Tennessee to California - What's Allowed?

You may want to see also

The average annual salary of life insurance agents is $62,000 to $76,000

Life insurance agents can make good money, but it is a challenging career path. The average annual salary for life insurance agents is $62,000 to $76,000, according to estimates by several employment websites. This figure can vary depending on various factors, such as location, experience, and the company one works for. For example, the average salary for an insurance agent in Dallas, TX, is $78,443 per year, while the national median income for all industries was $31,133 in 2019.

Life insurance agents are typically paid through commissions, which can range from 40% to 115% of the policy's first-year premiums. The commission structure can vary depending on the type of life insurance policy sold, with whole life insurance plans often earning agents the highest commissions. However, it is important to note that life insurance agents usually have to cover their business expenses, such as rent and advertising costs.

While the career has its challenges, there are also several benefits to being a life insurance agent. It offers flexible working hours, strong earning potential through commissions and bonuses, and the opportunity to work with prominent brands. Additionally, it can be a rewarding career as agents help individuals and families secure their financial futures through insurance, investments, and retirement planning.

However, it is important to consider the drawbacks as well. Life insurance agents often face rejection and negative public perception, and the job can be demanding due to the pressure of meeting sales targets and maintaining client relationships. The training and licensing requirements can also be rigorous and time-consuming. Furthermore, independent agents may have limited access to employee benefits, including paid time off.

Life Insurance and Trusts: What's the Deal?

You may want to see also

The pay is usually straight commission

Life insurance agents are typically paid on a commission basis, meaning their earnings are directly tied to the number of policies they sell. This pay structure can be challenging, especially for new agents who are still building their client base. It may take time and perseverance to establish a steady stream of income, and agents need to be prepared for potential financial instability during the initial stages of their career.

The commission rates vary depending on the type of life insurance policy sold. Whole life insurance plans often offer the highest commission rates, sometimes exceeding 100% of the total premiums for the first year. Universal life insurance plans typically provide commissions of at least 100% of the premiums paid in the first year, up to a certain target level. Term life insurance plans generally have the lowest commissions, ranging from 30% to 80% of the annual premiums.

While the potential for high earnings exists, there are also drawbacks to the commission-based pay structure. New agents may struggle to find clients and close sales, resulting in financial struggles during the initial stages of their career. The pressure to meet sales targets and the challenge of building a steady client base can be demanding and lead to burnout. Additionally, independent agents are often responsible for their own business expenses, such as rent, office supplies, and advertising costs, further impacting their earnings.

To succeed in this career, life insurance agents need to develop strong relationships with clients, establish a solid marketing strategy, and continuously prospect for new leads. It is important to note that life insurance is not an easy product to sell, as most people are reluctant to discuss their own mortality. Agents must also be prepared to face rejection and negative perceptions from the public, who may view them similarly to used car salespeople.

Permanent Life Insurance: Does It Expire or Not?

You may want to see also

Life insurance sales jobs are abundant and easy to find

Because most companies offer commission-based pay with no guaranteed income, they have no incentive to limit hiring. They offer jobs to anyone interested and hope that a small percentage of hires become productive agents. Most companies even reimburse the cost of obtaining your license, but only after you sell a certain amount of premiums.

Compared to most finance careers, becoming a life insurance agent is easy. No educational requirements exist beyond a high school diploma at most. Some states require you to take a licensing course and pass an exam, but these are as easy as a fifth-grade spelling test.

Jobs selling life insurance are everywhere. The online job search sites are full of them. If your resume is posted on a site such as LinkedIn, you may even be contacted by firms looking to swell their agent ranks.

Haven Life Insurance: Your Ultimate Financial Safety Net

You may want to see also

Life insurance agents can make a good living

Life insurance agents are typically paid through commissions, which can range from 40% to 115% of the policy's first-year premiums. While the commission rate varies depending on the type of life insurance policy sold, agents can continue to receive commissions on renewed policies, providing a source of passive income.

In addition to the potential for high earnings, life insurance agents also benefit from flexible working conditions and the opportunity to work with well-known companies. The job offers minimal entry barriers, as most employers provide training programs and only require a high school diploma or equivalent.

However, it is important to note that life insurance sales can be challenging. Agents often face rejection and may struggle to establish a steady client base. The product itself can be difficult to sell, as people are reluctant to discuss their own mortality.

Overall, while life insurance agents can make a good living, success in this career requires perseverance, strong people skills, and the ability to build solid relationships with clients.

Umbrella Insurance: Does It Cover Your Life?

You may want to see also

Frequently asked questions

The average annual salary for a life insurance agent in the US ranges from $62,000 to $83,442.

The amount of money a life insurance agent can expect to earn depends on several factors, including the state in which they sell insurance, the type of insurance they sell, their sales numbers, and their years of experience.

Some benefits of being a life insurance agent include flexible working hours, the potential for high earnings through commissions and bonuses, and the opportunity to work with well-known companies.

Life insurance agents often face negative perceptions and pressure to sell high-commission policies. The job typically involves working on commission, which can lead to financial instability, especially when starting out.