Permanent life insurance is a type of insurance policy that offers lifelong coverage, as opposed to term life insurance, which is valid for a specific period. Permanent life insurance policies are designed to last indefinitely or until the policyholder's death, provided that the premiums are paid. This type of insurance combines a death benefit with a savings component, allowing policyholders to build cash value over time. While permanent life insurance is more expensive than term life insurance, it provides the advantage of lifelong coverage and the opportunity to accumulate savings with tax benefits.

| Characteristics | Values |

|---|---|

| Expiry | Permanent life insurance policies never expire, unlike term life insurance policies. |

| Coverage | Permanent life insurance provides coverage for the full lifetime of the insured person. |

| Cost | Permanent life insurance is more expensive than term life insurance. |

| Death benefit | Permanent life insurance combines a death benefit with a savings component. |

| Types | The two primary types of permanent life insurance are whole life and universal life. |

| Tax treatment | Permanent life insurance policies enjoy favorable tax treatment. Cash value generally grows on a tax-deferred basis. |

What You'll Learn

- Permanent life insurance is more expensive than term life insurance

- Whole life insurance is a type of permanent life insurance

- Universal life insurance is another type of permanent life insurance

- Permanent life insurance policies have a cash value component

- Permanent life insurance policies have favourable tax treatment

Permanent life insurance is more expensive than term life insurance

Term life insurance is typically more affordable because it is temporary and does not build cash value. Permanent life insurance premiums are higher because the coverage usually lasts the policyholder's lifetime and the policy grows in cash value over time. This cash value component is a significant advantage of permanent life insurance policies. It allows policyholders to access and use the funds while they are still alive. The cash value grows over time and can be used as collateral for loans or withdrawn.

Whole life insurance, a common type of permanent life insurance, offers fixed premiums and a guaranteed death benefit. The premiums are locked in at the time of purchase and are guaranteed not to increase. While whole life coverage may be more expensive than term life initially, it may be a better value in the long run as it never needs to be renewed, and rates will not be adjusted as the policyholder gets older.

Universal life insurance is another type of permanent life insurance that offers more flexibility. Policyholders can adjust or skip premium payments and change their death benefit amount. Variable life insurance and indexed universal life insurance are riskier options that allow policyholders to invest their cash value in specific investments or a chosen stock market index. These policies can result in higher returns but may also lead to unexpected expenses.

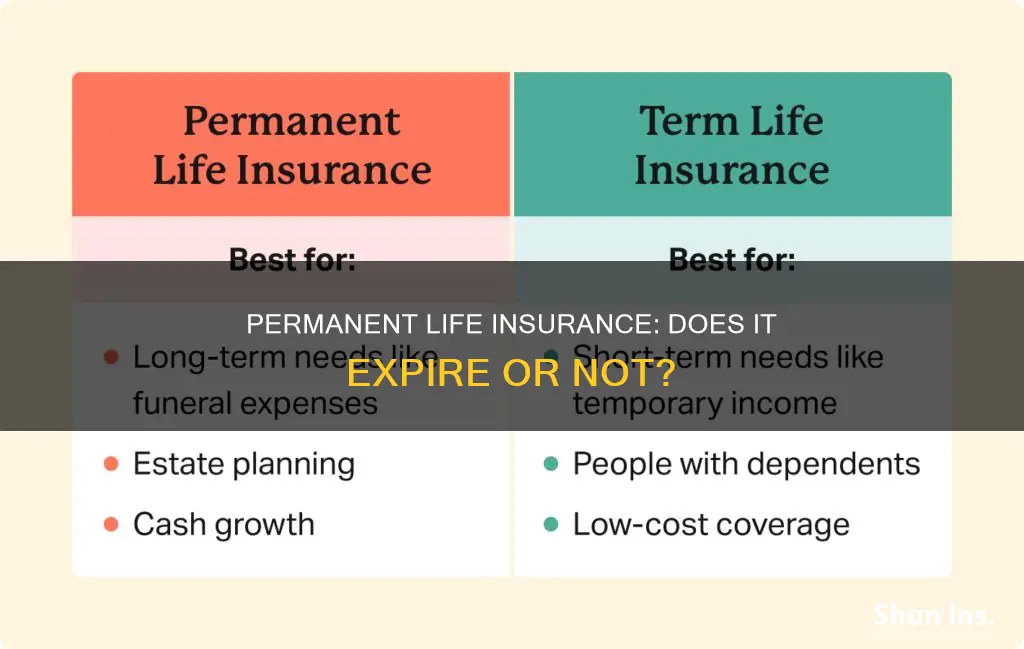

When deciding between term and permanent life insurance, it is essential to consider your long-term financial goals, budget, and desired coverage length. Term life insurance is ideal for those seeking affordable premiums and coverage for a specific period. Permanent life insurance is best for those who want lifetime coverage, access to cash value, and can afford the higher premiums.

Discover Card: Life Insurance Benefits and Coverage

You may want to see also

Whole life insurance is a type of permanent life insurance

Permanent life insurance provides coverage for the full lifetime of the insured person. It never expires, unlike term life insurance, which only lasts for a specific amount of time. Permanent life insurance is more expensive than term life insurance, but it combines a death benefit with a savings component that earns interest on a tax-deferred basis.

Whole life insurance is a common type of permanent life insurance. It provides lifelong coverage as long as you pay your premiums. No matter when you die, your beneficiary will receive the death benefit payout. Whole life insurance also has a cash value savings component that builds in value over time, which you can use to pay your premiums or borrow against in the form of a life insurance loan. However, if you withdraw or borrow against your policy's cash value without repaying it, you will reduce the cash value and death benefit of your policy.

Whole life insurance policies are typically more expensive than term life insurance policies, with higher premiums. This is because whole life insurance offers lifelong coverage and includes a cash value component. The cash value of whole life insurance grows at a guaranteed rate, whereas the earnings of universal life insurance, another type of permanent life insurance, are based on market interest rates.

Whole life insurance policies are distinguished as participating and non-participating plans. With a non-participating policy, any excess of premiums over payouts becomes profit for the insurer. With a participating policy, any excess of premiums is redistributed to the insured as a dividend, which can be used to make payments or increase policy coverage limits.

Whole life insurance offers several advantages, including lifetime coverage, a cash value component that can be used for loans or withdrawals, a guaranteed death benefit amount, and predictable premium payments. However, there are also some disadvantages to consider. Whole life insurance is more expensive than term life insurance, and the cash value may grow slower than with other policies. Additionally, whole life policies do not offer flexibility to adjust the premium or death benefit.

Life Insurance: Passing Outside of the Estate?

You may want to see also

Universal life insurance is another type of permanent life insurance

Universal life insurance policies have the potential to accumulate cash value, but this can fluctuate over time based on how you fund the policy and other factors. The cash value earns an interest rate set by the insurer, and it can change frequently, although there is usually a minimum rate that the policy can earn. If the investments underperform, your cash value can go down and your premiums could eventually go up.

The two types of universal life insurance are indexed and variable. Indexed universal life insurance has the same basic parts as a permanent life insurance policy, but the cash value grows based on a chosen stock market index. If the chosen index is performing well, the account will grow. If not, some companies allow it to grow at a minimum rate. Variable universal life insurance has flexible premiums and a savings component, but more factors influence how the savings can grow. The savings portion, or cash value, grows based on the investment methods that you choose. There is usually a minimum and maximum growth rate allowed in this type of permanent life insurance policy. More variables lead to more risk but can also lead to more reward.

Universal life insurance is more flexible than whole life insurance, but it requires more oversight. You can adjust your policy and even your premiums (within limits) as your life changes. Without adequate funding, your policy could potentially end since the death benefit is not guaranteed. However, universal life often gives you the most long-term protection for your money.

PCOS and Life Insurance: What You Need to Know

You may want to see also

Permanent life insurance policies have a cash value component

Permanent life insurance policies, such as whole life and universal life insurance, have a cash value component that accumulates over time. This means that a portion of the premium payments made by the policyholder is deposited into an interest-bearing savings account, allowing the cash value to grow tax-free over their lifetime. The cash value can be used for various purposes, such as borrowing against it or withdrawing cash from it. It can also be used to pay policy premiums or create an investment portfolio.

The cash value component of permanent life insurance offers several benefits. It can be utilised as a savings option, providing a mechanism for policyholders to accumulate funds for future use. Additionally, it allows policyholders to borrow against the accumulated cash value, which can be useful for those seeking to build a nest egg over several decades. The cash value can also be used to pay premiums, providing some relief if the policyholder is struggling to make payments.

However, it is important to note that the cash value component of permanent life insurance policies typically has higher premiums than term life insurance policies. This is because a portion of each premium payment is allocated to the cost of insurance, while the remainder is deposited into the cash value account. As a result, permanent life insurance is generally more expensive than term life insurance.

When considering permanent life insurance with a cash value component, it is crucial to understand the different types of policies available, such as whole life, universal life, and variable life insurance. Each type of policy carries a different level of risk and accumulates cash value in distinct ways. For example, whole life policies offer guaranteed fixed cash value accounts, while variable life policies depend on the performance of an asset, potentially resulting in greater cash value over time but with higher risk.

In summary, permanent life insurance policies with a cash value component offer both insurance protection and a financial asset. While it provides benefits such as lifelong coverage and the ability to build cash value, it is important to carefully consider the higher costs associated with these policies.

Life Insurance and Suicide: UK Payout Scenarios

You may want to see also

Permanent life insurance policies have favourable tax treatment

Death Benefit Paid Out Income Tax-Free

The death benefit from permanent life insurance is generally paid out to beneficiaries income tax-free. This is a significant advantage as life insurance policy payouts can be substantial, and avoiding a tax bill can make a big difference to your loved ones. In contrast, the government typically taxes retirement plan proceeds when received by beneficiaries. While estate taxes may apply to life insurance payouts in certain circumstances, the exemption is over $13 million for the 2024 tax year, so it's unlikely to be an issue for most people.

Tax-Deferred Accumulation of Cash Value

Permanent life insurance policies accumulate cash value over time as you pay premiums. This cash value grows tax-deferred, meaning it accumulates without the IRS taxing it. In the case of whole life insurance, the cash value grows at a rate guaranteed by the carrier and is unaffected by market conditions. Other permanent insurance policies offer different investment options, allowing you to choose how your cash value grows. This tax-deferred accumulation can become a valuable nest egg for your future financial planning.

Tax-Advantaged Access to Cash Value

You can access the cash value of your permanent life insurance policy on a tax-advantaged basis. Money borrowed or withdrawn from the cash value, up to the amount you've paid in premiums ("cost basis"), is generally not subject to income taxes. However, accessing the cash value reduces the death benefit and increases the chance of policy lapse, so careful consideration is necessary. Additionally, if a policy lapses with an outstanding loan that exceeds the cost basis, it becomes taxable.

Tax-Free Withdrawals Within Specified Limits

Within certain limits, you can make withdrawals from the cash value of your permanent life insurance policy tax-free, as long as the policy is current. However, if you withdraw more than your premium payments, you will owe income taxes on the gains above your premium payments.

Tax-Free Loans Against Policy Value

You can also borrow against the value of your permanent life insurance policy without incurring income taxes, even if the loan amount exceeds your premium payments. This feature can help you manage your tax bracket in retirement and prevent taxes on Social Security income. However, the insurer will charge interest on the loan, and if the loan plus interest exceeds the policy's cash value, additional payments will be needed to keep the policy active.

No Sales Tax on Premiums

Unlike many other purchases, you typically don't pay sales tax on life insurance premiums. While states may charge insurers a tax on the premiums collected, which may be passed on to consumers, it's not a direct sales tax on the premium amount.

These tax benefits make permanent life insurance an attractive option for individuals looking to provide financial protection for their loved ones while also enjoying the advantages of tax-favourable investment growth.

Life Insurance and Cirrhosis: What Coverage is Offered?

You may want to see also

Frequently asked questions

No, permanent life insurance does not expire as long as premiums are paid. It provides coverage for the full lifetime of the insured person.

Term life insurance covers the insured for a specific period, typically 10 to 30 years. It is more affordable but does not build cash value. Permanent life insurance, on the other hand, is designed to offer lifelong protection and includes a savings component that grows over time.

The two primary types of permanent life insurance are whole life and universal life. Whole life insurance has fixed premiums and the cash value grows at a guaranteed rate. Universal life insurance offers flexible premiums and the cash value is based on market interest rates or a chosen stock market index.

Permanent life insurance offers lifelong coverage, a savings component that can be used for loans or withdrawals, and favourable tax treatment. It is ideal for those who want ongoing coverage and desire a policy that can also serve as an investment vehicle.

Permanent life insurance has much higher premiums compared to term life insurance. There is a risk of not being able to keep up with the payments, and withdrawing the policy's cash value reduces the death benefit.