Taxes are an essential aspect of receiving life insurance proceeds, and understanding why they are withheld is crucial for policyholders. When a life insurance policy is in effect, the proceeds are often subject to taxation, which can be a significant consideration for beneficiaries. The withholding of taxes from life insurance payments is a standard practice to ensure that the government receives its fair share, and it is important to know the reasons behind this process to navigate the financial implications effectively. This paragraph aims to shed light on the reasons behind tax withholding, providing valuable insights for those seeking to understand the financial intricacies of life insurance.

What You'll Learn

- Taxable Income: Life insurance proceeds are considered taxable income, subject to federal and state taxes

- Withholding Rules: Employers and financial institutions are required to withhold taxes from these payments

- Estate Tax: Proceeds may be subject to estate tax, impacting beneficiaries and the distribution of funds

- State Variations: Tax laws vary by state, affecting the amount withheld and the timing of payments

- Tax Deductions: Certain expenses related to the policy may be deductible, reducing the taxable amount

Taxable Income: Life insurance proceeds are considered taxable income, subject to federal and state taxes

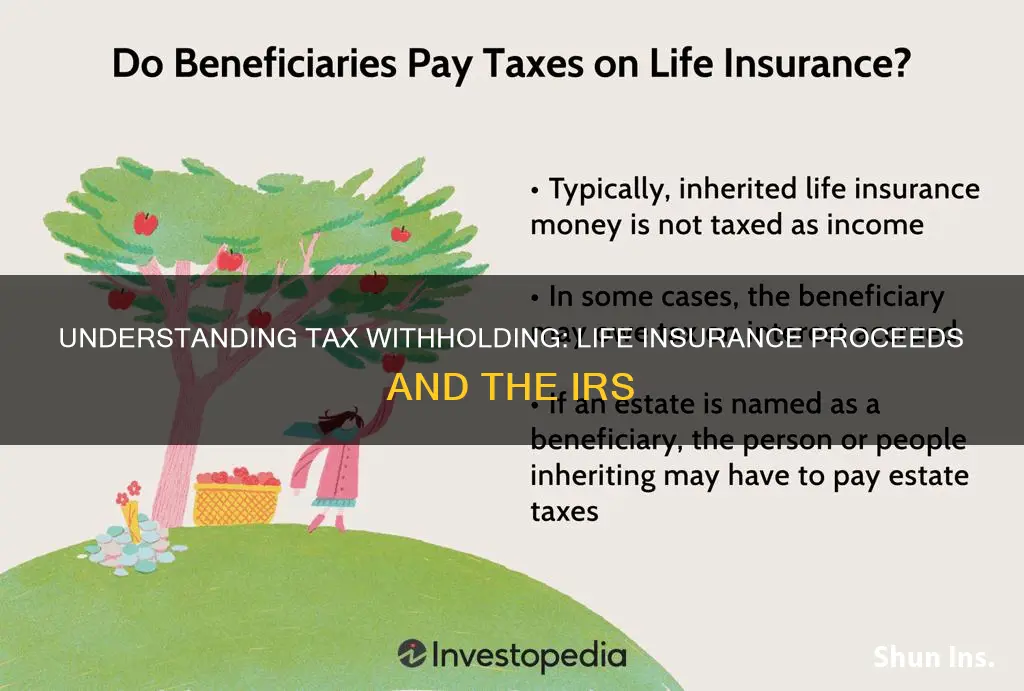

Life insurance proceeds can be a significant financial benefit for beneficiaries, but it's important to understand that these payments may be subject to taxation. When a life insurance policy is in force, the proceeds paid out upon the insured individual's death are often considered taxable income by the federal and state governments. This is a crucial aspect of financial planning that beneficiaries should be aware of to avoid any unexpected tax liabilities.

The tax treatment of life insurance benefits varies depending on the jurisdiction and the specific circumstances of the policy. In many countries, including the United States, life insurance payments are generally included in the recipient's taxable income for the year in which they are received. This means that the beneficiary will have to report these proceeds as income on their tax return, which can impact their overall tax liability. The amount of tax owed will depend on the individual's tax bracket and the total value of the policy's payout.

The tax laws surrounding life insurance are designed to ensure that insurance benefits are taxed at the appropriate rate, similar to other forms of income. For instance, in the United States, the Internal Revenue Service (IRS) considers life insurance proceeds as taxable income, and the tax is typically withheld at the source. This withholding ensures that the beneficiary receives a net payment after taxes, and it also helps to streamline the process for both the insurance company and the beneficiary.

It is essential for beneficiaries to be aware of these tax implications to plan their finances accordingly. When receiving a large sum of money from a life insurance policy, beneficiaries should consider consulting a tax professional or financial advisor to understand their specific tax obligations. They can provide guidance on how to manage the tax liability, potentially through strategic tax planning or by exploring available deductions and credits.

In summary, life insurance proceeds are taxable income, and beneficiaries should be prepared for potential tax obligations when receiving these payments. Understanding the tax laws and seeking professional advice can help individuals navigate this financial aspect of life insurance effectively. Being proactive in managing tax liabilities can ensure a smoother financial transition for beneficiaries and help them make the most of their life insurance benefits.

Who Collects Airforce Life Insurance: Daughter or Son?

You may want to see also

Withholding Rules: Employers and financial institutions are required to withhold taxes from these payments

When an individual receives a life insurance payout, it is often a significant financial windfall, and the tax authorities want to ensure that their fair share is paid. This is where the concept of withholding comes into play. Withholding taxes from life insurance proceeds is a legal requirement for employers and financial institutions to ensure compliance with tax laws. This process is an essential part of the financial system, designed to prevent tax evasion and ensure that the government receives its due.

Employers, including insurance companies, are responsible for withholding taxes on various payments, including life insurance benefits. When an employee or policyholder passes away, the employer must calculate the tax liability on the death benefit or proceeds. This is typically done by applying the appropriate tax rates and deductions based on the recipient's tax status. For instance, if the beneficiary is a spouse, the tax rate might be different compared to a charitable organization. The employer then deducts the calculated tax amount from the life insurance payout before releasing the remaining amount to the recipient.

Financial institutions, such as banks and investment firms, also play a crucial role in this process. When a financial institution receives a life insurance payment, they are required to withhold taxes on behalf of the payee. This is especially relevant in cases where the policyholder had a financial account with the institution. The institution must follow the same withholding rules as employers, ensuring that the correct tax amount is deducted and remitted to the tax authorities. This practice helps in maintaining transparency and preventing potential tax fraud.

The withholding rules for life insurance proceeds are designed to be comprehensive and adaptable to various scenarios. For instance, if the life insurance policy has a complex structure with multiple beneficiaries or payment options, the withholding process becomes more intricate. In such cases, financial institutions and employers must carefully consider the tax implications and ensure accurate calculations. It is essential to stay updated with the latest tax regulations to comply with the law and avoid any penalties.

In summary, withholding taxes from life insurance proceeds is a critical process to ensure tax compliance and prevent financial misconduct. Employers and financial institutions have a legal obligation to follow these rules, providing a safety net for the tax authorities and maintaining the integrity of the financial system. Understanding these withholding requirements is vital for all parties involved, ensuring a smooth and efficient process when dealing with life insurance payouts.

When Did My Life Insurance Coverage Begin?

You may want to see also

Estate Tax: Proceeds may be subject to estate tax, impacting beneficiaries and the distribution of funds

Life insurance proceeds can be a crucial source of financial support for beneficiaries, but it's important to understand that these payments may be subject to certain taxes, including estate tax. This tax is levied on the assets of a deceased individual and can significantly impact the distribution of funds to beneficiaries. When a life insurance policy is owned by the insured person, the proceeds can be considered part of their estate, potentially triggering estate tax obligations.

Estate tax is a complex area of taxation, and its application to life insurance proceeds can vary depending on the jurisdiction and the specific circumstances. In many countries, the tax is calculated based on the value of the entire estate, including any life insurance payouts. The tax rate can be substantial, often ranging from 10% to 40% or more, depending on the estate's value and the applicable tax laws. For example, in the United States, the federal estate tax exemption for the year 2023 is $12.06 million per individual, meaning that only estates valued at $12.06 million or more are subject to federal estate tax. However, some states have their own estate tax laws, which may apply even if the federal exemption is met.

When a life insurance policy is owned by the insured, the proceeds are typically paid out to the designated beneficiaries. However, if the policy is owned by an entity, such as a trust or a corporation, the proceeds may be subject to estate tax. In such cases, the entity itself is considered the owner, and the tax is imposed on the assets held within that entity. This can include not only the life insurance proceeds but also other assets held within the trust or corporation.

The impact of estate tax on life insurance proceeds can be significant. It may result in a reduction of the overall payout to beneficiaries, as a portion of the proceeds is withheld for tax purposes. This can affect the financial security and distribution plans of the beneficiaries. In some cases, beneficiaries may need to adjust their financial strategies or seek alternative sources of income to compensate for the tax impact. Proper estate planning, including the use of appropriate insurance policies and trust structures, can help mitigate these tax effects and ensure a more efficient distribution of assets.

Understanding the estate tax implications of life insurance proceeds is essential for both insured individuals and their beneficiaries. It is advisable to consult with tax professionals and estate planners who can provide tailored advice based on the specific circumstances. They can help navigate the complexities of estate tax laws and ensure that life insurance policies are structured in a way that minimizes tax burdens while providing the intended financial security.

Choosing Life Insurance: Selecting the Right Cover for You

You may want to see also

State Variations: Tax laws vary by state, affecting the amount withheld and the timing of payments

Tax withholding on life insurance proceeds can vary significantly depending on the state where the policyholder resides and the insurance company's location. Each state has its own tax laws and regulations, which can lead to different withholding requirements. For instance, some states may impose taxes on the entire amount of the life insurance payout, while others might only tax a portion of it. This variation in state laws can result in a complex and sometimes confusing process for both the insurance company and the beneficiary.

In some states, the insurance company is responsible for withholding taxes from the policy's death benefit and remitting these funds to the state's tax authority. This is often done to ensure compliance with state tax laws and to avoid potential penalties for the policyholder or the insurance provider. The amount withheld can vary based on the state's tax rates and the specific circumstances of the policy. For example, a state with a higher tax rate might withhold a larger percentage of the proceeds to cover the potential tax liability.

The timing of tax payments also differs across states. Some states require immediate withholding and payment of taxes upon the occurrence of a qualifying event, such as the death of the insured individual. In contrast, other states may allow for a more flexible approach, where taxes are withheld and paid at a later date, often during the regular tax filing process. This flexibility can provide policyholders with more control over their financial affairs, especially in the event of a large insurance payout.

Understanding these state variations is crucial for both insurance companies and policyholders. Insurance providers must navigate the complex web of state tax laws to ensure accurate withholding and payment, which can impact their operational efficiency. Policyholders, on the other hand, need to be aware of the potential tax implications to make informed decisions regarding their insurance policies and financial planning. It is essential to consult with tax professionals or insurance experts who can provide guidance tailored to the specific state where the policyholder resides.

Additionally, the impact of state variations extends beyond the immediate tax withholding. It can influence the overall cost of the insurance policy, as insurance companies may factor in the potential tax liabilities when setting premiums. Therefore, individuals should carefully consider the tax implications in their state when choosing a life insurance policy, as this can significantly affect the long-term financial outcomes for their beneficiaries.

HIV and Life Insurance: What Are Your Options?

You may want to see also

Tax Deductions: Certain expenses related to the policy may be deductible, reducing the taxable amount

When it comes to life insurance, understanding the tax implications is crucial, especially regarding the withholding of taxes from the proceeds. While the primary purpose of life insurance is to provide financial security to beneficiaries, the tax authorities also have their eye on these benefits. Taxes are withheld from life insurance proceeds to ensure that the government receives its fair share of the payout, which can be a significant amount, especially for large policies. This process is a standard procedure and is often a relief to policyholders, as it prevents them from having to pay taxes on the entire sum at once, which could be a substantial financial burden.

The withholding of taxes from life insurance is a strategic move by the tax authorities. It allows them to collect taxes gradually, ensuring a steady income stream. This approach is particularly important for high-value policies, where the tax liability could be substantial. By withholding taxes, the government can manage cash flow and ensure that the tax system remains fair and efficient. It also provides an opportunity for policyholders to plan their finances effectively, allowing them to consider the tax implications when structuring their life insurance policies.

Now, let's delve into the aspect of tax deductions, which can further reduce the taxable amount of life insurance proceeds. Certain expenses related to the policy itself may be deductible, providing a financial benefit to the policyholder. These deductions can include premiums paid, administrative fees, and even some investment-related costs associated with the policy. For instance, if a policyholder invests a portion of their premium payments into a tax-deferred account, they may be able to deduct the contributions, thus reducing their taxable income. This strategy can be particularly advantageous for those in higher tax brackets, as it allows them to maximize their tax benefits.

To claim these deductions, policyholders must maintain detailed records of their expenses and ensure they meet the specific criteria set by the tax authorities. This may include keeping receipts, bank statements, and any other relevant documentation. It is essential to stay organized and keep track of all policy-related expenses to ensure compliance with tax regulations. By doing so, individuals can take advantage of these deductions, which can significantly reduce the overall tax burden on life insurance proceeds.

In summary, understanding the tax implications of life insurance is vital for policyholders. While taxes are withheld from the proceeds, certain expenses related to the policy may be deductible, providing a valuable opportunity to reduce taxable amounts. By staying informed and organized, individuals can navigate the tax system effectively, ensuring they receive the financial benefits of their life insurance policies while also fulfilling their tax obligations. This knowledge empowers policyholders to make informed decisions and potentially save on taxes in the long run.

Term Life Insurance: Outliving and Navigating the Next Steps

You may want to see also

Frequently asked questions

Taxes are withheld from life insurance payouts because the proceeds are considered taxable income. When a life insurance policy pays out a death benefit, the amount received by the beneficiary is subject to income tax unless certain conditions are met. The tax is applied to ensure that the insurance company's profits and the value of the policy are appropriately taxed, and it also helps to fund government services and infrastructure.

The amount of tax withheld can vary depending on the jurisdiction and the specific circumstances of the policyholder and beneficiary. In many countries, a flat percentage of the payout is deducted as tax. For example, in the United States, a standard 10% tax is applied to the first $1 million of life insurance proceeds, and the rate can vary for amounts above this threshold.

Yes, there are strategies to minimize or avoid tax withholding on life insurance proceeds. One common method is to designate the policy as an "irrevocable trust" or to name multiple beneficiaries, allowing for the distribution of the payout in a tax-efficient manner. Additionally, some policies offer options to take a lump-sum payment or periodic payments, and choosing the latter can help spread the tax liability over time. Consulting a tax professional is advisable to understand the specific rules and options available in your region.