Farm Bureau Life Insurance is a regional life insurance provider with excellent financial ratings. It has a low complaint index for a company of its size and has been in the insurance business for nearly a century. However, its policy offerings are limited and available only to residents of certain states. Its customer service options are also limited to phone support, with no virtual assistance available outside business hours. Farm Bureau offers term, whole, and universal life insurance, as well as fixed and variable annuity insurance. Its whole life insurance policies allow policyholders to borrow against or withdraw from their policies. The company has an A rating from AM Best, indicating excellent financial strength.

| Characteristics | Values |

|---|---|

| Types of Insurance Offered | Term life, whole life, universal life, auto, home, farm and ranch, business, long-term care, disability income, and more |

| Customer Service | Phone, email, snail mail, social media presence |

| Pros | Wide range of insurance options, high ratings, strong financial stability, 24/7 claims reporting, several discounts available, seamless integration of multiple policies, automatic payments, clear communication, good customer service |

| Cons | No online claims reporting, mixed customer feedback, limited customer service support, higher average home rates, lack of empathy and professionalism, unresponsive agents, higher premiums |

What You'll Learn

- Farm Bureau Life Insurance offers competitive rates and superior customer service

- It has an Excellent rating from A.M. Best and an A+ rating from Better Business Bureau

- Farm Bureau offers a wide range of insurance options for individuals and businesses

- The company has nearly a century's worth of experience in the insurance industry

- Farm Bureau has a low complaint index from the National Association of Insurance Commissioners

Farm Bureau Life Insurance offers competitive rates and superior customer service

Farm Bureau Life Insurance is a competitive insurance provider with a range of products and superior customer service. With nearly a century's worth of experience in the industry, Farm Bureau offers a wide range of coverage options, including life insurance, and has excellent financial stability with an "A" rating from A.M. Best.

Competitive Rates and Superior Customer Service

Farm Bureau Life Insurance provides competitive rates to its customers, as evidenced by reviews highlighting reasonable prices and great service. One customer review mentions that they "have not found a better deal or rate" after being with the company for 15 years. The company's financial strength and stability are also reflected in its "A" rating from A.M. Best, indicating its ability to meet ongoing insurance obligations.

Range of Coverage Options

Farm Bureau offers a variety of life insurance policies, including term life, whole life, and universal life insurance. These policies cater to different needs, with term life providing coverage for a set period, whole life offering lifelong coverage, and universal life providing permanent coverage with a cash value component. Additionally, Farm Bureau provides multiple discounts, such as for nonsmokers and healthy living, across all three types of plans.

Superior Customer Service

Farm Bureau Life Insurance excels in customer service, with reviews highlighting the company's friendly and knowledgeable staff. Customers appreciate the convenience of having multiple policies with Farm Bureau, such as life, auto, and home insurance, and the ease of automatic payments. The company also provides 24/7 claims reporting over the phone and has multiple customer service hotlines available, ensuring that customers can always reach out for support.

Regional Availability

It is important to note that Farm Bureau Life Insurance is a regional provider, currently serving residents in 14 states in the Midwest, including Arizona, Iowa, Idaho, Kansas, Minnesota, Montana, and Wyoming. This limited availability may be a factor for potential customers outside these regions.

In conclusion, Farm Bureau Life Insurance offers competitive rates, a diverse range of coverage options, and superior customer service. With its strong financial stability and regional presence, Farm Bureau is a trusted choice for individuals and families seeking comprehensive life insurance protection.

Marijuana Use and Life Insurance: What's the Impact?

You may want to see also

It has an Excellent rating from A.M. Best and an A+ rating from Better Business Bureau

Farm Bureau Financial Services has received high ratings from A.M. Best and the Better Business Bureau (BBB), indicating strong financial stability and excellent customer service. With an "Excellent" (A) rating from A.M. Best, Farm Bureau Life Insurance demonstrates excellent capitalization, consistently favourable operating earnings, profitability, and a relatively low-risk product offering. This rating is a testament to their financial strength and ability to meet insurance obligations.

The Better Business Bureau (BBB) has also recognised Farm Bureau Financial Services with an "A+" rating, reflecting the company's commitment to providing exceptional service and maintaining positive relationships with its customers. These ratings from trusted sources reinforce Farm Bureau's reputation as a reliable and stable insurance provider, giving customers confidence in their ability to deliver on their promises.

Walgreens and Tricare: Understanding Your Insurance Coverage

You may want to see also

Farm Bureau offers a wide range of insurance options for individuals and businesses

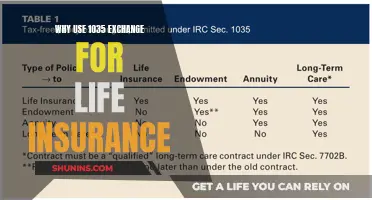

For individuals, Farm Bureau's life insurance options include term life, whole life, and universal life policies. Term life insurance provides coverage for a set period, usually between 10 and 30 years, and is one of the most affordable options on the market. Whole life insurance offers lifelong coverage as long as the policyholder makes fixed premium payments, and it also builds cash value that can be borrowed against or withdrawn. Universal life insurance is also permanent coverage with a cash value component, but it offers more flexibility in how the cash value can be allocated and has the potential to grow more quickly than traditional universal life policies.

Farm Bureau also provides insurance for businesses, including commercial auto insurance, professional liability insurance, small business insurance, business umbrella insurance, workers' compensation insurance, and commercial property insurance. Their business insurance options also include specialised coverage such as builders risk insurance, cyber liability insurance, and employment practices liability insurance.

In addition to their range of insurance products, Farm Bureau offers various discounts and perks to their members. These include discounts on farm equipment, travel savings, and the ability to bundle home and auto insurance for additional savings. Farm Bureau members also have access to exclusive benefits such as discounts on hotels, pharmacies, rental cars, and theme parks. They can also participate in various programs, such as competitive events for young farmers and ranchers, and advocacy initiatives.

Overall, Farm Bureau's extensive range of insurance options, combined with their member benefits and discounts, makes them a competitive choice for individuals and businesses seeking comprehensive and tailored insurance solutions.

Driving Records: Insurance Rates and Your History

You may want to see also

The company has nearly a century's worth of experience in the insurance industry

Farm Bureau Financial Services has been in the insurance industry for almost a century. The company was founded in 1931, initially providing liability coverage for farmers. Over the years, it has expanded its services and now offers a wide range of insurance options for individuals and businesses.

Farm Bureau has a strong reputation in the industry, with high ratings from A.M. Best and the Better Business Bureau (BBB). A.M. Best, a leading global credit rating agency, gives Farm Bureau an "A" rating, indicating its excellent ability to meet insurance obligations. This rating assures customers of Farm Bureau's financial stability and security. The BBB also gives the company an "A+" rating, reflecting its commitment to ethical business practices.

Farm Bureau's extensive experience in the industry has allowed it to develop a diverse range of insurance products. They offer various types of insurance, including motorcycle, recreational vehicle, farm vehicle, homeowners, mobile home, residential equipment, life, farm and ranch, long-term care, and disability income insurance. They also provide commercial business insurance and specialised coverage for home-based businesses.

The company's long history and diverse offerings demonstrate its adaptability and commitment to meeting the evolving needs of its customers. With a strong financial foundation and a wide range of insurance options, Farm Bureau is well-positioned to provide comprehensive protection for individuals, families, and businesses.

In addition to its insurance products, Farm Bureau also offers financial planning services, including investment, college, retirement, and estate planning. This comprehensive approach to financial services further highlights the company's experience and expertise in the industry.

Life Insurance and Arthritis: What You Need to Know

You may want to see also

Farm Bureau has a low complaint index from the National Association of Insurance Commissioners

The National Association of Insurance Commissioners (NAIC) is an organisation that tracks complaints made against insurance companies. The NAIC calculates a complaint index for each company, with a baseline of 1.00. An index above 1.00 indicates more complaints than expected, while an index below 1.00 indicates fewer complaints than expected. Farm Bureau Life Insurance has a very low NAIC complaint index of 0.17, which means it receives far fewer complaints than expected for a company of its size. This suggests that customers are highly satisfied with the company's products and services.

The low complaint index is a testament to Farm Bureau's commitment to providing superior customer service, as stated in its mission. The company's customers have praised its agents for their exceptional service, responsiveness, and effective communication. Additionally, Farm Bureau offers a wide range of insurance options, including life insurance, and has received high financial strength ratings from AM Best, indicating its ability to meet ongoing insurance obligations.

While Farm Bureau has received some negative reviews, particularly regarding its life insurance claims process and customer service in this domain, the vast majority of its customers express satisfaction with the company's offerings. The positive reviews highlight the convenience of having multiple policies bundled together, the ease of automatic payments, and the clarity of communication regarding policy options and coverage.

Overall, Farm Bureau's low NAIC complaint index and positive customer feedback reflect its competitiveness and strong standing in the insurance industry.

COPD and Life Insurance: What's the Deal?

You may want to see also

Frequently asked questions

Some pros of Farm Bureau life insurance are that most bureaus offer a wide variety of policy types, Farm Bureau membership may come with additional perks and deals, and home and auto insurance are also available from most bureaus, simplifying policy management. On the other hand, some cons are that service and digital tools may vary depending on the bureau, medical exams may be required, and guaranteed whole life insurance is not available in Montana.

Customer reviews of Farm Bureau life insurance are mixed. Some customers appreciate the seamless integration of multiple policies and the convenience of automatic payments, highlighting clear communication and understandable answers regarding policy options and coverage. However, there are also negative reviews, particularly in the life insurance domain, where beneficiaries describe the claims process as stressful and customer service as lacking in empathy and professionalism.

Farm Bureau offers term life insurance, whole life insurance, and indexed universal life insurance. Term life insurance is one of the most affordable types of life insurance and provides coverage for a set amount of time. Whole life insurance provides coverage for the rest of your life as long as you make fixed premium payments. Indexed universal life insurance offers permanent coverage and a cash value component that can be allocated to an equity-indexed account.

You can file a claim with Farm Bureau by contacting your local agent, calling their toll-free hotlines, filing online (available for some branches), or using their mobile app (available for some branches).