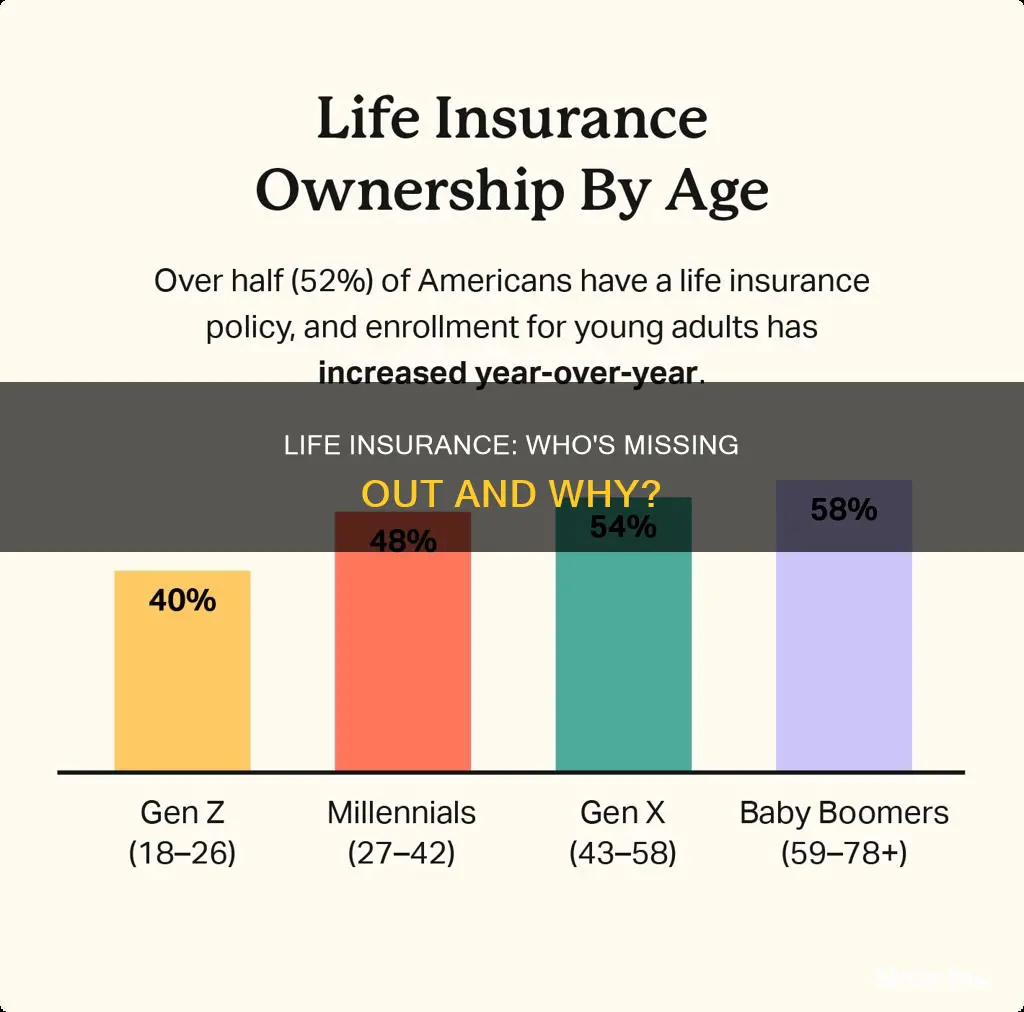

Life insurance is a financial product that isn't for everyone. While it can provide peace of mind and financial security for your loved ones, there are many reasons why someone might choose not to have it. For example, life insurance might not be worth it if you have no dependents, a tight budget, or alternative plans for providing for your loved ones after your death. In fact, only about 52% of Americans are insured, leaving a significant number of people who have decided they don't need it or haven't gotten around to getting it.

No Dependents

If you have no dependents, you may be wondering whether it's worth getting life insurance. Here are some things to consider:

Current and Future Dependents

While you may not have any dependents now, your life circumstances could change in the future. You may have children or acquire elderly parents who are dependent on you. If you're young and single, you may pay less for coverage, so it could be worth getting life insurance now to lock in lower premiums. This is especially true if you have a family history of health issues, as you could develop a serious health issue later in life that makes it harder to get affordable coverage.

Debt and Loans

If you have any outstanding debt, such as a mortgage or student loans, a term life insurance policy can help whoever is responsible for paying them off when you pass away. This is usually a co-signer, such as a parent, friend, or spouse.

Business Owners

If you own a business, a life insurance policy can help keep the business running when you pass. The death benefit could be used to hire someone to replace you, allow your partner(s) to buy remaining shares, or provide for employees.

Funeral Costs

Life insurance can also be a way to support your loved ones after you're gone by paying for your funeral and other end-of-life expenses.

Peace of Mind

Even if none of the above applies to you, getting life insurance while you're young and healthy can give you peace of mind. You'll have affordable protection in place should your life circumstances change, and you won't have to worry about whether you'll be able to get covered later on.

In summary, while life insurance is not a necessity for everyone without dependents, there are several reasons why it may still be worth considering.

Life Insurance: Accidental Death Coverage Explained

You may want to see also

Tight Budget

Life insurance is a valuable financial tool that can provide for your loved ones after your death. However, it is not a necessity for everyone, especially those on a tight budget. Here are some reasons why you may choose to forgo life insurance due to budget constraints:

High Cost Perception

The perception of high cost is a common reason why people choose not to purchase life insurance. Many people overestimate the cost of life insurance, assuming it is too expensive for their budget. In reality, the cost of life insurance can be more affordable than expected, even with other financial obligations. For example, a healthy 30-year-old can obtain a $250,000 20-year term life insurance policy for approximately $13 per month. This is significantly less than the average monthly cost of a coffee.

No Dependents

If you have no dependents, such as children or ageing parents, life insurance may not be a necessary expense. Life insurance is intended to provide financial support to those who rely on you financially. If no one depends on your income and your loved ones can easily support themselves without it, the need for life insurance is diminished.

Other Financial Priorities

When on a tight budget, it is essential to prioritize your financial obligations. Basic necessities such as housing, clothing, utilities, and food take precedence over life insurance. Additionally, if you have existing savings or investments that can cover end-of-life expenses, such as funeral costs, life insurance may not be a priority for you.

Alternative Estate Plans

If you already have an estate plan in place, you may not feel the need for life insurance. However, it is important to consider that life insurance can play a crucial role in estate planning. It can help your beneficiaries cover final expenses, including funeral costs, outstanding debts, and taxes. Life insurance can also be used to equalize your estate and assets among multiple beneficiaries.

Term Life Insurance

If you decide that some level of life insurance is necessary, term life insurance may be a more affordable option. Term life insurance covers you for a set number of years, usually 10, 20, or 30 years, and typically has lower premiums than permanent life insurance. While it does not have a cash value component, term life insurance can provide financial protection during the period when you need it the most, such as when you have young children or significant financial obligations.

In conclusion, while life insurance can be beneficial, it may not be a feasible option for those on a tight budget. It is important to carefully consider your financial situation, priorities, and alternatives before deciding whether or not to purchase life insurance.

Whole Life Insurance: Surrender Charges and You

You may want to see also

Alternative Plans

Life insurance is not always the best option for everyone. There are alternative plans that can help you provide for your loved ones after your death. Here are some options to consider:

Self-Funding

Self-funding involves creating a savings account for your family to use after your passing. The advantage of this method is that you have more control over the funds and can decide how much to save. However, there is a risk of the funds being accessed or used before your death, and there are no rules about when the money can be used.

Annuities

Annuities are savings accounts offered by life insurance companies that can provide a lifetime stream of income. If set up correctly, you can receive an income stream during your lifetime, and any remaining balance will go to your family after your death. Annuities are a taxable event, so your beneficiaries will have to pay taxes on the received amount.

Guaranteed Issue Plan

A guaranteed issue plan is an alternative to regular life insurance, which does not require a medical exam for eligibility. This option is suitable for individuals who have been rejected for life insurance due to health issues. However, these plans usually come with higher premiums.

Asset-Based or Combination Policy

An asset-based or combination policy provides money for your long-term care, which is not typically covered by regular life insurance. It can also provide a death benefit to your chosen beneficiaries if you haven't used all your long-term care benefits. Some of these policies come with a money-back guarantee.

Employer-Provided Health Benefits

You can explore whether your employer offers any health benefits that include optional life insurance coverage. This option may depend on your salary or position, and you may need to undergo a medical exam. It's important to note that losing your job or being fired may affect your ability to keep these benefits.

Pregnancy: A Life-Changing Event for Insurance Purposes?

You may want to see also

No Beneficiaries

Life insurance is a valuable financial tool that provides financial support to beneficiaries after the policy owner's death. However, it is not uncommon for individuals to forgo life insurance, as only about 52% of Americans have it. There are valid reasons for not purchasing life insurance, such as having no dependents, a tight budget, or alternative plans for providing financial support to loved ones.

When it comes to "No Beneficiaries," it is important to understand the implications. Life insurance policies typically require the policy owner to name at least one primary beneficiary. A beneficiary is a person or organization designated to receive the policy's death benefit when the insured person passes away. However, if there is no living primary beneficiary or contingent beneficiary (secondary beneficiary), the payout from the life insurance policy is handled differently.

In the absence of named beneficiaries, the life insurance payout is typically directed to the insured person's estate. This means that the payout becomes subject to the individual's will, financial affairs, and applicable state laws. As a result, the payout may be reduced by estate taxes, claims by creditors, and other debts. Additionally, the heirs may receive a smaller amount than the original death benefit and experience delays in receiving the funds due to the probate process, which can be lengthy, especially if the will is contested.

To avoid such complications, it is crucial to regularly review and update life insurance policies. Policyholders should ensure they have named at least one primary beneficiary and a contingent beneficiary to receive the benefits as intended. This proactive approach ensures a smooth transition and provides financial certainty for loved ones.

Life Insurance and Welfare: What's the Connection?

You may want to see also

No Cash Flow

One of the main reasons people don't buy life insurance is that they believe it is too expensive. Many people overestimate the cost of life insurance and think it is not worth it if they are young and healthy. However, this is a common misconception, as life insurance for young adults is often less expensive due to their lower health risks. Compared to older adults, young adults typically receive lower monthly rates and have access to more options.

In reality, the cost of life insurance can be more affordable than you think, even with other financial obligations. For example, a healthy 30-year-old can get a $250,000 20-year level term life insurance policy for about $13 a month. That is a small price to pay for the financial security and peace of mind that life insurance provides.

If you are concerned about the cost of life insurance, it is important to remember that there are different types of policies available, such as term life insurance and whole life insurance. Term life insurance is generally more affordable, as it only covers you for a set number of years, while whole life insurance covers you for your entire life. By choosing a term life insurance policy, you can get the coverage you need without breaking the bank.

Additionally, life insurance can provide valuable financial protection for your loved ones in the event of your death. It can help replace lost income, pay off debts, cover living expenses, and take care of final expenses such as funeral costs. These expenses can be a significant burden on your family, especially if they are already struggling financially.

If you are unsure about whether you can afford life insurance, it is a good idea to meet with a financial advisor to discuss your options. They can help you determine if life insurance is a worthwhile investment for your situation and guide you in choosing the right type of policy and coverage amount. Don't let a lack of cash flow prevent you from getting the protection you need; explore your options and make an informed decision.

Cigna Life Insurance: Depression History and Rejection Risk

You may want to see also

Frequently asked questions

Only about 52% of Americans have life insurance, according to one source. This means that a large number of people either haven't gotten around to purchasing it or have decided they don't need it.

If you have substantial savings to cover end-of-life expenses and your loved ones can support themselves financially without your income, you may not need life insurance. Additionally, if you're young, single, and have no dependents, you might also decide it's not necessary.

Some common reasons include the belief that it's too expensive, being young and healthy, already having an estate plan, and finding the process and options confusing or intimidating.

Yes, the two primary types are term life insurance and permanent life insurance (including whole, universal, and variable policies). Term life insurance covers you for a set number of years, while permanent life insurance covers you for your entire life.

It depends on your personal circumstances and financial situation. If you have dependents or loved ones who rely on your income, or if you have significant expenses or obligations, then you may want to consider purchasing life insurance. Consulting a financial advisor or insurance agent can help you make an informed decision.