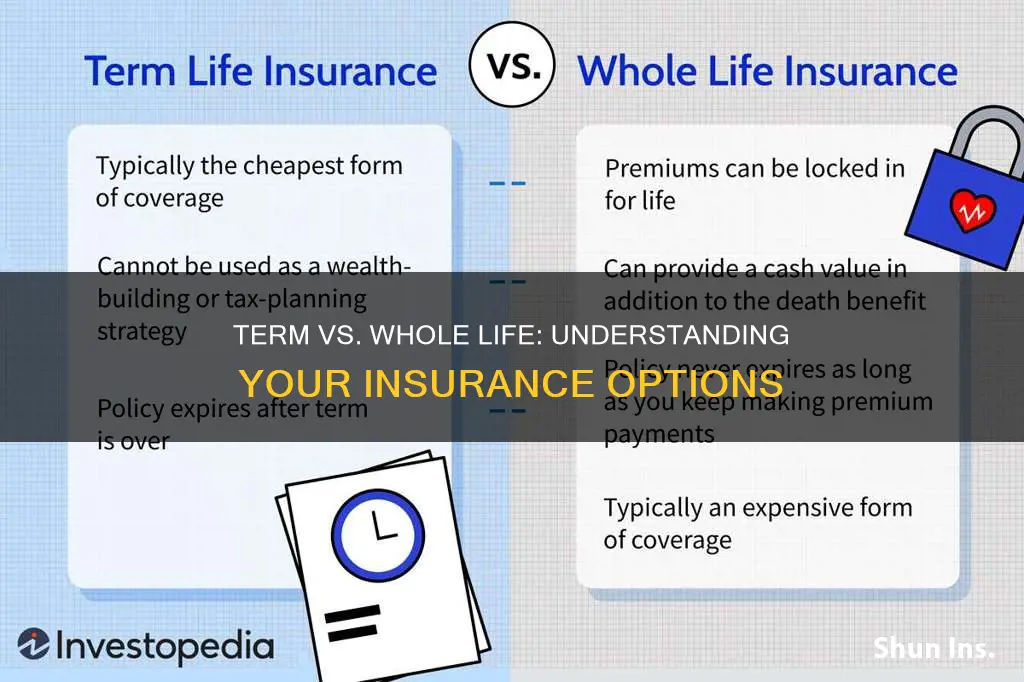

Term insurance and whole life insurance are two fundamental types of life insurance policies that offer financial protection and peace of mind to individuals and their families. Term insurance provides coverage for a specific period, such as 10, 20, or 30 years, and is designed to protect against financial loss in the event of the insured's death during that term. It is a cost-effective way to secure coverage for a defined period, making it ideal for those who want temporary protection or are looking to build a financial safety net for their loved ones. On the other hand, whole life insurance offers lifelong coverage and provides a combination of insurance and savings components. It ensures that the insured's beneficiaries receive a death benefit upon their passing and also includes a cash value component that grows over time, allowing policyholders to build a substantial savings account. Understanding the differences between these two insurance types is essential for individuals to choose the right coverage based on their financial goals, risk tolerance, and long-term needs.

What You'll Learn

- Term Insurance: Temporary coverage for a set period, offering affordable protection

- Whole Life: Permanent insurance with a savings component, providing lifelong coverage

- Premiums: Regular payments made to maintain insurance coverage

- Death Benefit: Payout upon the insured's death, ensuring financial security

- Investment Options: Whole life offers investment opportunities, growing cash value over time

Term Insurance: Temporary coverage for a set period, offering affordable protection

Term insurance is a type of life insurance that provides coverage for a specific period, often referred to as the "term" or "policy term." It is a straightforward and cost-effective way to secure financial protection for a predetermined duration. This type of insurance is ideal for individuals who want temporary coverage to safeguard their loved ones or assets during a particular phase of life, such as when starting a family, purchasing a home, or covering educational expenses.

The beauty of term insurance lies in its simplicity and affordability. It offers pure insurance, meaning it primarily focuses on providing financial protection in the event of the insured's death during the specified term. Unlike permanent life insurance, which provides coverage for the entire life of the insured, term insurance is designed to be a temporary solution. This makes it a more economical choice, especially for those who need coverage for a limited time.

During the policy term, the insurance company promises to pay a predetermined death benefit to the policy's beneficiaries if the insured individual passes away. This benefit can be used to cover various expenses, such as mortgage payments, child-rearing costs, or college tuition, ensuring financial security for the family during challenging times. Once the policy term ends, the coverage expires, and further coverage may need to be obtained if desired.

One of the advantages of term insurance is its flexibility. Policyholders can choose from various coverage options, including the term length, death benefit amount, and payment frequency. Common term lengths include 10, 20, and 30 years, allowing individuals to align the policy with their specific needs and financial goals. Additionally, term insurance often offers the option to convert the policy to a permanent life insurance plan if desired, providing long-term coverage.

In summary, term insurance is a practical and affordable solution for those seeking temporary life insurance coverage. It offers a straightforward approach to financial protection during a specific period, ensuring peace of mind and security for beneficiaries. With its flexibility and cost-effectiveness, term insurance is an excellent choice for individuals who want to safeguard their loved ones without the long-term commitments associated with permanent life insurance.

Understanding Life Insurance Units: How They Work

You may want to see also

Whole Life: Permanent insurance with a savings component, providing lifelong coverage

Whole life insurance is a type of permanent insurance policy that offers lifelong coverage and a savings component. It is a long-term financial commitment that provides financial security and peace of mind to the policyholder and their beneficiaries. This insurance policy is designed to be a permanent fixture in an individual's financial plan, offering several key benefits.

One of the primary advantages of whole life insurance is its guarantee of lifelong coverage. Unlike term insurance, which provides coverage for a specified period, whole life insurance remains in force for the entire life of the insured individual. This means that as long as the premiums are paid, the policyholder will have coverage, ensuring financial protection for their loved ones even in the long term. The policy's permanent nature provides a sense of security, knowing that the financial obligations are covered indefinitely.

In addition to providing lifelong coverage, whole life insurance also includes a savings component. A portion of the premium paid goes into an investment account, which grows over time. This investment aspect allows the policyholder to accumulate savings, which can be used for various financial goals. The savings component of whole life insurance can be particularly beneficial for those seeking to build a financial nest egg or save for retirement. As the investment account grows, it can provide a source of funds for the policyholder, offering flexibility and control over their financial future.

The savings component of whole life insurance works through an investment strategy managed by the insurance company. The policyholder's premiums are invested in a diversified portfolio, typically including stocks, bonds, and other securities. Over time, the value of these investments can grow, and the policyholder can benefit from the potential for higher returns compared to traditional savings accounts. This feature allows individuals to build wealth while also ensuring they have a safety net in the form of insurance coverage.

Furthermore, whole life insurance offers a fixed premium, which means the cost of insurance remains the same throughout the life of the policy. This predictability is advantageous as it allows policyholders to plan their finances effectively. The fixed premium also ensures that the insurance coverage is not affected by changes in health or age, providing consistent protection. This stability is a significant advantage over term insurance, where premiums can increase or decrease based on various factors.

In summary, whole life insurance is a permanent insurance solution that offers lifelong coverage and a valuable savings component. It provides financial security, peace of mind, and the potential for wealth accumulation. With its guaranteed coverage and fixed premiums, whole life insurance is an attractive option for individuals seeking long-term financial protection and a comprehensive insurance strategy.

Life Insurance and Taxes: What You Need to Know

You may want to see also

Premiums: Regular payments made to maintain insurance coverage

Premiums are a fundamental aspect of insurance, representing the regular financial contributions made by policyholders to ensure their insurance coverage remains active. These payments are a commitment to the insurance company, indicating the policyholder's willingness to maintain the insurance policy for a specified period or until a certain event occurs, depending on the type of insurance. Understanding the concept of premiums is crucial for anyone considering insurance as a means of financial protection.

In the context of term insurance, premiums play a vital role in securing coverage for a defined term. Term insurance is a type of coverage that provides protection for a specific period, such as 10, 20, or 30 years. During this term, the policyholder pays regular premiums to the insurance company. If an insured event occurs within the term, the insurance company pays out the death benefit to the policyholder or designated beneficiaries. Once the term expires, the policyholder can choose to renew it, but premiums may increase, and coverage terms might change. Term insurance is often more affordable than permanent life insurance, making it an attractive option for those seeking temporary coverage.

On the other hand, whole life insurance offers lifelong coverage, and premiums are structured accordingly. With whole life insurance, the policyholder pays a fixed premium throughout the policy's duration, which can be for the entire lifetime of the insured individual. The premiums are typically higher compared to term insurance due to the long-term commitment and the accumulation of cash value within the policy. The cash value grows over time and can be borrowed against or withdrawn, providing a financial benefit to the policyholder. This type of insurance provides a sense of security, knowing that the coverage will remain in force as long as the premiums are paid.

The amount of premium paid is determined by various factors, including the policyholder's age, health, gender, and the desired coverage amount. Younger individuals generally pay lower premiums as they are considered less risky. Additionally, the insurance company assesses the policyholder's health through medical exams or questionnaires to determine the premium rate. The frequency of premium payments can vary; some policies offer monthly, quarterly, or annual payment options. It is essential for policyholders to understand the payment schedule and ensure timely payments to avoid any lapse in coverage.

In summary, premiums are the cornerstone of insurance, enabling individuals to secure financial protection for themselves and their loved ones. Whether it's term insurance for a specific period or whole life insurance for lifelong coverage, understanding the premium structure is key to making informed decisions. Policyholders should carefully consider their financial capabilities and insurance needs to choose the most suitable premium payment plan, ensuring continuous coverage and peace of mind.

Understanding California's Free Look Period for Life Insurance Policies

You may want to see also

Death Benefit: Payout upon the insured's death, ensuring financial security

Term insurance and whole life insurance are two distinct types of life insurance policies, each offering different benefits and serving various purposes. Understanding these differences is crucial when choosing the right insurance plan to meet your financial needs.

Term Insurance:

Term insurance provides coverage for a specific period, known as the "term." This term can vary, ranging from a few years to several decades. During this term, the policyholder pays a premium to the insurance company. If the insured individual passes away within the term period, the death benefit is paid out to the designated beneficiaries. Term insurance is often more affordable compared to other types of life insurance, making it an attractive option for individuals seeking temporary coverage. It is particularly useful for those who want to provide financial security for a specific goal, such as covering mortgage payments or funding a child's education. The simplicity of term insurance lies in its straightforward nature; it offers protection during a defined period, ensuring that your loved ones receive the intended financial support in the event of your untimely demise.

Whole Life Insurance:

In contrast, whole life insurance offers lifelong coverage, providing a death benefit that remains in force as long as the policyholder is alive. This type of insurance is more comprehensive and involves a few key components. Firstly, the policyholder pays a premium, which is typically higher than term insurance. The premium is invested by the insurance company, and the investment grows over time, accumulating cash value. This cash value can be borrowed against or withdrawn, providing financial flexibility. Upon the insured's death, the death benefit is paid out, and the cash value can also be used to pay for the policy's expenses. Whole life insurance provides long-term financial security and a guaranteed death benefit, making it suitable for those seeking a more permanent solution for their insurance needs.

The death benefit is a critical aspect of both term and whole life insurance. It ensures that your loved ones receive a financial payout in the event of your passing, providing them with the necessary resources to maintain their standard of living or achieve specific financial goals. Whether you choose term insurance for its affordability and targeted coverage or opt for whole life insurance with its lifelong protection and investment opportunities, the death benefit remains a vital component, offering peace of mind and financial security during challenging times.

RV Loan Agreements: Life Insurance Implications Explained

You may want to see also

Investment Options: Whole life offers investment opportunities, growing cash value over time

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. One of its key features is the accumulation of cash value over time, which can be utilized as an investment option. When you purchase a whole life policy, a portion of your premium payments goes towards building this cash value, which grows tax-deferred. This growing cash value can be a significant benefit, especially for those seeking long-term financial planning and investment opportunities.

The investment aspect of whole life insurance allows policyholders to benefit from the power of compounding. As the cash value grows, it can be used in various ways. One common strategy is to borrow against the policy's cash value, taking out a loan with interest that is paid back to the policy. This provides immediate access to funds without selling the policy, which can be useful for various financial needs. Additionally, the cash value can be withdrawn, providing a lump sum that can be invested elsewhere or used for other financial goals.

Over time, the cash value in a whole life policy can become substantial, offering a valuable financial asset. This growing investment component is particularly attractive to those who want to ensure their loved ones are financially secure while also building a personal investment portfolio. The ability to invest within the policy provides a level of control and flexibility, allowing individuals to make the most of their money while also having a safety net in the form of life insurance.

It's important to note that the investment options within whole life insurance policies may vary. Some policies offer more flexibility, allowing policyholders to choose how the cash value is invested, while others may have more standardized investment options. Understanding the specific investment features of your policy is crucial to making informed decisions about your financial strategy.

In summary, whole life insurance provides more than just a safety net; it offers investment opportunities through the growing cash value. This feature allows individuals to build a financial asset while also ensuring their loved ones are protected. By exploring the investment options within whole life policies, individuals can make informed choices to secure their financial future.

Life Insurance: Empire Records' Employee Benefits Explored

You may want to see also

Frequently asked questions

Term insurance is a type of life insurance that provides coverage for a specific period, known as the "term." It offers pure insurance, meaning it pays out a death benefit if the insured person dies during the term. The key advantage is its affordability, as it is designed for short-term needs, such as covering mortgage payments or providing income for a family during a specific period. On the other hand, whole life insurance is a permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a death benefit and a cash value component, which grows over time. The main difference is that whole life insurance provides lifelong coverage, ensuring financial security for the policyholder's beneficiaries even after they pass away.

Term insurance is a straightforward and cost-effective way to secure financial protection for a specific duration. When you purchase a term insurance policy, you select a term length, typically 10, 15, 20, or 30 years. During this period, the policy provides a death benefit to the beneficiaries if the insured person dies. The benefits of term insurance include its simplicity, with no investment or savings component, making it easy to understand and budget for. It is ideal for those who want pure insurance coverage without the complexity of permanent policies. Additionally, term insurance is often more affordable, especially for younger individuals, as the risk of death is lower during the initial years of the policy.

Whole life insurance offers several advantages that make it an attractive long-term financial planning tool. Firstly, it provides guaranteed lifelong coverage, ensuring that the policyholder's beneficiaries receive a death benefit regardless of when the insured person passes away. This predictability is a significant advantage. Secondly, whole life insurance accumulates cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. The cash value grows at an assured rate, making it a stable investment. Additionally, whole life insurance offers a fixed premium, which remains constant throughout the policy's duration, providing long-term financial security. This type of insurance is suitable for those seeking permanent coverage and a stable investment option.