Postal employees can view their life insurance elections through the employee portal on the company's internal website. This portal provides access to various benefits and insurance information, allowing employees to review and update their life insurance coverage options. By logging into the portal, employees can ensure their insurance elections are accurate and up-to-date, providing peace of mind and financial security for themselves and their families.

| Characteristics | Values |

|---|---|

| Online Portal | Postal employees can access their life insurance elections through the USPS Benefits Portal, an online platform where they can manage various benefits and enrollments. |

| Human Resources (HR) Department | The HR team can provide information and assistance regarding life insurance elections, including any changes or updates. |

| Benefits Handbook | The USPS Benefits Handbook outlines the details of life insurance options and how to make elections, which employees can refer to for guidance. |

| Benefits Counselor | Employees can consult with a benefits counselor who can explain the different life insurance plans and help them make informed decisions. |

| Payroll System | Some payroll systems may display life insurance elections, allowing employees to review their current selections. |

| Benefits Statement | A benefits statement, often provided annually, summarizes an employee's current benefits, including life insurance elections. |

| USPS Website | The official USPS website might offer resources and FAQs related to life insurance elections for employees. |

| Benefits Office | Visiting the local Benefits Office can provide direct access to information and support for managing life insurance elections. |

What You'll Learn

- Employee Handbook: Check your employee handbook for insurance election details

- Benefits Portal: Access the benefits portal for life insurance enrollment and changes

- HR Department: Contact HR for life insurance election information and support

- Online Resources: Review online resources for life insurance policy details and elections

- Benefits Manager: Speak with your benefits manager for life insurance election guidance

Employee Handbook: Check your employee handbook for insurance election details

When it comes to understanding your life insurance options as a postal employee, your employee handbook is an invaluable resource. This comprehensive guide is designed to provide you with all the necessary information regarding your benefits, including life insurance. Here's how you can utilize it to check your insurance elections:

Locate the Benefits Section: Start by locating the section dedicated to benefits in your employee handbook. This section will outline the various insurance options available to you, such as life insurance, health insurance, and retirement plans. It is typically well-organized and easy to navigate, ensuring you can quickly find the relevant information.

Identify Insurance Election Process: Within the benefits section, look for a detailed explanation of how to make insurance elections. This part will guide you through the process of selecting your preferred insurance coverage options. It might include steps like choosing the desired level of coverage, specifying beneficiaries, and understanding any available add-ons or riders.

Review Election Deadlines: Pay close attention to the deadlines for making insurance elections. These deadlines are crucial to ensure your choices are valid and effective. The handbook will specify the timing for elections, which may vary depending on the type of insurance and your employment status. Missing these deadlines could result in default coverage, so it's essential to be aware of them.

Understand Election Methods: The handbook should also provide information on how to make your insurance elections. This could involve filling out specific forms, submitting them to the appropriate department, or using an online portal. Knowing the exact process will ensure your elections are processed correctly and efficiently.

Regularly Review and Update: Employee handbooks are often updated periodically to reflect any changes in company policies or benefits. Therefore, it's a good practice to periodically review your handbook to ensure you have the most current information regarding insurance elections. This proactive approach will help you stay informed and make any necessary adjustments to your coverage.

Strategies to Reduce Life Insurance Coverage and Save Money

You may want to see also

Benefits Portal: Access the benefits portal for life insurance enrollment and changes

The Benefits Portal is a comprehensive online platform designed to assist U.S. Postal Service (USPS) employees in managing their benefits, including life insurance. This portal serves as a centralized hub, allowing employees to enroll in, update, and review their life insurance coverage. Here's a step-by-step guide on how to access and utilize the Benefits Portal for life insurance-related actions:

Accessing the Benefits Portal:

Postal employees can access the Benefits Portal through the USPS Intranet, also known as the Employee Portal. To log in, you will need your USPS employee credentials, including your user ID and password. Once logged in, navigate to the 'Benefits' section, which is typically found under the 'My Benefits' or 'Benefits Management' tab.

Life Insurance Enrollment:

- On the Benefits Portal, locate the 'Life Insurance' section. Here, you will find options to enroll in different types of life insurance plans offered by the USPS.

- Review the available plans, including term life, whole life, and any other options provided. Each plan will have its own set of benefits, coverage amounts, and premiums.

- Choose the plan that best suits your needs and select the desired coverage amount. You may be able to customize your policy by adding or removing beneficiaries.

- Complete the enrollment process by providing the necessary personal and financial information. This may include your date of birth, social security number, and banking details for premium payments.

Making Changes to Your Life Insurance:

The Benefits Portal also allows employees to make adjustments to their existing life insurance policies. Here's how:

- Log in to the portal and navigate to the 'Life Insurance' section.

- Select the 'Manage Coverage' or 'Update Policy' option.

- Review your current life insurance details, including the policy type, coverage amount, and beneficiaries.

- Make the necessary changes, such as increasing or decreasing coverage, adding a new beneficiary, or updating personal information.

- Ensure that you understand the impact of any changes on your premiums and coverage.

Reviewing Life Insurance Elections:

Employees can easily review their current life insurance elections by following these steps:

- Access the Benefits Portal and go to the 'Life Insurance' section.

- Select 'View Elections' or 'Review Coverage'.

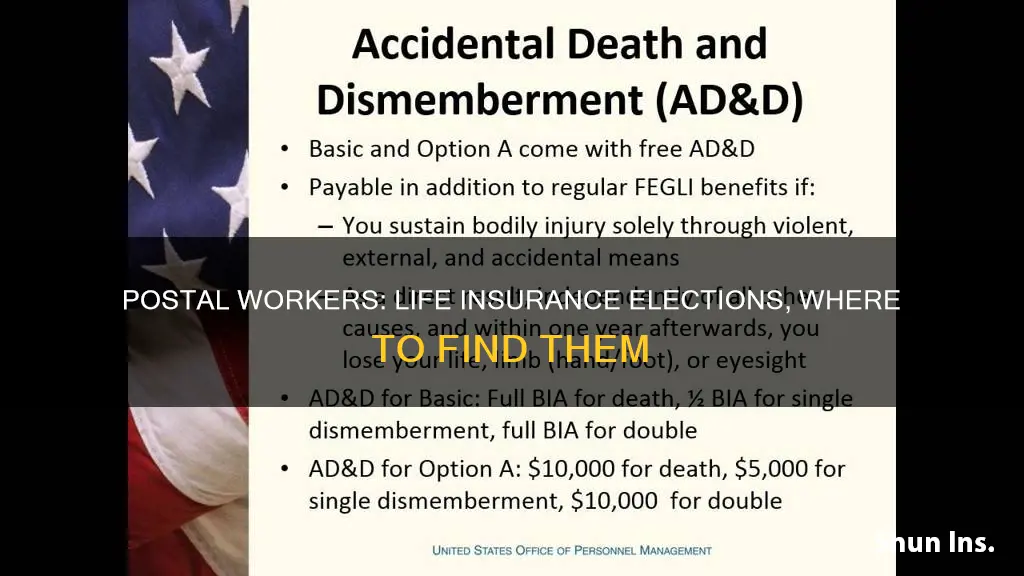

- Here, you will see a summary of your current life insurance coverage, including the plan type, coverage amount, and any additional benefits or riders.

- You can also view and update your beneficiary information, ensuring that your choices are up-to-date.

The Benefits Portal provides a user-friendly interface, making it convenient for postal employees to manage their life insurance benefits. By enrolling, updating, and reviewing their life insurance elections through this portal, employees can ensure that their coverage aligns with their current needs and preferences. It is essential to regularly review and update your life insurance choices to reflect any changes in your personal or financial situation.

Life Insurance Preferred Loans: What You Need to Know

You may want to see also

HR Department: Contact HR for life insurance election information and support

If you are a postal employee and want to review or understand your life insurance elections, the first step is to reach out to the HR department. They are the primary point of contact for all matters related to employee benefits, including life insurance. Here's how you can proceed:

The HR department will provide you with the necessary resources and guidance to access your life insurance information. They can offer detailed explanations of your current elections, including any changes made during open enrollment periods. It is essential to regularly review and update your life insurance coverage to ensure it aligns with your current needs and circumstances.

When you contact HR, they might ask for specific details to locate your account. This could include your employee ID, date of birth, or other personal information. Once they have verified your identity, they can assist in retrieving the relevant documents or provide you with a summary of your current life insurance coverage.

In some cases, HR may also be able to guide you through the process of making changes to your elections. This could involve updating your beneficiary information, changing the amount of coverage, or making other adjustments as per your requirements. They can ensure that your life insurance elections are accurate and reflect your current preferences.

Remember, the HR department is there to support you throughout the process. They can answer any questions you may have and provide the necessary documentation or guidance to help you make informed decisions about your life insurance benefits. It is always best to rely on official sources within the organization for such important matters.

Getting a Life Insurance License: How Long Does It Take?

You may want to see also

Online Resources: Review online resources for life insurance policy details and elections

When it comes to reviewing life insurance policy details and elections, postal employees can leverage various online resources to gain a comprehensive understanding of their coverage. One of the primary sources of information is the official website of the Postal Service. Here, employees can often find dedicated sections or portals specifically designed for employee benefits. These sections typically provide access to detailed policy documents, including the life insurance plan's terms, conditions, and coverage options. By logging into their personal accounts, employees can review their current elections, make necessary adjustments, and even download or print relevant documents for their records.

In addition to the Postal Service's website, many companies now offer online portals or dashboards where employees can manage their benefits. These platforms often provide a user-friendly interface, allowing employees to view and modify their life insurance elections. Employees can typically access these portals using their employee ID and password, ensuring secure access to their personal information. Through these online tools, they can easily track changes made to their policy, update beneficiaries, and stay informed about any new benefits or options available.

Another valuable resource is the company's human resources (HR) department or benefits office. Many organizations have dedicated HR professionals who can assist employees in understanding their life insurance coverage and making informed decisions. Employees can reach out to the HR team via email or phone to inquire about their policy details, including any recent updates or changes. The HR department may also provide online resources or links to external platforms where employees can find comprehensive information about their life insurance benefits.

Furthermore, postal employees can explore external websites and resources provided by insurance companies or benefit consultants. These sources often offer educational materials, FAQs, and guides to help employees understand their life insurance policies. Employees can search for relevant keywords or topics on these websites to find specific information related to their elections. Additionally, some insurance providers offer online calculators or tools that allow employees to estimate their potential death benefit payouts based on their current elections.

In summary, postal employees have a range of online resources at their disposal to review life insurance policy details and elections. From official Postal Service websites to company-provided portals and external insurance resources, employees can access comprehensive information, make adjustments to their elections, and stay informed about their valuable benefits. Utilizing these online tools empowers employees to take control of their financial security and make the most of the life insurance coverage provided by their employer.

Life, Accident, and Health Insurance: Do Licenses Expire?

You may want to see also

Benefits Manager: Speak with your benefits manager for life insurance election guidance

If you are a postal employee and want to understand your life insurance elections, it is crucial to seek guidance from your benefits manager. They are the go-to resource for all things related to your benefits package, including life insurance. Here's why speaking with your benefits manager is essential:

Understanding Your Elections: Life insurance elections can be complex, and your benefits manager can provide clarity. They can explain the different coverage options available, such as term life, whole life, or group life insurance, and help you choose the plan that best suits your needs. By discussing your financial goals, family situation, and risk factors, they can offer personalized advice to ensure you make informed decisions.

Reviewing Current Elections: Your benefits manager can assist in reviewing your current life insurance elections. They can verify if your coverage is adequate, considering any changes in your personal circumstances or employment status. This review process ensures that your life insurance remains aligned with your current needs and provides the necessary protection.

Making Changes: If you wish to make adjustments to your life insurance coverage, your benefits manager is the best person to guide you through the process. They can explain the implications of different changes, such as increasing or decreasing coverage, and help you navigate the necessary paperwork. Whether you want to add a beneficiary, update your personal information, or make other modifications, your benefits manager will ensure the process is smooth and compliant with postal policies.

During your conversation with the benefits manager, don't hesitate to ask questions. Inquire about the specific details of your life insurance policy, the terms and conditions, and any associated costs. They can provide you with the necessary documentation and resources to make well-informed choices. Remember, your benefits manager is there to support you in maximizing the benefits you are entitled to as a postal employee.

By speaking with your benefits manager, you can gain a comprehensive understanding of your life insurance elections and ensure that your coverage is tailored to your specific requirements. This proactive approach empowers you to make the best decisions regarding your financial security and peace of mind.

Life Insurance: Maximizing Benefits for Peace of Mind

You may want to see also

Frequently asked questions

You can access your life insurance elections through the Employee Self-Service portal on the Postal Benefits website. This secure online platform allows you to view and manage your coverage details, including any changes or updates you may have made to your elections.

Yes, you can visit your local Post Office and speak with a benefits representative who can assist you in accessing your life insurance elections. They will guide you through the process and provide any necessary documentation or explanations regarding your coverage.

Absolutely! Your employee benefits package, which is typically provided during onboarding or at regular intervals, will contain detailed information about your life insurance coverage and elections. It will outline the steps to view and manage your elections, either online or through the designated benefits contact.