Life insurance is a financial tool that provides coverage for a specified period or until the insured's death. It offers a safety net for beneficiaries by paying out a death benefit upon the insured's passing. There are various types of life insurance, each with distinct features and benefits. One such type is term life insurance, which is a pure form of coverage without any cash value accumulation. This type of insurance is designed to provide coverage for a specific period, such as 10, 20, or 30 years, and it pays out a predetermined death benefit if the insured dies during that term. Unlike permanent life insurance, which includes a savings component, term life insurance focuses solely on providing financial protection during a defined period, making it a straightforward and cost-effective option for those seeking temporary coverage.

What You'll Learn

Term Life Insurance: Pure protection for a set period

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the "term." It is designed to offer pure protection during that time, ensuring financial security for your loved ones if something happens to you. This type of insurance is often more affordable and straightforward compared to other life insurance policies, making it an attractive option for many individuals.

The beauty of term life insurance lies in its simplicity. It is a pure risk transfer mechanism, where the insurance company agrees to pay a predetermined death benefit to your beneficiaries if you pass away during the specified term. This benefit is typically used to cover expenses such as mortgage payments, children's education, or any other financial obligations you may have left behind. The key advantage is that it provides a clear and defined level of protection for a set period, ensuring that your family's financial needs are met during that time.

One of the critical aspects of term life insurance is its affordability. Since it offers pure protection without an investment component, the premiums are generally lower compared to permanent life insurance policies. This makes it accessible to a broader range of individuals who may not have substantial financial resources to invest in a policy with cash value. As a result, term life insurance is an excellent choice for those seeking temporary coverage, especially if they have a limited budget or prefer a more straightforward insurance product.

When choosing a term life insurance policy, it's essential to consider the length of the term. The term can vary, typically ranging from 10 to 30 years, or even longer in some cases. The longer the term, the more comprehensive the coverage, but it will also come with higher premiums. It's crucial to assess your financial needs and determine how long you want the coverage to last. For instance, if you have a mortgage that will be paid off within 15 years, a 10-year term policy might be sufficient to cover that period.

In summary, term life insurance is a powerful tool for providing pure protection during a specific time frame. It offers a cost-effective way to ensure your loved ones are financially secure if something happens to you. By understanding the term length and its implications, you can make an informed decision about the right coverage for your family's needs. Remember, this type of insurance is a valuable component of a comprehensive financial plan, helping to safeguard your loved ones' future.

Find Registered Life Insurance Agents in California

You may want to see also

No Investment Component: Focus solely on death benefit

Life insurance with no cash value is a type of policy that focuses exclusively on providing a death benefit to the policyholder's beneficiaries upon the insured individual's passing. This type of insurance is often referred to as "term life insurance" or "pure insurance." The primary purpose of this insurance is to offer financial protection to the policyholder's family or designated recipients in the event of their death, without any additional investment or savings components.

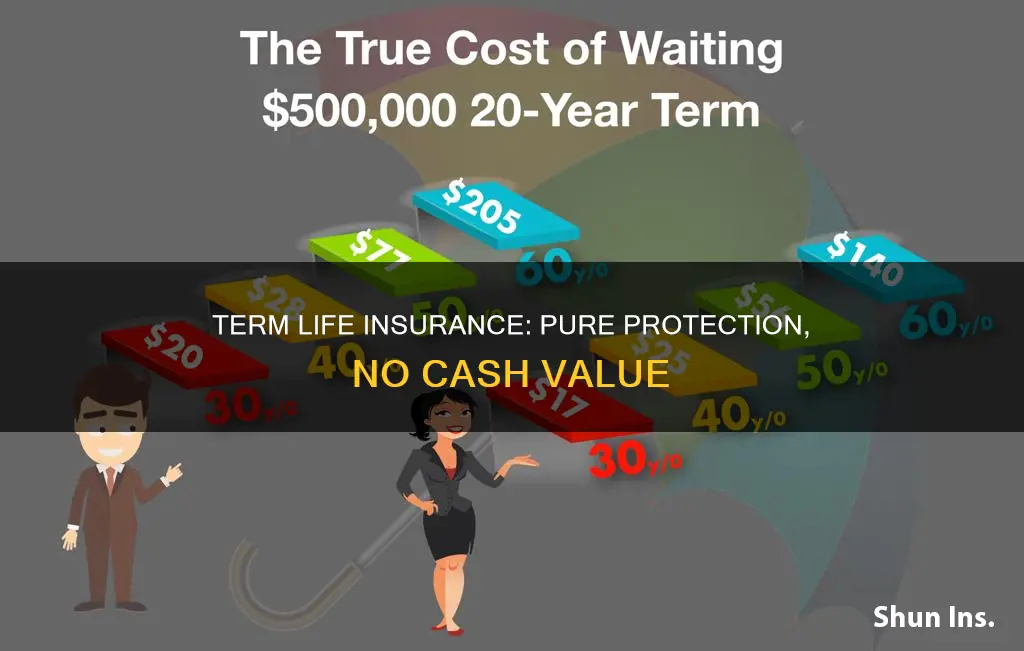

In this type of life insurance, the policy is designed to provide a predetermined amount of coverage for a specified period, known as the "term." For example, you might purchase a $500,000 term life insurance policy for a 20-year term. During this 20-year period, if the insured individual passes away, the insurance company will pay out the death benefit to the beneficiaries. The key advantage is that it offers pure protection, ensuring financial security for loved ones without any long-term financial commitments or investment returns.

The absence of an investment component means that the policy does not accumulate cash value over time. Unlike permanent life insurance, where a portion of the premium contributes to building cash value, the entire premium in this case goes towards providing the death benefit. This simplicity ensures that the cost of insurance remains predictable and affordable, making it an attractive option for those seeking straightforward coverage.

When considering this type of insurance, it's essential to evaluate the term length carefully. The term should align with the period during which the death benefit is needed, such as covering mortgage payments, children's education, or other financial obligations. After the term expires, the policy can be renewed, but the cost may increase, and the coverage might not be as comprehensive.

In summary, life insurance with no cash value is a term-based policy that provides a death benefit to beneficiaries without any investment or savings features. It offers pure protection, ensuring financial security for loved ones during a specified term. By understanding the term life insurance concept, individuals can make informed decisions about their insurance needs, ensuring they have the right coverage to protect their families.

Escape Whole Life Insurance: Strategies for Policy Surrender

You may want to see also

Temporary Coverage: Provides coverage for a limited time

Temporary coverage, as the name suggests, is a type of life insurance that offers protection for a specific, limited period. This form of insurance is designed to provide immediate coverage without the long-term financial commitment associated with traditional life insurance policies. It is an excellent option for individuals who need insurance for a particular event or period but don't want to be tied down to a long-term policy.

The primary advantage of temporary coverage is its flexibility. It allows individuals to secure their loved ones' financial future without the ongoing costs of a permanent policy. For instance, someone planning a major life event like a wedding or a significant purchase might want insurance to cover potential risks during that period. Temporary coverage can be tailored to fit the specific needs of such events, providing peace of mind without the long-term financial burden.

This type of insurance is often used for specific, short-term needs, such as:

- Event-Based Coverage: For a limited time, such as a wedding or a business venture, where insurance is required for a specific period.

- Travel Insurance: When traveling, especially to high-risk areas, for a short duration.

- Mortgage Protection: To cover mortgage payments if the primary income earner were to pass away during the loan term.

- Critical Illness Cover: Providing financial support during a critical illness, which can be a temporary need until the individual recovers and returns to work.

The duration of temporary coverage can vary, ranging from a few months to several years, depending on the individual's needs and the specific policy chosen. This flexibility ensures that the insurance is relevant and useful for the intended period, making it a practical choice for many.

In summary, temporary coverage is a valuable option for those seeking short-term life insurance without the long-term commitment. It provides a tailored solution for specific events or needs, ensuring that individuals can protect their loved ones and manage their finances effectively during critical times.

Life Insurance Checks: Who Gets Listed as Beneficiaries?

You may want to see also

Affordable Premiums: Lower costs due to no investment

When considering life insurance, one of the key factors that can significantly impact the overall cost is the type of policy you choose. Traditional life insurance policies often come with an investment component, where a portion of your premium is allocated to build cash value over time. However, there is an alternative type of life insurance that offers a more straightforward and cost-effective approach: term life insurance.

Term life insurance, as the name suggests, provides coverage for a specific period or 'term' of time, typically ranging from 10 to 30 years. Unlike permanent life insurance, which includes a savings component, term life insurance focuses solely on providing financial protection during the agreed-upon period. This simplicity in design allows for lower premiums, making it an attractive option for those seeking affordable life insurance.

The absence of an investment component in term life insurance is a significant factor in its lower costs. With no need to build cash value, the insurance company doesn't have to allocate a portion of the premium towards investment returns. As a result, the entire premium can be directed towards covering the death benefit, which is the primary purpose of life insurance. This direct approach ensures that the cost of the policy remains competitive and more affordable for the policyholder.

Additionally, term life insurance is often more flexible and customizable. Policyholders can choose the coverage amount and term length that best suit their needs and budget. This flexibility further contributes to the affordability of premiums, as individuals can tailor the policy to their specific requirements without unnecessary add-ons or complex features.

In summary, term life insurance offers a more straightforward and cost-effective solution for those seeking life insurance without the investment component. Its lower premiums, flexibility, and focus on providing pure protection make it an excellent choice for individuals looking to secure their loved ones' financial future without incurring higher costs associated with investment-based policies.

Stranger-Originated Life Insurance: What You Need to Know

You may want to see also

Simplified Process: Easier underwriting without investment components

Life insurance with no cash value, often referred to as 'term life insurance', is a straightforward and cost-effective way to protect your loved ones. This type of insurance is designed to provide coverage for a specific period, known as the 'term', and it does not accumulate any cash value over time. Here's a simplified breakdown of how this process works and why it's considered easier to underwrite:

Understanding Term Life Insurance:

Term life insurance is a temporary coverage that offers financial protection for a predetermined period, typically ranging from 10 to 30 years. It is a pure insurance product, meaning it is solely focused on providing a death benefit to the policyholder's beneficiaries if the insured person passes away during the term. The primary advantage is its simplicity and affordability, making it an excellent choice for those seeking short-term coverage without the complexities of other insurance types.

Easier Underwriting Process:

The underwriting process for term life insurance is generally more relaxed compared to other life insurance policies. Here's why:

- Simpler Medical Assessments: Underwriters often rely on a basic health questionnaire or a simple medical exam, especially for shorter terms. This streamlined approach reduces the need for extensive medical history reviews and complex health assessments.

- No Investment Component: Unlike permanent life insurance, term life insurance does not have an investment component. This means there is no need to evaluate the insured's investment behavior or financial goals, simplifying the underwriting process.

- Faster Approval: Without the investment aspect, the approval process can be quicker. Underwriters can focus on the insured's health and risk factors, making it easier to determine eligibility and set premiums.

Benefits of Simplified Underwriting:

This simplified process benefits both the insurer and the policyholder. For the insurer, it reduces administrative costs and allows for faster decision-making. Policyholders can obtain coverage more efficiently, ensuring they have protection when needed without the lengthy and potentially complex underwriting procedures associated with other life insurance types.

In summary, life insurance with no cash value, or term life insurance, offers a simplified and efficient way to secure financial protection for your loved ones. Its straightforward nature, combined with easier underwriting, makes it an attractive option for those seeking affordable and temporary coverage.

Finding Life Insurance Buyers: Strategies for Agents

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers pure protection and pays out a death benefit if the insured person passes away during the term. On the other hand, whole life insurance is a permanent policy that provides coverage for the entire life of the insured individual. It includes an investment component, known as cash value, which grows over time and can be borrowed against or withdrawn.

Term life insurance is a straightforward and cost-effective way to secure financial protection for a specified period. When you purchase a term policy, you choose the coverage amount, the duration of the term, and the premium you're willing to pay. If the insured person dies during the term, the beneficiary receives the death benefit. Once the term ends, the policy expires, and coverage ceases unless you decide to renew or convert it.

Term life insurance offers several benefits. Firstly, it is typically more affordable than permanent policies because it only provides coverage for a limited time. This makes it an excellent choice for those who want to secure financial protection for a specific goal, such as covering mortgage payments or providing for children's education. Additionally, term life insurance is easy to understand and offers clear coverage without the complexity of cash value accumulation.

Yes, many term life insurance policies offer the option to convert them into a permanent whole life insurance policy before the term ends. This conversion feature allows policyholders to continue their coverage indefinitely without the need for a medical examination or additional underwriting. It provides a seamless transition from term life to permanent coverage, ensuring long-term financial protection.

No-cash-value life insurance, also known as pure term life insurance, is designed to provide simple and affordable coverage without the investment component. It focuses solely on the death benefit and does not accumulate cash value. This type of policy is ideal for individuals who prioritize financial protection over long-term savings and want a straightforward insurance solution.