Life insurance is a sensitive topic that many people avoid discussing with their families. However, it is essential to have these conversations to ensure your loved ones are aware of your coverage and can access the benefits they are entitled to. If you are unsure whether a deceased relative had life insurance, there are several steps you can take to find out. Firstly, talk to friends, family members, and acquaintances as your loved one may have confided in them. Secondly, search through their personal belongings, old bills, and mail for any records or payments to insurance companies. Thirdly, contact their employers and member organisations as they may have had group life insurance or a policy through their work. You can also do an online search or contact your state's Insurance Commissioner's office for assistance.

| Characteristics | Values |

|---|---|

| How to find people who want life insurance | Check personal records and belongings |

| Review bank statements | |

| Monitor incoming mail | |

| Inspect storage spaces | |

| Browse address books and contact lists | |

| Examine tax returns | |

| Contact the deceased's financial advisors | |

| Use a life insurance policy locator | |

| Contact the insurance company | |

| Contact your state's unclaimed property office |

What You'll Learn

Check personal records and belongings for policy-related documents

Checking personal records and belongings for policy-related documents is a crucial step in locating a missing life insurance policy. Here are some detailed instructions to guide you through this process:

Start by gathering all the deceased's documents and correspondence, including paper and digital files, mail, and email. Review these carefully for any mentions of insurance-related information. Check for premium or dividend notices, as well as annual notices regarding the status of policies or statements of dividends. These notices may be found even if policy payments are up to date.

Next, examine the deceased's bank statements and check registers for payments made to life insurance companies. These transactions may be in the form of cheques or automatic drafts. Additionally, review their tax returns for the past two years to identify any interest income or expenses paid to life insurance companies. Life insurance companies often pay interest on accumulations on permanent policies and chart interest on policy loans.

If you come across any life insurance policy applications, pay close attention to them. These documents typically list any other life insurance policies owned by the deceased at the time of application.

It is also helpful to check the deceased's belongings, such as address books or personal phone directories, for the contact information of insurance agents. You can reach out to these agents to inquire if they have any records of the deceased's policies.

Don't forget to look through safe deposit boxes and other storage spaces for insurance-related documents. These could be kept with other important files and legal papers.

If you have access to the deceased's digital devices, such as computers or phones, you may also want to search their browsing history or downloaded files for any indications of online research or communication regarding life insurance policies.

By thoroughly checking personal records and belongings, you increase the chances of finding relevant policy documents or clues that can lead you to the life insurance policy you are seeking.

Pancreatitis: Can You Still Get Life Insurance?

You may want to see also

Contact the deceased's financial advisors

Contacting the deceased's financial advisors can be a crucial step in finding out if they had life insurance and can also help surviving family members navigate the financial aspects of their passing. Here are some reasons why contacting the deceased's financial advisors is important:

- Information on Life Insurance: Financial advisors often have knowledge of their clients' overall financial picture, including any life insurance policies they may have. They can inform you about the existence of such policies and guide you on the next steps to take.

- Wealth Protection and Estate Planning: Financial advisors are well-versed in wealth protection and estate planning. They can assist surviving family members in understanding the deceased's financial situation, including any debts, assets, and ongoing expenses. This can help the family make informed decisions about funeral arrangements, estate settlement, and managing immediate financial concerns.

- Beneficiary Support: Financial advisors can provide crucial support to the beneficiaries of the deceased's life insurance policy. They can help them understand their entitlements, rights, and the process of claiming benefits. This is especially important if the beneficiaries are unsure about their financial options or face challenges in navigating the insurance claim process.

- Referrals and Connections: Even if the financial advisor did not sell a life insurance policy to the deceased, they often have connections to qualified insurance professionals. They can provide valuable referrals, ensuring that the surviving family members receive the necessary support and guidance during this difficult time.

- Financial Planning for Surviving Spouses: For surviving spouses, the financial advisors of the deceased can offer valuable advice on financial planning for the long term. This includes guidance on managing finances, bills, and records, as well as making informed decisions about spending life insurance payouts or government benefits.

When a loved one passes away, contacting their financial advisors can provide much-needed clarity and support during a time of grief and uncertainty. It is a recommended step to help surviving family members navigate the financial implications of their loss and ensure they receive the benefits to which they are entitled.

Gun Ownership: Impact on Life Insurance Rates

You may want to see also

Use a life insurance policy locator

If you're trying to find out whether a deceased relative had a life insurance policy, you can use the National Association of Insurance Commissioners' (NAIC) Life Insurance Policy Locator Service. This is a free online tool that helps consumers find their deceased loved ones' life insurance policies and annuity contracts. It's important to note that this service is only available if you are the designated beneficiary or authorised legal representative.

Here's how you can use the NAIC Life Insurance Policy Locator:

- Go to naic.org in your web browser. Hover over 'Consumer' and click 'Life Insurance Policy Locator' under 'Tools'.

- Create an account by entering your email address and name.

- Log in and agree to the terms of use.

- Enter your name, mailing address, and email address.

- Submit a search request by entering the deceased's information from their death certificate, including their Social Security number, veteran status, and your relationship to the deceased.

- Once you've filled in all the required fields, click submit.

- Your request will be stored in a secure, encrypted database that participating life insurance and annuity companies can access through a secure portal.

- You will receive a confirmation email with the request details you submitted. If a policy is found and you are the beneficiary, the company will contact you directly, usually within 90 days.

- If no policy is found or you are not the beneficiary, you will not be contacted.

Please note that the NAIC has no policy or beneficiary information. This service is provided to help consumers locate relevant policies, but it is not a guarantee that a policy will be found.

Life Star: What Does Insurance Actually Cover?

You may want to see also

Contact the insurance company

If you are looking to find people who want life insurance, contacting the insurance company is a crucial step. Here are some detailed instructions on how to effectively do this:

- Identify the Insurance Company: Start by identifying the specific insurance company you believe your loved one had a policy with. This information can be found by examining personal records, such as documents, bank statements, notifications from insurance companies, premium payment receipts, or address books with contact information.

- Reach Out to the Company: Once you have identified the insurance company, don't hesitate to contact them directly. Explain your situation and provide relevant details, such as the full legal name of the deceased, their date of birth, Social Security number, and your relationship to them.

- Provide Proof of Beneficiary Status: Insurance companies have strict privacy and confidentiality policies. To access information, you will need to submit proof that you are a beneficiary or legally authorized to receive policy details. This can include providing a driver's license, Social Security number, and/or the policyholder's death certificate.

- Understand the Claim Process: If you discover that you are the beneficiary of a loved one's life insurance policy, understand the steps to file a claim. This typically involves collecting necessary documents, such as a certified copy of the death certificate and the completed claim form, and reaching out to the insurance company to notify them of the policyholder's passing.

- Be Proactive: Insurance companies may eventually try to contact beneficiaries if they are made aware of the policyholder's death. However, don't rely solely on this. Take the initiative to reach out and inquire about the policy and any necessary steps to make a claim.

- Utilize Online Resources: Many insurance companies have online resources and tools to help beneficiaries. Check their websites for policy locator tools, claim forms, and other relevant information to guide you through the process.

Selling Life Insurance in Georgia: A Comprehensive Guide

You may want to see also

Contact your state's unclaimed property office

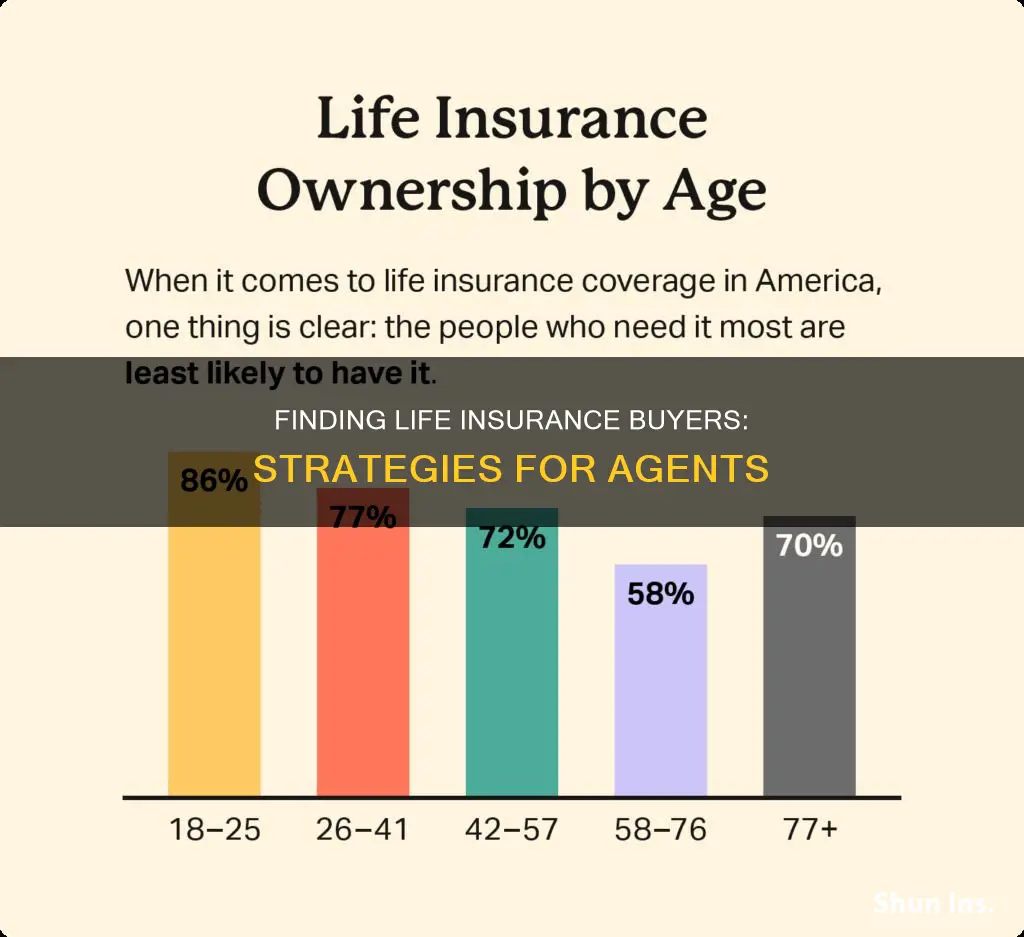

If you are looking to find people who want life insurance, there are several ways to go about it. Firstly, you can search for people who may be in the market for life insurance, such as those who have recently had children or purchased a home. These individuals may be looking to provide financial protection for their loved ones in the event of their death. You can also target individuals who are the primary breadwinners in their families, as they may want life insurance to ensure their families are taken care of financially if something happens to them. Additionally, you can use marketing strategies to reach a wider audience and create awareness about the importance of life insurance. This can include social media campaigns, collaborations with influencers, and educational workshops.

Another way to find people who want life insurance is to partner with employers. Many companies offer life insurance as part of their benefits packages, so you can reach out to HR departments and offer group life insurance plans for their employees. You can also attend industry events and conferences to network with potential clients and showcase the benefits of your life insurance offerings.

Now, if you are looking to find unclaimed life insurance policies or benefits, one suggestion is to contact your state's unclaimed property office. Each state has a process for handling unclaimed property, including unclaimed life insurance benefits. The Unclaimed Life Insurance Benefits Act requires life insurance companies to check the Social Security Administration's "Death Master File" database to identify deceased policyholders and their beneficiaries. If the insurance company is unable to locate the beneficiary, the funds are considered unclaimed or "dormant."

The process for claiming unclaimed life insurance benefits can vary by state, but here are some general steps to follow:

- Contact the unclaimed property office in the state where the deceased person last resided or where the policy was purchased. You can usually find this information on the state's government website.

- Provide the necessary information: You will likely need to provide documentation confirming your identity and your relationship to the deceased. This may include a death certificate, proof of your address, and other relevant information.

- Follow the state's claims process: Each state has its own procedure for filing claims and receiving benefits. Be sure to carefully follow the instructions provided by the state's unclaimed property office.

- Wait for the claim to be processed: The time it takes to process a claim can vary depending on the state and the complexity of the case. In some cases, you may be able to receive the benefits directly from the state, while in other cases, the state may facilitate a connection between you and the insurance company.

It's important to be vigilant and proactive in your search for unclaimed life insurance benefits. Don't wait for the insurance company to find you, as they may not have up-to-date information or may take a long time to notify beneficiaries. By taking the initiative and contacting the relevant state offices, you can increase your chances of recovering any unclaimed life insurance benefits that may be owed to you or your loved ones.

Children's Life Insurance: Who Gets the Money?

You may want to see also