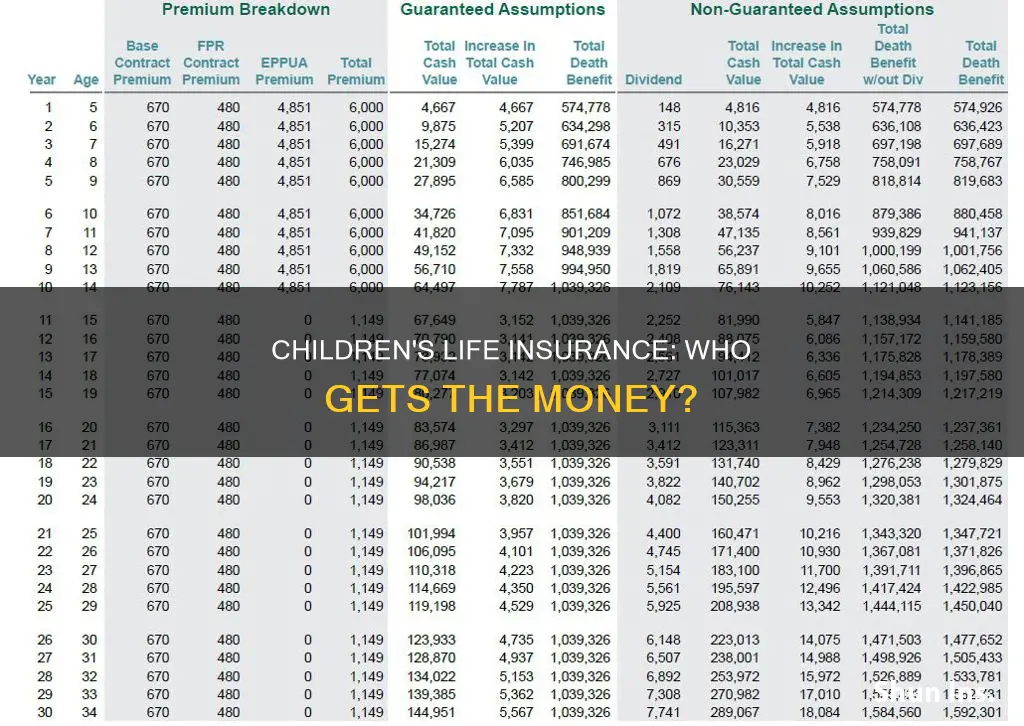

Life insurance for children is a permanent life insurance policy that provides a fixed death benefit to the beneficiary if the insured child dies while covered. It can also be used as a long-term savings mechanism, as the policy typically includes a cash value component that grows over time. The process for receiving life insurance proceeds depends on whether you are a named beneficiary or will inherit through an estate. If you are a named beneficiary, you typically only need to provide the insured person's proof of death and proof that you are the intended recipient of the benefits. However, if the inheritance is paid through a trust, the trustee is responsible for disbursing funds according to the direction of the trust documents.

| Characteristics | Values |

|---|---|

| Who inherits money from a life insurance policy? | The primary beneficiary or beneficiaries. If there are no primary beneficiaries, the money is paid to a contingent beneficiary. |

| How much money is needed to be eligible for life insurance inheritance? | You don't need any taxable income to be eligible for an inheritance. You need to be a named beneficiary to receive the policy death benefit or be listed in a will or trust as a beneficiary. |

| How long does it take to receive an inheritance from life insurance? | The proceeds from a life policy can pay out in a few business days once the insurance company has verified your claim. Sometimes, the verification process can take a few weeks to complete. |

| What type of life insurance should be purchased for inheritance? | Term life insurance, whole life insurance, universal life insurance, an annuity, and other insurance products. |

| Who should be named as a beneficiary? | It is recommended to name a trusted adult beneficiary who will use the money for the children's benefit. |

What You'll Learn

Naming a trusted adult beneficiary

Understanding the Role of a Beneficiary

Firstly, it's important to understand who a beneficiary is and their role in life insurance. A beneficiary is the person named in a life insurance policy who will receive the payout, also known as the death benefit, in the unfortunate event of the policyholder's demise. This individual is essentially the recipient of the financial protection offered by the life insurance policy.

Legal Restrictions on Minor Beneficiaries

When it comes to children's life insurance, it is generally not recommended to name minor children as the direct beneficiaries. Due to legal restrictions, life insurance companies cannot pay out the death benefit directly to minors. This means that if a minor is named as the beneficiary, there will be delays in the payout. Before the minor child can receive the death benefit, a court will appoint an adult custodian to manage the funds, which can take several months. During this time, the child will not have access to the financial support intended for them.

Options for Trust or Custodian Arrangements

To navigate this legal restriction, there are a few options to consider:

- Setting up a trust: You can set up an irrevocable life insurance trust (ILIT) and name the child as the beneficiary of that trust. This way, the death benefit is paid to the trust, and a trustee manages the funds according to your directions. You can specify how the funds should be used, such as for education, an allowance, or saved until the child reaches a certain age.

- Designating a custodian: If setting up a trust is not feasible, you can name a custodian to help the minor child claim and manage the death benefit. The custodian will be responsible for claiming the benefit and can use it for the child's interests, such as tuition or other necessities. It is crucial to choose a custodian you trust to act in the child's best interest.

Choosing the Right Adult Beneficiary

When selecting a trusted adult beneficiary, consider individuals who have the best interests of your child at heart and are capable of managing the funds responsibly. This could be a spouse, adult child, or another close relative. If you are a single parent, you might also consider naming a trusted family member who is already involved in your child's life and has their well-being at heart.

Communicating Your Wishes

Remember to communicate your wishes clearly to your chosen beneficiary. Discuss your plans with them and ensure they understand the responsibilities that come with being a beneficiary. Provide them with the necessary information about the policy, including the insurance company's details, and keep them updated on any changes.

Regularly Review and Update Beneficiaries

Life circumstances can change, and it's important to review and update your beneficiaries periodically. Major life events, such as marriage, divorce, the birth of a child, or a change in financial situation, should trigger a review of your beneficiaries. Ensure that the designated beneficiary is still the best choice and that their contact information and other relevant details are up to date.

In conclusion, when it comes to children's life insurance, it is essential to name a trusted adult beneficiary to ensure the smooth and timely distribution of the death benefit. By setting up a trust or designating a custodian, you can ensure that your child receives the financial protection you intended, even if they are a minor. Choosing the right beneficiary and maintaining open communication are vital steps in safeguarding your child's future.

Life Insurance and Terrorism: Payout Scenarios Explained

You may want to see also

Setting up a trust fund

Step 1: Understand the Different Types of Trusts

Before setting up a trust fund, it's important to understand the two main types: revocable and irrevocable trusts. A revocable trust offers more flexibility as you can make changes or cancel it at any time. This type of trust is typically chosen by most people and allows you to retain control over your trust and life insurance policy while you're alive. On the other hand, an irrevocable trust is permanent and cannot be easily changed or cancelled. This type of trust is often used by high net worth individuals to minimize federal estate taxes and protect their assets from creditors or lawsuits.

Step 2: Choose the Right Type of Trust for Your Needs

When deciding between a revocable and irrevocable trust, consider your specific needs and circumstances. If you have young children or want to maintain control over your trust and life insurance policy, a revocable trust is a good option. However, if you have a large estate and are concerned about estate taxes, an irrevocable trust may be more suitable. Keep in mind that irrevocable trusts are more complex and cannot be changed easily.

Step 3: Select the Right Type of Life Insurance for Your Trust

When setting up a trust fund, you can choose between term life insurance and permanent life insurance. Term life insurance covers a set number of years, usually 10 to 30, and is more affordable. Permanent life insurance, on the other hand, offers lifelong coverage as long as premiums are paid and often includes a "cash value" component that grows over time. Whole life insurance and universal life insurance are common types of permanent life insurance policies.

Step 4: Create a Trust Agreement

To set up your trust fund, you'll need to create a trust agreement. This document will include important information such as naming the trust's beneficiaries (typically your children) and providing instructions on how the life insurance policy's death benefit should be managed or distributed after your death. You can also specify the purposes for which the trust fund can be used, such as education, medical expenses, or a down payment for a home.

Step 5: Name a Trustee

A trustee is a person or entity responsible for managing the trust and distributing the assets according to your wishes. You can name yourself as the primary trustee while you're alive and designate a "successor" trustee to take over after your death. It's common to choose a close friend or family member as a trustee.

Step 6: Name Your Trust as the Beneficiary of Your Life Insurance Policy

Unless you have a large estate and are concerned about estate taxes, you can simply name your trust as the beneficiary of your life insurance policy. This will allow the trustee to collect and manage the death benefit on behalf of your children. You can also name your trust as a backup beneficiary if you prefer to have your spouse as the primary beneficiary.

Step 7: Continue Paying Your Life Insurance Premiums

It's important to stay up to date with your life insurance premiums to keep the policy active. If you've transferred ownership of the policy to your trust, the trustee will be responsible for making the premium payments on your behalf. You can fund these payments by sending money to the trust as a gift.

Step 8: Consider Seeking Professional Help

Fibromyalgia's Impact: Life Insurance Considerations and Challenges

You may want to see also

Using it for funeral costs

Funerals are expensive, with costs potentially running into the tens of thousands. Life insurance can be used to cover these costs, as well as other final expenses such as memorial services, headstones, urns, and burial or cremation.

The death benefit from a life insurance policy can be used to pay for funeral costs when a child passes away. This is typically paid out as a tax-free lump sum to the beneficiaries, who can then use the funds to cover funeral costs and other expenses.

There are several types of life insurance policies that can be used to cover funeral costs:

- Whole life insurance is a permanent life insurance policy that covers the insured for their whole life, provided that the premiums are paid. Whole life insurance policies tend to have higher premiums, but these are guaranteed to remain the same throughout the policy. A portion of the premium is often set aside and invested into a cash account, which grows in value over time. This type of policy is a safe and steady choice, as the cash value grows at a set rate.

- Term life insurance covers the insured for a chosen period, such as 20 or 30 years. This type of policy does not build any cash value, so the premiums tend to be cheaper. However, if the insured outlives the policy, there will be no payout to help with funeral expenses.

- Universal life insurance is another type of permanent life insurance that offers more flexibility than whole life insurance. The death benefit and premium can be adjusted at any time according to changes in circumstances. A portion of the premium goes into a cash account that grows at the market rate and can be borrowed against or withdrawn without decreasing the death benefit. However, this type of policy requires more attention to monitor the growth of the cash account, and the fees can add up and drain the account.

- Burial insurance or final expense insurance is a life insurance policy with a smaller benefit amount, typically designed to cover funeral expenses. These policies are usually purchased through an insurance company and cover amounts from $5,000 to $25,000. The application process is usually simple or non-existent, but these plans may only pay out a prorated amount to beneficiaries based on how much has been paid into the policy.

- Pre-need funeral insurance is offered by life insurance companies and, in some cases, funeral homes. These funds are paid directly to the funeral home and are usually paid out immediately after the insured's passing. Pre-need insurance can help save money by allowing individuals to pay for services that may be cheaper today than in the future. However, if the cost of the plan exceeds the cost of the funeral, loved ones will not receive the difference.

When deciding whether to use life insurance to cover funeral costs, it is important to consider the pros and cons of each type of policy. Whole life insurance, for example, guarantees future insurability and acts as a savings vehicle for the child, but it has a low rate of return and is a long-term financial commitment. Term life insurance, on the other hand, is more affordable but does not build cash value, and the coverage may expire before it is needed.

Voya's Life Insurance Offerings: What You Need to Know

You may want to see also

Paying off debt

Life insurance payouts can be used to pay off debt. This is one of the main reasons people take out a life insurance policy, to ensure they won't leave behind debts for their loved ones. The payout can be used to pay off any debt, including mortgages, credit card bills, and personal loans.

If you are considering using a life insurance payout to pay off debt, it is important to understand the different types of life insurance policies and how they can be used to pay off debt. There are two main types of life insurance: term life insurance and permanent life insurance.

Term life insurance is designed to last for a set period, such as 10 or 20 years. It is typically cheaper than permanent life insurance and can be a good option if you want to cover a specific debt, such as a mortgage or student loan. The payout from a term life policy goes directly to your beneficiary and can be used for any purpose.

Permanent life insurance, on the other hand, is open-ended and designed to last your entire life. It is more expensive than term life insurance and may not be necessary if you only need coverage for a specific period. However, if you want your beneficiaries to receive a payout regardless of when you die, permanent life insurance may be a good option.

When deciding whether to use a life insurance payout to pay off debt, there are a few things to keep in mind. First, consider the interest rates on your debt. If you are paying high-interest rates on credit cards or other loans, it may make sense to use the payout to eliminate that debt. This can free up disposable income that can be redirected to a retirement account or savings account.

Another thing to consider is the tax implications of the payout. In general, life insurance death benefits are not taxable, but if you choose to receive the payout in installments, any interest earned on those installments may be taxable. Consult a financial professional to understand the tax implications of your specific situation.

Additionally, it is important to weigh the emotional impact of receiving a life insurance payout. It can be tempting to make impulsive decisions or go on a spending spree after receiving a large sum of money. Give yourself time to grieve and make financial decisions without the pressure of immediate financial concerns. Seek guidance from a financial professional to determine the best use of the life insurance payout for your specific situation.

Life Insurance: A Warm Welcome or Cold Comfort?

You may want to see also

Covering living costs

- Paying off debt: The death benefit can be used to pay off any high-interest credit card debt or loans that the bereaved family might be dealing with. This can help reduce monthly expenses and free up disposable income for other needs.

- Creating an emergency fund: A life insurance payout can provide financial security for the family by establishing an emergency fund to cover unexpected medical costs, home repairs, or temporary job loss. Financial professionals generally recommend setting aside three to six months' worth of living expenses in an emergency fund.

- Purchasing an annuity: For families who have lost their primary breadwinner, the life insurance payout can be used to purchase an annuity to guarantee a steady income stream. This can help replace the lost income and provide financial stability for the family.

- Collecting installments: Instead of receiving a lump-sum payout, beneficiaries can opt for installment payments that provide a steady income over a period. This can ensure a regular source of funds to cover monthly living expenses.

- Investing for growth: If the bereaved family does not need immediate access to the entire death benefit, they can invest the money for potential growth. This can include investing in stocks, bonds, or retirement accounts to ensure long-term financial security and supplement retirement savings.

- Education expenses: A portion of the life insurance payout can be allocated to a college fund for the children's education. This can help secure their future and reduce the financial burden of higher education.

- Combination approach: Depending on the family's financial situation, a combination of the above approaches might be suitable. For example, a portion of the death benefit can be used to cover short-term living expenses, while the rest is invested for potential growth over the long term.

Life Insurance and Motorcycle Accidents: What's Covered?

You may want to see also

Frequently asked questions

A parent, guardian, or grandparent typically purchases life insurance for a child.

The average annual premium for a $25,000 policy on a newborn is $166.

If there are multiple beneficiaries, the life insurance death benefit will be split among them. It is important to establish clear communication between all parties to ensure everyone's needs are met and to prevent disputes.

Yes, a child can be named as a beneficiary of a life insurance policy. However, if the child is a minor, the court will appoint a property guardian, which can result in additional costs and hassle.

Life insurance money can be distributed to beneficiaries in a lump sum or through an annuity, which provides installment payments over several years.