Life insurance is a contract under which an insurance company agrees to pay a specified amount after the death of an insured party, provided that the premiums are paid. The payout amount is called a death benefit. The younger and healthier you are, the less you’ll pay for premiums. However, older people can still get life insurance. The cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The older you are, the more likely you are to die, and so the higher your premium will be. There are several methods to calculate the right amount of life insurance coverage, including multiplying your income by 10, the DIME (debt, income, mortgage, and education) method, and using a life insurance calculator.

| Characteristics | Values |

|---|---|

| Factors that determine life insurance premium | Age, gender, health, smoking status, family medical history, driving record, occupation, lifestyle, type of life insurance, policy term length, and risk class |

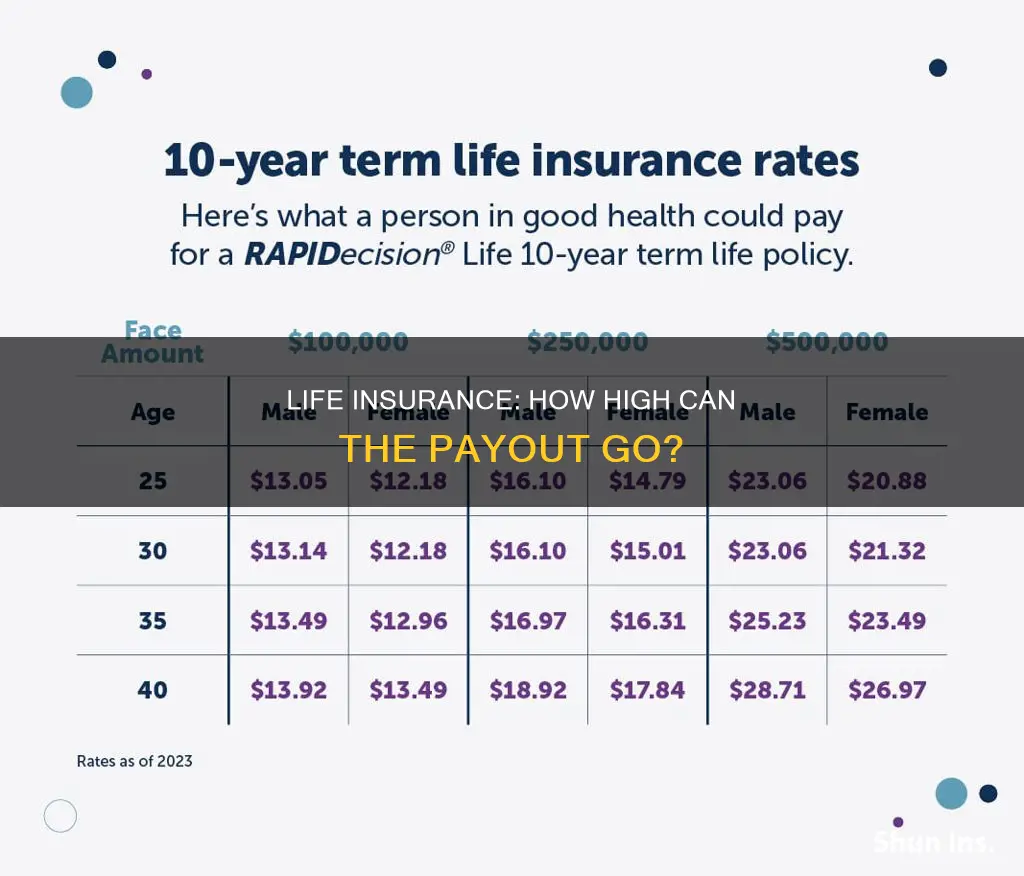

| Average cost of life insurance | $26 a month for a 40-year-old buying a 20-year, $500,000 term life policy |

| Average annual rates for men (term life insurance, non-smokers) | $360 (age 30), $480 (age 40), $840 (age 50) |

| Average annual rates for women (term life insurance, non-smokers) | $280 (age 30), $360 (age 40), $560 (age 50) |

| Average annual rates for men (term life insurance, smokers) | $600 (age 30), $840 (age 40), $1,440 (age 50) |

| Average annual rates for women (term life insurance, smokers) | $440 (age 30), $600 (age 40), $920 (age 50) |

| Average annual rates for men (whole life insurance, non-smokers) | $4,400 (age 30), $6,600 (age 40), $11,600 (age 50) |

| Average annual rates for women (whole life insurance, non-smokers) | $3,600 (age 30), $5,400 (age 40), $8,800 (age 50) |

| Average annual rates for men (whole life insurance, smokers) | $7,200 (age 30), $11,200 (age 40), $18,800 (age 50) |

| Average annual rates for women (whole life insurance, smokers) | $5,600 (age 30), $8,400 (age 40), $14,000 (age 50) |

What You'll Learn

Life insurance rates and age

Life insurance rates vary depending on several factors, with age being one of the most influential. As a rule of thumb, the older you get, the more life insurance rates increase. The younger you are, the less you'll pay for premiums, as younger people are generally healthier and have a lower risk profile. Insurance companies assess risk when determining premiums, and the lower risks for younger individuals translate to lower term life insurance rates.

Age is not the only factor that affects life insurance rates. Here are some other factors that play a role:

- Health: Many insurers require you to take a medical exam to get term life insurance. You may have to pay higher premiums if you have health issues such as diabetes, heart disease, or high blood pressure.

- Family's medical history: Your family's medical history can also impact your premiums. When applying for term life insurance, the insurer may ask if your family has a history of serious illnesses or diseases, such as cancer.

- Gender: Since women have a longer life expectancy than men, women typically pay less for life insurance.

- Smoking: Smokers often pay more for life insurance due to the increased risk of health issues associated with smoking.

- Lifestyle and occupation: People with high-risk jobs or hobbies may pay more in term life insurance premiums. For example, a construction worker or a skydiver may pay higher premiums.

- Coverage: The type and amount of coverage you choose can also affect your premiums. Term life insurance, for example, typically has lower premiums than permanent life insurance.

When determining how much life insurance you need, consider your financial and family situation, including your income, debts, and family's financial goals. A common rule of thumb is to have life insurance coverage of at least 10 times your annual income, but you may need more or less depending on your specific circumstances.

SSDI: Life Insurance and Death Benefits Explained

You may want to see also

Life insurance for seniors

Types of Life Insurance for Seniors

The most common types of life insurance for seniors include:

- Term life insurance: This is a good option if you know how long you want coverage for, as you can choose the length of your plan. However, the older you are, the less variety there is in term lengths, and the fees will likely be higher.

- Whole life insurance: This provides coverage for the entire life cycle of the policyholder, so benefits will be payable to your beneficiary no matter when you pass away.

- Final expense insurance: This is a type of permanent life insurance that offers a small death benefit to cover funeral, burial, and other end-of-life expenses. It typically has lower premiums than other permanent life insurance policies.

How to Choose a Life Insurance Policy as a Senior

When choosing a life insurance policy, consider your financial goals and physical health. If you're a healthy senior with few time-sensitive financial obligations, a term life policy may be a good option. On the other hand, if you want to leave something behind for your family beyond funeral expenses, consider whole or universal life insurance.

You can also look into simplified or guaranteed issue life insurance if you have a health condition that might disqualify you from conventional life insurance. These options have fewer or no health restrictions, but they generally cost more and offer less coverage.

NFL Players: Lifetime Health Insurance Coverage?

You may want to see also

Life insurance and health

Life insurance is a contract under which an insurance company agrees to pay a specified amount after the death of an insured party, as long as the premiums are paid. The payout amount is called a death benefit. Policies give insured people the assurance that their loved ones will have financial protection and peace of mind after their death.

There are two main types of life insurance: permanent and term. Permanent life insurance policies do not have an expiration date, meaning you’re covered for life as long as your premiums are paid. Many permanent life insurance policies offer an investment component that allows you to build cash value by investing a portion of the premiums you pay in the stock market or earning interest on your account. Term life insurance, on the other hand, only covers you for a set number of years and does not accumulate cash value.

The younger and healthier you are, the less you’ll pay for life insurance premiums. However, older people can still get life insurance, although it may be more cost-prohibitive depending on their health and the type of coverage they qualify for.

Your life insurance needs might also change as you age. For example, a young person living with their partner with no plans of having children may need less coverage and will often qualify for cheaper life insurance rates. On the other hand, an older person who is supporting a family or running a business will likely require a larger policy that lasts longer. This policy will likely be more expensive compared to that of a younger person who needs less coverage.

When determining how much life insurance you need, it's important to consider your financial and family situation. If you're single and have no dependents, have beneficiaries for your major assets, and have enough money to cover your debts and final expenses, you may not need life insurance. However, if you're the primary provider for your dependents or have a significant amount of debt, then insurance can help ensure your loved ones are well provided for if something happens to you.

There are several ways to calculate the ideal amount of coverage, such as multiplying your income by 10 or using the DIME (debt, income, mortgage, education) method. Ultimately, the amount of life insurance you need will depend on your age, income, mortgage, debts, anticipated funeral expenses, and other factors.

Senior Life Insurance: Scam or Legit?

You may want to see also

Life insurance and family

Life insurance is a crucial consideration for anyone looking to protect their family's financial future. It offers peace of mind by ensuring your loved ones will be financially secure even in your absence or illness. Here's how life insurance can benefit your family:

Financial Security

The primary purpose of life insurance is to provide financial protection for your family in the event of your death. It ensures that your family can maintain their standard of living, covering essential expenses such as mortgage payments, debts, and education costs. By replacing lost income, life insurance helps your family meet day-to-day living expenses and protects their financial stability.

Funeral and Burial Expenses

Life insurance can assist with funeral and burial costs, which can be substantial. This ensures that your family doesn't have to bear the financial burden of these expenses during an already difficult time.

Medical Bills

In the event of illness or injury, life insurance can help cover medical bills not fully paid by government or employer health plans. This is especially important if the primary breadwinner becomes sick or injured, as it relieves the financial strain on the family.

Retirement Planning

Life insurance can play a role in retirement planning. It can help protect retirement savings and ensure that your spouse or partner has the financial resources they need during their golden years.

Education Funding

Life insurance can provide funds for your children's education, ensuring they can pursue their academic goals without the burden of student debt.

Grieving and Healing

Life insurance gives your family the financial means to take time off to grieve and heal without the immediate pressure of financial worries.

Leaving a Legacy

Life insurance allows you to leave a financial legacy for your loved ones. This can include inheritance, establishing a trust, or contributing to a charity that aligns with your values.

When considering life insurance for your family, it's important to assess your unique needs and circumstances. Factors such as age, health, income, mortgage, debts, and future goals will influence the type and amount of coverage you require. Consulting with an advisor or insurance specialist can help you navigate the different options and choose the most suitable plan for your family.

Cigna's Roots: Connecticut General Life Insurance History

You may want to see also

Life insurance and debt

Life insurance can be used to pay off debt, although it's worth noting that debts are rarely inherited, so your loved ones are not usually left with the bill. However, there are instances when an outstanding balance can become the responsibility of others.

If you have a lot of debt, it may be wise to take out life insurance to cover the amount you owe. This will ensure that your beneficiaries can use the payout to pay it off. According to a NerdWallet study, 35% of Americans who buy life insurance do so to cover significant debts that others would be responsible for.

The primary purpose of life insurance is to replace your income after you die. So, aside from covering debt, you may need coverage if anyone relies on you financially. The payout can replace your salary and give your loved ones the cash they need to maintain their lifestyle.

In general, the assets in your estate are used to pay off your debts when you die. If there isn't enough money in the estate to settle the debt, it goes unpaid. However, there are circumstances where other people may be responsible for the remaining balance. These include:

- Cosigners and joint owners: If someone cosigns your debt, they are typically responsible for it after you die.

- Spouses: In community property states, surviving spouses are responsible for debts left by deceased partners. Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin are community property states.

- Even if no one is responsible for your debts after you die, you may still want coverage. A life insurance payout can help your beneficiaries pay off the debt so the money in your estate can go to your heirs.

Covering debt: Term or permanent life insurance?

There are two main types of life insurance: permanent and term. Term life insurance is designed to last for a set period, like 10 or 20 years, and is sufficient for most families and a common option for covering debt. You can choose a term length that matches the length of the loan. Permanent life insurance, on the other hand, is open-ended and designed to last your entire life, although some policies have a maximum payout age.

Life insurance can be used to pay off any debt, including mortgages, credit card bills and personal loans.

Using life insurance to pay off a mortgage

If someone cosigned your mortgage or is a co-borrower on the loan, they would be responsible for the debt if you die. Putting them as the beneficiary on a life insurance policy means they can use the payout to settle the debt and keep the house.

If no one is responsible for the debt and your estate doesn't have enough funds to cover the mortgage, the lender may foreclose on the property. However, if someone inherits the home and wants to keep it, they are usually allowed to continue paying the mortgage. In this case, a life insurance payout can help them cover the cost.

Using life insurance to pay off student loans

Student debt is often forgiven after death, so life insurance coverage may not be necessary. For example, if you take out a parent's federal PLUS loan for your child's college fees, and you or your child die, the debt is discharged. Even if you cosign a private student loan, you may not be responsible for the debt if your child (the borrower) dies.

However, if your child relies on your income to pay off their student loan and you die, a life insurance payout can help them cover the debt in your absence. You may also consider getting a life insurance policy if you take out a private parent loan for your child, as these loans are usually not discharged if you (the borrower) die.

Using life insurance to pay off credit card debt

The remaining balance on your credit cards may become the responsibility of a cosigner or joint owner of your account. Buying a policy to cover the amount you owe can help your beneficiaries pay it off if you die. Authorized users, such as partners or children who are allowed to use cards on the account, are not responsible for the debt.

Using life insurance to pay off business loans

After you die, the payout from a life insurance policy can help your business partners pay off any loans they would now be solely responsible for. Even if your partners are not required to pay off the loan, a life insurance payout can help cover costs during a difficult time.

Life Insurance and Long-Term Disability: What's the Deal?

You may want to see also

Frequently asked questions

The cost of life insurance is influenced by age, gender, smoking status, health, family medical history, driving record, occupation, and lifestyle. Life insurance rates increase with age as the likelihood of a payout rises. Women tend to pay lower premiums than men due to higher life expectancy. Smokers pay higher rates due to increased health risks. Health factors such as pre-existing conditions, blood pressure, cholesterol, and weight also impact premiums. Family medical history, driving record, hazardous jobs, and risky activities can further affect rates.

Life insurance calculation methods include multiplying your income by 10, the DIME (debt, income, mortgage, education) method, and the years-until-retirement method. The income multiplication method suggests coverage of at least 10 times your annual salary. The DIME method covers debts, income replacement, mortgage, and children's education. The years-until-retirement method multiplies annual salary by the years left until retirement.

The two main types of life insurance are term life insurance and permanent life insurance. Term life insurance covers a set number of years without building cash value. It is the least expensive option. Permanent life insurance lasts a lifetime and includes a cash value component, allowing policyholders to borrow against the policy or withdraw funds. It is significantly more expensive than term life insurance.

The amount of life insurance needed depends on your financial and family situation. Factors to consider include your savings, debts, income, mortgage, children's education, and end-of-life expenses. Calculate your financial obligations and subtract existing assets that can be used toward those obligations to estimate your life insurance need.