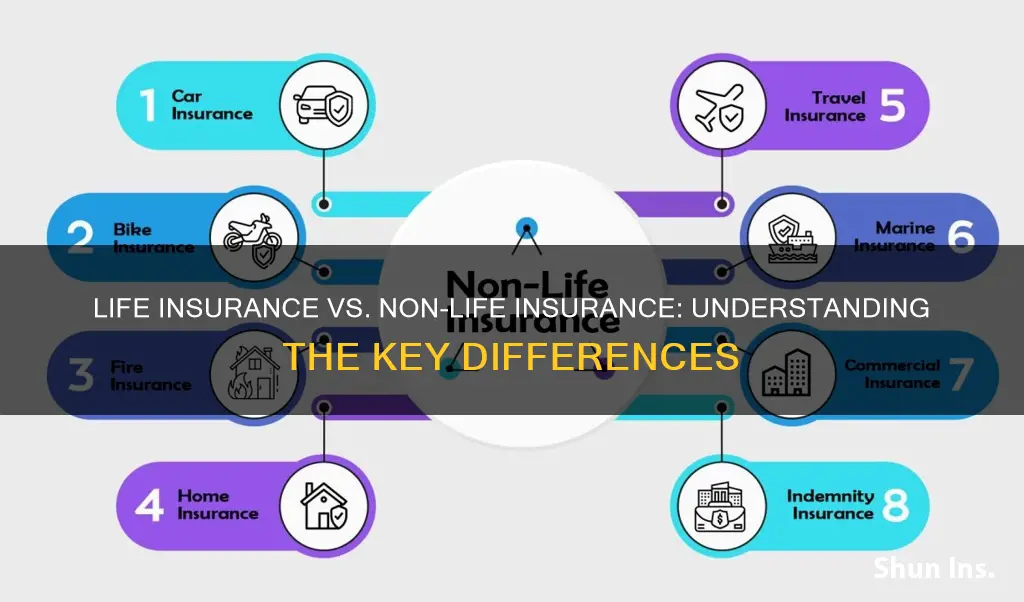

Life insurance and non-life insurance are two distinct types of insurance policies that offer financial protection and coverage for different aspects of life. Life insurance is a contract between an individual and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the insured person's death. This type of insurance provides financial security to loved ones, covering expenses such as funeral costs, mortgage payments, or living expenses. On the other hand, non-life insurance, also known as general insurance, covers various risks and perils associated with property, vehicles, health, and liability. It provides financial protection against accidents, natural disasters, theft, and other unforeseen events, ensuring individuals and businesses are safeguarded from potential financial losses. Understanding the differences between these insurance types is essential for individuals to choose the right coverage based on their specific needs and circumstances.

What You'll Learn

- Coverage Duration: Life insurance provides coverage for a specific period, while non-life insurance covers for a defined event or until a claim is made

- Risk Assessment: Life insurance involves assessing long-term risks, whereas non-life insurance focuses on immediate or specific risks

- Benefits: Life insurance offers financial support to beneficiaries, while non-life insurance provides compensation for losses or damages

- Premiums: Life insurance premiums are typically paid regularly, while non-life insurance premiums may be paid annually or at specific intervals

- Claims Process: Life insurance claims often involve a more complex process, while non-life insurance claims are usually straightforward and quick

Coverage Duration: Life insurance provides coverage for a specific period, while non-life insurance covers for a defined event or until a claim is made

The primary distinction between life and non-life insurance lies in their coverage duration and the nature of the events they are designed to protect against. Life insurance is a financial safety net that provides coverage for a specific period, typically the insured individual's lifetime. This type of insurance is crucial for individuals who want to ensure their loved ones are financially secure in the event of their passing. The policy's duration is predetermined, and the coverage ends upon the insured person's death. For example, a term life insurance policy might cover an individual for 10, 20, or 30 years, providing a sense of security during that specific period.

On the other hand, non-life insurance, also known as general insurance, covers a defined event or period until a claim is made. This category includes various insurance types, such as property insurance, liability insurance, and health insurance. For instance, a homeowner's insurance policy protects a property against damage or loss for a specific period, usually a year, and the coverage continues as long as the policy remains active. Similarly, liability insurance provides coverage for a defined period, such as a year, and the policyholder is protected until a claim is made or the policy expires.

The key difference is that life insurance offers long-term protection, ensuring financial security for beneficiaries over an extended period. In contrast, non-life insurance provides coverage for a more limited time, focusing on specific events or risks. Non-life insurance policies are often renewable, allowing policyholders to extend coverage if needed, while life insurance policies are typically non-renewable, meaning the coverage ends as per the policy terms.

Understanding the coverage duration is essential for individuals to choose the right insurance type for their needs. Life insurance is ideal for those seeking long-term financial protection for their families, while non-life insurance caters to various risks and events with defined coverage periods. This distinction highlights the importance of evaluating one's insurance requirements and selecting policies that align with specific coverage needs.

Life Insurance Beneficiaries: Divorce and Your Entitlements

You may want to see also

Risk Assessment: Life insurance involves assessing long-term risks, whereas non-life insurance focuses on immediate or specific risks

Life insurance and non-life insurance are two distinct types of insurance policies, each serving different purposes and addressing various risks. Understanding the difference between these two forms of insurance is crucial for individuals seeking financial protection and peace of mind.

Life insurance is a long-term financial planning tool designed to provide financial security for the insured's beneficiaries in the event of their death. It primarily focuses on assessing and managing risks associated with mortality. When considering life insurance, the primary risk assessment revolves around the likelihood and potential consequences of the insured's death. This includes evaluating factors such as age, health, lifestyle, and family medical history. The goal is to determine the probability of the insured's untimely demise and calculate the appropriate coverage amount to ensure the financial well-being of the beneficiaries. Life insurance policies often offer various coverage options, such as term life, whole life, or universal life, each with its own set of benefits and risk considerations.

On the other hand, non-life insurance, also known as general insurance, covers a wide range of risks and perils that may affect an individual or their assets. This category includes various types of insurance, such as health insurance, auto insurance, home insurance, and property insurance. Non-life insurance policies typically focus on immediate or specific risks that can impact an individual's daily life or possessions. For example, health insurance provides coverage for medical expenses and healthcare services, ensuring financial protection against unexpected illnesses or accidents. Auto insurance safeguards against financial losses resulting from vehicle damage or liability claims. Home insurance protects against risks like fire, theft, or natural disasters that could damage one's residence.

The key difference in risk assessment lies in the time frame and nature of the risks covered. Life insurance deals with long-term risks, primarily centered around the insured's mortality. It requires a thorough understanding of statistical data, mortality rates, and life expectancy to determine appropriate coverage. In contrast, non-life insurance addresses immediate or specific risks that can occur at any time. These risks are often more localized and can be managed through various policy options and coverage limits tailored to individual needs.

In summary, life insurance and non-life insurance serve distinct purposes and require different risk assessment approaches. Life insurance involves evaluating long-term mortality risks to provide financial security for beneficiaries, while non-life insurance focuses on immediate or specific risks that can impact daily life and assets. Understanding these differences is essential for individuals to make informed decisions when selecting the appropriate insurance coverage for their unique circumstances.

Who Gets Notified: Life Insurance Beneficiaries and the Process

You may want to see also

Benefits: Life insurance offers financial support to beneficiaries, while non-life insurance provides compensation for losses or damages

Life insurance is a financial safety net designed to provide financial security and peace of mind to individuals and their loved ones. When someone purchases life insurance, they essentially make a promise to an insurance company that, in exchange for regular premium payments, the company will pay out a predetermined sum of money (the death benefit) to the policy's beneficiaries upon the insured individual's death. This death benefit can be a crucial source of financial support for the beneficiaries, helping them cover various expenses and maintain their standard of living. For instance, it can be used to pay for funeral expenses, outstanding debts, mortgage payments, or even to fund a child's education. The primary benefit of life insurance is that it ensures the financial well-being of the family or dependents even in the event of the insured's untimely passing.

On the other hand, non-life insurance, also known as property, casualty, or general insurance, focuses on providing financial protection against various risks and losses associated with property, vehicles, and other assets. This type of insurance covers a wide range of potential issues, such as damage to one's home or car, medical expenses for injuries sustained in an accident, or liability claims. For example, if a person's car is involved in an accident and causes damage to another vehicle or property, their non-life insurance policy might cover the repair or replacement costs. Similarly, health insurance, a common form of non-life insurance, helps individuals manage medical expenses by covering doctor visits, hospital stays, and prescription medications.

The key difference in benefits lies in the nature of the coverage. Life insurance is specifically tailored to provide financial support to designated individuals (beneficiaries) when the insured person dies. It offers a sense of security and ensures that the family's financial obligations are met, even in the absence of the primary income earner. Non-life insurance, however, is more about compensating for losses or damages that occur during the policy period. It provides financial protection against various risks, helping individuals and businesses recover from unforeseen events and minimize potential financial setbacks.

In summary, while life insurance focuses on providing financial security to beneficiaries in the event of the insured's death, non-life insurance is designed to offer protection and compensation for a wide range of potential losses and damages. Both types of insurance play vital roles in helping individuals and families manage financial risks and ensure a more secure future. Understanding these differences is essential for making informed decisions when choosing the right insurance coverage to meet one's specific needs.

Understanding Cash Surrender Value of Life Insurance Policies

You may want to see also

Premiums: Life insurance premiums are typically paid regularly, while non-life insurance premiums may be paid annually or at specific intervals

When it comes to insurance, understanding the differences between life and non-life insurance is essential for making informed decisions about your coverage. One key aspect to consider is how premiums are structured and paid for each type of insurance.

Life insurance is designed to provide financial protection and peace of mind for your loved ones in the event of your passing. The premiums for life insurance are often structured as regular payments, typically made monthly, quarterly, or annually. These regular premium payments ensure that you maintain continuous coverage, providing a financial safety net for your beneficiaries. The frequency of payments can vary depending on the insurance provider and the specific policy, but the consistent nature of these payments is a defining characteristic of life insurance.

On the other hand, non-life insurance, also known as general insurance, covers a wide range of risks and events that can occur during your lifetime. This category includes various types of insurance, such as health insurance, auto insurance, homeowners' insurance, and property insurance. Non-life insurance premiums can be structured in different ways. Some policies may require annual payments, where the entire premium is due at the start of the policy year. Others might offer semi-annual or quarterly payment options, providing more flexibility for policyholders. Additionally, some non-life insurance companies may offer discounts for paying premiums annually, encouraging customers to opt for this payment method.

The difference in premium payment structures between life and non-life insurance is primarily due to the nature of the coverage and the associated risks. Life insurance is a long-term commitment, providing coverage for an extended period, often until the insured individual's passing. The consistent premium payments ensure that the policy remains active and that the insurance company can fulfill its obligations. In contrast, non-life insurance policies may cover shorter periods or specific events, and the payment structure reflects the varying levels of risk and the potential for more frequent claims.

Understanding these premium payment differences is crucial when comparing and choosing insurance policies. It allows individuals to make informed decisions based on their specific needs and financial circumstances. Whether it's the regular payments of life insurance or the varied payment options of non-life insurance, knowing these details ensures that you select the right coverage for your requirements.

When to Renew Your Illinois Life Insurance License

You may want to see also

Claims Process: Life insurance claims often involve a more complex process, while non-life insurance claims are usually straightforward and quick

The claims process is a critical aspect that distinguishes life insurance from non-life insurance. When it comes to life insurance, the claims process can be intricate and time-consuming due to the sensitive nature of the event. Typically, a life insurance claim involves verifying the death of the insured individual, which requires gathering and submitting various documents such as death certificates, medical records, and sometimes even witness statements. This process is often more rigorous and may involve multiple parties, including funeral directors, medical examiners, and insurance company representatives. The complexity arises from the need to ensure the accuracy of the insured's details, the cause of death, and the validity of the claim, especially in cases where the death is unexpected or sudden.

In contrast, non-life insurance claims are generally more straightforward and rapid. Non-life insurance, such as property or health insurance, deals with events that can be more easily documented and verified. For instance, when filing a property insurance claim, the process usually involves assessing the damage, providing proof of loss, and obtaining estimates from repair professionals. The insurance company will then review the evidence and either approve or deny the claim based on the policy's terms. This process is often quicker because the events covered by non-life insurance are typically less complex and more commonly encountered, making the claims handling more standardized and efficient.

The difference in the claims process is primarily due to the nature of the risks covered by each type of insurance. Life insurance involves a high-stakes, emotional event, which demands a meticulous and sensitive approach to ensure the rightful beneficiary receives the payout. Non-life insurance, on the other hand, deals with more frequent and predictable events, allowing for a more streamlined and automated claims process. This distinction in complexity and speed of the claims process is a key factor for consumers to consider when choosing between life and non-life insurance policies, as it can significantly impact the overall experience and satisfaction of the policyholder.

Understanding these differences in the claims process is essential for individuals to navigate the insurance landscape effectively. It empowers policyholders to make informed decisions and manage their expectations regarding the time and effort required to settle a claim. Moreover, it highlights the importance of choosing the right type of insurance coverage based on one's specific needs and the potential risks associated with different life events.

In summary, the claims process for life insurance is often more intricate and time-intensive due to the verification of death and the sensitivity of the event. In contrast, non-life insurance claims are typically quicker and more straightforward, dealing with events that are easier to document. This distinction is a fundamental aspect of the insurance industry, influencing how policyholders perceive and interact with their insurance providers.

Life Insurance, Health Insurance, and Taxes: What's the Link?

You may want to see also

Frequently asked questions

Life insurance is a type of coverage that provides financial protection for the beneficiaries in the event of the insured person's death. It offers a death benefit to help cover expenses and provide financial security to the family or designated recipients. Non-life insurance, also known as general insurance, covers various risks and perils other than death. This includes health insurance, which provides coverage for medical expenses, and property insurance, which protects against damage or loss of assets.

Life insurance offers a guaranteed payout upon the insured individual's passing, ensuring financial stability for the beneficiaries. The death benefit can be used to cover funeral expenses, outstanding debts, mortgage payments, or provide long-term financial support for dependents. Non-life insurance, on the other hand, focuses on protecting against financial losses due to accidents, illnesses, natural disasters, or other specified events. For example, health insurance covers medical bills, while property insurance safeguards against property damage.

Both types of insurance policies provide financial protection and peace of mind to individuals and their families. They are designed to manage risks and mitigate potential financial losses. Additionally, both life and non-life insurance can be customized to fit specific needs and can be tailored to include various coverage options, benefits, and exclusions.

A common misconception is that life insurance is only necessary for families with young children or those with financial dependents. In reality, life insurance can be beneficial for individuals of all ages, as it provides financial security for loved ones and helps cover final expenses. Another myth is that non-life insurance is less important because it doesn't provide a death benefit. However, non-life insurance is crucial for managing everyday risks and can offer essential financial protection against unforeseen events.