Life insurance is an important financial tool that provides financial protection to those who rely on you in the event of your death. It is a contract between an insurance company and an individual, where the company agrees to pay a specified amount, known as a death benefit, to the insured person's beneficiaries after their death, as long as the premiums are paid. While it is a valuable part of an overall financial portfolio, a significant number of people do not have adequate coverage or any coverage at all. According to recent studies, approximately 51% of Americans have at least one life insurance policy, while about 42% of adults need to obtain life insurance or increase their existing coverage. This gap between those who have life insurance and those who need it highlights the importance of addressing misconceptions about cost and educating consumers on the value and potential affordability of life insurance.

| Characteristics | Values |

|---|---|

| Percentage of Americans with life insurance | 52% |

| Percentage of Americans with only group coverage | 26% |

| Percentage of Americans intending to buy life insurance online | 29% |

| Percentage of insured Americans who wish they had purchased their policies younger | 40% |

| Percentage difference between life insurance ownership for women and men | 11% |

| Face amount of life insurance policy purchases in the US | $3.29 trillion |

| Percentage difference between premiums for men and women | 24% |

| Number of life insurance policies purchased in the US in 2018 | N/A |

| Number of life insurance policies purchased in the US in 2022 | N/A |

| Number of life insurance policies purchased in the US in 2023 | N/A |

What You'll Learn

- Life insurance can cover funeral and burial expenses, pay off remaining debts, and help with day-to-day living expenses

- Life insurance can be purchased through an employer or individually

- The younger and healthier you are, the less you'll pay for life insurance premiums

- Life insurance can be a helpful financial tool, but it doesn't make sense for everyone

- Life insurance can be used to provide an inheritance or establish a trust upon death

Life insurance can cover funeral and burial expenses, pay off remaining debts, and help with day-to-day living expenses

Life insurance is a financial safety net for your loved ones after you pass away. It ensures they have the financial security to cover your funeral and burial expenses, pay off any remaining debts, and manage day-to-day living expenses.

Covering Funeral and Burial Expenses

The median cost of a funeral with viewing and burial in 2021 was $7,848. Burial insurance, also known as funeral or final expense insurance, is a type of whole life insurance policy designed to cover these end-of-life costs, including funeral arrangements and burial costs. This relieves your loved ones of the financial burden during their time of grief.

Paying Off Remaining Debts

Your beneficiaries can use life insurance to pay off any outstanding debts, although not all debts are inherited. In general, the assets in your estate are used to settle your debts, and if there's not enough money, the debt goes unpaid. However, there are situations where others may be responsible for the remaining balance. For example, if someone cosigned your debt or was a joint owner, they would typically be responsible for it after your death. Life insurance can help your beneficiaries manage these financial obligations.

Helping with Day-to-Day Living Expenses

The primary purpose of life insurance is to replace your income after your death. If anyone relies on you financially, the payout can replace your salary and provide your dependents with the money they need to maintain their lifestyle and cover daily expenses. This is especially important if you have children or other dependents who require ongoing financial support.

Life insurance is a valuable tool to ensure your loved ones have the financial resources they need to manage the various expenses that arise after your passing. It provides peace of mind, knowing that your family will be taken care of during a difficult time.

Life Insurance for Patent Holders: Is It Possible?

You may want to see also

Life insurance can be purchased through an employer or individually

Life insurance is a crucial financial product that ensures your loved ones are provided for in the unfortunate event of your death. When it comes to purchasing life insurance, you have two main options: buying it through your employer or purchasing it individually. Here are some detailed paragraphs outlining the steps and considerations for each option.

Purchasing Life Insurance Through Your Employer

Many companies offer group life insurance coverage as an employee benefit. This can be a convenient and cost-effective way to obtain life insurance. Here are some key points to consider:

- Understanding the Policy: When offered life insurance through your employer, it's important to carefully review the policy details. Understand the coverage amount, any restrictions or limitations, and whether the policy is renewable or convertible upon leaving the company.

- Automatic Enrollment: In some cases, employers may automatically enrol their employees in a basic life insurance plan. This is often provided as a complimentary benefit, and the coverage amount may be equal to your annual salary. However, you may have the option to opt out or customise the coverage.

- Additional Coverage: If the employer-provided coverage doesn't meet your needs, you can often purchase supplemental life insurance through your company. This allows you to increase your coverage amount or extend it to include your spouse or dependents.

- Portability: Keep in mind that employer-provided life insurance policies are usually tied to your employment. If you leave the company, your coverage may end or become more expensive to maintain. Consider your long-term plans and whether you may need portable coverage that stays with you even if you change jobs.

- Cost and Convenience: One of the main advantages of employer-provided life insurance is the cost. Group life insurance policies are often more affordable than individual policies, and the premiums may be deducted directly from your paycheck, making payments convenient.

Purchasing Life Insurance Individually

If you're not satisfied with the coverage offered by your employer or don't have access to employer-provided insurance, you can purchase life insurance on your own. Here are some key steps and considerations:

- Assess Your Needs: Before purchasing life insurance, evaluate your financial situation and the needs of your dependents. Consider your income, debts, mortgage, and the future expenses of your loved ones, such as education costs. This will help you determine the coverage amount and policy type that best suits your situation.

- Choose a Policy Type: There are two main types of life insurance policies: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, often 10 to 30 years, and is generally more affordable. Permanent life insurance offers lifelong coverage and often includes a cash value component, making it more expensive.

- Compare Insurance Providers: Research different life insurance companies and their offerings. Consider their financial strength, customer service reputation, and the specific policy options they provide. This will help you identify providers that align with your needs and preferences.

- Request Quotes: Contact multiple insurance companies to request quotes. Provide them with personal information, such as age, gender, and health history, to receive an accurate estimate of the premiums. Comparing quotes will help you find the most competitive rates and suitable coverage.

- Complete the Application Process: Once you've selected a provider, fill out the application form. Be prepared to provide basic personal information, answer health-related questions, and choose your beneficiaries. The insurance company may also require a phone interview and a medical exam before finalising your application.

- Review and Purchase: After submitting your application, the insurance company will evaluate your information and determine your eligibility and premium amount. If you're satisfied with the offer, review the policy documents carefully before signing and making the first premium payment. Your coverage will then become active.

Guardian Life Insurance: A Smart Choice?

You may want to see also

The younger and healthier you are, the less you'll pay for life insurance premiums

Life insurance premiums are largely influenced by your age and health. The younger and healthier you are, the less likely you are to incur health issues or die, which translates to lower premiums. Conversely, older individuals tend to pay higher premiums as they are more likely to face health complications or pass away, increasing the risk for insurers.

Age-Based Premiums

Age is a pivotal factor in determining life insurance premiums. The likelihood of passing away increases with age, elevating the risk for insurers and leading to higher policy costs. Generally, the premium amount increases by about 8-10% for each year of age, but this can vary depending on your age group. For individuals in their 40s, the annual increase may be as low as 5%, while those over 50 may experience increases of up to 12%.

Term life insurance, a popular choice for young families, offers fixed premiums throughout the policy term. However, permanent life insurance premiums may rise annually, making it more expensive for older individuals.

Health Status and Lifestyle

In addition to age, insurers consider overall health and lifestyle choices when calculating premiums. Individuals with pre-existing medical conditions or unhealthy habits, such as smoking, may face higher rates due to an increased likelihood of a payout. Obesity, high blood pressure, and risky hobbies like skydiving can also contribute to higher premiums.

Timing is Key

As the saying goes, "the longer you wait, the costlier it gets." The best time to purchase life insurance is when you're young and healthy, as you're considered low risk and will be offered lower premiums. Waiting too long may result in higher costs or even difficulties in obtaining coverage, especially if health issues arise.

Example Scenarios

To illustrate, consider a young, healthy couple in their 30s with a child. They might opt for term life insurance with a $500,000 coverage over 30 years. This ensures financial protection for their spouse and child in the event of an untimely death. The premium for this scenario would be significantly lower than that of an older individual with a larger policy, reflecting the lower risk associated with their age and health.

Credit Union Life Insurance: What You Need to Know

You may want to see also

Life insurance can be a helpful financial tool, but it doesn't make sense for everyone

Life insurance is a helpful financial tool for many, but not everyone needs it. While it can provide financial security for loved ones, covering expenses like daily living, education, and debts, it's not always necessary. Here are some scenarios where life insurance is beneficial, as well as situations where it may not be needed:

When Life Insurance Makes Sense

Life insurance is particularly relevant for those who have financial dependents. Here are some groups of people who may benefit from having life insurance:

- Parents of young children: Life insurance can ensure that children's needs are met and provide financial stability if a parent passes away. It can cover costs such as food, clothing, education, and daily living expenses.

- Stay-at-home parents: Even if a parent doesn't earn a traditional salary, their contributions to the family, such as childcare, cooking, and transportation, have significant financial value. Life insurance can help cover these costs if the stay-at-home parent passes away.

- Couples without children: If one partner relies financially on the other, life insurance can ensure the surviving partner maintains their standard of living and covers shared debts.

- People with co-owned debt: Life insurance can help pay off shared debts, such as a mortgage, so that the surviving partner or family members are not burdened.

- Business owners: Life insurance can protect business partners and employees by providing financial support in the event of the owner's death. It can also be used to buy out the deceased owner's share of the business.

- Those wanting to leave a financial legacy: Life insurance can be used to pass on money to grandchildren for education or to support charitable causes.

When Life Insurance May Not Be Necessary

On the other hand, there are situations where life insurance may not be necessary:

- Single individuals without dependents: If someone is single, financially independent, and has no dependents, they may not need life insurance. However, if they have financial dependents, such as siblings with special needs, they may still want to consider it.

- Individuals with sufficient wealth: If someone has accumulated enough wealth to cover their final expenses and take care of their family upon their passing, they may not need life insurance.

- Older adults with no financial dependents: If someone is retired, has a paid-off mortgage, and no longer has financial dependents, they may not require life insurance.

In conclusion, while life insurance can be a valuable financial tool, it's important to assess your personal circumstances to determine if it aligns with your needs. It's crucial to weigh factors such as financial obligations, dependents, and future goals when considering life insurance.

Pera's Life Insurance Offering: What You Need to Know

You may want to see also

Life insurance can be used to provide an inheritance or establish a trust upon death

Life insurance is an important financial tool that can provide financial protection to your loved ones after you're gone. It can be used to leave an inheritance or establish a trust for your beneficiaries, ensuring they receive the money you intended for them. Here are some key points on how life insurance can be used to provide an inheritance or establish a trust upon your death:

Using Life Insurance to Provide an Inheritance

Life insurance is a powerful tool to provide an inheritance for your loved ones. Here are some key benefits:

- Tax-free Payouts: The death benefit from a life insurance policy is typically tax-free, allowing your beneficiaries to receive the full amount without paying income tax.

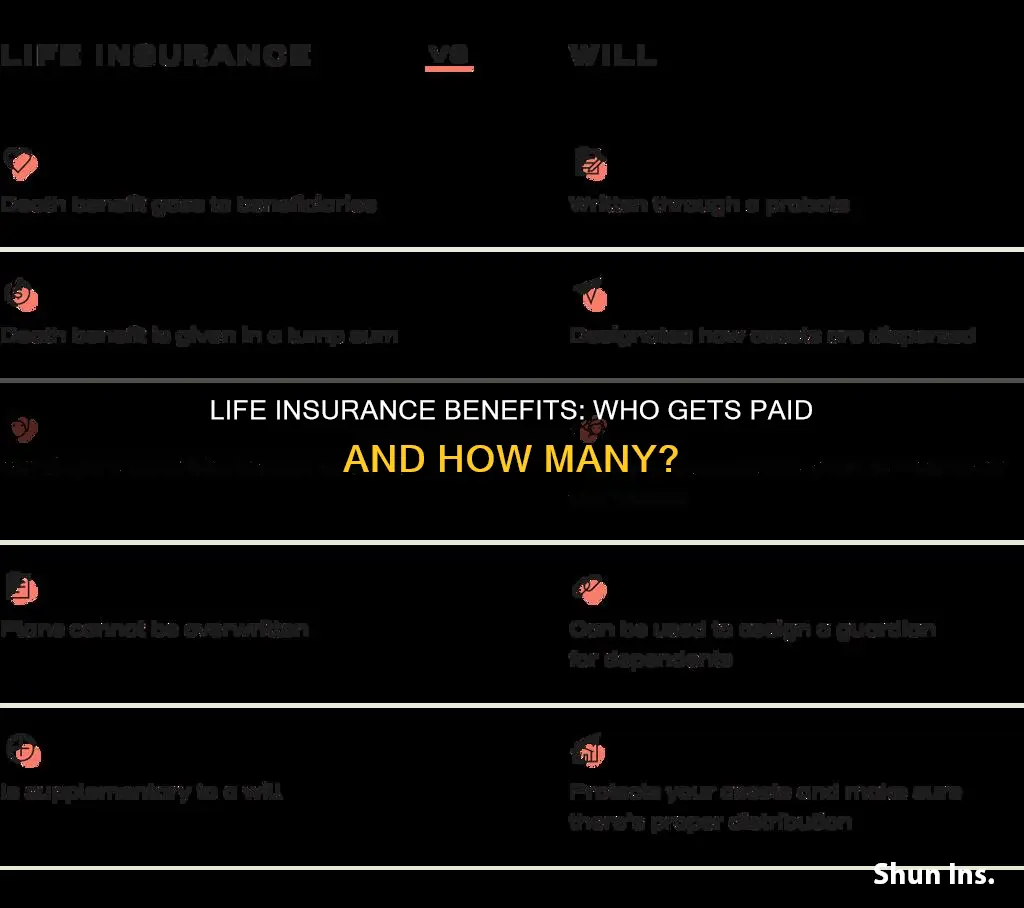

- Direct Payout to Beneficiaries: The life insurance payout goes directly to the named beneficiaries, bypassing the probate process and ensuring quick access to funds. This means your beneficiaries can use the money for any purpose, such as covering final expenses, paying off debts, or investing for the future.

- No Strings Attached: Life insurance provides a cash inheritance with no strings attached. Your beneficiaries can use the money as they see fit, giving them financial flexibility during a difficult time.

- Protection for Young Children: If you have young children, you can set up a life insurance trust and name the trust as the beneficiary. This ensures that the payout goes into the trust, and a trustee can manage and distribute the funds according to your wishes, protecting your children's interests.

- Supplementing Retirement Income: Life insurance can be used to supplement retirement income, providing additional financial security for retirees.

Using Life Insurance to Establish a Trust

Life insurance can also be used to establish a trust, giving you more control over how and when your beneficiaries receive their inheritance:

- Controlled Payouts: By naming a trust as the beneficiary of your life insurance policy, you can determine how and when the funds are distributed. This is especially useful if you want to control how your minor children receive their inheritance or if you want to protect beneficiaries who may have spending problems or aggressive creditors.

- Avoiding Probate: Establishing a trust as the beneficiary can help avoid the probate process, which can be time-consuming and expensive. It also keeps the life insurance proceeds out of your estate, simplifying the distribution process.

- Tax Planning: Trusts can be used for tax planning purposes, helping to reduce potential estate taxes and ensuring more of your wealth goes to your beneficiaries.

- Long-term Financial Security: Trusts can provide long-term financial security for your beneficiaries, especially if you set up an irrevocable life insurance trust (ILIT). This type of trust owns the life insurance policy and receives the death benefit, keeping the proceeds out of your estate and providing a significant financial resource for your loved ones.

In conclusion, life insurance is a versatile tool that can be used to provide an inheritance or establish a trust upon your death. It offers financial protection and flexibility for your loved ones, ensuring they receive the money you intended and helping them through a difficult time. By understanding the options available, you can make informed decisions about how to use life insurance to benefit your beneficiaries.

Leaving Life Insurance to Minors: Is It Possible?

You may want to see also

Frequently asked questions

Around 50% of Americans have life insurance, though this number has fluctuated over the years.

According to the 2023 Insurance Barometer Study, 39% of consumers intend to buy life insurance within the next year. This number is higher for Gen Z adults (44%) and millennials (50%).

This varies depending on the source. One source states that 41% of adults report not having sufficient coverage, while another source states that 20% of people with life insurance believe they do not have enough coverage.

50% of people would be more likely to buy life insurance if it didn't require a medical exam.