If you're looking to find a lost life insurance policy in California, there are a few steps you can take. The National Association of Insurance Commissioners (NAIC) has a Life Insurance Policy Locator service, which is a free online tool that helps consumers find their deceased loved one's life insurance policies and annuity contracts. You can also try looking through the decedent's records, contacting their previous employer, checking bank accounts and canceled checks, or reviewing their income tax records. Additionally, the California Department of Insurance (CDI) provides tools and resources to help you understand life and annuity insurance and make informed decisions.

| Characteristics | Values |

|---|---|

| Tracking System | National Association of Insurance Commissioners (NAIC) Life Insurance Policy Locator |

| Purpose | Help consumers locate benefits from life insurance policies or annuity contracts |

| Search Criteria | Social Security number, veteran status, relationship to the deceased |

| Security | Request is stored in a secure, encrypted database |

| Notification | A "Do Not Reply" email is sent to confirm the request details |

| Contact | Life insurance or annuity company contacts the beneficiary directly if a policy is found |

| Cost | Free |

| Requirements | Conduct a diligent search of the deceased person's records |

| Additional Support | California Department of Insurance (CDI) Consumer Hotline |

What You'll Learn

Locating a lost life insurance policy

Search the Deceased's Documents and Correspondence

Start by searching through the deceased person's paper and digital files, bank safe deposit boxes, and other storage spaces for any insurance-related documents. Check bank statements for checks or automatic drafts to life insurance companies, and review mail and email for premium or dividend notices. The deceased's income tax records may also provide information about payments made to life insurance companies.

Contact Relevant Parties

Get in touch with the deceased's previous employer, as they may have had an employer-provided group life policy. The decedent's auto or home insurance agent may also have information, as life insurance could have been purchased through them. Talking to the deceased's banker, financial advisor, and attorney can also be helpful.

Utilize the NAIC Life Insurance Policy Locator Service

The National Association of Insurance Commissioners (NAIC) offers a free online tool called the Life Insurance Policy Locator Service, which allows you to search for insurance policies or annuities in the names of deceased individuals. To use this service, you must be the designated beneficiary or a legal representative of the deceased. You will need to provide information such as the Social Security number, legal name, date of birth, date of death, and veteran status of the deceased.

Check with the State's Unclaimed Property Office

When a life insurance company is aware of a deceased client but cannot locate the beneficiary, they are required to turn the death benefit over to the state as "unclaimed property." You can search the state's unclaimed property database, and if the policy was purchased in California, you can check the State Controller's Office Life Insurance Settlement Property Search engine or call them at 800-992-4647.

Consider Fee-Based Services

If you are unable to locate the policy through the above methods, you may consider using fee-based services. MIB, an insurance membership corporation, offers services for a fee that may be able to find evidence of life insurance applications. Additionally, several private companies can assist in the search for a lost life insurance policy for a fee.

It is important to note that life insurance companies are required to report and deliver property to the California State Controller's Office after there has been no activity or contact with the owner for a specified period, generally three years or more. This means that if a policy has been inactive for an extended period, it may be reported as unclaimed property, and you can inquire with the state to locate it.

Incorporating Life Insurance in Your Net Worth Calculation

You may want to see also

Understanding different life insurance products

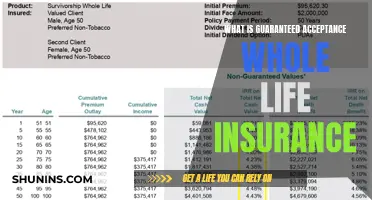

Life insurance is an essential part of financial and legacy planning. There are various products available, which can be categorized into two main types: term life and permanent life (also known as whole life). Understanding the differences between these two main types of insurance can help you make coverage decisions according to your needs and goals.

Term life insurance is purchased to last for a specified period, such as 1, 5, 10, or sometimes up to 30 years. Coverage expires when that period ends, so a payout only occurs if the insured person dies during the specified period. Term life insurance is often the most straightforward and affordable option. It does not build cash value, so your premiums are comparatively lower than for permanent life insurance. However, some insurers offer term life products with a "return of premium" feature, which refunds a portion of the premiums if a claim is not filed before the end of the coverage term. These policies tend to be more expensive upfront than standard term life insurance.

Permanent life insurance, on the other hand, provides coverage for the insured person's lifetime as long as premium payments are maintained. These policies may build cash value, which the policyholder or their heirs can access under certain conditions. Due to this feature, premiums can be higher than for term life policies. Permanent life insurance includes several subcategories, including traditional whole life, universal life, variable life, and variable-universal life.

Whole life insurance policies typically offer the advantage of coverage during your entire life but may charge higher premiums than term life products. This means that your death benefit may be smaller than with term life for the same amount of money. People choosing whole life insurance often prioritize certain features such as the ability to plan for consistent benefits and premiums and the potential for tax-deferred savings growth through the cash value component of their policy.

In addition to these main types of life insurance, there are other products available that combine insurance with savings or investment components. These include endowment plans, money-back plans, retirement plans, and unit-linked insurance plans (ULIPs).

Endowment plans offer dual benefits of life cover and wealth creation. They provide a lump sum payout on maturity or a death payout to the beneficiary/nominee if the policyholder dies during the plan term. Endowment plans may also offer bonuses, payable in addition to the policy's life cover.

Money-back plans are similar to endowment policies but with increased liquidity benefits and systematic payments. These plans pay out a percentage of the life cover at regular intervals and are designed to meet short-term financial goals.

Retirement plans are designed to build a large corpus for retirement, providing financial security during non-working years. These plans allow for saving and investing over a long period and offer various options for withdrawing money, such as lump-sum payments, regular income, or a combination of both.

ULIPs provide a combination of investment and insurance benefits. Part of the premium paid goes towards a life cover, while the rest is invested in market-linked funds such as equity and debt funds. ULIPs offer the opportunity to invest in different options depending on your risk appetite and provide the potential for wealth generation through market-linked returns.

Northwestern's Life Insurance: Principal Provider?

You may want to see also

How much insurance is needed

While California does not have a life insurance tracking system, the National Association of Insurance Commissioners (NAIC) has created a Life Insurance Policy Locator service to help consumers find benefits from life insurance policies purchased anywhere in the US. This service is free of charge.

Now, how much insurance does one need? Well, there are multiple ways to calculate the right amount of life insurance coverage. Your savings, debts, income, age, family situation, and financial goals all play a role in figuring out how much life insurance you need.

- Multiply your income by 10 or more: Financial experts often recommend purchasing at least 10 times your annual income in coverage. However, this guideline does not take into account your savings, existing policies, or the specific needs of your family.

- DIME method: This method considers your debt, income, mortgage, and education expenses. It provides a more detailed look at your finances than simply multiplying your income.

- Replace your income, plus add a cushion: With this method, you buy enough coverage that your beneficiaries can replace your income without spending the payout itself. For example, if your income is $50,000, you can buy a $1 million policy. Your beneficiaries can invest the payout and use the annual interest to cover expenses.

- Use a life insurance calculator: You can use an online calculator to input your income, expenses, and other financial details to determine how much coverage you need.

When deciding on the amount of coverage, consider the following:

- Your annual salary and the number of years you want to replace that income.

- Your mortgage balance and any other large debts.

- Future expenses such as college fees for your children and funeral costs.

- The cost to replace services that a stay-at-home parent provides, such as childcare.

- Your existing assets and savings that can be used to cover expenses.

Charities Collecting Death Benefits: The Life Insurance Loophole

You may want to see also

Affordability of life insurance

The affordability of life insurance in California depends on various factors, including age, gender, health status, lifestyle choices, and the amount of coverage chosen. The average cost of life insurance in the state is $73 for women and $89 for men, but these figures can vary depending on individual circumstances.

For instance, in San Jose, the average monthly premium for term life insurance is $29 for women and $33 for men. The best life insurance company in San Jose, according to MoneyGeek, is Protective, which offers competitive rates for both genders. For men, the average premium is $42, while for women, it is $33 per month. These rates are based on a 20-year term policy with $500,000 in coverage.

When considering the best life insurance companies in California as a whole, GEICO and Protective are rated highly. GEICO is recommended for men, with an average premium of $21 per month, while Protective is suggested for women, with an average premium of $18 per month. These recommendations are based on MoneyGeek scores, which take into account customer satisfaction, financial stability, and product diversity.

It is worth noting that the cost of life insurance in California can differ from other parts of the country due to various factors, such as local economic conditions, health statistics, and lifestyle trends. Therefore, it is essential to compare rates and consider multiple companies to find the most affordable option for your specific needs.

Life Insurance and Welfare Benefits: Compatible or Not?

You may want to see also

The National Association of Insurance Commissioners (NAIC)

NAIC members come from diverse backgrounds, politics, and geographies but are united in their shared commitment to protect consumers and ensure fair, competitive, and healthy insurance markets. They do this by establishing standards, conducting peer reviews, and coordinating regulatory oversight. The NAIC also provides data reporting, licensing, analysis, and financial assessments.

To support compliant and informed decisions, the NAIC sets standards and best practices, conducts peer reviews, provides regulatory support functions, and coordinates regulatory oversight. Their efforts help make the US one of the strongest and most resilient insurance markets in the world.

The NAIC has created a Life Insurance Policy Locator service to help consumers locate benefits from life insurance policies or annuity contracts purchased anywhere in the United States. This free online tool helps consumers find their deceased loved one's life insurance policies and annuity contracts. Consumers are required to conduct a diligent search of the deceased person's records before using the service. The companies will then search their records to determine whether they have life policies or annuity contracts in the name of the deceased. If a policy is found and the consumer is the beneficiary, the life insurance or annuity company will contact them directly.

How to Cancel American Income Life Insurance Policies

You may want to see also

Frequently asked questions

The National Association of Insurance Commissioners (NAIC) has created a Life Insurance Policy Locator service to help consumers find lost policies. This is a free service. You can also call the California Department of Insurance (CDI) Consumer Hotline for assistance.

You will need to provide the deceased's information from the death certificate, including their Social Security number, veteran status, and your relationship to the deceased.

You can call the Consumer Hotline at 1-800-927-4357 or check the Company Profile on the CDI website to obtain address and phone contact information.

You can look through the decedent's records, including their safety deposit box, check their bank accounts and canceled checks, contact their previous employer, or review their income tax records.