Life insurance is a crucial financial tool that provides protection and peace of mind for individuals and their families. When considering what life insurance policies to offer, it's essential to understand the diverse range of options available to cater to various needs and preferences. From term life insurance, which provides coverage for a specified period, to permanent life insurance, offering lifelong protection, the market offers a wide array of choices. Additionally, there are universal life insurance policies, which allow policyholders to build cash value over time, and variable life insurance, providing investment options. Each type of policy has its unique features, benefits, and considerations, making it important for agents and advisors to carefully assess the specific requirements of their clients before recommending the most suitable life insurance product.

What You'll Learn

Term Life: Affordable coverage for a set period

Term life insurance is a straightforward and cost-effective way to protect your loved ones financially during a specific period. It provides a clear and defined benefit, making it an attractive option for those seeking affordable coverage. This type of policy is ideal for individuals who want to ensure their family's financial security for a particular duration, such as covering mortgage payments, children's education, or any other long-term financial commitments.

The beauty of term life insurance lies in its simplicity. It offers pure insurance, meaning there are no investment components or additional fees. The policyholder pays a fixed premium for a predetermined period, typically 10, 20, or 30 years. During this term, the insurer guarantees a death benefit if the insured person passes away. If the insured individual survives the term, the policy expires, and no further payments are required. This structured approach ensures that the coverage is relevant and relevant only during the agreed-upon period.

One of the key advantages of term life insurance is its affordability. Since it focuses solely on providing coverage for a specific duration, the premiums are generally lower compared to permanent life insurance policies. This makes it accessible to a broader range of individuals, allowing them to secure their family's future without incurring significant financial strain. For those with temporary financial goals, term life insurance offers a practical solution.

When considering a term life insurance policy, it's essential to evaluate your specific needs. Assess the duration of your financial commitments and choose a term length that aligns with your goals. For instance, if you're looking to cover a 15-year mortgage, a 15-year term policy would be appropriate. Additionally, consider the death benefit amount, ensuring it adequately provides for your family's needs during the specified period.

In summary, term life insurance is a practical and affordable choice for individuals seeking temporary financial protection. Its defined term and competitive pricing make it an excellent option for those with specific financial obligations. By understanding your unique requirements, you can select the right term length and death benefit, ensuring your loved ones' financial security during the agreed-upon period.

Life Insurance Payout Process for Australian Beneficiaries

You may want to see also

Whole Life: Permanent insurance with cash value accumulation

Whole life insurance is a type of permanent life insurance policy that offers a range of benefits, making it a valuable financial tool for individuals seeking long-term protection and wealth accumulation. This policy is designed to provide coverage for the entire lifetime of the insured individual, hence the term "permanent." One of the key advantages of whole life insurance is its ability to accumulate cash value over time, which can be a significant financial asset for policyholders.

When you purchase a whole life policy, a portion of your premium payments goes towards building cash value. This cash value grows tax-deferred and can be borrowed against or withdrawn as needed. The accumulation of cash value is a unique feature that sets whole life insurance apart from other types of policies. As the policyholder, you have the option to utilize this cash value in various ways. For instance, you can take out loans against the policy's cash value to fund major purchases, education expenses, or business ventures without the typical constraints associated with other loan sources. Additionally, the cash value can be used to pay for the policy's premiums in the future, ensuring that the coverage remains in force even if other income sources are unavailable.

The permanent nature of whole life insurance means that the coverage remains in effect as long as the premiums are paid. This provides a sense of security and peace of mind, knowing that your loved ones will be financially protected even if you are no longer around. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers a consistent level of protection throughout your entire life. This consistency is particularly beneficial for those who want to ensure their family's financial stability over the long term.

Another advantage of whole life insurance is its potential to act as an investment vehicle. The cash value accumulation can grow significantly over time, providing a substantial financial asset that can be passed on to beneficiaries or used for personal financial goals. Policyholders can also consider taking advantage of the policy's death benefit, which is typically tax-free and can provide a substantial financial cushion for beneficiaries. This aspect of whole life insurance makes it an attractive option for those seeking both insurance protection and investment opportunities.

In summary, whole life insurance with cash value accumulation offers a comprehensive solution for individuals seeking permanent coverage and financial security. The ability to accumulate cash value provides flexibility and potential investment benefits, while the permanent nature of the policy ensures long-term protection. By understanding the features and advantages of whole life insurance, individuals can make informed decisions about their life insurance needs and potentially build a valuable financial asset for themselves and their loved ones.

Unraveling the Mystery: Employee Optional Life Insurance Explained

You may want to see also

Universal Life: Flexible premiums and investment options

Universal life insurance offers a unique and flexible approach to life coverage, providing policyholders with a range of benefits and customization options. One of its key advantages is the ability to adjust premiums and investment strategies, making it a versatile choice for individuals seeking tailored financial protection.

With universal life, policyholders have the freedom to choose their premium payments, which can be structured to fit various financial situations. This flexibility allows for lower initial premiums, making it more affordable for those on a budget, while still ensuring adequate coverage. Over time, as the policyholder's financial circumstances improve, they can increase the premium payments, building up a substantial cash value in the process. This cash value can be invested in various options, providing an opportunity for growth and potential tax advantages.

The investment options within universal life policies are diverse, catering to different risk appetites and financial goals. Policyholders can typically choose from a range of investment accounts, such as fixed accounts offering stable returns or variable accounts linked to the performance of stocks, bonds, or other securities. This investment aspect allows individuals to potentially grow their policy's cash value, which can be used to pay future premiums or withdrawn as a loan, providing financial flexibility.

A significant advantage of this policy is the ability to customize the death benefit, which is the amount paid to the beneficiary upon the insured's passing. Policyholders can adjust the death benefit over time, ensuring it remains appropriate as their financial needs change. This flexibility is particularly beneficial for those who want to provide for their family's long-term financial needs or for individuals who want to maximize their insurance coverage without the constraints of a fixed premium structure.

In summary, universal life insurance provides a flexible and powerful tool for individuals seeking to manage their financial security. The ability to adjust premiums and investment strategies allows policyholders to create a personalized plan, ensuring they have the right level of coverage and the potential for financial growth. This type of policy is an excellent choice for those who value customization and want to adapt their insurance strategy as their life circumstances evolve.

Becoming a Sun Life Insurance Agent: A Step-by-Step Guide

You may want to see also

Variable Life: Offers investment returns, tailored to individual needs

Variable life insurance is a unique and flexible type of life insurance policy that offers a combination of insurance coverage and investment opportunities. Unlike traditional whole life insurance, which provides a fixed death benefit and a guaranteed interest rate, variable life insurance allows policyholders to customize their insurance and investment strategy to meet their specific needs and goals. This policy is particularly appealing to individuals who want to take control of their financial future and potentially grow their wealth over time.

One of the key features of variable life insurance is its investment component. Policyholders can allocate a portion of their premium payments to various investment options, such as stocks, bonds, or mutual funds. These investment accounts are typically separate from the insurance portion, allowing for a more tailored and personalized approach to wealth management. The investment returns can vary depending on the performance of the chosen investment options, providing an opportunity for policyholders to potentially earn higher returns compared to traditional fixed-rate investments.

The flexibility of variable life insurance is one of its main advantages. Policyholders have the freedom to adjust their investment strategy as their financial goals and circumstances change. They can choose to increase or decrease the amount allocated to investments, switch between different investment options, or even take out loans against the cash value of the policy. This adaptability ensures that the policy can be customized to fit the evolving needs of the individual, whether it's for long-term wealth accumulation, retirement planning, or other financial objectives.

Another benefit of variable life insurance is the potential for tax advantages. The investment accounts within the policy may offer tax-deferred growth, allowing policyholders to build up a substantial cash value over time. Additionally, the death benefit paid to the beneficiary upon the insured's passing is generally not subject to income tax, providing a tax-efficient way to pass on wealth to loved ones.

In summary, variable life insurance offers individuals a powerful tool to secure their financial future while also providing investment opportunities. With its customizable nature, policyholders can tailor the policy to their specific needs, potentially earning higher investment returns and benefiting from tax advantages. This type of life insurance is an excellent choice for those who want to take an active role in managing their finances and building a secure future.

Life Insurance Proceeds: Massachusetts Tax Laws Explained

You may want to see also

Final Expense: Covers funeral costs and burial expenses

Final expense insurance, also known as burial insurance, is a type of life insurance policy designed to cover the costs associated with final arrangements and funeral services. This policy is specifically tailored to provide financial assistance during a difficult time, ensuring that the deceased's loved ones are not burdened with unexpected expenses. It is a crucial aspect of financial planning, especially for those who want to ease the financial strain on their families in the event of their passing.

When considering final expense insurance, it is essential to understand the coverage it offers. This policy typically includes the costs of funeral services, including the funeral director's fees, embalming, casket or urn, transportation of the body, and other related expenses. It also covers burial or cremation costs, such as the purchase of a grave plot, cemetery fees, and burial vault or casket. The primary goal is to provide a comprehensive solution, ensuring that all these essential expenses are taken care of, leaving the family with peace of mind.

The benefits of final expense insurance are numerous. Firstly, it provides financial security for the family, knowing that the costs associated with the deceased's final wishes will be met. This can reduce the emotional burden on loved ones during an already challenging time. Secondly, it allows individuals to plan ahead and make decisions about their final arrangements, ensuring their wishes are respected. Many people prefer to have control over their funeral plans, and this type of insurance enables them to do so.

Another advantage is the simplicity and ease of the process. Final expense policies are designed to be straightforward, often with no medical exams or health questions, making it accessible to a wide range of individuals. This simplicity ensures that the policy can be obtained quickly, providing immediate coverage when needed. Additionally, these policies are often affordable, with fixed premiums that remain the same over the life of the policy, providing long-term financial protection.

In summary, final expense insurance is a vital consideration for anyone looking to provide financial security and peace of mind for their loved ones. It covers the essential costs associated with funeral and burial expenses, ensuring that the deceased's wishes are honored and the family's financial burden is minimized during a difficult period. With its straightforward application process and affordable premiums, it is a practical and compassionate choice for life insurance.

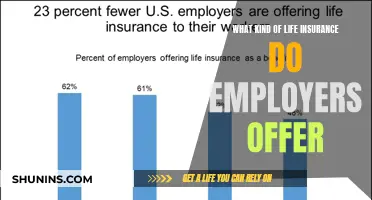

Employer-Provided Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

There are several types of life insurance policies available, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each type has its own unique features and benefits, catering to different financial needs and goals.

Selecting the appropriate life insurance policy involves considering various factors such as your age, health, financial goals, and the level of coverage required. It's essential to assess your risk tolerance, understand the policy terms, and evaluate the benefits that align with your long-term objectives. Consulting with a financial advisor can provide personalized guidance.

Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. It offers a fixed premium and death benefit. Whole life insurance, on the other hand, is a permanent policy that provides lifelong coverage. It includes an investment component, allowing the policyholder to accumulate cash value over time, and offers a flexible premium payment option.

Absolutely! Many life insurance companies offer customizable policies, allowing you to tailor the coverage to your unique needs. You can adjust the death benefit amount, choose different riders or add-ons, and select payment options that suit your preferences. This flexibility ensures you get a policy that aligns perfectly with your circumstances.

Life insurance policies with investment features, such as universal life or variable life insurance, offer several advantages. These policies provide a combination of insurance coverage and investment opportunities. You can potentially build cash value, which can be borrowed against or withdrawn, and the investment returns can enhance the overall value of the policy over time. This type of policy can be a valuable tool for long-term financial planning.