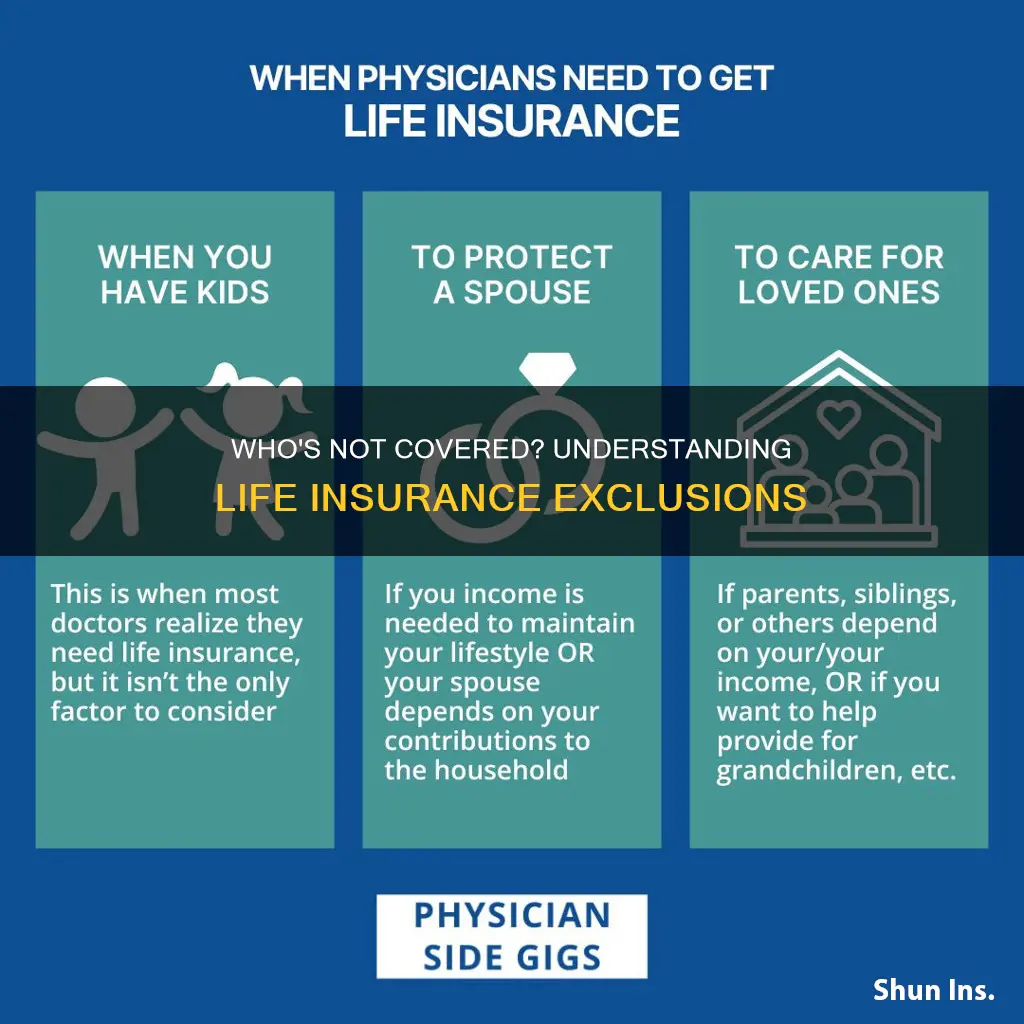

Group life insurance is a valuable benefit offered by employers to provide financial security to their employees and their families in the event of death. However, not all groups are eligible for this coverage. Certain factors, such as the size of the group, the industry, and the specific circumstances of the employees, can determine eligibility. For instance, small businesses or self-employed individuals may not qualify due to the higher administrative costs associated with group insurance. Additionally, groups with a high-risk profile, such as those in dangerous professions or with a high incidence of health issues, may also face challenges in obtaining group life insurance. Understanding these eligibility criteria is essential for both employers and employees to ensure that the right coverage is in place to protect the financial well-being of the group.

What You'll Learn

- Age: Groups with members older than a certain age may not qualify

- Health: Pre-existing conditions or poor health can exclude certain groups

- Occupation: High-risk jobs or extreme sports enthusiasts may not be eligible

- Lifestyle: Smokers, heavy drinkers, or those with extreme hobbies may face exclusions

- Group Size: Smaller groups might not meet the insurer's requirements

Age: Groups with members older than a certain age may not qualify

Age is a critical factor when it comes to group life insurance eligibility. Insurance companies often have age restrictions for group life insurance plans, and these can vary depending on the insurer and the specific policy. Typically, the maximum age limit for group life insurance is around 65 to 70 years old. This means that any group with members older than this age range may not qualify for coverage.

The reason for these age limits is primarily due to statistical factors. Insurance providers assess the risk associated with insuring individuals based on their age. As people age, the likelihood of developing health issues or facing life-threatening situations increases. Older individuals may have a higher risk profile, which could lead to more frequent and costly claims for the insurance company. Therefore, insurers may set age limits to ensure that the group life insurance policy remains financially viable and sustainable.

For younger groups, the benefits of group life insurance can be significant. Younger members often have lower premiums and may even be eligible for additional coverage options. This is because younger individuals generally have a longer life expectancy, reducing the potential long-term costs for the insurer. Additionally, younger members are less likely to have pre-existing health conditions or chronic illnesses, making them lower-risk candidates for insurance coverage.

When forming a group, it is essential to consider the age range of its members. If the group includes individuals older than the insurer's maximum age limit, they may need to explore alternative insurance options. This could involve seeking individual life insurance policies or considering group plans offered by different insurance providers that cater to a broader age range.

In summary, age is a crucial consideration when determining eligibility for group life insurance. Groups with members older than a certain age may face challenges in qualifying for coverage. Understanding these age restrictions and exploring alternative insurance options can help ensure that all group members receive the necessary protection and support.

Hospital Bills and Life Insurance: Who Pays?

You may want to see also

Health: Pre-existing conditions or poor health can exclude certain groups

When it comes to group life insurance, certain individuals may find themselves ineligible due to pre-existing health conditions or overall poor health. This exclusion is primarily based on the principle of risk assessment, as insurance companies aim to provide coverage to those who are statistically less likely to require large payouts. Here's a detailed breakdown of how health factors can impact eligibility:

Pre-existing Conditions: Insurance providers often scrutinize medical histories, and any pre-existing health issues can significantly impact eligibility. For instance, individuals with a history of chronic illnesses like diabetes, heart disease, or cancer may be deemed high-risk. These conditions could lead to increased healthcare costs and potential long-term complications, making them less attractive candidates for group life insurance. The severity and stability of the condition also play a role; a well-managed condition with stable vital signs might be considered more favorable than an uncontrolled or rapidly progressing one.

Poor Health and Lifestyle Factors: Poor overall health, often associated with lifestyle choices, can also exclude individuals from group life insurance coverage. Smoking, excessive alcohol consumption, and obesity are common factors that insurance companies consider. These behaviors can lead to a higher risk of various health issues, including cardiovascular diseases, respiratory problems, and certain types of cancer. As a result, individuals with these lifestyle habits may face higher premiums or even be denied coverage altogether.

Impact on Group Size and Premiums: The presence of individuals with pre-existing conditions or poor health can influence the overall risk profile of a group. Insurance companies may adjust their rates accordingly, potentially increasing premiums for the entire group to account for the higher expected costs. This adjustment ensures that the insurance provider can sustain the financial burden of potential payouts.

Alternative Options: For those who are ineligible for standard group life insurance due to health reasons, there are alternative coverage options available. These may include term life insurance, which provides coverage for a specified period, or individual health insurance plans tailored to specific medical needs. Exploring these alternatives can help individuals find suitable coverage despite their health status.

Understanding these eligibility criteria is crucial for both individuals seeking coverage and employers offering group life insurance. It highlights the importance of maintaining a healthy lifestyle and managing any pre-existing conditions to ensure access to comprehensive life insurance benefits.

Cheating Life Insurance: Strategies for Success

You may want to see also

Occupation: High-risk jobs or extreme sports enthusiasts may not be eligible

For group life insurance, certain occupations and lifestyles can impact an individual's eligibility, often leading to higher risk assessments by insurers. High-risk jobs and extreme sports enthusiasts may find themselves in a less favorable position when it comes to securing group life insurance coverage.

Occupations that are inherently dangerous or involve a high likelihood of injury or death are typically considered high-risk. These jobs often include professions such as construction workers, miners, loggers, and firefighters. The physical demands and potential hazards associated with these careers can significantly increase the chances of accidents and health complications, making them less attractive to insurers. For instance, construction sites are rife with potential dangers, from heavy machinery to falls from great heights, all of which can result in severe injuries or fatalities. Similarly, firefighters face extreme physical and mental challenges, battling blazes in hazardous conditions that can lead to permanent disabilities or even death.

In addition to high-risk occupations, individuals who actively participate in extreme sports also face challenges in obtaining group life insurance. Extreme sports enthusiasts engage in activities that are inherently dangerous and often involve a high degree of speed, height, or physical exertion. Examples of such sports include skydiving, BASE jumping, rock climbing, and white-water rafting. These activities carry a substantial risk of injury or death, which can lead to higher insurance premiums or even ineligibility for coverage. Insurers may view these individuals as high-risk policyholders due to the potential for severe injuries or fatalities associated with these sports.

The impact of high-risk occupations and extreme sports on group life insurance eligibility is significant. Insurers often use standardized tables and rates to determine the cost of coverage, and certain occupations or lifestyles may result in higher risk assessments. This can lead to increased premiums or even denial of coverage for these individuals. It is essential for high-risk job holders and extreme sports enthusiasts to be aware of these potential challenges and explore alternative insurance options or take steps to mitigate their risks, such as through safety training or equipment upgrades.

In summary, high-risk jobs and extreme sports enthusiasts may face difficulties in obtaining group life insurance due to the inherent dangers and increased likelihood of injury or death associated with these activities. Insurers often consider these factors when assessing eligibility and determining coverage costs, making it crucial for individuals in these categories to understand the potential impact on their insurance options.

Life Insurance: Out-of-Country Coverage and Its Complexities

You may want to see also

Lifestyle: Smokers, heavy drinkers, or those with extreme hobbies may face exclusions

When it comes to group life insurance, certain lifestyle choices and activities can impact your eligibility and coverage. Insurance providers often consider lifestyle factors as they directly influence an individual's health and longevity, which are crucial aspects of life insurance underwriting. Here's an overview of how lifestyle choices can affect your inclusion in group life insurance plans:

Smoking is a well-known risk factor for various health issues, including cardiovascular diseases, lung cancer, and respiratory problems. Insurance companies often view smokers as high-risk individuals when it comes to life insurance. As a result, smokers may face higher premiums or even exclusions from certain group life insurance policies. The impact can vary depending on the insurance provider and the specific policy. For instance, some insurers might offer reduced rates for non-smokers or provide coverage with certain restrictions for smokers who are willing to quit.

Similarly, heavy drinking or excessive alcohol consumption can also lead to exclusions or higher costs. Excessive alcohol use is associated with liver damage, increased risk of accidents, and various health complications. Insurance providers may consider individuals with a history of heavy drinking as high-risk candidates, potentially resulting in limited or no coverage. It's important to note that moderate drinking, as defined by the guidelines of most health organizations, is generally not a cause for exclusion.

Extreme hobbies and recreational activities can also impact your eligibility. Engaging in high-risk hobbies like skydiving, scuba diving, rock climbing, or professional sports may lead to exclusions or higher premiums. These activities often involve a higher likelihood of injury or death, which can make insurance providers hesitant to offer full coverage. For example, a group life insurance policy might exclude coverage for participants in extreme sports, or the premium could be significantly increased to reflect the higher risk.

Additionally, individuals with certain medical conditions or health issues may also face exclusions or limited coverage. Pre-existing conditions, chronic illnesses, or severe health concerns can impact the underwriting process. It is essential to disclose all relevant health information to the insurance provider to ensure accurate assessment and appropriate coverage.

In summary, lifestyle choices play a significant role in determining eligibility for group life insurance. Smokers, heavy drinkers, and individuals with extreme hobbies may encounter exclusions or higher costs. It is advisable to maintain a healthy lifestyle and disclose any relevant information to the insurance company to ensure a smooth underwriting process and potentially secure the desired coverage.

Life Insurance: Can a Primary Also Be a Secondary?

You may want to see also

Group Size: Smaller groups might not meet the insurer's requirements

When it comes to group life insurance, the size of the group can significantly impact eligibility. Smaller groups may find themselves facing challenges in securing this type of coverage. Insurance providers often have specific requirements and criteria for group life insurance, and one of the key factors they consider is the number of members in the group.

Smaller groups might not meet the minimum requirements set by insurers. These requirements can vary, but typically, insurers prefer to offer group life insurance to larger, more diverse groups. This is because larger groups provide a more substantial pool of potential policyholders, reducing the risk for the insurance company. With a smaller group, the insurer may perceive a higher risk, as there are fewer individuals to spread the potential financial burden. As a result, smaller groups might be considered less attractive to insurers, making it more difficult to secure favorable terms or even obtain coverage at all.

The insurer's perspective is crucial here. They aim to balance the benefits of group life insurance with the potential risks. With a larger group, the insurer can offer competitive rates and better coverage options, as the collective risk is lower. However, for smaller groups, the insurer may charge higher premiums or impose stricter conditions to mitigate the perceived risk. This could include requiring a higher minimum age, excluding certain health conditions, or offering limited coverage options.

To address this challenge, smaller groups can explore alternative approaches. One strategy is to collaborate with other smaller groups to form a larger, combined group. By doing so, they can meet the insurer's minimum group size requirement and potentially negotiate more favorable terms. Another option is to consider alternative insurance products, such as individual life insurance policies, which may be more accessible for smaller groups.

In summary, smaller groups should be aware of the potential challenges they may face when seeking group life insurance. Understanding the insurer's requirements and exploring creative solutions, such as group consolidation or alternative insurance options, can help smaller groups secure the coverage they need. It is essential to stay informed and proactive in finding the right insurance solution that suits the specific needs of the group.

Life Insurance for Incarcerated Individuals: Is It Possible?

You may want to see also

Frequently asked questions

Generally, individuals who are not employed or do not have a professional relationship with the organization offering the insurance are not eligible. This includes freelancers, independent contractors, and those with temporary or seasonal employment.

Yes, certain health conditions or age groups may be excluded. Pre-existing medical conditions, such as severe heart disease or cancer, might make an individual ineligible. Additionally, age limits can vary, but typically, younger individuals may have more favorable rates and terms.

Full-time students may not qualify for group life insurance if they are not actively employed or contributing to the organization's workforce. However, some educational institutions offer student life insurance plans, which can provide coverage tailored to students' needs.