When considering life insurance, it's important to understand that the cheapest option may not always be the best. The cost of life insurance depends on various factors, including age, health, lifestyle, and the amount of coverage needed. Term life insurance, which provides coverage for a specific period, is often the most affordable option for younger individuals in good health. However, it's crucial to evaluate the policy's terms, coverage limits, and any additional benefits or riders to ensure it meets your specific needs and provides adequate financial protection for your loved ones.

What You'll Learn

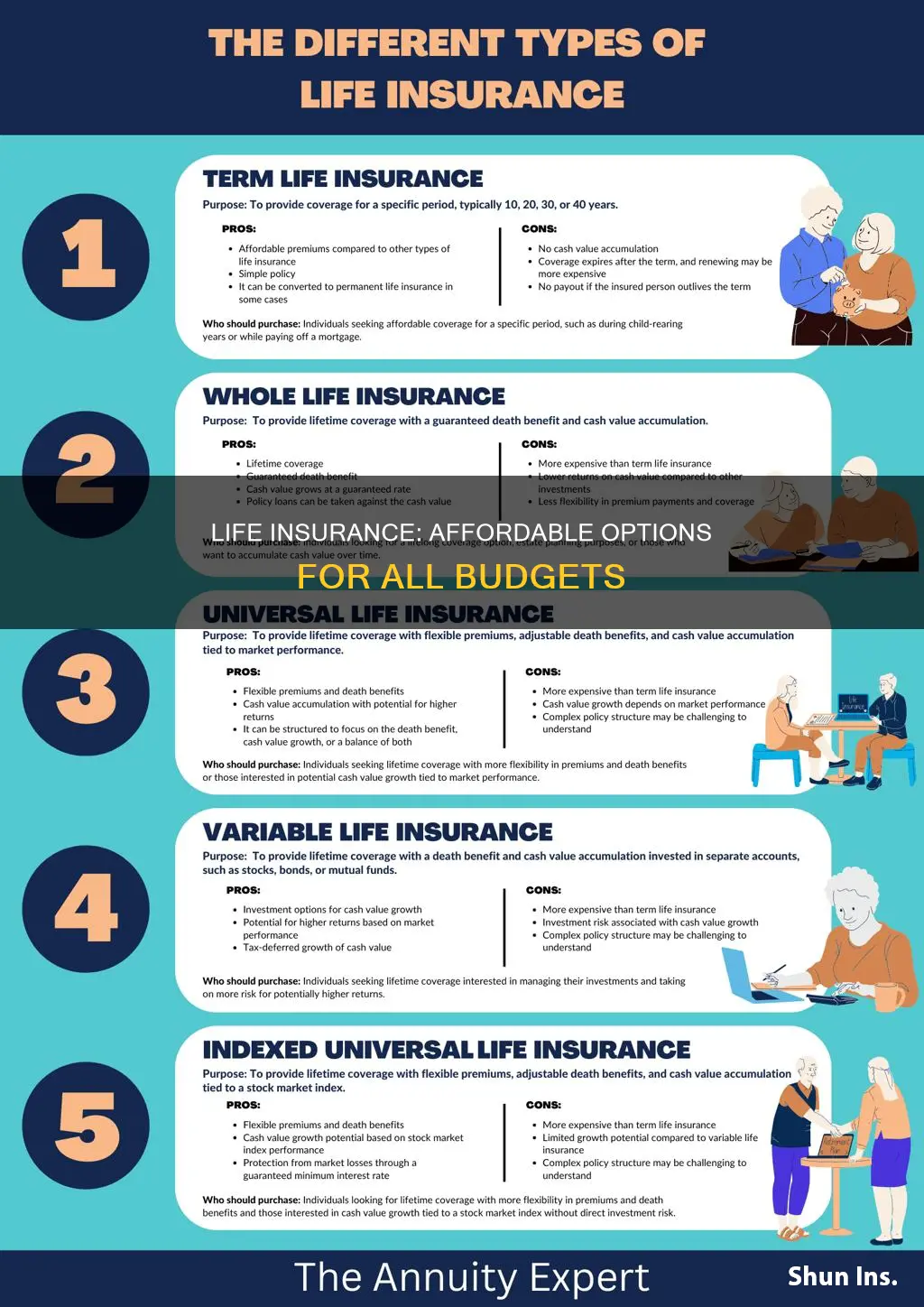

Term Life Insurance: Cheapest coverage for a set period

Term life insurance is often considered the most cost-effective option for those seeking affordable life coverage for a specific period. This type of insurance provides a straightforward solution for individuals who want temporary protection without the long-term commitments and higher costs associated with permanent life insurance policies.

The beauty of term life insurance lies in its simplicity. It offers a fixed amount of coverage for a predetermined duration, typically ranging from 10 to 30 years. During this term, the policyholder pays a consistent premium, which is generally lower compared to other life insurance types. This affordability is particularly attractive to those who require insurance for a particular goal, such as covering mortgage payments or providing financial security for children's education, without wanting to pay for coverage beyond that period.

One of the key advantages of term life insurance is its predictability. The premium remains stable throughout the term, allowing policyholders to plan and budget effectively. This predictability is a significant factor in making term life insurance the cheapest option, as it provides a clear understanding of future costs. Unlike other insurance types, where premiums can increase over time, term life insurance offers a fixed rate, ensuring that the policyholder knows exactly what they will pay.

When considering term life insurance, it's essential to evaluate the length of the term carefully. Longer terms might offer lower premiums but could result in higher overall costs due to the extended coverage period. Conversely, shorter terms provide more affordable premiums but may leave individuals vulnerable if they outlive the policy. Finding the right balance between coverage duration and cost is crucial to ensuring the cheapest and most suitable term life insurance policy.

In summary, term life insurance is an excellent choice for those seeking the most affordable life coverage for a defined period. Its predictable premiums, straightforward nature, and flexibility in term length make it an attractive option for individuals who want temporary protection without the higher costs of permanent insurance. By understanding the benefits and considerations of term life insurance, individuals can make informed decisions to secure their loved ones' financial future without breaking the bank.

Marriage and Life Insurance: What Changes and What Stays the Same

You may want to see also

Whole Life: More expensive, but offers lifelong coverage

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It is often considered more expensive compared to other forms of life insurance, but it offers several unique benefits that make it an attractive option for many. While it may not be the cheapest form of insurance, its long-term value and security make it a wise investment for those seeking comprehensive coverage.

One of the key advantages of whole life insurance is its guaranteed death benefit. This means that regardless of when the insured person passes away, the beneficiary will receive the full death benefit amount. This aspect provides financial security and peace of mind, knowing that your loved ones will be taken care of even if unexpected events occur. The death benefit can be used to cover various expenses, such as mortgage payments, children's education, or any other financial obligations the individual may have left behind.

Another benefit is the accumulation of cash value over time. As premiums are paid, a portion of the money goes towards building cash value, which grows tax-deferred. This cash value can be borrowed against or withdrawn, providing a source of funds for the policyholder during their lifetime. This feature makes whole life insurance a valuable financial tool, allowing individuals to access their money for various purposes, such as starting a business, funding education, or investing in other opportunities.

While whole life insurance may have higher upfront costs compared to term life insurance, it is essential to consider the long-term benefits. The guaranteed coverage and the potential for cash value accumulation make it a more stable and reliable choice. Additionally, whole life insurance policies typically have fixed premiums, which means the cost remains consistent over the policy's duration, providing budget certainty.

In summary, whole life insurance offers lifelong coverage, a guaranteed death benefit, and the potential for cash value accumulation. While it may be more expensive initially, the long-term security and financial benefits make it a valuable investment for those seeking comprehensive life insurance protection. It is a suitable option for individuals who prioritize long-term financial stability and want to ensure their loved ones are protected, regardless of future circumstances.

Get a Life Insurance License: Nevada Requirements

You may want to see also

Universal Life: Flexible and can be cheaper over time

Universal life insurance offers a unique and flexible approach to life coverage, often providing a more affordable option over time compared to other types of policies. This type of insurance is a permanent life insurance policy that allows policyholders to customize their coverage and premiums, making it a versatile and potentially cost-effective choice.

One of the key advantages of universal life is its flexibility. Policyholders can choose how much to pay in premiums, and they have the option to increase or decrease the amount based on their financial situation and goals. This adaptability is particularly beneficial for those who want to ensure they have adequate coverage but may not have a fixed budget for insurance premiums. By adjusting the payments, individuals can manage their expenses more effectively, especially during periods of financial uncertainty.

Over time, universal life insurance can become more affordable for several reasons. Firstly, the initial costs associated with the policy are typically lower compared to other types of life insurance, such as term life. This is because universal life policies have a cash value component, which grows tax-deferred and can be borrowed against or withdrawn. As the cash value accumulates, it can offset future premiums, reducing the overall cost of the policy. Additionally, the flexibility in premium payments allows policyholders to make larger payments when they can, further decreasing the long-term expense.

Another factor contributing to the potential cost-effectiveness of universal life is the ability to customize the policy. Policyholders can choose the death benefit amount, which represents the payout to the beneficiary upon the insured's passing. By selecting a higher death benefit, individuals can ensure their loved ones are adequately provided for, even if it means slightly higher premiums. This customization allows for a more personalized and potentially cheaper policy tailored to individual needs.

In summary, universal life insurance stands out for its flexibility and potential cost savings. The ability to adjust premiums and customize the policy makes it a suitable choice for those seeking an affordable and adaptable life insurance option. Over time, the policy's cash value and flexible payment structure can contribute to lower overall costs, making universal life insurance a wise long-term investment for individuals and their families.

Strategies to Avoid Outliving Your Life Insurance Policy

You may want to see also

Simplified Issue: Less medical questions, potentially lower premiums

When it comes to life insurance, the term "simplified issue" refers to a type of policy that offers a streamlined application process, often with fewer medical questions and a quicker underwriting process. This type of insurance is designed to provide coverage to individuals who may have pre-existing health conditions or are considered high-risk by traditional insurance companies. By simplifying the underwriting process, insurers can offer policies with potentially lower premiums, making life insurance more accessible and affordable for a broader range of people.

Simplified issue life insurance is an excellent option for those who want coverage but may not qualify for standard life insurance due to health concerns. This type of policy typically requires applicants to answer fewer medical questions and provide less detailed medical information compared to traditional life insurance. Instead of a thorough medical examination and extensive health history, simplified issue policies often rely on a basic health questionnaire, making the application process quicker and less invasive.

The reduced medical scrutiny can lead to lower premiums, as the insurer takes on less risk by assessing a smaller set of health-related factors. This is particularly beneficial for individuals with pre-existing conditions or those who have experienced health issues in the past. By offering simplified underwriting, insurers can provide coverage to people who might otherwise be denied or charged higher rates, making life insurance more inclusive.

During the application process, you'll likely be asked about your overall health, any recent illnesses or surgeries, and lifestyle factors such as smoking or drinking habits. The information provided will help the insurer determine your risk profile and set an appropriate premium. This streamlined approach allows for a faster decision and potentially a quicker start to your coverage.

Simplified issue life insurance is a convenient and cost-effective solution for individuals seeking life coverage without the extensive medical scrutiny. It provides an accessible entry point into the world of life insurance, allowing people to protect their loved ones without the barriers of complex medical questions and potentially higher costs associated with traditional policies. This type of insurance is a valuable option for those who want coverage now, without the delays and potential rejections that can come with more thorough underwriting processes.

Selling Life Insurance: Your Path to Millionaire Status?

You may want to see also

Group Life: Often included in benefits packages, cost-effective

Group life insurance is a cost-effective and convenient option for many employers and employees. This type of coverage is often included in benefits packages, providing a safety net for both the employer and the workforce. Here's a detailed look at why group life insurance can be considered one of the cheapest forms of life insurance:

Employer-Sponsored Benefits: Many companies offer group life insurance as part of their employee benefits package. By doing so, they can attract and retain talent, as comprehensive benefits are a significant factor in job satisfaction. For the employer, this arrangement is cost-efficient because the insurance premiums are typically shared between the company and the employees. The employer may pay a portion or even the entire premium, making it an affordable option for both parties. This shared cost structure is a significant advantage, especially for small businesses or startups with limited budgets.

Pre-Determined Rates: Group life insurance policies often have pre-determined rates based on the group's demographics and risk factors. Since the risk is spread across a large number of individuals, the cost per person is relatively low. This is in contrast to individual life insurance policies, where rates are calculated based on personal factors like age, health, and lifestyle, which can vary significantly. By pooling the risk, insurance companies can offer more competitive rates for group policies, making it an affordable choice for the entire group.

Simplified Underwriting: Group life insurance policies often have a simplified underwriting process. This means that instead of a thorough medical examination and extensive health history review, which is common in individual policies, group applicants may only need to answer a few health-related questions. This streamlined process reduces the administrative burden and costs associated with underwriting, allowing insurance companies to offer more competitive rates.

Convenience and Coverage: Group life insurance provides a convenient way to obtain coverage without the need for extensive research and comparison. Employees can typically enroll in the group plan during open enrollment periods or when they start a new job. This immediate coverage can be especially valuable, as it ensures that employees and their families are protected without the hassle of individual policy selection and application processes.

Customizable Options: Group life insurance plans can be tailored to meet the specific needs of the employer and the workforce. This customization allows for flexibility in terms of coverage amount, term length, and other policy details. By offering a range of options, employers can ensure that the group life insurance plan fits the diverse needs of their employees, making it an attractive and cost-effective benefit.

In summary, group life insurance is often the cheapest form of life insurance due to its employer-sponsored nature, pre-determined rates, simplified underwriting, convenience, and customizable options. It provides a practical and affordable way to secure life insurance coverage for both employers and employees, making it a popular choice in the benefits package landscape.

Selling Life Insurance Over the Phone: Script for Success

You may want to see also

Frequently asked questions

Term life insurance is generally considered the most affordable type of life insurance. It provides coverage for a specific period, typically 10, 20, or 30 years, and is often more cost-effective than permanent life insurance (whole life or universal life) because it doesn't accumulate cash value over time.

To find the cheapest policy, you can compare quotes from multiple insurance providers. Factors that influence the cost include your age, health, lifestyle, the amount of coverage needed, and the duration of the policy. Shopping around and requesting quotes from various companies will help you identify the most competitive rates.

Yes, many insurance companies offer no-medical-exam or simplified issue life insurance policies. These are designed for individuals who may have health issues or are considered high-risk. The underwriting process is less rigorous, and you may not need a medical exam, making it more accessible and potentially cheaper for those with pre-existing conditions.

Absolutely! Online life insurance providers often offer competitive rates and a streamlined application process. You can compare quotes, customize your policy, and purchase coverage directly from their websites. This convenience can make it easier to find and purchase the cheapest life insurance policy that suits your needs.

The cost of life insurance generally increases with age. Younger individuals typically qualify for lower premiums because they are considered less risky. As you get older, your health may become a factor in determining the cost. Additionally, the amount of coverage you need might change over time, which can also impact the price.