Whole life insurance is a type of permanent life insurance that offers lifelong coverage and a guaranteed death benefit. It is a popular choice for individuals seeking long-term financial security and a way to provide for their loved ones. New York Life, a well-established insurance company, offers whole life insurance policies tailored to meet the unique needs of its customers. This comprehensive insurance product combines savings and investment components, allowing policyholders to build cash value over time, which can be borrowed against or withdrawn. With New York Life's whole life insurance, individuals can ensure their financial protection and leave a lasting legacy for their beneficiaries.

| Characteristics | Values |

|---|---|

| Definition | Whole life insurance, offered by New York Life, is a permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. |

| Features | - Offers both death benefit and investment components. - Accumulates cash value over time, which can be borrowed against or withdrawn. - Provides guaranteed death benefit and fixed premiums. - Dividend-based earnings potential. |

| Benefits | - Long-term financial security for beneficiaries. - Potential for tax-deferred growth of cash value. - Flexibility to customize the policy with riders and options. - Income replacement for the policyholder during their lifetime. |

| Premiums | - Fixed premiums that remain the same throughout the policy's life. - Premiums are typically higher compared to term life insurance but are guaranteed not to increase. |

| Riders and Options | - Critical illness riders. - Long-term care riders. - Waiver of premium riders. - Additional riders for increased death benefit or cash value accumulation. |

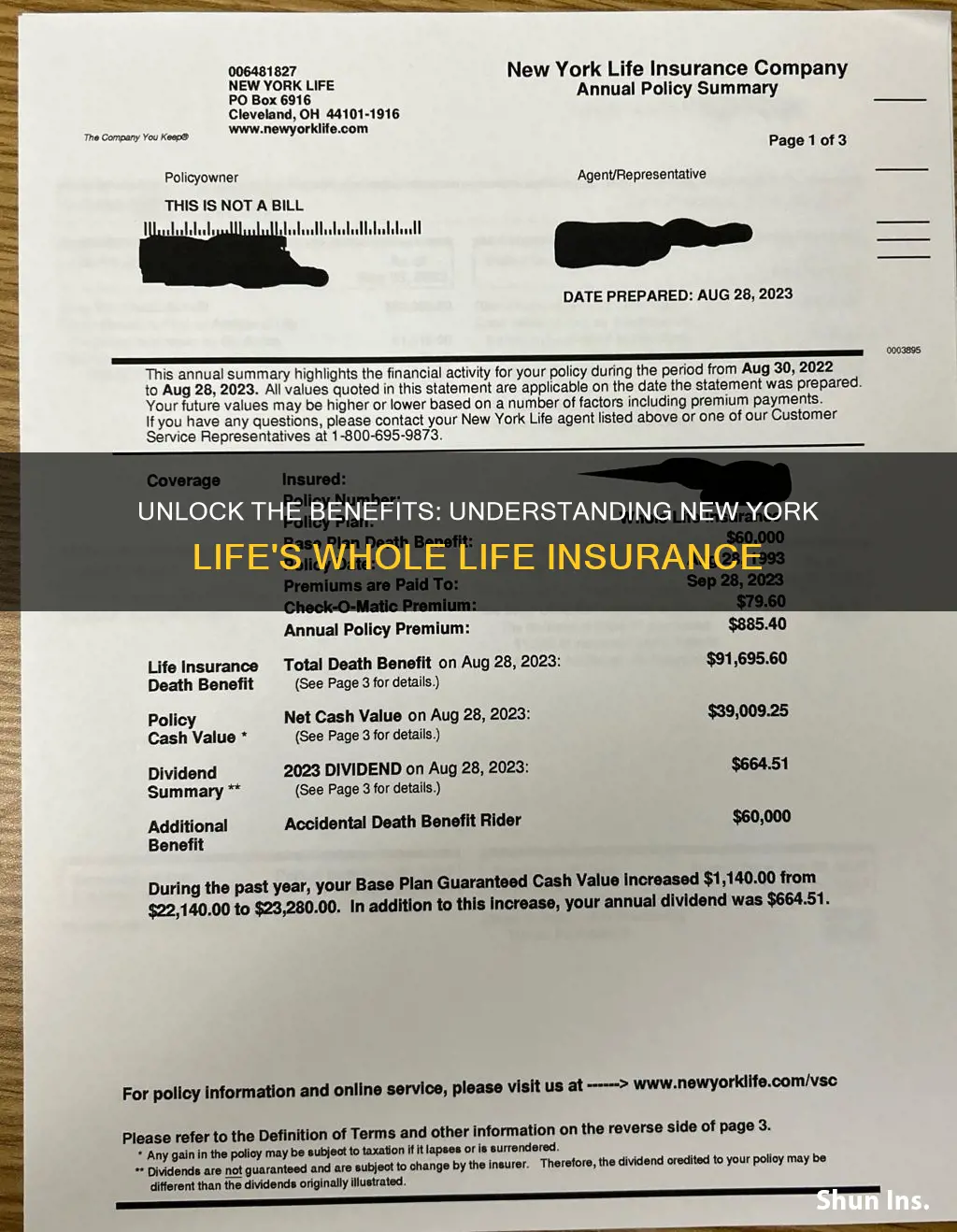

| Dividend Participation | - New York Life may declare dividends, which can increase the cash value of the policy and provide additional death benefit. |

| Cash Value Accumulation | - The policy's cash value grows over time, allowing for potential loan options and tax-advantaged withdrawals. |

| Policy Customization | - Policyholders can choose the death benefit amount, premium payment options, and other features to suit their needs. |

| Guarantees | - New York Life provides guarantees for death benefit, cash value accumulation, and premium payments. |

| Tax Advantages | - Potential for tax-deferred growth of cash value, similar to other permanent life insurance policies. |

What You'll Learn

- Definition: Whole life insurance is a permanent policy with guaranteed death benefit and cash value accumulation

- Benefits: Offers lifelong coverage, fixed premiums, and potential investment returns

- Comparison: How it differs from term life insurance in terms of coverage and flexibility

- Cost: Factors influencing premium rates, including age, health, and desired death benefit

- New York Life: Company overview, history, and its role in the New York market

Definition: Whole life insurance is a permanent policy with guaranteed death benefit and cash value accumulation

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It is a long-term financial commitment that offers a range of benefits, making it an attractive option for those seeking comprehensive protection. One of the key features of whole life insurance is its guaranteed death benefit. This means that, regardless of the insured's age or health at the time of death, the insurance company will pay out a predetermined amount to the policy's beneficiaries. This guarantee provides financial security and peace of mind, knowing that your loved ones will receive the intended financial support upon your passing.

In addition to the death benefit, whole life insurance also accumulates cash value over time. This is a significant advantage, as it allows the policyholder to build a valuable asset within the insurance policy. The cash value is essentially the investment component of the policy, and it grows tax-deferred. As the policyholder makes regular premium payments, a portion of each payment goes towards building this cash reserve. Over the policy's lifetime, the cash value can be borrowed against or withdrawn, providing financial flexibility. This feature is particularly beneficial for those who may need access to funds for various purposes, such as education expenses, business investments, or retirement planning.

The accumulation of cash value in whole life insurance is a powerful tool for long-term financial planning. It allows individuals to build a substantial sum of money that can be used for various financial goals. For example, policyholders can take out loans against the cash value to access funds for major purchases or investments. Additionally, the cash value can be used to pay for future premiums, ensuring that the policy remains in force even if the insured's financial situation changes. This flexibility is a key advantage, especially for those who want to build a financial safety net while also having a reliable insurance coverage.

Furthermore, whole life insurance offers a level of stability and predictability that is unique in the insurance market. The guaranteed death benefit and the accumulation of cash value provide a sense of security and control. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force for the insured's entire life. This permanence ensures that the policyholder's loved ones are protected even if their financial circumstances change over time. It also allows individuals to build a substantial financial asset that can be passed on to beneficiaries, providing a legacy for future generations.

In summary, whole life insurance is a permanent policy that offers a guaranteed death benefit and the potential for cash value accumulation. This type of insurance provides financial security, flexibility, and long-term financial planning opportunities. With its guaranteed benefits and the ability to build a valuable asset, whole life insurance is an attractive choice for individuals seeking comprehensive protection and a reliable financial partner for the future. Understanding the features of whole life insurance can help individuals make informed decisions about their insurance needs and overall financial strategy.

Navigating Life Insurance: Your Guide to Parent's Policies

You may want to see also

Benefits: Offers lifelong coverage, fixed premiums, and potential investment returns

Whole life insurance, offered by New York Life, is a comprehensive and long-term financial solution that provides numerous benefits to policyholders. One of its key advantages is lifelong coverage, ensuring that your loved ones are protected even in the long run. This type of insurance guarantees that the policy remains in force for the entire life of the insured individual, providing a sense of security and peace of mind. Unlike term life insurance, which has a limited duration, whole life insurance offers a permanent safety net, allowing you to build a financial legacy that endures.

In addition to lifelong coverage, New York Life's whole life insurance boasts fixed premiums, which means that the cost of the policy remains consistent throughout the entire term. This predictability is a significant advantage, as it allows policyholders to plan their finances effectively. With fixed premiums, you can budget and manage your expenses without the worry of sudden increases, providing financial stability for the long term.

Another notable benefit is the potential for investment returns. Whole life insurance policies often include an investment component, allowing policyholders to grow their money over time. This investment aspect can provide a financial boost, and the returns can be utilized to enhance the policy's value or even provide additional benefits to the policyholder. The investment portion of the policy is professionally managed, offering an opportunity to potentially increase the overall value of your insurance coverage.

Furthermore, the investment returns in whole life insurance can be particularly advantageous for long-term financial goals. Policyholders can utilize these returns to build a substantial cash value, which can be borrowed against or withdrawn to meet various financial needs. This flexibility ensures that your insurance policy becomes a versatile tool, catering to both your current and future financial requirements.

In summary, New York Life's whole life insurance offers a robust set of advantages, including lifelong coverage, fixed premiums, and the potential for investment returns. These features make it an attractive and reliable financial product, providing security, predictability, and growth opportunities for policyholders. Understanding these benefits can help individuals make informed decisions about their insurance needs and long-term financial planning.

Unraveling the Mystery: Understanding Flexible Universal Life Insurance

You may want to see also

Comparison: How it differs from term life insurance in terms of coverage and flexibility

Whole life insurance, offered by New York Life, is a permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which is designed to cover a specific period, whole life insurance offers a range of unique features and benefits that make it a comprehensive and long-term financial solution. Here's a comparison highlighting how whole life insurance differs from term life insurance in terms of coverage and flexibility:

Coverage:

- Long-Term Commitment: Whole life insurance provides coverage for the entire life of the policyholder, ensuring that the beneficiary receives a death benefit regardless of the insured's age or health status. This long-term commitment is a key advantage, especially for those seeking a stable and permanent financial safety net.

- Fixed Death Benefit: The death benefit in whole life insurance is guaranteed and remains constant throughout the policy's duration. This means that the beneficiary will receive the specified amount upon the insured's passing, providing financial security and peace of mind.

- Cash Value Accumulation: One of the most significant advantages is the accumulation of cash value over time. A portion of the premium payments goes towards building a cash reserve, which can be borrowed against or withdrawn, providing financial flexibility during the insured's lifetime.

Flexibility:

- Permanent Solution: Unlike term life, which has a defined end date, whole life insurance is a permanent policy. It remains in force as long as the premiums are paid, making it a reliable long-term financial strategy. This flexibility ensures that the coverage is tailored to the insured's needs throughout their entire life.

- Customizable Premiums: New York Life offers the option to customize premium payments. Policyholders can choose to pay level premiums, ensuring consistent payments, or opt for increasing premiums to match the insured's income growth over time. This flexibility allows for better financial planning and budgeting.

- Investment Opportunities: Whole life insurance policies often include an investment component, allowing policyholders to grow their cash value through various investment options. This feature provides an opportunity to potentially increase the overall value of the policy, offering both insurance protection and investment growth.

In summary, whole life insurance from New York Life stands out for its permanent coverage and the ability to provide financial security for the entire life of the insured. The accumulation of cash value and investment opportunities add a layer of flexibility, allowing policyholders to adapt the policy to their changing financial goals and needs. This makes whole life insurance a comprehensive and attractive option for long-term financial planning.

Life Insurance for the Rich: Who Needs It?

You may want to see also

Cost: Factors influencing premium rates, including age, health, and desired death benefit

Whole life insurance is a permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a range of benefits, including a guaranteed death benefit, an accumulation of cash value, and the potential for dividends. When it comes to New York Life, a well-known insurance company, understanding the cost structure of whole life insurance is essential for making informed financial decisions.

The cost of whole life insurance is primarily determined by several key factors. Firstly, age plays a significant role in premium calculations. Younger individuals typically pay lower premiums because they have a longer life expectancy, reducing the insurance company's risk. As individuals age, the risk of mortality increases, leading to higher premium rates. This is a standard practice in the insurance industry, as older individuals may face health challenges that could impact their longevity.

Another critical factor is the insured's health and medical history. Insurance companies assess the overall health of the applicant, including any pre-existing conditions, lifestyle factors, and medical history. A person with a healthy lifestyle, no chronic illnesses, and regular medical check-ups may be considered a lower-risk candidate, resulting in more affordable premiums. Conversely, individuals with health issues or those who smoke, have a sedentary lifestyle, or engage in risky activities may face higher premium rates due to the increased likelihood of health-related claims.

The desired death benefit, or the amount of coverage the policyholder wants, also influences the cost. Higher death benefits mean the insurance company takes on more financial risk, as they need to pay out a larger sum upon the insured's death. As a result, the premium rates tend to increase with the desired death benefit amount. It is essential for individuals to carefully consider their financial goals and choose a death benefit that aligns with their needs while also being financially feasible.

In summary, the cost of whole life insurance from New York Life is influenced by age, health, and the desired death benefit. Younger individuals and those in good health generally pay lower premiums, while older individuals and those with health issues may face higher rates. Additionally, increasing the desired death benefit will lead to higher premiums. Understanding these factors allows individuals to make informed decisions when purchasing whole life insurance, ensuring they receive appropriate coverage while managing their financial resources effectively.

Lupus and Life Insurance: What You Need to Know

You may want to see also

New York Life: Company overview, history, and its role in the New York market

New York Life Insurance Company, commonly known as New York Life, is a prominent financial services provider with a rich history spanning over 150 years. Founded in 1845, it has become one of the largest mutual life insurance companies in the United States, offering a wide range of financial products and services. The company's headquarters are located in New York City, which is fitting given its name and deep-rooted presence in the state.

The history of New York Life is a testament to its resilience and adaptability. It began as a small, local insurance company, catering to the needs of the growing population in New York. Over time, it expanded its operations, diversifying its product offerings to include various insurance and investment products. During the late 19th and early 20th centuries, the company played a crucial role in providing financial security to individuals and businesses, contributing to the economic growth of New York and the nation.

In the New York market, New York Life has established itself as a trusted and reliable financial partner. The company's extensive network of agents and financial advisors allows it to reach a wide range of customers, from individuals seeking life insurance to businesses requiring comprehensive financial solutions. New York Life offers a comprehensive suite of products, including whole life insurance, term life insurance, annuities, and retirement planning services. Their whole life insurance policies provide lifelong coverage, ensuring financial security for beneficiaries, which has become a cornerstone of the company's offerings.

The company's commitment to the New York community is evident through its various initiatives and sponsorships. New York Life has been a significant supporter of local charities and non-profit organizations, particularly those focused on education, youth development, and community development. This involvement has helped strengthen the company's reputation and build a strong connection with the residents of New York.

In recent years, New York Life has continued to innovate and adapt to the changing financial landscape. They have embraced digital technologies to enhance customer experience and streamline their operations. The company's online platforms and mobile applications allow customers to manage their policies, access resources, and receive personalized financial advice conveniently. Despite the challenges posed by the digital age, New York Life remains dedicated to its core values and mission, ensuring that its customers receive the best possible service and financial solutions.

Life Insurance After Military Service: What's Covered?

You may want to see also

Frequently asked questions

Whole Life Insurance, also known as permanent life insurance, is a long-term insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a combination of death benefit protection and a cash value component that grows over time. This type of insurance is designed to provide financial security and peace of mind, ensuring that beneficiaries receive a death benefit when the insured person passes away, and also allowing the policyholder to build a valuable asset.

New York Life's Whole Life Insurance offers a straightforward and reliable way to secure financial protection for your loved ones. Upon enrollment, the policyholder pays a set premium, which remains constant throughout their lifetime. The insurance company guarantees that the death benefit will be paid out as a lump sum to the designated beneficiaries when the insured individual dies. Additionally, the cash value of the policy accumulates and can be borrowed against or withdrawn, providing financial flexibility.

New York Life is a reputable and trusted insurance provider with a rich history. Their Whole Life Insurance policies offer several advantages, including guaranteed death benefit, fixed premiums, and the potential for cash value accumulation. Policyholders can build a substantial cash value over time, which can be used for various purposes, such as loan payments, tax-free withdrawals, or even purchasing an annuity. New York Life also provides excellent customer service and a range of policy options to suit individual needs.

Absolutely! New York Life understands that every individual's needs are unique. You can customize your Whole Life Insurance policy by choosing the appropriate death benefit amount, selecting the desired premium payment options (lump sum or periodic payments), and deciding on the policy term (lifetime coverage). Additionally, you can opt for various riders and add-ons to enhance your policy, such as an accidental death benefit or a waiver of premium rider, providing extra protection and flexibility.