Dave Ramsey, a renowned personal finance expert, has gained popularity for his straightforward approach to financial management. One of the key components of his financial advice is the importance of having adequate life insurance. In his books and podcasts, Ramsey emphasizes the need for individuals to protect their families' financial well-being by securing life insurance. He recommends a specific type of policy that aligns with his financial philosophy, advocating for term life insurance over whole life or universal life policies. This recommendation is based on the simplicity and cost-effectiveness of term life insurance, which provides coverage for a specified period, typically 10, 20, or 30 years, making it a practical choice for those seeking affordable protection during their working years.

| Characteristics | Values |

|---|---|

| Type of Life Insurance | Dave Ramsey recommends term life insurance, which provides coverage for a specific period, typically 10, 20, or 30 years. |

| Coverage Amount | The coverage amount should be equal to or slightly higher than your annual income. Ramsey suggests aiming for 10 times your annual income as a starting point. |

| Term Length | He advises choosing a term length that aligns with your financial goals and responsibilities. For example, if you have children who need financial support until they become independent, consider a longer term. |

| Cost | Term life insurance is generally more affordable than permanent life insurance. Ramsey emphasizes the importance of finding a policy with a reasonable premium that fits your budget. |

| No-Lapse Guarantee | Look for a policy with a no-lapse guarantee, ensuring that your premiums cannot increase unexpectedly. |

| Investment Component | Some term life insurance policies offer an investment component, allowing you to grow your money over time. However, Ramsey suggests avoiding policies with high investment fees. |

| Review and Adjustment | Regularly review and adjust your life insurance coverage as your financial situation changes. This ensures that your policy remains appropriate and cost-effective. |

| Avoid Over-Insuring | Ramsey warns against over-insuring, as it can lead to unnecessary financial burden. Focus on insuring your income-earning years and the financial obligations you want to protect. |

| No Medical Exam Policies | Consider no-medical-exam term life insurance, which is typically more affordable and accessible, especially for individuals with pre-existing health conditions. |

| Additional Benefits | Look for policies with additional benefits like accidental death coverage, waiver of premium, and critical illness coverage. |

What You'll Learn

- Dave Ramsey's Life Insurance Philosophy: Emphasizes term life insurance for coverage

- Term Life Insurance: Cost-effective, pure protection, no cash value

- Whole Life Insurance: Permanent coverage with cash value accumulation

- Universal Life Insurance: Flexible premiums, potential for higher returns

- Dave's Recommendations: Focus on coverage, avoid unnecessary features

Dave Ramsey's Life Insurance Philosophy: Emphasizes term life insurance for coverage

Dave Ramsey, a renowned personal finance expert, has a strong stance on life insurance, advocating for a specific type that aligns with his financial philosophy. His primary recommendation is term life insurance, a straightforward and cost-effective solution for providing financial protection to your loved ones. This type of insurance is designed to cover a specific period, typically 10, 20, or 30 years, and it offers a clear and defined purpose.

Ramsey's approach to life insurance is simple yet powerful. He believes that term life insurance is the most practical and efficient way to ensure your family's financial security. The primary goal is to provide coverage during the years when your family's needs are most significant, such as raising children, paying for education, or covering mortgage payments. By focusing on this critical period, term life insurance offers a targeted and effective solution.

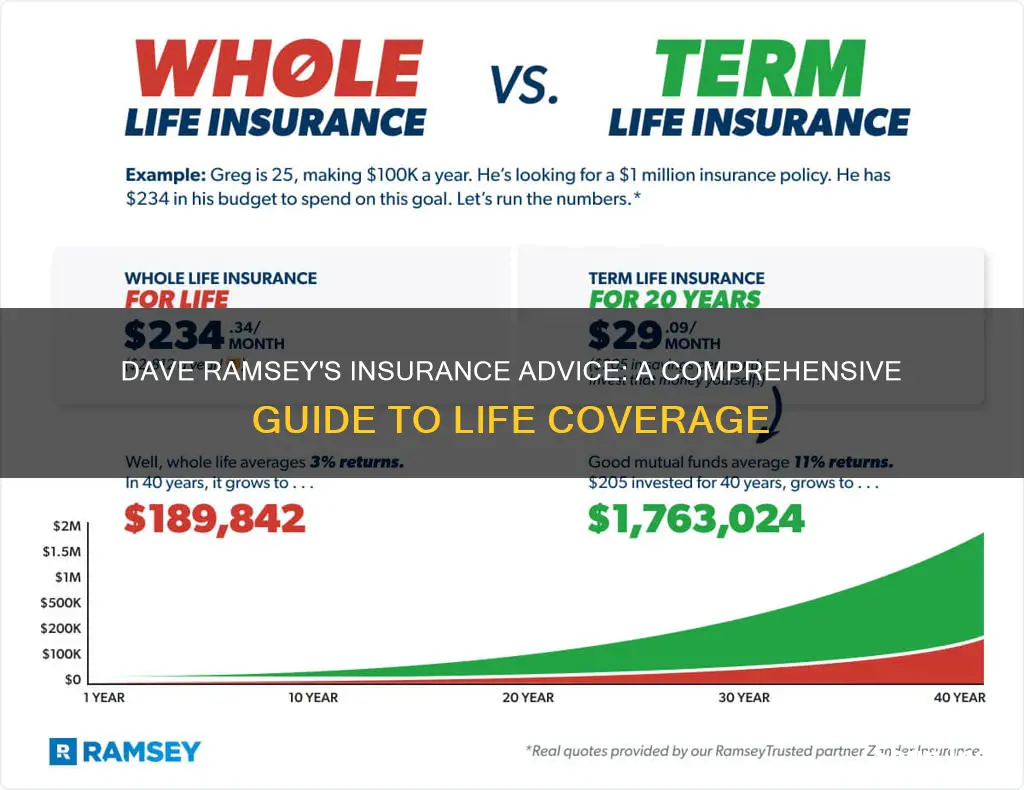

The beauty of term life insurance, as Ramsey emphasizes, is its affordability. It is generally more cost-effective than permanent life insurance because it has a defined term. This means that the premiums are lower, making it accessible to a broader range of individuals and families. Ramsey's philosophy encourages people to prioritize their family's needs and ensure they have the necessary financial protection without breaking the bank.

In his teachings, Ramsey often highlights the importance of calculating the correct amount of coverage. He suggests that individuals should consider their family's annual expenses and ensure that the life insurance policy covers at least that amount. This approach ensures that the financial burden on the surviving family members is minimized, allowing them to maintain their standard of living and cover essential costs.

By advocating for term life insurance, Dave Ramsey provides a practical and affordable way to secure your family's future. His philosophy encourages individuals to take control of their financial well-being and make informed decisions about life insurance, ultimately ensuring that their loved ones are protected during the most critical years of their lives. This approach has resonated with many, as it offers a straightforward and effective solution to a complex financial decision.

Life Insurance: Who Has It and Who Doesn't?

You may want to see also

Term Life Insurance: Cost-effective, pure protection, no cash value

Term life insurance is a popular and cost-effective choice recommended by many financial experts, including Dave Ramsey. This type of insurance provides pure protection for a specified period, offering financial security to your loved ones in the event of your untimely demise. Unlike permanent life insurance, term life insurance is designed to cover a specific period, typically 10, 20, or 30 years. During this term, it provides a death benefit if the insured individual passes away.

The beauty of term life insurance lies in its simplicity and affordability. It is a straightforward product that focuses solely on providing coverage for a defined period. This approach makes it highly cost-effective, as the premiums are generally lower compared to permanent life insurance. The primary advantage is that you get the coverage you need without the added complexity and higher costs associated with building cash value.

When considering term life insurance, it's essential to understand the coverage period. Choosing a term that aligns with your financial goals and the duration of your family's dependency on your income is crucial. For instance, if you have children who are still dependent on your financial support until they reach a certain age, you might opt for a 20-year term. This way, your family will have financial security during the years when they need it most.

One of the key advantages of term life insurance is its flexibility. You can select the coverage amount based on your family's needs and financial obligations. For example, you might consider your annual income, mortgage or loan payments, children's education costs, and other expenses to determine the appropriate death benefit. This flexibility ensures that your loved ones are adequately protected without over-insuring or paying for unnecessary coverage.

Additionally, term life insurance is a pure protection policy, meaning it does not accumulate cash value. This feature is particularly appealing to those who prefer a straightforward insurance solution. The premiums are calculated based on the coverage amount, term length, and your personal and family medical history. By understanding these factors, you can make an informed decision and choose a term life insurance policy that suits your specific needs and budget.

Term Life Insurance: Residual Value and Its Benefits

You may want to see also

Whole Life Insurance: Permanent coverage with cash value accumulation

Whole life insurance is a type of permanent life insurance that offers a range of benefits, making it an attractive option for those seeking long-term financial security. This insurance policy provides coverage for the entire lifetime of the insured individual, ensuring that beneficiaries receive a death benefit when the insured passes away. One of the key advantages of whole life insurance is its ability to accumulate cash value over time, which can be a valuable asset for various financial goals.

As the name suggests, whole life insurance offers coverage for the entire life of the policyholder. This means that once the policy is in force, the death benefit is guaranteed, providing financial security to the insured's loved ones. Unlike term life insurance, which provides coverage for a specific period, whole life insurance remains in effect for the duration of the policy, ensuring that the insured's family is protected even if their needs change over the years.

The cash value accumulation aspect of whole life insurance is a significant feature. As the policyholder makes regular premium payments, a portion of these payments goes towards building a cash value. This cash value grows over time, earning interest, and can be borrowed against or withdrawn as needed. The cash value can be a valuable financial tool, allowing policyholders to access funds for various purposes, such as starting a business, funding education, or investing in other opportunities. Additionally, the cash value can be used to pay for future premiums, ensuring that the policy remains in force without the need for additional funding.

One of the benefits of whole life insurance is its predictability. The death benefit and premium payments are fixed, providing a stable financial plan for the insured and their family. This predictability is especially useful for long-term financial planning, as it allows individuals to budget and save effectively. Moreover, the cash value growth can be a powerful tool for wealth accumulation, providing an opportunity to build a substantial financial reserve over time.

When considering life insurance, Dave Ramsey often emphasizes the importance of permanent coverage, and whole life insurance aligns with this recommendation. The permanent nature of this policy ensures that the insured's family is protected throughout their lives, providing peace of mind and financial security. Additionally, the cash value accumulation feature allows individuals to build a financial asset that can be utilized for various purposes, making whole life insurance a versatile and valuable financial tool.

Does Farmers Life Insurance Test for THC?

You may want to see also

Universal Life Insurance: Flexible premiums, potential for higher returns

Universal life insurance is a type of permanent life insurance that offers a unique blend of flexibility and potential financial benefits. This policy type is often recommended by financial experts, including Dave Ramsey, due to its adaptability and the opportunity for long-term growth. Here's an overview of why it might be a suitable choice for your insurance needs:

In traditional term life insurance, you lock in a premium rate for a specific period, providing coverage for a defined duration. However, universal life insurance takes a different approach. With this policy, you can adjust your premiums over time, allowing for flexibility in your budget. This is particularly advantageous for those who prefer a more tailored insurance plan. For instance, if you start with a lower premium and later decide to increase coverage, you can do so without the constraints of a fixed-rate term policy. The ability to customize your payments makes universal life insurance an attractive option for individuals who want to adapt their insurance strategy as their financial situation evolves.

One of the key advantages of universal life insurance is the potential for higher returns on your premiums. Unlike other insurance products, the cash value of a universal life policy can grow tax-deferred. This means that a portion of your premium payments is invested, and any earnings generated are added back into the policy, allowing your money to grow. Over time, this can result in a substantial accumulation of cash value, which can be borrowed against or withdrawn if needed. This feature provides a safety net and a potential source of funds for various financial goals, such as education expenses or starting a business.

The flexibility of universal life insurance extends beyond premium adjustments. Policyholders have the option to increase or decrease their coverage as their needs change. For example, if you welcome a new family member or experience a significant life event, you can opt to enhance your coverage without the hassle of applying for a new policy. This adaptability ensures that your insurance remains relevant and aligned with your evolving circumstances. Additionally, the potential for higher returns on cash value can make universal life insurance a more cost-effective long-term solution compared to other types of permanent insurance.

When considering universal life insurance, it's essential to understand the investment options available within the policy. These investment accounts can vary, offering different levels of risk and potential returns. Some policies provide a fixed account, ensuring a guaranteed minimum return, while others offer variable accounts, which can provide higher potential returns but also carry more risk. Policyholders can choose how to allocate their premiums between these investment options, allowing for a personalized approach to growing their insurance's value.

In summary, universal life insurance stands out for its flexibility in premium payments and the potential for higher returns on your investments. This type of policy is well-suited to individuals who seek control over their insurance strategy and want to adapt it to changing financial circumstances. By offering both customization and the opportunity for growth, universal life insurance can be a powerful tool in managing and protecting your financial well-being.

Liquidating Life Insurance for Assisted Living Expenses

You may want to see also

Dave's Recommendations: Focus on coverage, avoid unnecessary features

Dave Ramsey, a well-known personal finance expert, has offered his insights on life insurance, emphasizing the importance of coverage over unnecessary add-ons. He advocates for a straightforward approach to life insurance, ensuring that the policy provides adequate financial protection for the insured's loved ones. According to Ramsey, the primary goal is to secure a substantial death benefit that can cover essential expenses and provide financial security for the family.

When selecting a life insurance policy, Ramsey recommends focusing on term life insurance. Term life is a pure insurance product, offering coverage for a specified period, typically 10, 20, or 30 years. This type of policy provides a straightforward and cost-effective way to ensure financial protection during the years when your family's needs are likely to be the highest. By choosing a term life policy, you avoid the complexities and potential drawbacks of permanent life insurance, which often includes investment components that may not align with your primary goal of coverage.

One of the key advantages of term life insurance, as recommended by Dave Ramsey, is its simplicity. It is a no-frills policy, ensuring that the death benefit is paid out upon the insured's death, with no additional features or investment components. This simplicity allows the policy to remain affordable, providing the necessary coverage without unnecessary costs. Ramsey suggests that the focus should be on the amount of coverage rather than the policy's complexity, making term life insurance an ideal choice.

Additionally, Ramsey advises against adding riders or optional benefits to the policy. These additional features can increase the cost of the insurance without providing significant value. For instance, riders like accidental death benefits or waiver of premium riders might offer some additional protection but can also complicate the policy and increase premiums. Instead, he recommends keeping the policy basic and ensuring that the death benefit is the sole focus.

In summary, Dave Ramsey's life insurance recommendations emphasize the importance of coverage. He suggests that individuals should opt for term life insurance, which provides straightforward and affordable protection. By avoiding unnecessary features and focusing solely on the death benefit, individuals can ensure that their loved ones are financially secure without incurring additional costs. This approach aligns with Ramsey's philosophy of keeping personal finance decisions simple and effective.

Understanding Conditional Contracts in Life Insurance

You may want to see also

Frequently asked questions

Dave Ramsey, a well-known personal finance expert, advocates for term life insurance as a practical and cost-effective solution for families. He suggests that individuals should focus on covering their family's essential expenses, such as mortgage payments, education costs, and living expenses, for a specific period. Term life insurance provides a death benefit if the insured person passes away during that term, ensuring financial security for the family during the specified period.

Dave Ramsey's philosophy on life insurance is distinct from traditional financial advisors. He emphasizes the importance of keeping it simple and affordable. Unlike permanent life insurance policies that offer cash value accumulation, Ramsey recommends term life insurance, which is pure protection. This approach ensures that the policy is easy to understand, with no unnecessary features, and provides the necessary coverage at a lower cost.

Yes, Dave Ramsey acknowledges that certain life situations may warrant a different approach. For instance, if an individual has significant assets or a high net worth, he recommends considering whole life insurance, which offers lifelong coverage and a cash value component. Additionally, for those with specific business or investment needs, he suggests consulting a financial advisor to tailor the life insurance strategy accordingly.