Optional life insurance is an additional insurance policy that employees can take out to increase the amount paid out to their beneficiaries upon their death. This is offered as an add-on to basic life insurance policies, which are often provided by employers. The amount of optional life insurance coverage can be up to several times an employee's base salary, with a maximum limit. This maximum is usually based on the size of the employer.

| Characteristics | Values |

|---|---|

| What is it? | Additional protection and insurance for employees and eligible dependents |

| How does it work? | Increases the amounts paid as part of existing Life or Dependent Life Insurance policies |

| Who is it for? | Employees who are eligible for Basic Life Insurance |

| How much does it cost? | The premium is based on a rate (determined by age) per $1,000 of coverage |

| How is it paid? | Through biweekly payroll deductions |

| Is it taxable? | Yes, if the group term life insurance is in excess of $50,000 |

| Is it voluntary? | Yes |

What You'll Learn

How much does it cost?

The cost of optional life insurance depends on a few factors, including the size of the employer, the employee's age, and the amount of coverage desired. The premium for optional life insurance coverage is typically based on a rate per $1,000 of coverage, which is determined by the employee's age. The premium is usually paid through biweekly payroll deductions, with the deduction amount calculated by multiplying the rate by the coverage amount.

For example, if an employee's base salary is $50,000, they may be able to purchase optional life insurance coverage of up to $300,000, which is six times their base salary. This amount is in addition to any basic life insurance coverage they may have, such as the standard $50,000 coverage.

The maximum coverage available can vary depending on the employer and the specific optional life insurance plan offered. For instance, the Texas Employees Group Benefits Program offers optional term life insurance coverage of up to two times an employee's annual salary, with a maximum coverage of $400,000. On the other hand, the City of Portsmouth, Virginia, offers optional life insurance coverage of up to four times an employee's annual salary.

It's important to note that optional life insurance is typically considered a voluntary benefit, and employees are responsible for paying the entire cost of the plan. This means that the cost of optional life insurance can vary significantly depending on individual circumstances and the specific plan offered by the employer.

Business Owners: Life Insurance Through Your Company?

You may want to see also

Who is eligible?

Employees who are eligible for Basic Life Insurance may also purchase Optional Life Insurance coverage. This is a voluntary benefit, and employees pay for the entire cost of the plan. Optional Life Insurance coverage can be one, two, three, four, five, six or seven times an employee's base salary up to $300,000. This amount is in addition to the Basic Life Insurance coverage amount of $50,000.

The Texas Employees Group Benefits Program (GBP) offers three types of life insurance for retirees: Basic Term Life Insurance, Optional Term Life Insurance and Retiree Fixed Optional Life Insurance. Retirees are eligible for Basic Term Life Insurance when enrolled in a GBP health plan and only one of the optional life plans. Basic Term Life Insurance pays $2,500 to your beneficiary upon your death.

Optional Term Life Insurance provides additional coverage — up to two times your annual salary when you retired. Maximum coverage is $400,000. The monthly premium is based on your coverage election, your salary and your age.

To apply for Optional Life, speak with your Advisor or Plan Administrator. You will be required to submit medical evidence for all amounts of Optional Life and can apply for amounts up to the overall Life Insurance maximum. This maximum is usually based on the size of the employer.

California Teachers' Life Insurance: What's Covered?

You may want to see also

What is the maximum amount?

The maximum amount of employee optional life insurance depends on the size of the employer. For example, if your workplace has ten employees, you may qualify for a combined Life and Optional Life Insurance maximum of $850,000.

The amount of optional life insurance coverage can be one, two, three, four, five, six or seven times an employee's base salary up to $300,000. This is in addition to the Basic Life Insurance coverage amount of $50,000.

The Texas Employees Group Benefits Program (GBP) offers three types of life insurance for retirees. Basic Term Life Insurance, Optional Term Life Insurance and Retiree Fixed Optional Life Insurance. Retirees are eligible for Basic Term Life Insurance when enrolled in a GBP health plan and only one of the optional life plans. Basic Term Life Insurance pays $2,500 to your beneficiary upon your death. Optional Term Life Insurance provides additional coverage — up to two times your annual salary when you retired. Maximum coverage is $400,000.

The City of Portsmouth, Virginia offers employees the option to enrol in an Optional Life Insurance plan up to four times your annual salary.

Life Insurance and NRA Membership: What's the Link?

You may want to see also

What is the application process?

To apply for optional life insurance, you must first check if you are eligible. This will depend on whether you are already enrolled in a basic life insurance plan. If you are, you can apply for optional life insurance coverage. This can be one, two, three, four, five, six or seven times your base salary, up to $300,000. This is in addition to the basic life insurance coverage amount of $50,000.

To apply, you will need to speak with your advisor or plan administrator. You will be required to submit medical evidence for all amounts of optional life insurance. The premium for optional life insurance coverage is based on a rate determined by your age per $1,000 of coverage. The premium is paid through biweekly payroll deductions. The biweekly deduction amount is determined by multiplying the appropriate rate by the coverage amount.

OPM Life Insurance: Can It Be Sold?

You may want to see also

What is the benefit?

Optional life insurance provides additional protection and insurance to employees and their eligible dependents. It increases the amounts paid as part of existing life or dependent life insurance policies. This can be one, two, three, four, five, six or seven times an employee's base salary, up to a certain maximum. For example, the Texas Employees Group Benefits Program (GBP) offers optional term life insurance that provides additional coverage of up to two times an employee's annual salary, with a maximum coverage of $400,000.

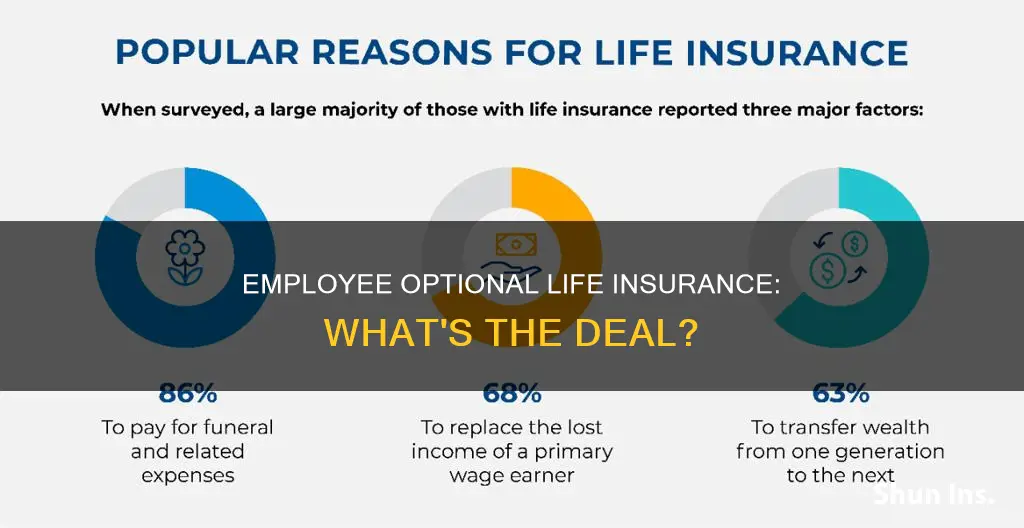

The benefit of optional life insurance is that it provides employees with greater financial security in the event of their death. It ensures that their loved ones will receive a larger payout, which can help to cover expenses and provide financial support. This can be especially important for employees who have dependents or financial commitments.

Another advantage of optional life insurance is that it can be tailored to the individual's needs. Employees can choose the level of coverage that best suits their financial situation and goals. This flexibility allows employees to customise their benefits package and ensure they have the right level of protection for their specific circumstances.

Additionally, optional life insurance can provide peace of mind and reduce financial stress. By having this extra layer of protection, employees can feel more secure about their future and the well-being of their family. This can lead to improved morale, productivity and overall job satisfaction.

Finally, optional life insurance can help to fill any gaps in an employee's existing life insurance coverage. Basic life insurance policies may not always be sufficient to meet an individual's needs, especially if they have a high salary or significant financial obligations. By enrolling in an optional life insurance plan, employees can enhance their financial protection and ensure that their loved ones are adequately provided for in the event of their death.

Health and Life Insurance: Licensing Together or Separately?

You may want to see also

Frequently asked questions

Employee optional life insurance is an additional insurance policy that employees can choose to take out on top of their basic life insurance.

This depends on the employer, but it can be up to several times an employee's base salary, up to a certain limit.

The premium is based on a rate determined by age per $1,000 of coverage. The premium is paid through biweekly payroll deductions.

Employees who are eligible for basic life insurance can also purchase optional life insurance coverage.

To apply for optional life insurance, speak with your advisor or plan administrator.