When the owner of a participating whole life insurance policy receives a portion of the company's investment profits, it can significantly enhance the policy's value. This participation in the company's success is a unique feature of participating whole life insurance, offering policyholders an opportunity to benefit from the insurer's financial performance. This type of policy is particularly attractive to those seeking long-term financial security and the potential for additional returns. Understanding how participation works is crucial for policyholders to maximize the benefits of their insurance investment.

What You'll Learn

- Policy Benefits: Understand death benefit, cash value accumulation, and guaranteed interest rates

- Premiums and Payments: Learn about premium structures, payment options, and potential savings

- Policy Loans: Explore borrowing options, interest rates, and repayment terms for policyholders

- Policy Lapse: Discover grace periods, surrender values, and strategies to prevent policy lapse

- Policy Transfers: Understand the process of transferring ownership, riders, and policy values

Policy Benefits: Understand death benefit, cash value accumulation, and guaranteed interest rates

When you own a participating whole life insurance policy, you gain access to several valuable benefits that can provide financial security and growth over time. Understanding these benefits is crucial to making informed decisions about your insurance coverage. Here's a detailed breakdown of the key advantages:

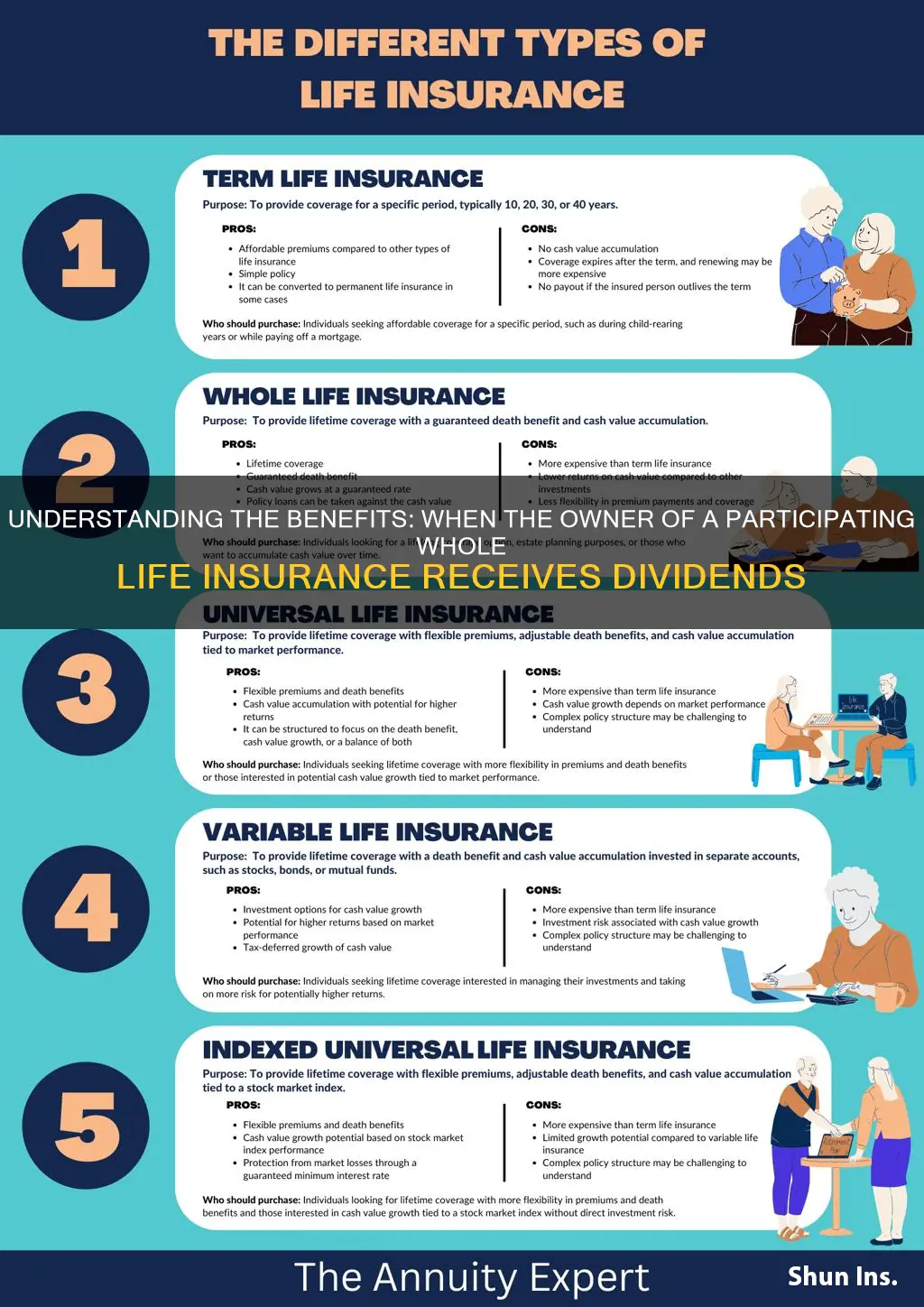

Death Benefit: One of the primary benefits of whole life insurance is the death benefit, which is a guaranteed payout to your designated beneficiaries upon your passing. This financial safety net ensures that your loved ones receive the financial support they need during a difficult time. The death benefit is typically a fixed amount, agreed upon at the time of policy inception, and it remains constant throughout the policy's duration. This guarantee provides peace of mind, knowing that your family's financial obligations will be met regardless of market fluctuations.

Cash Value Accumulation: Participating whole life insurance policies offer a unique feature called cash value accumulation. As you make regular premium payments, a portion of each payment goes towards building a cash reserve. This cash value grows over time due to interest credits and investment performance. The cash value can be borrowed against or withdrawn, providing you with a source of funds that can be used for various purposes, such as funding education, starting a business, or covering unexpected expenses. This feature is particularly beneficial as it allows you to build a personal savings account within your insurance policy.

Guaranteed Interest Rates: Another advantage of participating whole life insurance is the potential for guaranteed interest rates. These policies often include an investment component that guarantees a certain rate of return on the cash value accumulation. This means that, over time, your cash value will grow at a predetermined rate, ensuring a steady increase in the policy's value. Guaranteed interest rates provide a level of security, especially for long-term financial planning, as they offer a consistent return on your investments.

In summary, as the owner of a participating whole life insurance policy, you benefit from a death benefit that provides financial security for your loved ones, cash value accumulation allowing for personal savings and loan capabilities, and guaranteed interest rates that offer consistent growth. These features make whole life insurance a powerful tool for long-term financial planning and risk management. Understanding these benefits is essential to maximizing the value of your insurance policy and ensuring your financial goals are met.

First-to-Die Life Insurance: Whole Life Coverage for Couples

You may want to see also

Premiums and Payments: Learn about premium structures, payment options, and potential savings

When you own a participating whole life insurance policy, understanding the premium structure and payment options is crucial for making informed financial decisions. Here's a detailed breakdown of how premiums work and the potential savings you can unlock:

Premium Structure:

The premium for a participating whole life insurance policy is typically calculated based on several factors. Firstly, the insurance company assesses your age, health, and lifestyle, as these factors influence the risk associated with insuring your life. Older individuals may face higher premiums due to the increased likelihood of claiming benefits. Additionally, the amount of coverage you choose directly impacts the premium; higher coverage amounts result in higher premiums. The duration of the policy also plays a role; longer-term policies often have lower monthly premiums but higher overall costs over time.

Payment Options:

Policyholders have several payment options to choose from:

- Level Premiums: This option involves paying a fixed amount at regular intervals (monthly, annually) for the entire term of the policy. It provides predictable expenses but may be more costly over time compared to other payment structures.

- Increasing Premiums: Here, the premium amount starts low and gradually increases annually, keeping pace with inflation and potential cost increases. This option is suitable for those who expect their income to rise over time.

- Decreasing Premiums: As the name suggests, these premiums start high and decrease over time, often aligning with the policyholder's retirement age. This structure is beneficial for those who want lower initial payments but may face higher costs later in life.

Potential Savings:

Participating whole life insurance policies offer an opportunity to build cash value, which can be utilized in various ways:

- Loan Features: You can borrow against the cash value of your policy, allowing you to access funds for significant purchases or investments without selling the policy.

- Tax-Deferred Growth: The cash value grows tax-free, providing a potential source of funds for future financial goals.

- Death Benefit and Income: The policy's death benefit ensures financial security for your loved ones, and the cash value can be used to generate income during retirement, providing financial stability.

Understanding the premium structure and payment options is essential for maximizing the benefits of your participating whole life insurance policy. By carefully considering your financial situation and goals, you can make informed decisions to optimize your savings and ensure financial security for the long term. Remember, the key to successful insurance ownership is staying informed and adapting your strategy as your life circumstances change.

Uninsured: The Surprising Number of Adults Without Life Insurance

You may want to see also

Policy Loans: Explore borrowing options, interest rates, and repayment terms for policyholders

When you own a participating whole life insurance policy, you have the option to borrow against the cash value of your policy, which can be a valuable financial tool. Policy loans allow you to access the funds accumulated in your insurance policy while still maintaining coverage. This can be particularly useful for various financial needs, such as covering unexpected expenses, funding education, or starting a business. Here's an overview of policy loans and what you need to know:

Borrowing Options: Policyholders can typically borrow against their whole life insurance policy by taking out a loan from the insurance company itself or through a third-party lender. The insurance company often provides policy loans as a way to offer additional benefits to policyholders. When considering borrowing, it's essential to understand the terms and conditions set by the insurance provider. These terms may include the loan amount, interest rate, and repayment period. Some policies might offer a lump-sum loan, while others provide a line of credit, allowing you to borrow as needed within a specified limit.

Interest Rates: Interest rates on policy loans are usually lower compared to traditional loans from banks or other financial institutions. This is because the insurance company considers the policy's cash value as collateral. The interest rate may vary depending on the insurance company's policies and the overall market conditions. Typically, the interest rate on a policy loan is fixed, ensuring predictable monthly payments. It's crucial to review the interest rate structure to understand how much you'll pay in interest over the loan term.

Repayment Terms: Repayment terms for policy loans are designed to align with the policyholder's needs. Repayments are usually made monthly and are automatically deducted from the policy's cash value. The repayment period can vary, but it often aligns with the policy's term. For example, if you have a 20-year whole life insurance policy, the loan repayment might also span 20 years. It's important to ensure that the loan repayment schedule doesn't compromise your insurance coverage. Some policies may offer flexibility in repayment, allowing you to make additional payments to reduce the loan balance faster.

Before taking out a policy loan, it's advisable to carefully review the loan agreement and seek professional financial advice. Understanding the terms, interest rates, and potential impact on your insurance coverage is crucial. Policy loans can be a valuable financial strategy when managed properly, providing access to funds without disrupting your insurance protection.

BDO Life Insurance: What You Need to Know

You may want to see also

Policy Lapse: Discover grace periods, surrender values, and strategies to prevent policy lapse

When the owner of a participating whole life insurance policy faces the challenge of policy lapse, it's crucial to understand the grace period and surrender value options available. Policy lapse occurs when the insured individual fails to make the required premium payments, leading to the potential termination of the policy. However, insurance companies often provide a grace period to give policyholders a chance to rectify the situation. During this grace period, typically ranging from 10 to 30 days, the policy remains in force, and the owner can pay the overdue premium without incurring additional fees. This grace period is a valuable safety net, allowing policyholders to address financial setbacks and ensure their insurance coverage remains intact.

Understanding the surrender value is essential in managing policy lapse. The surrender value represents the cash value of the policy accumulated over time, and it can be accessed by the policyholder if they choose to surrender the policy. In the event of policy lapse, the surrender value can be utilized to pay the overdue premiums, preventing the policy from terminating. It is a financial cushion that provides flexibility and control to the policy owner, enabling them to make informed decisions regarding their insurance coverage.

To prevent policy lapse, several strategies can be employed. Firstly, maintaining open communication with the insurance provider is vital. Policyholders should promptly inform their insurer about any financial difficulties or changes in circumstances that may affect their ability to make premium payments. Many insurance companies offer payment plans or flexible payment options, allowing policyholders to spread out their payments over time. Additionally, exploring the option of increasing the policy's coverage amount can provide a financial buffer, making it easier to manage premium payments.

Another effective strategy is to review and assess the policy regularly. Policyholders should carefully examine their insurance needs and adjust the policy accordingly. By ensuring that the coverage remains appropriate for their current situation, they can better manage the associated costs. Furthermore, maintaining a healthy financial lifestyle, such as budgeting and saving, can help build a financial cushion to cover unexpected expenses, including insurance premiums.

In summary, policy lapse in participating whole life insurance can be mitigated through a combination of grace periods, surrender values, and proactive financial management. Grace periods offer a temporary reprieve, allowing policyholders to address payment issues, while surrender values provide a financial safety net. By staying informed, communicating with the insurer, and implementing strategic financial planning, policy owners can effectively prevent policy lapse and maintain their valuable insurance coverage.

Canceling Manulife Life Insurance: A Step-by-Step Guide

You may want to see also

Policy Transfers: Understand the process of transferring ownership, riders, and policy values

When it comes to whole life insurance, understanding the concept of policy transfers is crucial for policyholders, especially if they are the owners of a participating policy. A policy transfer is a process that allows the owner of a life insurance policy to pass on certain aspects of the policy to another party, such as a new owner or beneficiary. This can be a strategic move to ensure the policy's benefits continue to be utilized effectively or to align with changing personal circumstances.

The process typically begins with the current owner initiating the transfer. This involves contacting the insurance company and providing them with the necessary details, including the policy number, the name of the new owner or beneficiary, and any specific instructions regarding the transfer. It is essential to have all the required documentation ready, such as proof of identity and ownership, to ensure a smooth transition. The insurance company will then review the application and may require additional information or documentation to verify the authenticity of the transfer.

One of the key aspects of a policy transfer is the ability to transfer the policy's riders. Riders are additional benefits or features added to the base policy, providing enhanced coverage or specific protections. For example, a rider might offer accelerated death benefits, allowing the policyholder to access a portion of the death benefit while still alive if they are diagnosed with a critical illness. When transferring ownership, the new owner can choose to retain these riders, ensuring the policy continues to provide the desired level of protection. This is particularly beneficial if the original owner wanted to pass on the policy's value and associated benefits to a family member or trusted individual.

The transfer of policy values is another critical aspect. Whole life insurance policies accumulate cash value over time, which can be borrowed against or withdrawn. When transferring ownership, the new owner can decide how to utilize this cash value. They may choose to continue building upon the policy's value, making additional premium payments to increase the death benefit and further enhance the policy's overall worth. Alternatively, the new owner might opt to take out a loan against the policy's cash value or make a partial withdrawal to access the funds for other financial needs.

In summary, policy transfers for whole life insurance owners offer a flexible way to manage and pass on the policy's benefits. By understanding the process and its implications, policyholders can make informed decisions about transferring ownership, riders, and policy values. This ensures that the insurance policy continues to serve its intended purpose, providing financial security and peace of mind to the new owner and their beneficiaries. It is always advisable to consult with a financial advisor or insurance professional to navigate the transfer process effectively and make the most of the policy's features.

Life Insurance for Babies: Is It Possible?

You may want to see also

Frequently asked questions

Participating whole life insurance is a type of policy where the owner benefits from the profits of the insurance company. This means that if the company performs well financially, the policyholder may receive additional benefits, such as bonus dividends, which can increase the cash value of the policy. Non-participating policies, on the other hand, do not offer these profit-sharing features.

The owner of a participating whole life insurance policy has a significant influence on its performance. They can make decisions regarding premium payments, policy loans, and other policy-related actions. Additionally, the owner's investment in the policy's cash value can grow over time, providing financial security and potential tax advantages.

Yes, the owner of a participating whole life insurance policy typically has the flexibility to withdraw funds. This can be done through policy loans, where the owner borrows money from the policy's cash value, or through surrender, where the owner returns the policy to the insurance company in exchange for a payout. These options provide liquidity and allow the owner to access the accumulated value in the policy.

Participating whole life insurance policies can offer tax advantages. The cash value growth within the policy may be tax-deferred, allowing it to accumulate over time without being taxed annually. Additionally, withdrawals made for policy loans or surrenders may be taxed as ordinary income, while withdrawals for policy loans used for qualified education expenses or first-time home purchases may be tax-free, depending on the jurisdiction and specific policy terms.