Life insurance is a way to ensure that your loved ones are financially protected if anything happens to you. While it is a common practice in some countries, the availability and requirements for getting life insurance vary across the world. For instance, in the US, even foreign nationals can get life insurance coverage, while in Japan, it may be difficult as most policies are designed for the local market. The percentage of the population with life insurance also differs from country to country, with Taiwan having the highest percentage of people with life insurance coverage.

| Characteristics | Values |

|---|---|

| Percentage of the population with life insurance | Romania: 0.23% |

| Australia: 2.39% | |

| Taiwan: 18.71% | |

| Requirements for foreigners to get life insurance | In the US, foreign nationals need to demonstrate ties to the country, such as employment in a US-based company or property ownership. |

| In Japan, most life insurance policies are designed for the local market, so foreigners are encouraged to get life insurance from their home country. | |

| In the US, foreign nationals need to be in the country for the full duration of the application process, which can take 4-8 weeks. | |

| Foreign nationals from certain countries, such as Afghanistan, Cambodia, Haiti, Iraq, and Lebanon, are not eligible for US life insurance due to high-risk profiles or strict regulations. | |

| Some countries, including Croatia, Greece, Hungary, Japan, Panama, Poland, Switzerland, and Uruguay, do not allow their citizens to buy life insurance outside their home country. | |

| Influence of travel on life insurance | Life insurance companies consider travel a factor when approving policies and determining premiums. |

| Travel history and future travel plans may affect eligibility, coverage, and premium costs. | |

| Travel to medium- or high-risk countries may lead to coverage restrictions or exclusions. |

What You'll Learn

International life insurance for expats and global citizens

International life insurance is a type of insurance policy that provides coverage and financial protection to individuals who live or work in multiple countries or have an international lifestyle. It is designed to meet the unique needs of expatriates, frequent travellers, and individuals with global connections. The policy is a contract between the insured individual and the insurer, where the individual pays regular premiums, and the insurance company pays the sum insured to the beneficiary upon the individual's death.

The main benefit of international life insurance is that it offers worldwide coverage, ensuring that the death benefit is paid out to beneficiaries regardless of where the insured person passes away. This provides peace of mind for expatriates, knowing that their loved ones will be taken care of financially even if they die overseas.

Types of International Life Insurance

There are two main types of international life insurance policies:

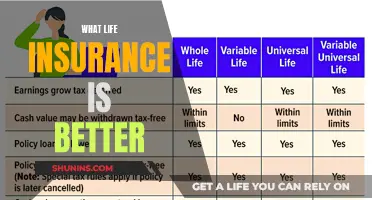

- Term Life Insurance: This type of policy offers coverage for a limited period, typically ranging from 1 to 30 years. It is the most popular option among expats and global travellers due to its economical premiums and flexible coverage terms. However, these policies do not build cash value and become more expensive to renew.

- Whole Life Insurance: Whole life insurance provides lifetime coverage and a guaranteed death benefit. It tends to be more expensive than term life insurance but offers the advantage of permanence and financial security. This type of policy is often chosen by those concerned about their changing health and the possibility of not being eligible for a policy in the future.

Key Benefits of International Life Insurance

In addition to worldwide coverage, international life insurance offers several other benefits:

- Coverage Options: Expats can choose from various coverage options, including term life, whole life, and annually renewable life plans.

- Currency Flexibility: Policyholders can pay premiums and receive payouts in different currencies, such as USD, EUR, or GBP.

- Portability: International life policies are portable, allowing policyholders to maintain coverage even if they change countries or move frequently.

- Beneficiary Flexibility: Beneficiaries can be named anywhere in the world, providing flexibility for expats with global connections.

Factors Affecting Premium Calculation

International life insurance premiums are calculated based on several factors, including age, nationality, residence country, coverage amount and term length, lifestyle habits (e.g., smoking), and the inclusion of additional riders.

Considerations for Expats

When considering international life insurance, it is important for expats to review the terms and conditions of their existing policies carefully. Many domestic life insurance policies may not provide coverage for death abroad or may have travel restrictions. Therefore, it is crucial to ensure that your loved ones will be protected financially regardless of your location.

Additionally, when moving to a new country, it is essential to inform your insurer about changes in your country of residence to ensure that your policy remains compliant with local regulations.

Providers of International Life Insurance

Several companies offer international life insurance, including William Russell, Unisure, and Guardian. These providers are known for their commitment to offering comprehensive and reliable solutions to individuals and families worldwide.

In conclusion, international life insurance is a vital consideration for expats and global citizens to ensure their loved ones are financially protected. By understanding the unique needs of this mobile population, insurance providers have developed tailored policies that offer worldwide coverage, flexibility, and peace of mind.

Life Insurance and Social Security Disability: What's the Link?

You may want to see also

Getting life insurance as a foreigner

The requirements for getting life insurance as a foreigner vary depending on the country you are in and your residency status. Here is a guide to help you understand the process and requirements for obtaining life insurance as a foreigner in different countries.

United States

In the United States, foreign nationals can get life insurance coverage from American companies, but the process and availability of policies depend on their residency status. There are three main categories of foreign nationals in the US: green card holders/permanent residents, non-permanent residents with visas, and non-resident foreign nationals with US ties.

Green Card Holders/Permanent Residents

Green card holders are considered permanent residents of the US and have access to a wider range of life insurance options. Most insurance companies require a minimum of two years of permanent residency before providing coverage. After residing in the US for two consecutive years, green card holders are generally eligible for the same life insurance options as US citizens. However, factors such as age, health status, and income level will still affect the cost and coverage options.

Non-Permanent Residents with Visas

Foreign nationals holding valid US visas may be eligible for life insurance coverage, but they may face more challenges and limitations compared to permanent residents. Some visa types that may be eligible for coverage include E, H1B, K, L, O, TN, and TD visas. The specific coverage options will depend on the visa type, duration, and the guidelines of the insurance company. It is important to ensure that your visa is up to date and valid when applying for life insurance, and additional documentation and assessments may be required.

Non-Resident Foreign Nationals with US Ties

High-net-worth foreign nationals with significant business, financial, and family ties to the US may also qualify for life insurance coverage. These policies are typically specialized and designed to meet the complex needs of internationals with interests in multiple countries. Availability may depend on the country of residence, and the underwriting process can be involved. These policies can be valuable for internationals looking to protect their assets and family capital in the US, especially considering the federal estate tax exemption for non-residents.

Japan

Obtaining life insurance as a foreigner in Japan can be difficult, as most life insurance policies are designed for the local market. Foreigners in Japan are usually encouraged to acquire life insurance from their home country, if available.

Other Countries

The availability and requirements for life insurance for foreigners can vary across different countries. It is important to research the specific regulations and options in your country of residence or the country where you intend to obtain life insurance. Some countries may have restrictions on purchasing insurance outside the country, while others may have limitations based on residency status or visa type. Working with an insurance broker or advisor who specializes in international or expatriate insurance can be beneficial in navigating the options and requirements.

Selling AAA Life Insurance Policies: Is It Possible?

You may want to see also

Country-specific restrictions on buying life insurance abroad

Each country has its own set of regulations and requirements for purchasing life insurance, and these can vary significantly. Here are some country-specific restrictions to consider when buying life insurance abroad:

United States of America

The US allows foreign nationals residing in the country to obtain life insurance coverage. However, they must provide evidence of ties to the US, such as employment in a US-based company or ownership of a business or property. The quote they receive may depend on their medical condition, income, and occupation.

Japan

Obtaining life insurance as a foreigner in Japan can be challenging since most policies are designed for the local market. Foreigners are often encouraged to acquire life insurance from their home country if it is available.

United Kingdom

UK citizens living abroad can obtain international life insurance, which covers them regardless of their location. This type of insurance is essential for expats who want to ensure their loved ones are financially protected.

Australia

Australia has a relatively high percentage of its population with life insurance, at 2.39%. The availability of comparison websites and the encouragement of policies with different premiums have contributed to this. Premiums can vary based on individual factors such as health and income.

Taiwan

Taiwan has the highest percentage of its population with life insurance, at 18.71%. This is because Taiwanese people use life insurance as a savings accumulation tool, as it offers a higher return than traditional bank accounts.

When considering purchasing life insurance abroad, it is crucial to research the specific requirements and restrictions of the country in question. Each country has its own unique set of regulations, and understanding these can help ensure that you and your loved ones are adequately protected.

Life Insurance with Parkinson's: Is It Possible?

You may want to see also

Travel plans and their impact on life insurance

When planning a trip, it is essential to consider how your travel plans may impact your life insurance policy. Here are some key points to keep in mind:

Impact on Policy Application

Your travel plans can significantly impact your application for a new life insurance policy. Insurers may delay or deny your application if they deem your intended travel destinations to be high-risk. This assessment is based on factors such as political instability, civil unrest, natural disasters, or a high incidence of crime. It is crucial to be transparent about your travel history and future plans during the application process.

Destination Restrictions

Life insurance policies often include destination restrictions, excluding coverage for high-risk countries or regions. If you travel to these restricted areas and something happens to you, your insurance company may deny your claim or reduce the payout. These restrictions are in place to manage the risks associated with travel to certain destinations.

Notification and Approval Requirements

Some life insurance policies require you to notify and obtain approval from the insurance company before traveling to specific destinations, especially those considered high-risk. The insurance provider may request details about your trip and activities to assess the level of risk involved. Failure to obtain the necessary approvals may result in complications with your coverage.

Travel Advisories

Insurance companies may restrict or exclude coverage for countries that are subject to travel advisories issued by the government. Traveling to these countries against official advice could lead to denied claims or reduced payouts. It is important to stay informed about travel advisories and understand the implications for your insurance coverage.

Impact on Premiums

Frequent travel, especially to high-risk areas, can result in increased life insurance premiums. Insurance companies perceive frequent travelers or those traveling to high-risk destinations as having a higher risk exposure. Consequently, they may implement stricter guidelines and higher premiums to mitigate their financial risks.

Additional Coverage Options

If you frequently travel to high-risk countries, consider purchasing additional coverage options, such as specialized travel insurance or add-ons like war and terrorism coverage or emergency evacuation insurance. These supplementary plans can provide extra protection and peace of mind during your travels.

In conclusion, travel plans can have a significant impact on your life insurance coverage. It is essential to carefully review your policy, disclose your travel plans, and stay informed about any restrictions or requirements related to your destination. By taking these proactive steps, you can ensure that your life insurance remains valid and provides the necessary protection for you and your loved ones.

Irrevocable Life Insurance Trusts: Taxable or Not?

You may want to see also

Country risk ratings and their effect on life insurance

Country risk ratings are assessments of the financial and economic conditions of a country, which can impact the life insurance sector. These ratings take into account various factors, including the stability of the economy, government regulations, market competition, and investment risks. While country risk ratings do not directly determine life insurance premiums, they provide valuable insights into the overall stability and attractiveness of the insurance market in a particular country.

For example, a country with a very low-country risk rating, such as Denmark, benefits from a strong and stable economy, a supportive institutional framework, and a competitive market structure. This environment can foster confidence in the life insurance sector, potentially leading to more favourable premium rates and broader access to insurance products for its citizens.

On the other hand, countries with higher country risk ratings may face challenges in their life insurance sectors. For instance, a country with economic instability, political uncertainty, or stringent regulations might be deemed riskier for insurers to operate in. As a result, insurance companies may charge higher premiums to account for the increased risk, or they may even choose to limit their presence in that market.

Country risk ratings can also influence the availability and cost of reinsurance, which is essential for life insurers to manage their risk exposure. Reinsurers carefully evaluate country risk ratings before providing coverage to primary insurers. If a country is deemed riskier, reinsurance rates may increase, which can subsequently affect the pricing of life insurance policies for consumers.

Furthermore, country risk ratings can impact the investment strategies of life insurance companies. Insurers typically invest a significant portion of their premiums in various financial instruments to generate returns. Country risk ratings can influence the perceived risk and return potential of these investments, thereby affecting the overall profitability of the life insurance sector in that country.

In summary, country risk ratings play a crucial role in assessing the stability and attractiveness of a country's life insurance market. These ratings can indirectly influence the availability and pricing of life insurance products, as they reflect the economic, political, and regulatory environment in which insurers operate. While country risk ratings are just one factor among many that shape the life insurance landscape, they provide valuable insights for insurers, reinsurers, and consumers alike when making decisions about risk management and financial protection.

Life Insurance with Atrial Fibrillation: What You Need to Know

You may want to see also

Frequently asked questions

Yes, many countries offer life insurance to their citizens and some even have specific policies for foreigners or expatriates.

If you are a foreign national, you can get life insurance in another country, but the requirements vary. For example, in the US, foreign nationals need to demonstrate ties to the country, such as employment or property ownership, and may need to provide various financial and medical records.

The country you visit, the length of your stay, your purpose for visiting, and your occupation can all impact your coverage. Travel longer than six months may qualify you as a foreign national, which can affect your coverage and premium costs.

Yes, participating in high-risk activities or travelling to dangerous locations can void your life insurance policy. Insurance companies consider factors like the medical facilities available, political stability, and the presence of endemic diseases in the country when assessing risk.