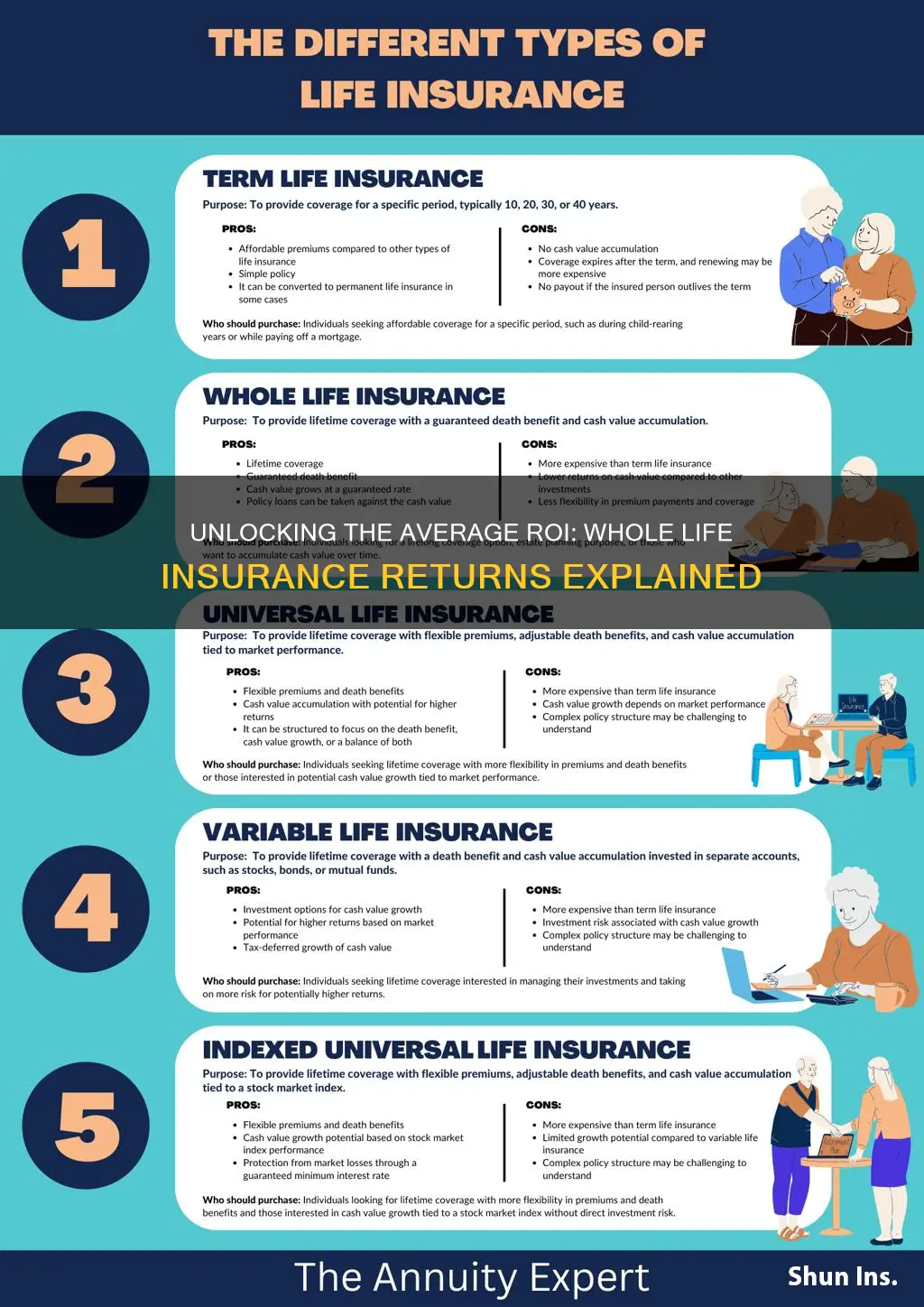

Whole life insurance is a type of permanent life insurance that offers a guaranteed death benefit and a cash value component. The average return on whole life insurance refers to the average annual rate of return that policyholders can expect to earn on the cash value portion of their policy over time. This return is typically higher than that of term life insurance but lower than that of investment vehicles like stocks or bonds. Understanding the average return on whole life insurance is crucial for policyholders as it directly impacts the overall value and growth of their investment.

What You'll Learn

- Historical Performance: Average returns over time for whole life insurance policies

- Investment Component: Returns from the investment portion of whole life insurance

- Guaranteed Returns: Fixed rates and guarantees in whole life insurance

- Market Influence: How market conditions affect whole life insurance returns

- Policyholder Benefits: Returns and benefits for policyholders in whole life insurance

Historical Performance: Average returns over time for whole life insurance policies

The concept of average returns on whole life insurance policies is an important aspect to consider when evaluating the performance of these long-term financial products. Historically, whole life insurance has been known for its consistent and relatively stable returns over extended periods. This type of insurance policy, also known as permanent life insurance, offers a guaranteed death benefit and a cash value component that grows over time.

When examining the historical performance, it is essential to understand that whole life insurance policies typically have higher upfront costs compared to term life insurance. This is because the policy provides coverage for the entire lifetime of the insured, ensuring a payout to the beneficiary upon the insured's death. The higher costs are justified by the long-term security and the accumulation of cash value, which can be borrowed against or withdrawn.

Over the past several decades, the average annual return on whole life insurance policies has been quite competitive. On average, the cash value of these policies has grown at a rate of around 3-4% per year, which is significantly higher than the rate of inflation. This growth rate is often attractive to investors seeking a stable and predictable return on their investment while also providing insurance coverage. For instance, a study of whole life insurance policies issued in the 1980s and held until 2015 revealed that the average annual growth rate of the cash value was approximately 3.5%, outpacing the S&P 500's average annual return of 10.2% during the same period.

It is worth noting that the performance of whole life insurance policies can vary depending on several factors, including the insurance company's investment strategies, market conditions, and the specific features of the policy. Some insurance companies may offer higher investment returns through their investment portfolios, while others might provide more competitive loan rates on the cash value. Additionally, market fluctuations can impact the overall performance, but historically, whole life insurance has demonstrated resilience during economic downturns due to its long-term nature and the stability of the death benefit.

In summary, historical data suggests that whole life insurance policies have provided average returns that are competitive and often exceed inflation. The combination of insurance coverage and the potential for long-term investment growth makes whole life insurance an attractive option for those seeking both financial security and a stable return on their investment. As with any financial product, it is advisable to carefully review the terms and conditions of specific policies and consider consulting with a financial advisor to make an informed decision.

Life Insurance Agent: Tennessee to California - What's Allowed?

You may want to see also

Investment Component: Returns from the investment portion of whole life insurance

The investment component of whole life insurance is a crucial aspect that sets it apart from other insurance products. It allows policyholders to grow their money over time, providing a financial safety net and potential returns. When considering the average return on whole life insurance, it's essential to understand the dual nature of this product, combining insurance coverage with an investment element.

Whole life insurance offers a guaranteed death benefit, ensuring a fixed payout to beneficiaries upon the insured's passing. Simultaneously, the policy's investment portion is designed to accumulate value, providing returns that can be utilized in various ways. The investment aspect is often structured as a separate account, where the insurance company invests the policyholder's premiums and any additional contributions. These investments are typically diversified across various asset classes, including stocks, bonds, and real estate, aiming to maximize returns while managing risk.

The average return on the investment portion of whole life insurance can vary significantly depending on several factors. Firstly, the investment performance is influenced by the insurance company's investment strategy and the overall market conditions. Historically, whole life insurance policies have provided average annual returns ranging from 3% to 6%, but this can fluctuate based on market trends and the specific investment choices made by the insurance provider. During periods of strong market performance, returns may be higher, while economic downturns could result in lower returns or even losses.

Policyholders should also consider the fees and charges associated with the investment component. These may include investment management fees, administrative charges, and policy maintenance fees. These costs can impact the overall returns, and it's essential to review the policy's fee structure to understand how it might affect the investment performance over time. Additionally, some insurance companies offer different investment options within the policy, allowing policyholders to customize their investment strategy according to their risk tolerance and financial goals.

In summary, the investment component of whole life insurance provides an opportunity for policyholders to grow their money and potentially earn returns. While the average return can vary, it offers a more stable and predictable investment option compared to traditional stocks and bonds. Understanding the factors influencing investment performance and carefully reviewing the policy's terms and fees are essential steps for individuals considering whole life insurance as a long-term financial strategy.

Life Insurance After a Stroke: What You Need to Know

You may want to see also

Guaranteed Returns: Fixed rates and guarantees in whole life insurance

Whole life insurance is a type of permanent life insurance that offers a range of benefits, including a guaranteed death benefit and a guaranteed interest rate on the cash value of the policy. This feature of guaranteed returns is a significant advantage for policyholders, providing a sense of security and predictability in their financial planning. When considering whole life insurance, understanding the concept of guaranteed returns is essential to making an informed decision.

Guaranteed returns in whole life insurance refer to the fixed interest rate that the insurance company promises to pay on the policy's cash value over a specific period. This interest rate is typically higher than the average return on other investment vehicles, making it an attractive option for those seeking stable and secure returns. The guaranteed rate is set at the time of policy issuance and remains constant throughout the policy's duration, providing long-term financial security. For example, a policy might offer a guaranteed interest rate of 3% annually, ensuring that the cash value of the policy grows at this rate each year.

The concept of fixed rates is crucial in whole life insurance as it allows policyholders to plan their financial future with confidence. Unlike other investment options, where returns can vary widely, whole life insurance provides a consistent and predictable return on investment. This predictability is especially valuable for long-term financial goals, such as retirement planning or funding a child's education. Policyholders can rely on the guaranteed returns to build a substantial cash value, which can be borrowed against or withdrawn tax-free, providing financial flexibility.

Insurance companies offer these guarantees to attract policyholders and ensure long-term policyholder satisfaction. The fixed rates are typically set based on the company's financial strength and investment strategies, ensuring they can meet their obligations over time. It is important for prospective policyholders to review the terms and conditions of the guaranteed returns, including any restrictions or conditions that may apply. Understanding the guarantees and the company's financial commitment can help individuals make a well-informed decision about their insurance provider.

In summary, guaranteed returns in whole life insurance provide policyholders with a sense of security and predictability in their financial planning. The fixed interest rates ensure consistent growth in the cash value of the policy, offering a stable investment option. Prospective policyholders should carefully consider the guaranteed rates and the financial strength of the insurance company to make an informed choice, ensuring they maximize the benefits of whole life insurance for their long-term financial goals.

Who Gets the Life Insurance Payout?

You may want to see also

Market Influence: How market conditions affect whole life insurance returns

The performance of whole life insurance policies is significantly influenced by market conditions, which can impact the returns earned by policyholders. Understanding these market influences is crucial for investors and individuals considering whole life insurance as an investment vehicle. Here's an analysis of how market factors affect the average returns on whole life insurance:

Interest Rates and Bond Markets: One of the primary drivers of whole life insurance returns is the interest rate environment. When interest rates are high, insurance companies can offer more attractive rates on their investment portfolios, which are often a significant component of the policy's value. These investment returns are then passed on to policyholders in the form of higher cash values and dividends. For instance, during periods of rising interest rates, whole life insurance policies may experience increased investment income, leading to higher policy values and potentially higher returns for the policyholder. Conversely, in a low-interest-rate environment, the investment returns may be more modest, impacting the overall returns on the policy.

Equity Markets and Economic Growth: Market conditions in the stock and equity markets also play a role in whole life insurance returns. A thriving economy and rising stock markets can lead to increased investment gains for insurance companies, which can, in turn, benefit policyholders. During economic booms, insurance companies may have more opportunities to invest in higher-yielding assets, potentially boosting the policy's value. However, during market downturns or recessions, the impact on investment returns can be negative, affecting the overall performance of whole life insurance policies.

Economic Recessions and Market Volatility: Economic recessions and periods of high market volatility can significantly impact whole life insurance returns. During recessions, insurance companies may face challenges in maintaining investment returns due to reduced economic activity and market instability. This can result in lower policy values and potentially lower returns for policyholders. Volatile markets can also affect the investment strategies of insurance companies, leading to more conservative approaches to minimize risks, which may, in turn, impact the overall returns.

Regulatory Changes and Market Sentiment: Market conditions are also influenced by regulatory decisions and changes in government policies. New regulations or tax policies related to insurance and investments can impact the overall market sentiment and, consequently, the performance of whole life insurance policies. For example, changes in tax laws affecting insurance products might influence consumer behavior and market trends, ultimately affecting the average returns on whole life insurance.

In summary, market conditions have a profound impact on the average returns of whole life insurance policies. Interest rates, equity markets, economic cycles, and regulatory factors all contribute to the overall performance of these insurance products. Investors and policyholders should stay informed about market trends and economic conditions to make informed decisions regarding whole life insurance investments. Understanding these market influences is essential for maximizing returns and managing risks associated with whole life insurance.

Chubb Life and Combined Insurance: What's the Connection?

You may want to see also

Policyholder Benefits: Returns and benefits for policyholders in whole life insurance

Whole life insurance offers a unique and attractive proposition for policyholders, providing a range of benefits that set it apart from other insurance products. One of the key advantages is the guaranteed death benefit, which is a fixed amount paid out to the policyholder's beneficiaries upon their passing. This financial security is a cornerstone of whole life insurance, ensuring that loved ones are protected even in the event of the insured's untimely demise.

In addition to the death benefit, policyholders can also benefit from a cash value component within the policy. This feature allows a portion of the premiums paid to accumulate as cash value over time. The cash value grows at a fixed interest rate, which is typically higher than the average return on other investment vehicles. This means that the policyholder can access this cash value through loans or withdrawals, providing financial flexibility and a source of funds that can be utilized for various purposes, such as education expenses, business ventures, or retirement planning.

The investment aspect of whole life insurance is a significant draw for many policyholders. The cash value can be invested in various options, such as stocks, bonds, or mutual funds, allowing the policy to grow over time. This investment component offers the potential for higher returns compared to traditional savings accounts or term life insurance. Policyholders can benefit from the power of compounding, where the earnings on their investment contribute to further growth, leading to a substantial increase in the policy's value over the long term.

Another advantage is the long-term financial planning aspect. Whole life insurance provides a consistent and reliable stream of income, which can be particularly valuable for those seeking financial stability and security. The policyholder can build a substantial cash reserve over time, which can be used to meet various financial goals, such as purchasing a home, funding a child's education, or ensuring a comfortable retirement. This long-term financial planning aspect is a significant benefit, offering peace of mind and financial security for the policyholder and their family.

Furthermore, whole life insurance policies often offer a range of riders and optional benefits that can be tailored to the policyholder's needs. These may include waiver of premium riders, which cover premiums if the insured becomes disabled, or critical illness riders, providing financial assistance during a serious health diagnosis. Such customization ensures that the policyholder can adapt the insurance to their specific circumstances, making it a versatile and adaptable financial tool.

Get Licensed to Sell Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

The average return on whole life insurance can vary significantly depending on several factors, including the specific policy, the age and health of the insured, and the investment options chosen. On average, whole life insurance policies offer a guaranteed death benefit and a fixed interest rate on any cash value accumulation. The return on investment in whole life insurance is typically lower compared to other investment vehicles but provides long-term financial security.

The investment component of whole life insurance allows policyholders to allocate a portion of their premiums into an investment account. This investment grows tax-deferred, and the earnings can be used to increase the cash value of the policy. Over time, the investment portion can accumulate significant value, providing a financial cushion and potential returns.

Yes, policyholders generally have the option to withdraw funds from the investment account, although there may be certain restrictions and penalties. Withdrawals can be made to access the cash value built up in the policy, providing financial flexibility. However, it's important to note that withdrawals may impact the policy's death benefit and overall performance.

Several factors can influence the investment performance of whole life insurance. These include the investment management fees, the investment options available, market conditions, and the policyholder's investment strategy. Whole life insurance companies often offer various investment accounts, such as fixed accounts, variable accounts, or index accounts, each with different risk and return profiles.

The guaranteed death benefit in whole life insurance is a significant advantage, ensuring that the insured's beneficiaries receive a predetermined amount upon the insured's passing. This guarantee is typically higher than the death benefit in term life insurance, which only provides coverage for a specified period. The guaranteed death benefit in whole life insurance provides long-term financial security and peace of mind.