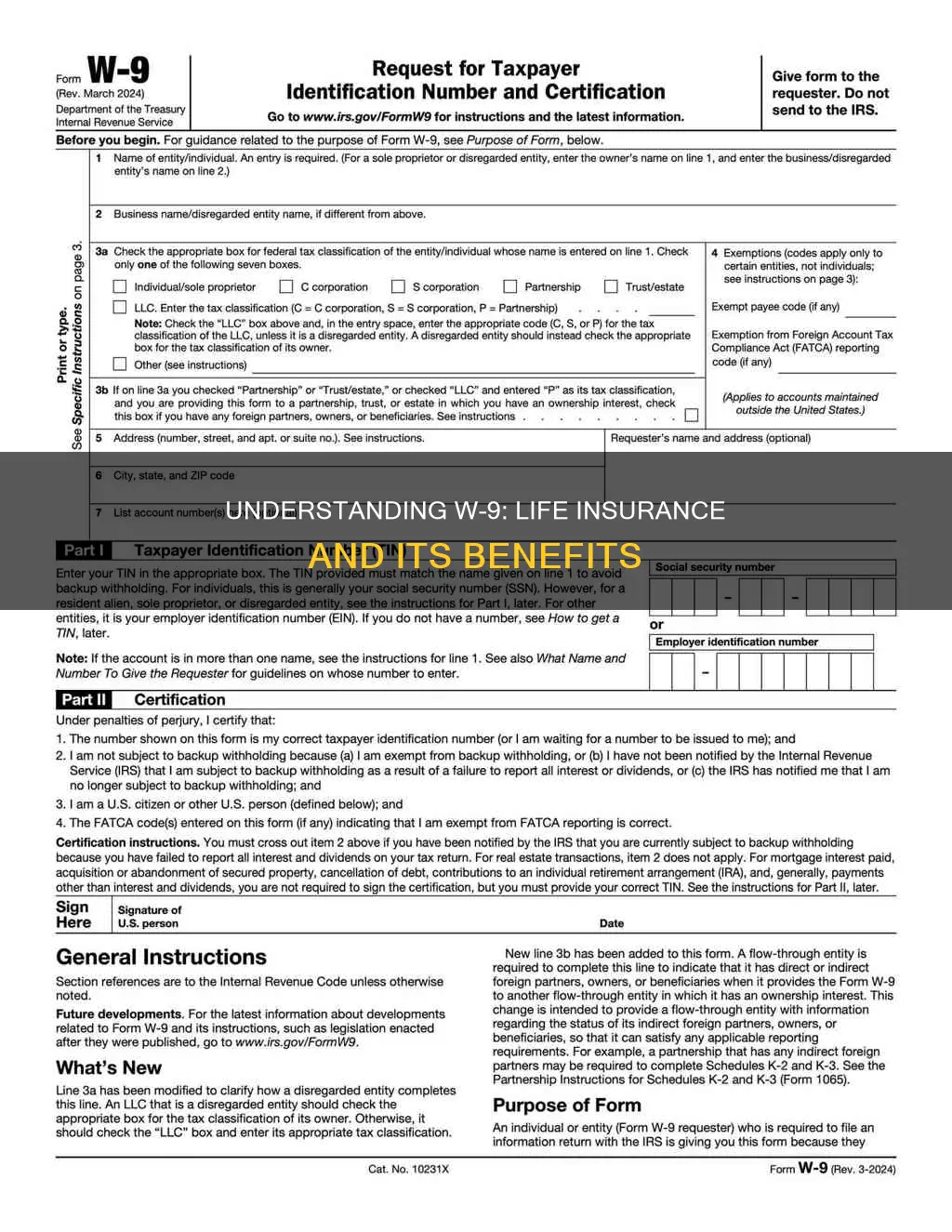

The W-9 form is a crucial document in the life insurance industry, specifically for tax purposes. It is a form that insurance companies and other financial institutions use to obtain and verify the tax identification number (TIN) of the policyholder or beneficiary. This form ensures compliance with tax regulations and helps in the proper allocation of tax benefits and deductions associated with life insurance policies. Understanding the W-9 form is essential for individuals and businesses to navigate the tax implications of their life insurance coverage effectively.

What You'll Learn

- Definition: A W-9 form is a tax document for life insurance payments

- Purpose: It's used to provide personal information to the insurance company

- Tax Implications: The form ensures proper tax reporting for life insurance benefits

- Filing Requirements: You must file a W-9 for life insurance proceeds

- Compliance: This form helps ensure compliance with tax laws and regulations

Definition: A W-9 form is a tax document for life insurance payments

A W-9 form is a crucial document in the realm of life insurance, specifically designed to provide essential tax information related to life insurance payments. This form is a standard tool used by insurance companies and financial institutions to ensure compliance with tax regulations and to facilitate the proper reporting of income. When an individual receives life insurance proceeds, whether as a beneficiary or an insured person, the insurance company is required to report these payments to the Internal Revenue Service (IRS) for tax purposes. The W-9 form is the primary means of obtaining the necessary details to complete this reporting accurately.

The form itself is a simple document that requires the individual to provide specific information about their identity and tax status. It includes sections for the person's name, address, taxpayer identification number (such as a Social Security number), and a declaration of their tax classification. By completing this form, the insurance company can verify the recipient's tax status, ensuring that the correct tax treatment is applied to the life insurance payment. This is particularly important for beneficiaries who may not have a pre-existing tax relationship with the IRS, as the W-9 form helps establish their tax residency and eligibility for certain tax benefits or deductions.

In the context of life insurance, the W-9 form is typically requested by the insurance company when an individual applies for a policy or when there is a change in the policy's beneficiary information. It is a standard procedure to ensure that the insurance company has the most up-to-date and accurate tax information. This process is essential for maintaining compliance with tax laws and for proper record-keeping by the insurance provider. By providing the W-9 form, individuals contribute to a transparent and regulated financial system, especially in the complex area of life insurance and taxation.

The information provided on the W-9 form is critical for the insurance company to determine the correct tax treatment of the life insurance payment. This includes deciding whether the payment is taxable, tax-free, or partially taxable, depending on the recipient's tax status and the specific provisions of the life insurance policy. For example, if the recipient is a non-resident alien, the insurance company must report the payment as taxable income, whereas a payment to a U.S. resident may be tax-free if certain conditions are met. Thus, the W-9 form plays a vital role in ensuring accurate tax reporting and compliance for life insurance recipients.

In summary, the W-9 form is an essential tax document for life insurance payments, enabling insurance companies to report income accurately and comply with IRS regulations. It provides a standardized way for individuals to declare their tax status, ensuring that life insurance proceeds are taxed appropriately. Understanding the purpose and importance of this form is crucial for anyone involved in life insurance, as it contributes to a transparent and regulated financial system.

Understanding Life Insurance: The Accord Format Explained

You may want to see also

Purpose: It's used to provide personal information to the insurance company

The W-9 form is a crucial document in the life insurance process, serving as a means to gather essential personal details from the insured individual. Its primary purpose is to provide the insurance company with comprehensive information about the policyholder, ensuring a smooth and efficient underwriting process. This form is particularly important as it helps the insurance provider assess the risk associated with insuring the individual and make informed decisions regarding coverage options and premiums.

When completing a W-9 form for life insurance, you will be required to provide various personal details, including your full name, address, Social Security number, and date of birth. This information is vital for the insurance company to verify your identity and establish your eligibility for coverage. Additionally, you may need to disclose details about any existing health conditions or medical history that could potentially impact the insurance assessment.

The form also includes sections for you to provide information about your employment status, income, and assets. This data is essential for the insurance company to understand your financial situation and determine the appropriate level of coverage. By disclosing your income and assets, you enable the insurer to assess your ability to afford the premiums and make informed decisions about the policy's terms.

Furthermore, the W-9 form may request details about any previous insurance policies you have held. This information is valuable for the insurance company to gauge your insurance history and identify any potential gaps in coverage. It also helps in assessing your risk profile and making accurate underwriting decisions.

In summary, the W-9 form is a critical document in the life insurance process, allowing the insurance company to gather personal and financial information. By providing accurate and comprehensive details, you facilitate a smoother underwriting process, ensuring that the insurance provider can offer suitable coverage options tailored to your needs. Completing this form accurately is essential to establishing a successful and long-lasting relationship with your chosen insurance company.

Contacting American General Life Insurance: A Step-by-Step Guide

You may want to see also

Tax Implications: The form ensures proper tax reporting for life insurance benefits

The W-9 form is a crucial document for individuals receiving life insurance benefits, as it ensures accurate tax reporting and compliance with the Internal Revenue Service (IRS) regulations. When an individual receives a life insurance payout, it is considered taxable income, and the W-9 form helps in the proper allocation and reporting of these benefits. This form is particularly important for non-residents and non-citizens who may have different tax obligations and requirements.

In the context of life insurance, the W-9 form is used to provide the IRS with essential information about the beneficiary and the insurance policy. It includes details such as the beneficiary's name, address, and Social Security number or Tax Identification Number (TIN). By filling out this form, the beneficiary ensures that the life insurance proceeds are reported correctly, which is essential for tax purposes. The form also allows the insurance company to verify the beneficiary's identity and tax status, ensuring that the benefits are paid out according to the applicable tax laws.

One of the key tax implications of the W-9 form is the determination of taxable income. Life insurance benefits received by an individual are generally subject to income tax. The W-9 form helps calculate the taxable amount by providing details about the policy, such as the death benefit and any applicable deductions or exclusions. For example, if the policy has a cash value component, the beneficiary may be able to exclude a portion of the death benefit from taxation. Proper completion of the W-9 form ensures that the beneficiary can take advantage of any available tax exemptions or deductions, reducing their taxable income accordingly.

Furthermore, the W-9 form is essential for non-residents and non-citizens to comply with tax obligations. These individuals may have different tax residency rules and requirements, and the form helps in identifying the appropriate tax treatment for the life insurance benefits. It ensures that the insurance company complies with tax laws regarding non-resident or non-citizen beneficiaries, including any withholding or reporting obligations.

In summary, the W-9 form plays a critical role in the tax implications of life insurance benefits. It ensures proper tax reporting, helps calculate taxable income, and assists in compliance for non-residents and non-citizens. By providing accurate information, individuals can navigate the tax obligations associated with life insurance payouts and ensure they meet their legal requirements. This form is a vital tool for both beneficiaries and insurance companies to maintain transparency and adhere to IRS regulations.

Understanding Average Life Insurance Coverage: A Comprehensive Guide

You may want to see also

Filing Requirements: You must file a W-9 for life insurance proceeds

When it comes to life insurance, the W-9 form is an important document that plays a crucial role in the tax process. This form is specifically designed to provide information about the beneficiary or payee of a life insurance policy, ensuring that the correct tax treatment is applied to the proceeds. Filing a W-9 is a mandatory requirement for individuals who receive life insurance payments, as it helps the insurance company and the tax authorities verify the identity and tax status of the recipient.

The W-9 form is a simple yet essential step in the life insurance claims process. It requires the beneficiary to provide their personal details, including their name, address, and Social Security Number (or Tax Identification Number for non-residents). This information is then used to determine the tax implications of the life insurance payout. By filing this form, the insurance company can ensure compliance with tax laws and regulations, which is particularly important when dealing with large sums of money.

For individuals receiving life insurance proceeds, the W-9 filing process is a straightforward one. It typically involves completing the form with accurate personal details and providing any necessary supporting documents. This might include proof of identity, such as a driver's license or passport, and proof of address, like a recent utility bill or bank statement. The W-9 form is usually submitted to the insurance company or the designated tax authority, depending on the jurisdiction and the specific insurance provider's requirements.

It is essential to understand that failing to file the W-9 form can result in potential tax issues and delays in receiving the life insurance benefits. The insurance company relies on this information to process the claim efficiently and accurately. Therefore, beneficiaries should ensure they provide all the required details promptly to avoid any unnecessary complications.

In summary, the W-9 form is a critical document in the life insurance claims process, requiring beneficiaries to provide personal and tax-related information. Filing this form is a necessary step to ensure compliance with tax regulations and to facilitate the smooth distribution of life insurance proceeds. By adhering to these filing requirements, individuals can navigate the tax implications of life insurance payments with confidence and efficiency.

Life Insurance and THC: What You Need to Know

You may want to see also

Compliance: This form helps ensure compliance with tax laws and regulations

The W-9 form is a crucial document in the realm of life insurance, primarily serving the purpose of ensuring compliance with tax regulations. When an individual or entity purchases life insurance, the insurance company is required to report the premium payments to the Internal Revenue Service (IRS) for tax purposes. The W-9 form is a self-certification document that allows the insurance company to obtain the necessary tax information from the policyholder, thereby facilitating accurate tax reporting.

This form is essential for several reasons. Firstly, it helps insurance companies comply with tax laws by providing them with the required details to report premium payments to the IRS. By obtaining the W-9 form, insurance providers can ensure that they are meeting their tax obligations and avoiding potential penalties for non-compliance. Secondly, it simplifies the tax reporting process for individuals and businesses. Instead of providing extensive tax information each time a premium payment is made, the W-9 form allows for a one-time submission, making it more efficient and convenient for policyholders.

The information typically requested on a W-9 form includes the policyholder's name, address, and Tax Identification Number (TIN), which could be a Social Security Number (SSN) or an Employer Identification Number (EIN). This data is then used to generate Form 1099-INT, which reports the interest and dividend income, including life insurance premiums, to the IRS. Ensuring accuracy in these submissions is vital to avoid any discrepancies or issues with tax authorities.

In summary, the W-9 form is a critical tool for life insurance companies to comply with tax regulations and for policyholders to streamline their tax reporting. It provides a standardized method for obtaining tax information, ensuring that all parties involved are meeting their respective tax obligations. By completing and submitting the W-9 form, individuals and entities can contribute to a more transparent and efficient tax system.

Life Insurance: Necessary Without Kids?

You may want to see also

Frequently asked questions

A W-9 form, also known as a Request for Taxpayer Identification Number and Certification, is a document used in the United States to provide your tax identification number (TIN) to a third party, such as an insurance company. In the context of life insurance, it is often required by the insurance provider to verify the identity and tax information of the policyholder and any beneficiaries.

Completing a W-9 form is an essential step in the life insurance application process. It helps the insurance company comply with tax regulations and ensures that the policy is set up correctly. The form also allows the insurance provider to understand the tax implications of the policy, especially regarding premium payments and any potential tax benefits or deductions.

The W-9 form for life insurance will ask for basic personal information, including your full name, address, and TIN (Social Security number or EIN for businesses). It may also request details about the life insurance policy, such as the policy number, type of policy, and the amount of coverage. This information is crucial for the insurance company to process the application and issue the policy.

Failing to provide a W-9 form can delay the processing of your life insurance application. Insurance companies are required by law to verify the identity and tax information of applicants, and without the W-9, they cannot complete this step. It is important to provide the necessary documentation to ensure a smooth and efficient application process.