Accidental death insurance, also known as accidental death and dismemberment (AD&D) insurance, is a type of coverage that provides financial protection in the event of an accidental death or dismemberment. One of the reasons why accidental death insurance is often cheaper than regular life insurance is that it is designed to cover specific, high-risk scenarios. Accidental death insurance typically has lower premiums because it focuses on accidents, which are statistically less likely than other causes of death. Regular life insurance, on the other hand, covers a broader range of causes of death, including natural causes and illnesses, which are more common and thus more expensive to insure against. The lower risk associated with accidental death makes it a more affordable option for those seeking additional financial protection beyond what regular life insurance might offer.

What You'll Learn

- Risk Assessment: Accidental death insurance covers specific risks, reducing overall risk for insurers

- Claim Frequency: Lower claim rates due to accidental deaths make premiums more affordable

- Policy Duration: Short-term coverage means lower costs compared to long-term life insurance

- Medical History: No medical exams often result in cheaper premiums for accidental death insurance

- Market Demand: Higher demand for life insurance drives up prices, making accidental death insurance more affordable

Risk Assessment: Accidental death insurance covers specific risks, reducing overall risk for insurers

Accidental death insurance, often referred to as accidental death and dismemberment (AD&D) insurance, is indeed cheaper than regular life insurance for several reasons, primarily related to the risk assessment and coverage provided. This type of insurance focuses on a specific and well-defined set of risks, which allows insurers to assess and manage these risks more effectively, ultimately leading to lower premiums.

The primary risk covered by accidental death insurance is, as the name suggests, accidental death. This means that the insurance policy is triggered by the insured individual's death caused by an accident, such as a car crash, fall, or accidental poisoning. By limiting the coverage to these specific events, insurers can accurately predict and calculate the likelihood of a payout, which is a critical aspect of risk assessment. Regular life insurance, on the other hand, covers a broader range of causes of death, including natural causes, diseases, and old age, which introduces more variability and uncertainty in risk assessment.

The specific nature of accidental death insurance also reduces the complexity of underwriting. Insurers can assess the risk of accidental death based on statistical data, age, occupation, and other relevant factors. For instance, younger individuals are generally considered lower-risk for accidental death, while high-risk occupations like construction or emergency services may require higher premiums. This straightforward risk assessment process enables insurers to offer more competitive rates for accidental death insurance.

Moreover, the lower cost of accidental death insurance is further justified by the fact that the coverage amount is typically lower compared to regular life insurance. Accidental death insurance usually pays out a fixed sum, often a percentage of the insured's policy, whereas regular life insurance can have a much higher death benefit. The reduced payout in accidental death insurance reflects the lower overall risk, as the specific and accidental nature of the event is less likely to be influenced by the insured's lifestyle or health factors, which are more prevalent in regular life insurance.

In summary, the affordability of accidental death insurance is a result of its focused risk assessment, which allows insurers to accurately predict and manage the likelihood of accidental death. This precision in risk assessment, combined with the lower coverage amount, contributes to the lower premiums associated with accidental death insurance compared to the more comprehensive coverage of regular life insurance. Understanding these factors provides valuable insights into the insurance market and the pricing strategies employed by insurers.

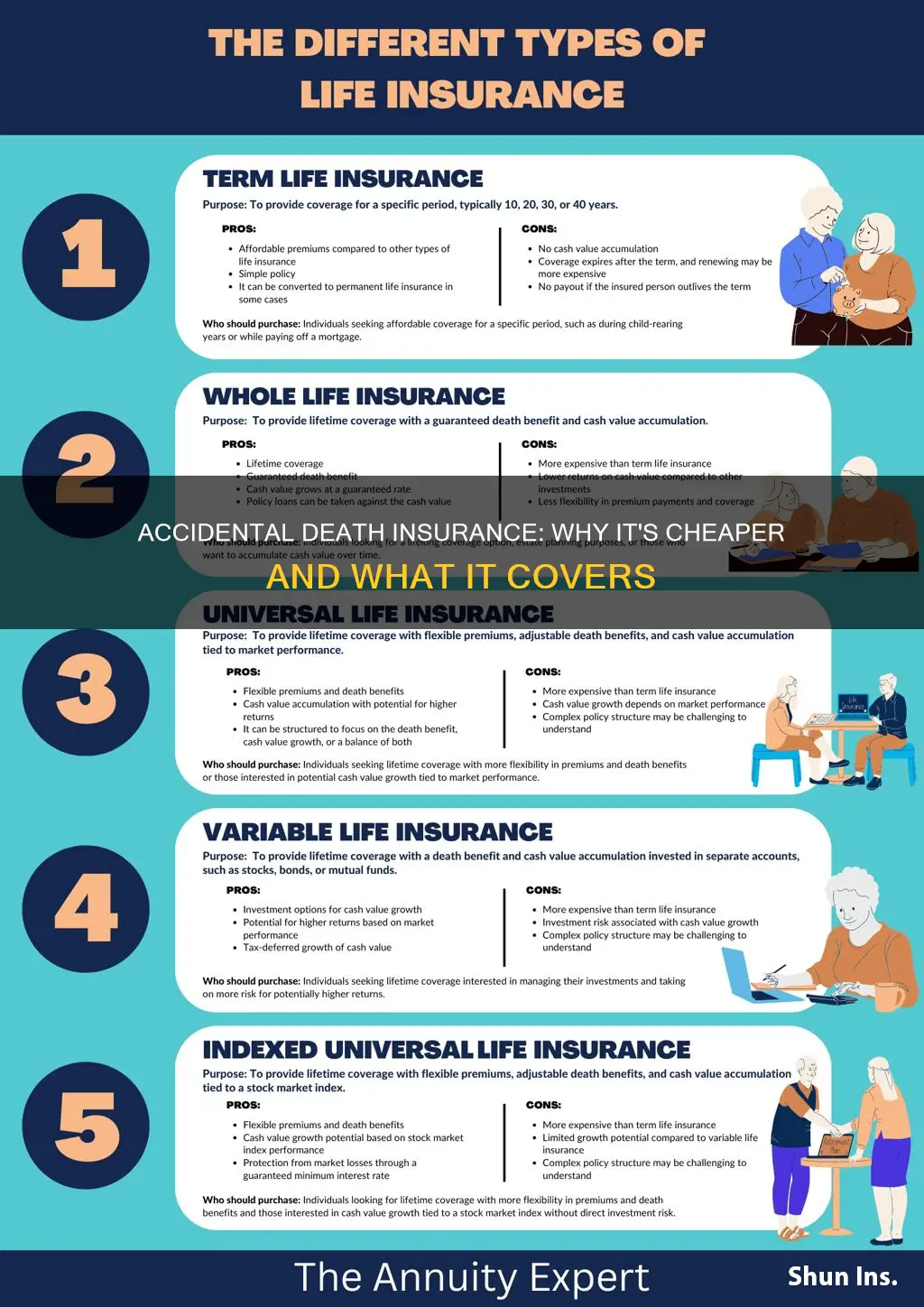

Understanding Essential Life Insurance: A Comprehensive Guide

You may want to see also

Claim Frequency: Lower claim rates due to accidental deaths make premiums more affordable

Accidental death insurance is indeed cheaper than regular life insurance, and this cost difference can be attributed to several factors, including the claim frequency and the nature of the risks involved. One of the primary reasons for the lower cost of accidental death insurance is the lower claim rates associated with accidental deaths compared to regular life insurance claims.

In the context of life insurance, claim frequency refers to the likelihood and rate at which insurance companies pay out claims. Regular life insurance policies typically cover a wide range of causes of death, including illnesses, diseases, and natural causes. These causes often result in higher claim frequencies, as a larger portion of the insured population may be affected. For instance, conditions like heart disease, cancer, and chronic illnesses can lead to numerous claims, driving up the overall cost of regular life insurance.

On the other hand, accidental death insurance focuses specifically on coverage for deaths resulting from accidents, such as car crashes, falls, drowning, or other unforeseen events. These types of deaths are generally less common and often occur unexpectedly, making them less frequent. The lower claim rate for accidental deaths directly impacts the pricing of these policies. Insurance companies can offer more competitive premiums because the likelihood of paying out a claim is significantly reduced.

The lower claim frequency due to accidental deaths allows insurance providers to calculate more precise risk assessments and set premiums accordingly. With fewer claims expected, the financial burden on the insurance company is reduced, enabling them to offer policies at lower rates. This is particularly advantageous for individuals seeking affordable coverage, as accidental death insurance can provide a cost-effective way to protect their loved ones without the higher costs associated with comprehensive life insurance.

In summary, the lower claim rates due to accidental deaths are a significant factor in making accidental death insurance cheaper. This cost-effectiveness is a result of the reduced frequency of claims, which allows insurance companies to offer more competitive pricing without compromising on the coverage provided. Understanding this aspect of insurance pricing can help individuals make informed decisions when choosing the right type of coverage for their needs.

Can Unemployed People Get Life Insurance?

You may want to see also

Policy Duration: Short-term coverage means lower costs compared to long-term life insurance

Accidental death insurance, often referred to as accidental death and dismemberment (AD&D) insurance, is indeed cheaper than regular life insurance for several reasons, and one of the primary factors is the policy duration. Short-term coverage, typically lasting for a few years, offers a more affordable alternative to long-term life insurance policies.

The cost of insurance is directly related to the risk it covers. Accidental death insurance primarily focuses on providing financial protection in the event of an accidental death. Since the risk of accidental death is generally lower compared to the risk of natural death, especially over a shorter period, insurance companies can offer more competitive rates. For instance, a 30-year-old purchasing a 10-year term accidental death policy will likely pay less than someone buying a 30-year term policy, as the former has a more limited coverage period.

Long-term life insurance policies, on the other hand, are designed to provide coverage for an extended period, often until the insured individual reaches a certain age or for the rest of their life. These policies are more comprehensive and cover a broader range of risks, including natural causes of death, which are more common over a longer period. As a result, the premiums for long-term life insurance are higher to account for the increased likelihood of paying out claims.

The shorter duration of accidental death insurance policies also means that the insurance company's risk is mitigated. With a limited time frame, the likelihood of the insured individual outliving the policy decreases, reducing the potential financial burden on the insurer. This lower risk translates to more affordable premiums for the policyholder.

In summary, the policy duration is a critical factor in the cost difference between accidental death insurance and regular life insurance. Short-term coverage allows insurance companies to offer more competitive rates due to the reduced risk and limited coverage period, making accidental death insurance a more affordable option for those seeking temporary financial protection.

Thyroid Problems: Life Insurance Complications?

You may want to see also

Medical History: No medical exams often result in cheaper premiums for accidental death insurance

Accidental death insurance, often referred to as accidental death and dismemberment (AD&D) insurance, is indeed cheaper than regular life insurance for several reasons, and one of the primary factors is the absence of a medical examination for coverage. This unique aspect of accidental death insurance significantly influences its cost structure. When you purchase accidental death insurance, the insurer typically does not require a medical exam, which is a stark contrast to the process of obtaining regular life insurance. This lack of a medical examination is a critical factor in the pricing of these policies.

The absence of a medical exam for accidental death insurance is primarily due to the nature of the coverage. Accidental death insurance is designed to provide financial protection in the event of an accidental death, often without considering the underlying health conditions of the insured individual. Since the risk is limited to accidental deaths, the insurer can assess the likelihood of such events occurring without delving into the insured's medical history. This streamlined approach to underwriting results in lower administrative costs and, consequently, more affordable premiums.

Regular life insurance, on the other hand, involves a comprehensive evaluation of the insured's health and medical history. Insurers use this information to assess the risk of the insured's death during the policy term. A medical exam is a standard part of the process, allowing insurers to measure vital signs, assess overall health, and review medical records. This thorough evaluation is necessary for determining the likelihood of the insured's death and the appropriate premium rate. The more detailed and extensive this process is, the higher the cost of regular life insurance.

The no-medical-exam aspect of accidental death insurance simplifies the underwriting process, making it more efficient and cost-effective. Without the need for medical exams, insurers can quickly issue policies, reducing the time and resources required for processing. This efficiency directly translates to lower premiums for policyholders. Additionally, the absence of medical exams means that insurers can offer coverage to individuals who might not qualify for regular life insurance due to health issues, providing a valuable safety net for those who may not otherwise have access to life insurance.

In summary, the lack of a medical examination for accidental death insurance is a key reason for its lower cost compared to regular life insurance. This streamlined approach to underwriting allows insurers to offer coverage quickly and at a more affordable rate. While regular life insurance requires a detailed medical evaluation, accidental death insurance focuses on the specific risk of accidental death, making it a more accessible and cost-effective option for individuals seeking additional financial protection.

Life Insurance: Term vs Universal, Which is Cheaper?

You may want to see also

Market Demand: Higher demand for life insurance drives up prices, making accidental death insurance more affordable

The concept of market demand and its impact on insurance pricing is a fascinating aspect of the insurance industry. When it comes to life insurance, the demand for coverage is often high, especially for those seeking comprehensive protection. This increased demand can lead to higher prices for regular life insurance policies, as insurance providers aim to meet the needs of a large customer base. As a result, the market becomes more competitive, and insurance companies may adjust their rates accordingly.

In contrast, accidental death insurance, a specialized form of coverage, often finds itself in a different market position. This type of insurance is designed to provide financial protection in the event of an accidental death. The demand for accidental death insurance is typically lower compared to regular life insurance, as it caters to a specific and often smaller segment of the population. This lower demand can be attributed to the fact that accidental death is an unfortunate but less common occurrence compared to other causes of death.

The lower demand for accidental death insurance has a direct impact on its pricing. Insurance companies can offer more competitive rates for this type of coverage because the risk of paying out claims is relatively smaller. With a reduced need to cover extensive medical expenses or long-term care, as is the case with regular life insurance, the cost of providing accidental death insurance becomes more manageable. This affordability factor makes accidental death insurance an attractive option for individuals seeking additional financial protection without breaking the bank.

Furthermore, the market dynamics play a crucial role in this pricing strategy. Insurance providers often use the law of supply and demand to their advantage. By understanding that the demand for accidental death insurance is lower, they can set prices accordingly, ensuring a steady income stream while keeping the costs relatively low for policyholders. This approach allows insurance companies to offer a valuable service to those who need it without the burden of high premiums.

In summary, the market demand for life insurance, being more extensive and varied, contributes to higher prices. Meanwhile, the lower demand for accidental death insurance makes it more affordable, providing individuals with a cost-effective way to secure financial protection in the event of accidental death. This dynamic highlights the intricate relationship between market forces and insurance pricing strategies.

Trustage Life Insurance: Suicide Coverage and Exclusions

You may want to see also

Frequently asked questions

Accidental death insurance is a type of coverage that provides financial protection in the event of an accidental death. Since it focuses solely on accidental deaths, the risk is generally lower compared to regular life insurance, which covers a broader range of causes of death. The lower risk translates to a more affordable premium for accidental death insurance.

Regular life insurance policies consider various factors like age, health, lifestyle, and occupation when determining premiums. Younger and healthier individuals with no risky hobbies or professions often pay lower rates. Accidental death insurance, on the other hand, primarily assesses the likelihood of accidental death, which is typically less expensive to insure against.

Pre-existing medical conditions can impact the cost of both types of insurance. However, accidental death insurance may be more affordable for individuals with certain health issues because the focus is on accidental events rather than overall health. Regular life insurance might have higher premiums for those with pre-existing conditions due to the broader coverage.

Accidental death insurance is often more affordable for younger individuals. As people age, the likelihood of accidental death decreases, and the risk of other causes of death increases, which can lead to higher insurance premiums. Younger age groups are generally considered lower-risk for accidental death insurance providers.

Yes, lifestyle choices can significantly impact the cost of both insurance types. Regular life insurance premiums may be affected by smoking, excessive drinking, dangerous hobbies, or high-risk occupations. Accidental death insurance, however, might be more favorable for individuals engaging in such activities, as it focuses on accidental events rather than lifestyle choices.