Ordinary life insurance is a type of insurance policy that provides financial protection for individuals and their families in the event of death. It is designed to offer a regular income or a lump sum payment to the policyholder's beneficiaries, typically upon the insured individual's passing. This type of insurance is a fundamental tool for risk management, ensuring that loved ones are financially secure even if the primary breadwinner is no longer available. The policy's value is determined by the insurance company based on various factors, including the insured person's age, health, lifestyle, and the amount of coverage desired. Ordinary life insurance can be a valuable asset for anyone looking to provide financial stability and peace of mind for their loved ones.

What You'll Learn

- Ordinary Life Insurance: Coverage for everyday risks, typically term life insurance

- Standard Coverage: Provides financial protection for the policyholder's family in the event of death

- Affordable Premiums: Offers basic insurance at lower costs compared to term life

- Limited Benefits: May not include riders or additional coverage options

- Term Duration: Typically lasts for a specific period, e.g., 10 or 20 years

Ordinary Life Insurance: Coverage for everyday risks, typically term life insurance

Ordinary life insurance, often referred to as term life insurance, is a type of coverage designed to provide financial protection for individuals and their families during their everyday lives. It is a straightforward and essential form of insurance that offers peace of mind by ensuring that loved ones are financially secure in the event of the insured's untimely death. This type of insurance is particularly relevant for those with financial responsibilities, such as mortgages, children's education, or a spouse or partner who relies on their income.

The primary purpose of ordinary life insurance is to cover the risks associated with everyday life events. It is typically a term policy, meaning it provides coverage for a specified period, often 10, 20, or 30 years. During this term, the insurance company promises to pay out a predetermined death benefit to the policyholder's beneficiaries if the insured individual passes away. This benefit can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses for the family.

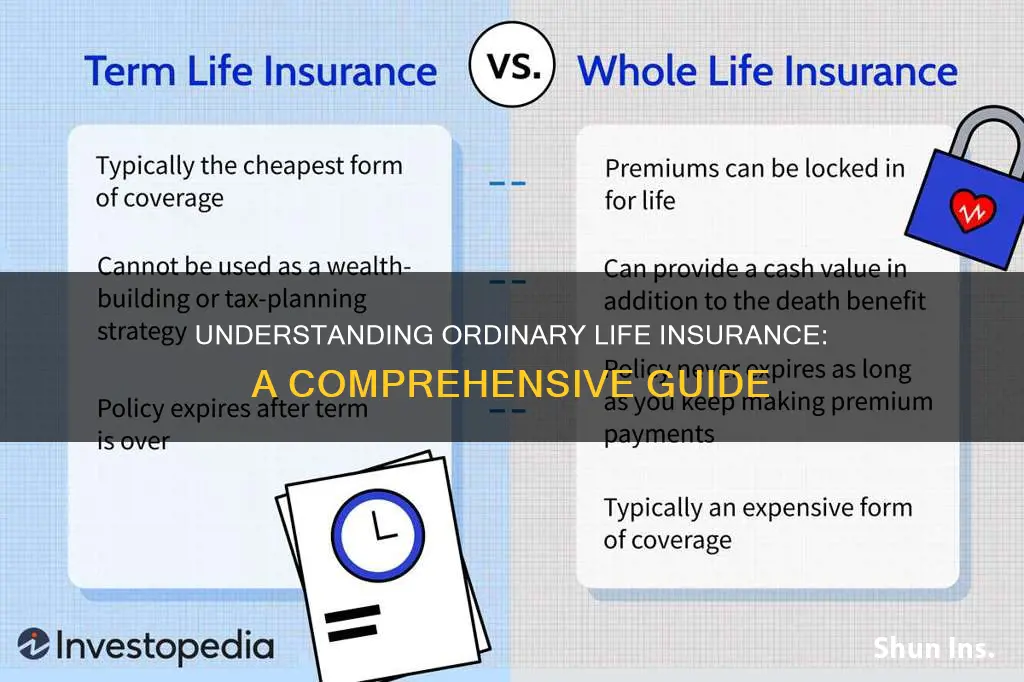

Term life insurance is known for its simplicity and affordability. It is designed to be a cost-effective way to secure financial protection for a specific period. The premiums are generally lower compared to permanent life insurance policies because the coverage is limited to a defined term. This makes it an attractive option for individuals who want to ensure their family's financial stability without the long-term financial commitment of a permanent policy.

One of the key advantages of ordinary life insurance is its flexibility. Policyholders can choose the coverage amount based on their specific needs and financial obligations. For example, a young professional with a growing family might opt for a higher coverage amount to ensure their children's future needs are met. As individuals progress through different life stages, they can adjust their policy to reflect changing circumstances, such as taking out a new mortgage or having children.

In summary, ordinary life insurance, or term life insurance, is a practical and affordable way to protect against the financial risks associated with everyday life. It provides a safety net for individuals and their families, ensuring that their financial obligations are met in the event of the insured's death. With its flexibility and cost-effectiveness, this type of insurance is an essential tool for anyone looking to secure their loved ones' financial future.

Life Insurance and Child Support: Can It Be Garnished?

You may want to see also

Standard Coverage: Provides financial protection for the policyholder's family in the event of death

Standard coverage in life insurance is a fundamental aspect of the policy, offering a safety net for the insured's loved ones in the event of their passing. This type of coverage is designed to provide financial security and peace of mind to the policyholder's family, ensuring that their financial obligations and future needs are met. When an individual purchases a life insurance policy with standard coverage, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a lump sum payment (the death benefit) if the insured individual dies during the term of the policy.

The primary purpose of standard coverage is to protect the financial interests of the policyholder's beneficiaries. These beneficiaries can be anyone named in the policy, such as a spouse, children, parents, or other dependents. In the unfortunate event of the insured's death, the death benefit is paid out to the designated beneficiaries, providing them with a financial cushion to cover various expenses. These expenses may include mortgage payments, education costs for children, funeral and burial expenses, and ongoing living expenses.

This type of insurance is often considered ordinary because it is a standard and widely available form of coverage. It is a basic level of protection that many people opt for as a safety net for their families. Standard coverage typically offers a fixed amount of insurance, which is determined by the policyholder's age, health, and other factors. The death benefit remains the same throughout the policy term, providing a consistent level of financial protection.

When purchasing a life insurance policy with standard coverage, policyholders have the flexibility to choose the term length, which can range from a few years to several decades. This allows individuals to tailor the coverage to their specific needs and financial goals. Additionally, standard policies often offer the option to convert the term life insurance into a permanent policy, providing lifelong coverage and a cash value component, which can be borrowed against or withdrawn.

In summary, standard coverage in life insurance is a critical component of financial planning, offering a reliable source of financial protection for the policyholder's family. It provides a safety net during challenging times and ensures that loved ones are taken care of, even when the insured is no longer present. This ordinary yet essential coverage is a cornerstone of personal financial security.

How Nephews Can Insure Aunts' Lives

You may want to see also

Affordable Premiums: Offers basic insurance at lower costs compared to term life

Ordinary life insurance, often referred to as term life insurance, is a type of coverage that provides financial protection for a specified period, typically ranging from 10 to 30 years. It is designed to offer a cost-effective way to secure your loved ones' financial future in the event of your untimely demise. One of the key advantages of ordinary life insurance is its affordability, making it an attractive option for individuals seeking basic insurance coverage without breaking the bank.

The lower premiums associated with ordinary life insurance are a result of its term nature. Unlike permanent life insurance, which provides coverage for the entire life of the insured individual, term life insurance is specifically tailored to meet the needs of a particular period. This shorter-term focus allows insurers to offer more competitive rates since the risk of paying out a death benefit is lower over a defined duration. As a result, individuals can secure a substantial amount of coverage for a relatively small monthly or annual premium.

When considering ordinary life insurance, it's essential to understand that the premiums are calculated based on various factors, including age, health, lifestyle, and the amount of coverage chosen. Younger individuals typically pay lower premiums as they are considered less risky to insure. Additionally, maintaining a healthy lifestyle, such as regular exercise and a balanced diet, can also contribute to more affordable rates. Insurers often provide quotes based on different scenarios, allowing policyholders to choose a coverage amount that aligns with their financial goals while keeping premiums manageable.

The affordability of ordinary life insurance makes it an excellent choice for those seeking to protect their families or businesses without incurring significant financial strain. It provides a safety net during the term, ensuring that your loved ones or beneficiaries receive the intended financial support in the event of your passing. Moreover, the simplicity of term life insurance makes it easy to understand and manage, allowing individuals to focus on other financial priorities without compromising their insurance needs.

In summary, ordinary life insurance, or term life, offers a practical solution for individuals seeking basic insurance coverage at affordable premiums. Its term-based nature allows insurers to provide competitive rates, making it an accessible option for those who want to secure their family's financial future without excessive costs. By understanding the factors influencing premiums and choosing the right coverage amount, individuals can make informed decisions about their insurance needs and ensure a more financially stable future.

Understanding Life Insurance: Calculating Cash Surrender Value

You may want to see also

Limited Benefits: May not include riders or additional coverage options

Ordinary life insurance, often referred to as term life insurance, is a type of coverage that provides a death benefit to the policyholder's beneficiaries in the event of the insured individual's death. It is a straightforward and relatively simple form of insurance, offering a defined level of financial protection for a specified period, known as the 'term'. This type of insurance is characterized by its limited scope, which is a key distinction from other life insurance products.

One of the primary characteristics of ordinary life insurance is its limited benefits. Unlike permanent life insurance policies, which offer coverage for the entire life of the insured, term life insurance is designed for a specific period, typically 10, 20, or 30 years. During this term, the policy provides a death benefit if the insured person passes away. Once the term ends, the policy may lapse, and the coverage ceases unless the policyholder chooses to renew it. This limited duration is a defining feature, making it an attractive option for those seeking temporary coverage for a particular period, such as covering mortgage payments or providing financial security for a family during a specific stage of life.

The lack of riders or additional coverage options is another aspect that sets ordinary life insurance apart. Riders are additional benefits or features that can be added to a life insurance policy to enhance its value. For example, a rider might provide an additional death benefit if the insured dies as a result of a specific accident or illness. In ordinary life insurance, such riders are often not available, keeping the policy structure simple and focused on the core benefit of providing a death benefit during the specified term. This simplicity can make the policy easier to understand and more affordable, as the lack of additional features reduces the overall cost.

This simplicity and limited scope make ordinary life insurance an excellent choice for individuals who want a straightforward and cost-effective way to secure their family's financial future for a defined period. It is particularly suitable for those who require coverage for a specific financial obligation, such as a mortgage or business loan, and can provide peace of mind knowing that their loved ones will be financially protected during that time. However, it is essential to consider that, due to its limited nature, ordinary life insurance may not offer the same level of long-term financial security as permanent life insurance policies.

In summary, ordinary life insurance, with its limited benefits and lack of additional riders, provides a simple and affordable way to secure financial protection for a specific period. This type of insurance is ideal for those seeking temporary coverage and is a fundamental component of a comprehensive financial plan, especially for individuals with defined financial obligations that require coverage for a particular duration.

Life Insurance Field Underwriters: Their Role and Importance

You may want to see also

Term Duration: Typically lasts for a specific period, e.g., 10 or 20 years

Ordinary life insurance is a type of coverage that provides financial protection for a specified period, known as the term duration. This term can vary, but it typically ranges from 10 to 20 years, offering a defined period of coverage for the insured individual. The primary purpose of this insurance is to provide a safety net for the policyholder's beneficiaries in the event of their death during the specified term.

During the term duration, the insurance company promises to pay a predetermined death benefit to the designated beneficiaries if the insured person passes away. This benefit is a financial safety net, ensuring that the family or designated recipients receive a lump sum or regular payments as per the policy terms. The term duration is a critical aspect of ordinary life insurance, as it defines the length of time the insurance company guarantees the coverage.

For instance, if a person purchases a 20-year term life insurance policy, the insurance company will provide coverage for the entire 20 years. If the insured individual dies during this period, the beneficiaries will receive the death benefit. Once the term ends, the coverage may continue, but it would then be subject to conversion to a permanent life insurance policy, which typically has higher premiums.

The term duration is an essential factor in determining the cost of the policy. Longer term durations often result in higher premiums, as the insurance company assumes a higher risk for an extended period. Conversely, shorter terms may offer lower premiums, but the coverage is limited to that specific period. Policyholders should carefully consider their needs and financial goals when choosing the term duration to ensure they have adequate protection during the desired period.

In summary, the term duration in ordinary life insurance is a defined period, usually 10 to 20 years, during which the insurance company provides a death benefit to the policyholder's beneficiaries. This feature allows individuals to tailor their insurance coverage to their specific needs and financial objectives, ensuring they have the necessary protection for a predetermined timeframe.

Life Insurance Underwriter: Your Career Guide

You may want to see also

Frequently asked questions

Ordinary life insurance, also known as term life insurance, is a type of coverage that provides financial protection for a specified period, typically 10, 20, or 30 years. It offers a death benefit to the policyholder's beneficiaries if the insured individual passes away during the term. This type of insurance is generally more affordable than permanent life insurance and is designed to provide coverage for a specific period, making it suitable for individuals who want temporary protection for their loved ones.

When you purchase ordinary life insurance, you agree to pay a premium to the insurance company for a defined period. The insurance provider then promises to pay a predetermined death benefit to your designated beneficiaries if you pass away during the term. The policy's value is based on the agreed-upon term and the insured individual's age, health, and lifestyle factors. Upon the policy's expiration, the coverage ends, and no further premiums are required.

Ordinary life insurance offers several advantages, including:

- Affordability: Term life insurance is generally more affordable than permanent policies, making it accessible to a wider range of individuals.

- Flexibility: You can choose the term length that best suits your needs, providing coverage for a specific period.

- Simplicity: The policy structure is straightforward, with no cash value accumulation, making it easier to understand.

- Peace of Mind: Knowing that your loved ones are financially protected in the event of your passing can provide significant peace of mind.

Ordinary life insurance is suitable for individuals who want temporary coverage for a specific period, such as:

- Young families: Those with young children or a mortgage may benefit from the financial protection that term life insurance provides.

- Homeowners: People with a mortgage or those looking to secure their family's financial future may consider this type of insurance.

- Individuals with temporary financial goals: Those saving for a child's education or a specific financial goal may find term life insurance a practical choice.