Life insurance for teenagers is a specialized product designed to provide financial protection for young individuals. While the average life insurance policy typically caters to adults, teens can also benefit from this coverage, although the terms and rates may differ. The average life insurance for a teen often focuses on providing financial support to the family in the event of the teen's untimely death. This coverage can be particularly important for young individuals who have financial dependents or who are responsible for specific financial obligations. Understanding the options available and the factors influencing the cost of life insurance for teens is essential for making informed decisions regarding their financial security.

What You'll Learn

- Teen Life Insurance Basics: Understanding coverage options and requirements for young adults

- Cost Factors: Age, health, and lifestyle influence teen life insurance premiums

- Term vs. Permanent: Exploring different policy types and their benefits for teens

- Parental Policies: How to include teens in existing life insurance plans

- Teen Insurance Challenges: Navigating age restrictions and limited coverage options

Teen Life Insurance Basics: Understanding coverage options and requirements for young adults

Life insurance for teenagers is a specialized area of the insurance industry, and it's important to understand the basics when considering coverage for young adults. While it might seem counterintuitive to think about life insurance for someone so young, there are valid reasons why parents and guardians might want to explore this option. Teenagers are not typically considered high-risk candidates for life insurance, but there are still important factors to consider.

The primary reason for taking out life insurance for a teenager is often related to financial security. If a young person were to pass away, life insurance can provide a financial safety net for their loved ones. This can help cover various expenses, such as funeral costs, outstanding debts, or even educational expenses if the insured individual was planning to attend college or university. It's a way to ensure that the financial burden of an unexpected loss doesn't fall solely on the remaining family members.

When it comes to coverage options, term life insurance is the most common type for young adults. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. This type of policy is generally more affordable and offers a straightforward way to secure financial protection during the years when the insured individual is most likely to need it. For teenagers, the coverage amount might be relatively small, often ranging from $5,000 to $10,000, depending on their health and lifestyle.

One of the critical aspects of teen life insurance is understanding the requirements and eligibility criteria. Insurance companies often consider factors such as the individual's age, health, and lifestyle when determining eligibility. Teenagers who are in good health and lead active lives may be more likely to qualify for coverage. Additionally, some insurance providers offer policies specifically tailored for young adults, which might have different terms and conditions compared to adult policies.

It's essential to consult with an insurance agent or broker who specializes in life insurance for young people. They can provide personalized advice and help navigate the various options available. Parents and guardians should also be aware of the potential impact of future life events, such as marriage or the birth of a child, which might influence the need for increased coverage or policy adjustments. Understanding the basics of teen life insurance is the first step toward making an informed decision about securing the financial future of a young family member.

Life Insurance Options for People with Kidney Failure

You may want to see also

Cost Factors: Age, health, and lifestyle influence teen life insurance premiums

The cost of life insurance for teenagers can vary significantly, and several factors come into play when determining the premiums for this age group. Firstly, age is a critical factor. Teenagers, especially those in their early years, often have lower insurance rates compared to older individuals. This is primarily because younger individuals have a longer life expectancy, and the risk of death is generally lower. As teens mature and approach adulthood, their insurance rates may increase due to the changing risk profile associated with age.

Health and lifestyle choices also play a pivotal role in determining life insurance premiums for teens. Insurance companies often consider the overall health of an individual, including any pre-existing medical conditions or genetic predispositions. For instance, teens with a family history of heart disease or diabetes may face higher insurance rates due to the increased risk of developing similar conditions. Additionally, lifestyle factors such as smoking, drug use, or participation in high-risk sports can significantly impact premium costs. Insurance providers may view these behaviors as high-risk factors, leading to higher premiums or even denial of coverage.

The type of life insurance policy chosen can also influence the cost. Term life insurance, which provides coverage for a specified period, typically costs less than whole life insurance, which offers lifelong coverage. For teens, term life insurance might be more affordable and suitable, especially if they are considered low-risk by the insurance company. The duration of the policy term can also affect the price; longer terms generally result in higher premiums.

Furthermore, the amount of coverage selected will directly impact the cost. Teenagers may not require extensive coverage, especially if they are not primary breadwinners or have limited financial responsibilities. A lower coverage amount can lead to more affordable premiums. It's essential for parents or guardians to assess the teen's financial obligations and future goals when determining the appropriate coverage amount.

In summary, the cost of life insurance for teens is influenced by age, health, lifestyle choices, policy type, and coverage amount. Understanding these factors can help individuals make informed decisions when purchasing life insurance for teenagers, ensuring they receive appropriate coverage at a reasonable cost. It is always advisable to consult with insurance professionals who can provide tailored advice based on individual circumstances.

Does Level Benefit Life Insurance Offer Cash Value?

You may want to see also

Term vs. Permanent: Exploring different policy types and their benefits for teens

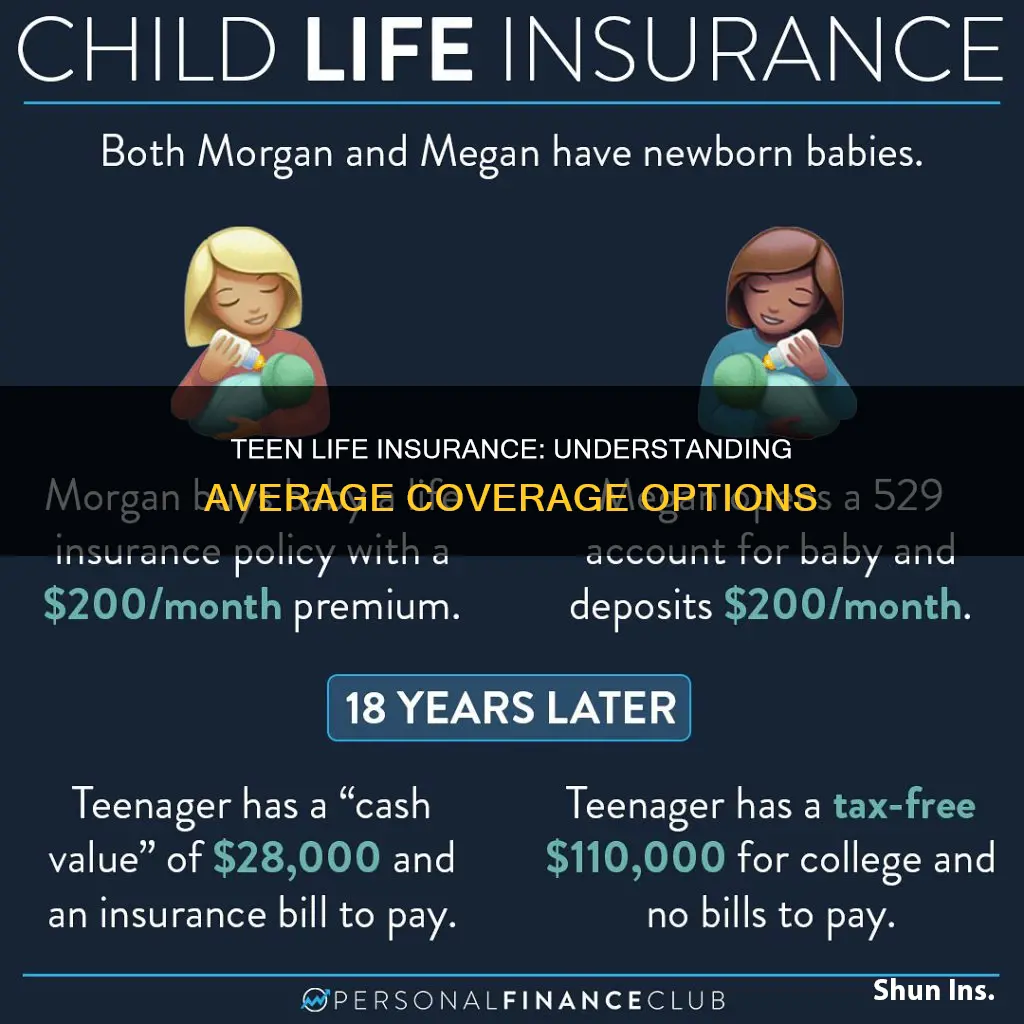

When considering life insurance for teens, it's important to understand the different types of policies available and their respective benefits. The two primary types of life insurance are term life and permanent life, each catering to distinct needs and circumstances.

Term Life Insurance:

Term life insurance is a straightforward and cost-effective option for teens. It provides coverage for a specified period, often ranging from 10 to 30 years. This type of policy is ideal for teens who want coverage during a specific period, such as while they are in college or until they reach a certain age. The primary advantage of term life is its affordability; it offers a higher death benefit relative to the premium cost, making it an excellent choice for those on a budget. For teens, term life can be a strategic investment, ensuring financial protection during their formative years without straining their parents' finances.

Permanent Life Insurance:

Permanent life insurance, on the other hand, is a long-term commitment. It provides coverage for the entire life of the insured individual, offering a cash value component that grows over time. While permanent life insurance is more expensive than term life, it offers several advantages. One key benefit is the potential for tax-deferred growth of the cash value, which can be borrowed against or withdrawn. This type of policy is suitable for teens who want a lifelong financial safety net and are willing to invest in a more expensive but comprehensive plan. Permanent life insurance can also be a valuable tool for building wealth, as the cash value can accumulate and be used for various financial goals.

Choosing the Right Policy:

Deciding between term and permanent life insurance for a teen depends on individual circumstances and financial goals. For those seeking temporary coverage, term life is a practical choice, ensuring that the teen's life is protected during critical periods. In contrast, permanent life insurance is more suitable for long-term financial planning, providing both coverage and an investment component. It's essential to consider the teen's current and future financial needs, as well as their ability to afford the premiums, when making this decision.

In summary, understanding the differences between term and permanent life insurance is crucial for teens and their families. Term life offers affordable coverage for specific periods, while permanent life provides lifelong protection and investment opportunities. By exploring these policy types, teens can make informed decisions about their insurance needs, ensuring they are adequately protected and prepared for the future.

Hostplus Life Insurance: What You Need to Know

You may want to see also

Parental Policies: How to include teens in existing life insurance plans

When it comes to life insurance for teenagers, it's important to understand that the average coverage might not always be sufficient for their unique needs. However, if you're a parent with an existing life insurance policy, there are ways to include your teen in your plan. Here's a guide on how to navigate this process:

Review Your Policy: Start by carefully reviewing your current life insurance policy. Understand the terms, coverage amounts, and any existing beneficiaries. Check if your policy allows for additional coverage or if there are options to increase the sum insured. Many parental policies offer the flexibility to add family members as beneficiaries, ensuring your teen is included.

Consult Your Insurance Provider: Contact your insurance company and inquire about the process of adding a teenager to your policy. They might provide specific guidelines or requirements, such as a medical examination or a review of the teen's health history. Insurance providers often have dedicated customer service teams that can assist with these adjustments.

Consider Additional Coverage: If your policy doesn't allow for direct inclusion, consider purchasing a separate life insurance policy for your teen. This can be a dedicated policy tailored to their needs. When shopping for a policy for your teenager, consider their age, health, and any potential risks. Younger teens might qualify for lower premiums, but it's essential to provide accurate health information during the application process.

Name Your Teen as a Beneficiary: Even if you can't add them to your existing policy, you can still ensure they are a beneficiary. This means that in the event of your passing, the death benefit will be paid out to your teen. Review the beneficiary designation regularly, especially as your family structure changes.

Educate Your Teen: Involve your teenager in the process and educate them about the importance of life insurance. Discuss the potential risks and benefits, and address any concerns they might have. By involving them, you can ensure their understanding and cooperation, which is crucial for a smooth transition if something were to happen.

Voluntary Life Insurance for Children: What Parents Need to Know

You may want to see also

Teen Insurance Challenges: Navigating age restrictions and limited coverage options

The concept of life insurance for teenagers is often overlooked, and for good reason. Teenagers typically don't have extensive financial obligations or long-term commitments that would necessitate such coverage. However, there are certain situations and life events that may prompt parents or guardians to consider life insurance for their teens. Understanding the challenges and options available is crucial for making informed decisions.

One of the primary challenges is the age restriction imposed by insurance companies. Life insurance policies are generally designed for individuals who have reached a certain age and have a more extended life expectancy. Teenagers, being relatively young, may face difficulties in qualifying for standard life insurance plans. Most insurance providers have a minimum age requirement, often starting from 18 years old, which means that younger teens might not be eligible for coverage. This restriction can be a significant hurdle for parents who want to ensure their children's financial security.

Another challenge lies in the limited coverage options available for teens. Life insurance policies typically offer two main types of coverage: term life and permanent life. Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years, and is often more affordable. However, teenagers may not require long-term coverage, as their financial needs are generally more immediate, such as education expenses or future marriage costs. Permanent life insurance, on the other hand, offers lifelong coverage but is generally more expensive and may not be necessary for a teenager's current situation. The limited coverage options can make it challenging to find a policy that suits the specific needs of a young individual.

Despite these challenges, there are strategies to navigate age restrictions and limited coverage options. One approach is to consider alternative forms of insurance, such as dependent life insurance, which is designed for individuals who are financially dependent on a parent or guardian. This type of policy can provide coverage for a specific period, ensuring that the teenager's financial needs are met during their formative years. Additionally, some insurance companies offer juvenile or youth life insurance plans, which cater specifically to younger individuals and may have more flexible terms.

For teens who are already financially independent or have specific financial goals, there are other forms of coverage to consider. For instance, a simple term life insurance policy with a lower coverage amount can be an affordable option for providing a basic level of financial security. Alternatively, parents can explore the option of adding their teenager as a beneficiary on their own life insurance policy, which can be a temporary solution until the teen reaches the age eligibility for individual coverage.

In conclusion, while life insurance for teenagers presents unique challenges due to age restrictions and limited coverage options, there are still ways to ensure their financial well-being. By understanding the available alternatives and exploring different insurance providers, parents can make informed decisions to protect their children's future. It is essential to carefully review the terms and conditions of any insurance policy and seek professional advice to find the best fit for the teenager's specific circumstances.

Changing Life Insurance Beneficiaries: A Guide for Bankers

You may want to see also

Frequently asked questions

The average life insurance policy for a teenager typically ranges from $10,000 to $25,000. This coverage amount is usually determined by the insurance company based on various factors, including the teen's age, health, and the specific policy terms. It's important to note that life insurance for minors is often limited and may not provide a substantial financial benefit, but it can still offer some protection for the family.

While it might seem unusual, there are a few reasons why a teenager might have life insurance. Firstly, if a minor has a significant financial responsibility, such as a large debt or a substantial inheritance, life insurance can ensure that these obligations are met in the event of their passing. Additionally, some families may choose to purchase term life insurance for their children to provide financial security and peace of mind. This is especially relevant if the child has a pre-existing medical condition that could affect their future insurability.

Minors can typically obtain life insurance through their parents' existing policies, as many insurance companies offer dependent coverage. This means that a child can be added as a beneficiary on a parent's policy. Alternatively, some insurance providers offer specific minor-focused policies, which may have different terms and conditions. It's essential to consult with a licensed insurance agent or broker to understand the options available and determine the most suitable coverage for the teenager's needs.