Life insurance for seniors is a topic that raises many questions, such as what type of insurance is best, how much coverage is needed, and whether seniors even need life insurance at all. The answer to these questions depends on various factors, including budget, family responsibilities, and individual circumstances. While some seniors may not need life insurance if they have no debt and their funeral expenses are prepaid, others may benefit from the financial security it provides for their loved ones.

There are several types of life insurance available to seniors, including term life insurance, whole life insurance, and final expense insurance. Term life insurance provides coverage for a specified term, such as 10 or 20 years, while whole life insurance offers lifelong coverage as long as premiums are paid. Final expense insurance is a type of permanent life insurance that covers funeral, burial, and other end-of-life expenses.

When considering life insurance, seniors should think about their budget, family needs, and personal finances. Additionally, factors such as age, medical history, and gender can impact the cost of premiums. It is essential to carefully consider your situation and seek advice from a qualified professional to determine the best type of life insurance for your needs.

| Characteristics | Values |

|---|---|

| Age range | 0-85 |

| No. of employees | 200+ |

| No. of agents | 6,500+ |

| Availability | 40+ states and DC |

| Medical exam required | No |

| BBB rating | A+ |

| AM Best rating | N/A |

| Website | Unpolished, dated, confusing, unintuitive, graphics not styled properly |

| Customer feedback | Mixed, mostly negative |

| Customer service | Phone, contact form, email, online claims reporting |

| Whole life insurance | Available |

| Final expense insurance | Available |

| Discounts | Not readily available |

| Term life insurance | 20-year plans available |

What You'll Learn

Seniors can get life insurance, but it's more expensive

Life insurance for seniors is similar to regular life insurance but tends to be more expensive due to age being a crucial factor that insurers consider when determining premiums. Seniors can get life insurance, but the options available to them may be more limited and costly.

Seniors over 70 will likely pay higher premiums than other age groups, but improving health and shopping around for quotes can help lower these costs. Life insurance for seniors typically has different coverage and price points based on their age and specific needs. For example, insurers may not offer 30-year term life policies to those aged 60 or older.

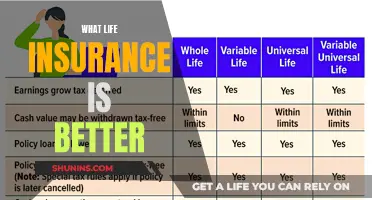

There are several types of life insurance available for seniors, including term life insurance, whole life insurance, final expense insurance, simplified issue life insurance, and guaranteed issue life insurance. Term life insurance lets seniors choose a term length of 10 to 30 years, with longer lengths costing more in premiums. Whole life insurance lasts for life and comes with a cash value component that grows with each premium payment. Final expense insurance is a small whole life insurance policy that helps cover funeral costs, medical bills, and other end-of-life expenses. Simplified issue life insurance offers a quicker application process and no medical exam, but with smaller coverage amounts. Guaranteed issue life insurance skips the medical exam and may ask few or no health questions, but it also has lower coverage amounts.

The right senior life insurance policy depends on the individual's situation and coverage needs. Seniors can evaluate their income, expenses, and dependents to determine the appropriate coverage and whether they need lifelong coverage or a term policy. They can also decide if they are willing to take a medical exam, which may impact the cost of premiums.

While life insurance for seniors can be more expensive, comparing quotes from multiple insurers can help individuals find the best rates for their needs.

Life Insurance and Home Equity: What's the Connection?

You may want to see also

Term life insurance is a good option for seniors

Life insurance is a valuable tool for seniors to protect their loved ones, build wealth, and leave a legacy for their heirs. While seniors may have fewer life insurance options due to age restrictions, term life insurance is a good choice for those who want coverage for a specific period. Here's why:

Flexibility and Affordability

Term life insurance offers flexibility, allowing seniors to choose a policy term that aligns with their needs, typically ranging from 10 to 30 years. This option is ideal for those with short-term coverage requirements, such as covering outstanding debts or mortgages. The premiums for term life insurance are generally lower compared to other types, making it a cost-effective choice for seniors.

Customizable Coverage

Seniors can customize their term life insurance policies to meet their specific needs. They can adjust the term length and death benefit amount accordingly. Additionally, riders can be added for extra coverage, such as an inflation rider to increase the death benefit annually to keep up with inflation.

Peace of Mind

Term life insurance provides peace of mind for seniors who want to ensure their loved ones are financially secure. The death benefit payout can help supplement the income of their loved ones and assist in paying off any remaining debts. This can be especially beneficial for married seniors with pensions without survivor benefits or those parenting grandchildren.

Ease of Application

Term life insurance policies often have simplified application processes, especially if you opt for a no-medical-exam policy. This shorter application process reduces stress and increases the chances of approval by removing specific health considerations.

Suitable for Seniors with Time-Sensitive Obligations

Term life insurance is well-suited for seniors in their 60s who are in good health and have time-sensitive financial obligations. It provides affordable coverage until debts are paid off, and being in good health helps keep the premiums low.

While term life insurance is a good option for seniors, it's important to remember that coverage will lapse if the policy term is outlived. For those seeking lifelong coverage, whole life insurance or universal life insurance may be more suitable. However, term life insurance can provide the necessary protection and financial support for a defined period, making it a popular choice for seniors.

Lumico Life Insurance and Medicare Part C: What's the Deal?

You may want to see also

Whole life insurance is often unnecessary for seniors

Firstly, whole life insurance tends to be more expensive than term life insurance. Whole life insurance provides coverage for an individual's entire life, whereas term life insurance only covers a fixed period, usually 10 to 30 years. Due to the shorter duration, term life insurance has lower premiums, making it a more affordable option for seniors, especially those on a limited income.

Secondly, the primary purpose of life insurance is to provide financial protection for loved ones after the policyholder's passing. However, as seniors typically have fewer financial dependents, such as grown-up children, the need for a large death benefit payout decreases. If seniors have already accumulated sufficient assets, their families may not require additional financial support through life insurance.

Thirdly, whole life insurance policies are most beneficial when purchased at a younger age. As age is a significant factor in determining insurance premiums, seniors may face higher costs. Moreover, health risks tend to increase with age, making it more challenging to qualify for certain policies. Seniors may find that the coverage options available to them are more limited and come with higher premiums.

Additionally, whole life insurance policies often require medical exams, which some seniors may find inconvenient or invasive. While there are smaller whole life policies that do not mandate medical exams, these typically offer limited coverage. Seniors in poor health or with pre-existing medical conditions might find the premiums for whole life insurance cost-prohibitive.

Finally, whole life insurance policies have a cash value component that grows over time. This feature can be advantageous for wealth accumulation. However, seniors who are primarily concerned with covering end-of-life expenses may find that other options, such as final expense insurance, are more suitable and cost-effective.

In conclusion, while whole life insurance can offer benefits to seniors, it is not always necessary. Seniors should carefully consider their financial situation, the availability of assets, the number of dependents, and their health before deciding whether to opt for whole life insurance. Alternative options, such as term life insurance or final expense insurance, might be more appropriate and affordable choices.

Life Insurance Medical Exam: Blood or Urine Test?

You may want to see also

Final expense insurance is a small policy to cover funeral costs

Final expense insurance is a small whole life insurance policy that covers funeral costs, medical bills, and other end-of-life expenses. It is a permanent policy designed to pay for end-of-life expenses, and it is typically less expensive than traditional whole life insurance. Final expense insurance is an affordable way to ease the financial burden on your family when you pass away. It provides funds for your funeral, medical bills, and more.

The average funeral costs $8,300, and cremation is only 28% cheaper than a traditional funeral. Final expense insurance can help cover these costs, as well as burial costs, cremation, and headstone expenses. It can also cover any outstanding medical, legal, or credit card bills.

Final expense insurance offers competitive, fixed premiums that do not change over time. The policy builds cash value, which can be used to borrow against or withdrawn. You can choose to pay your premium monthly or annually, and coverage can be issued quickly, sometimes on the same day you apply. Your coverage starts immediately upon approval, and your policy never expires as long as your premiums are paid.

Final expense insurance does not require a medical exam, only a brief health questionnaire. This makes it easier to get coverage, especially for those who are not in the best health. However, payouts for final expense insurance are typically smaller, ranging from $2,000 to $40,000. If you are looking for a higher coverage amount, you may need to consider alternative options.

Overall, final expense insurance is a great way to help protect your loved ones with a small payout upon your death. It can ease the financial burden and allow your family to focus on healing during a difficult time.

Life Insurance for Canadians in Ireland: Is It Possible?

You may want to see also

Life insurance can help seniors leave an inheritance

Life insurance can be a useful tool for seniors to leave an inheritance for their loved ones. While it may be an uncomfortable topic for some, it is an important aspect of financial planning that can provide peace of mind and ensure your beneficiaries are taken care of. Here's how life insurance can help seniors leave an inheritance:

Financial Security for Loved Ones

Life insurance provides financial security for your loved ones after you're gone. The death benefit from a life insurance policy offers a financial safety net for your family, helping them maintain their standard of living, pay off any outstanding debts, and cover end-of-life expenses. This can be especially important for seniors who want to ensure their families are taken care of even after their passing.

Customizable Coverage

Senior life insurance allows for customization to meet your specific needs. You can choose from different types of policies, adjust the death benefit amount, and select the term length for term life insurance policies. Additionally, you can add riders for extra coverage, such as an inflation rider that increases the death benefit over time to keep up with inflation. This flexibility ensures that you can create a policy that aligns with your unique financial situation and goals.

Estate Planning Benefits

Life insurance can enhance your estate planning strategies. By placing the policy in an irrevocable life insurance trust (ILIT), you can pass on more assets to your heirs while avoiding estate taxes. The death benefit from the life insurance policy may not be considered part of your estate, allowing you to maximize the amount your beneficiaries receive. This can be particularly advantageous for larger estates that may be subject to significant estate taxes.

Tax-Free Payouts

The death benefit from a life insurance policy is typically tax-free for your beneficiaries. They won't have to pay income tax on the proceeds, providing them with a greater financial benefit. While beneficiaries may have to pay tax on any interest earned if they receive the payout in installments, the principal amount remains tax-free. This further maximizes the value of the inheritance.

Universal Life Insurance for Inheritance

When considering life insurance for inheritance purposes, universal life insurance is worth exploring. Universal life insurance is a form of permanent life insurance that provides coverage for your entire life. It offers more flexibility than whole life insurance, as the policy can be customized to your specific needs. You can choose the age of coverage, such as 90, 95, or even 100 years old. This guarantees coverage until a very late age, ensuring your heirs receive an inheritance.

In conclusion, life insurance can be a powerful tool for seniors to leave an inheritance. It provides financial security, customizable coverage, and tax benefits that can ensure your loved ones are taken care of and receive the maximum inheritance possible. By incorporating life insurance into your financial and estate planning, you can have peace of mind knowing that you are leaving a notable sum of money behind for your heirs.

Insuring Your Mother-in-Law: Is It Possible?

You may want to see also

Frequently asked questions

Life insurance for seniors can provide financial security for loved ones, help cover final expenses such as funeral costs and medical bills, and allow seniors to leave a non-taxable inheritance. It can also help seniors build and preserve wealth, and leave a larger legacy for their heirs.

Term life insurance, whole life insurance, final expense insurance, simplified issue life insurance, and guaranteed issue life insurance are all options for seniors. Term life insurance covers a fixed term, while whole life insurance provides lifelong coverage. Final expense insurance is a small whole life policy to cover end-of-life expenses. Simplified issue life insurance offers a faster application process and no medical exam, while guaranteed issue life insurance has minimal or no health questions.

It's important to review provider ratings and conduct a "needs analysis" to determine the appropriate coverage amount. Consider factors such as outstanding debt, future medical expenses, and the financial support needed by loved ones. Additionally, you can add optional riders to your policy for specific types of extra coverage, such as long-term care, critical illness, or waiver of premium in case of serious illness or disability.

Life insurance for seniors is generally more expensive than for younger individuals, with premiums increasing with age. The cost depends on factors such as age, gender, health status, and the type of policy chosen. For context, a healthy, non-smoking senior could pay around $718 to $960 for a 10-year, $250,000 term life insurance policy.