Life insurance is a crucial financial tool that provides a safety net for individuals and their families in the event of unexpected death. There are several types of life insurance policies available to suit different needs and preferences. Term life insurance offers coverage for a specified period, typically 10, 20, or 30 years, providing a fixed death benefit if the insured passes away during that time. Whole life insurance, on the other hand, is a permanent policy that offers lifelong coverage and includes an investment component, allowing the policyholder to build cash value over time. Universal life insurance provides flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change. Additionally, there are various riders and add-ons available, such as accidental death insurance, critical illness coverage, and waiver of premium, which can enhance the policy's benefits. Understanding these options is essential for individuals to choose the life insurance plan that best fits their financial goals and provides the necessary protection for their loved ones.

What You'll Learn

- Term Life: Temporary coverage, affordable, renewable annually

- Permanent Life: Long-term, builds cash value, provides lifelong coverage

- Universal Life: Flexible, adjustable premiums, potential for higher returns

- Whole Life: Permanent, fixed premiums, guaranteed death benefit

- Variable Life: Investment-linked, offers potential for higher returns, adjustable

Term Life: Temporary coverage, affordable, renewable annually

Term life insurance is a straightforward and cost-effective way to secure financial protection for your loved ones during a specific period. This type of policy provides coverage for a predetermined number of years, often ranging from 10 to 30 years, and is designed to offer temporary insurance at an affordable premium. It is an excellent choice for individuals who want to ensure their family's financial stability without the complexity of permanent life insurance.

The beauty of term life insurance lies in its simplicity. It is a pure risk-based product, meaning it focuses solely on providing coverage for a defined period. During this term, the policyholder pays a regular premium, and in return, the insurance company promises to pay a death benefit to the designated beneficiaries if the insured individual passes away within the specified term. This simplicity makes it easy to understand and manage, especially for those who prefer a more temporary commitment.

One of the most appealing aspects of term life insurance is its affordability. Since the coverage is limited to a specific period, the premiums are generally lower compared to permanent life insurance. This makes it accessible to a wide range of individuals, including those who may have been previously priced out of more comprehensive insurance options. By choosing term life, you can get the necessary coverage without breaking the bank, ensuring that your financial plan remains flexible and adaptable.

Renewability is another key feature of term life insurance. At the end of the initial term, policyholders have the option to renew their coverage annually. This renewability ensures that you can maintain the protection you need without the hassle of reapplying for a new policy. Annual renewals also provide an opportunity to review and adjust the coverage as your life circumstances change, allowing you to stay protected even as your needs evolve.

In summary, term life insurance offers temporary coverage that is both affordable and renewable. It is an ideal solution for those seeking a practical and cost-effective way to secure their family's financial future. With its straightforward nature, lower premiums, and renewability, term life insurance provides a flexible and reliable form of protection, ensuring that your loved ones remain financially secure during the term of the policy.

IRS and Key Life Insurance: What's the Jurisdiction?

You may want to see also

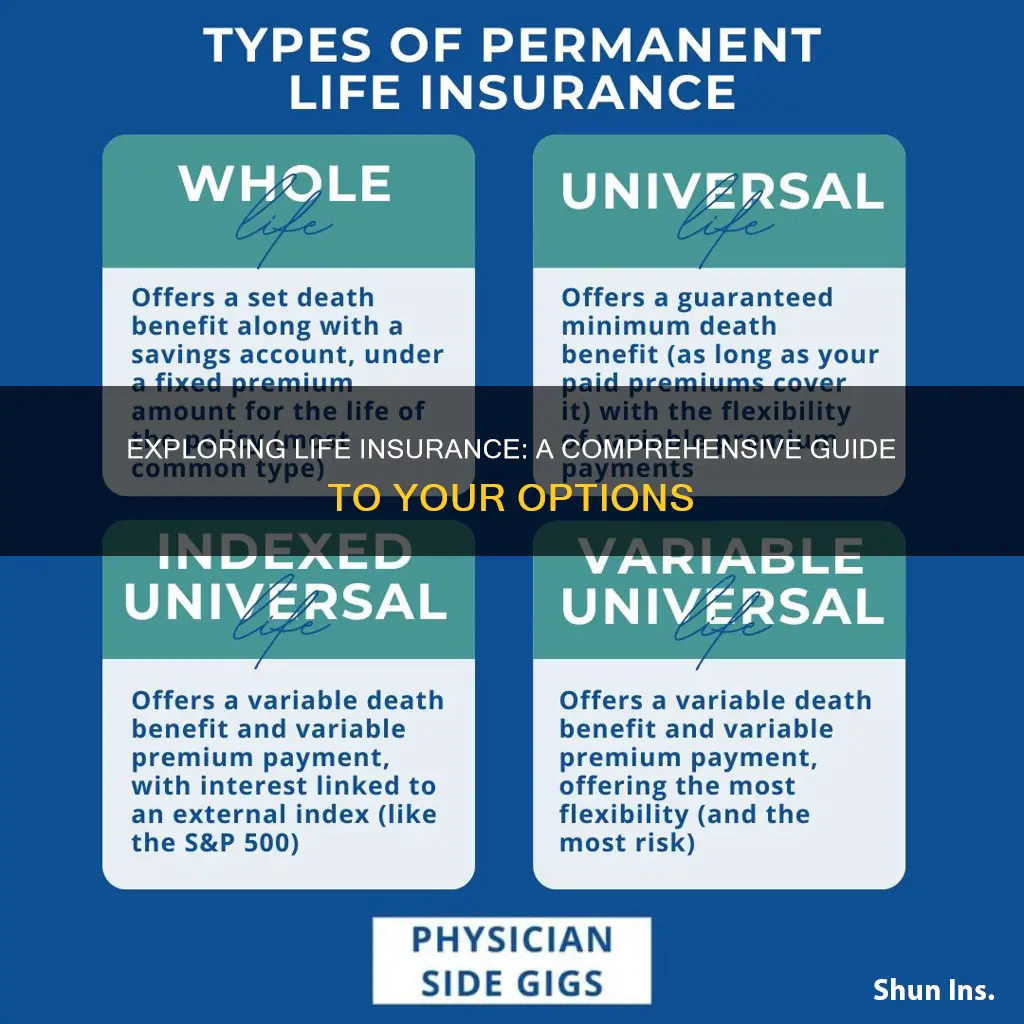

Permanent Life: Long-term, builds cash value, provides lifelong coverage

Permanent life insurance, also known as whole life insurance, is a long-term financial commitment that offers several unique advantages over other life insurance options. This type of policy is designed to provide coverage for the entire lifetime of the insured individual, hence the term "permanent." One of the key features of permanent life insurance is its ability to build cash value over time.

When you purchase a permanent life insurance policy, a portion of your premium payments goes towards building a cash reserve. This reserve grows tax-deferred, meaning it can accumulate savings that can be used for various purposes. The cash value in a permanent life insurance policy can be borrowed against or withdrawn, providing a financial safety net for the policyholder. This feature is particularly useful for those who want to have a source of funds available for major purchases, education expenses, or any other financial needs that may arise during their lifetime.

The long-term nature of permanent life insurance ensures that the insured individual is protected throughout their entire life. Unlike term life insurance, which provides coverage for a specified period, permanent life insurance offers lifelong coverage. This means that as long as the premiums are paid, the policyholder will have a guaranteed death benefit that will be paid out to the designated beneficiaries upon their passing. The peace of mind that comes with knowing you have lifelong coverage can be invaluable, especially for those with families or financial dependents.

Another advantage of permanent life insurance is its potential to act as an investment vehicle. The cash value accumulation can be used to build a substantial savings portfolio over time. This can be particularly beneficial for individuals who want to secure their financial future and potentially pass on a legacy to their heirs. With proper management and investment strategies, the cash value in a permanent life insurance policy can grow significantly, providing a substantial financial asset.

In summary, permanent life insurance is a comprehensive and long-lasting solution for life coverage. It offers the advantage of building cash value, providing financial flexibility, and ensuring lifelong protection. This type of insurance is ideal for those seeking a stable and secure financial plan, especially for those with long-term financial goals and a desire to leave a lasting legacy. Understanding the features of permanent life insurance can help individuals make informed decisions about their life coverage options.

Adding a Beneficiary: A Simple Guide to Life Insurance

You may want to see also

Universal Life: Flexible, adjustable premiums, potential for higher returns

Universal life insurance offers a unique and flexible approach to life coverage, providing policyholders with a range of benefits and the potential for long-term financial growth. This type of policy is designed to offer both immediate protection and the opportunity to build a substantial cash value over time. One of the key advantages of universal life is its adaptability; it allows policyholders to customize their insurance plan according to their specific needs and financial goals.

In this type of policy, premiums are typically flexible and adjustable, meaning they can be tailored to fit various financial situations. Policyholders can choose to pay a fixed amount regularly or vary the premium payments to accommodate changing circumstances. This flexibility is particularly beneficial for those who may experience fluctuations in income or prefer to have more control over their insurance expenses. For instance, during periods of financial stability, individuals might opt for higher premium payments to accumulate more cash value, which can be useful for future financial objectives. Conversely, when funds are tighter, they can adjust the premiums downward, ensuring the policy remains affordable without compromising its essential coverage.

The cash value accumulation in universal life insurance is a significant feature. As premiums are paid, a portion is allocated towards building a cash reserve, which grows tax-deferred. This cash value can be used for various purposes, such as loaning money to the policyholder, paying for college tuition, or even purchasing an additional policy. The potential for higher returns makes universal life an attractive option for those seeking to maximize their insurance dollar. Over time, the cash value can grow, providing a financial asset that can be borrowed against or withdrawn, offering policyholders a level of financial security and flexibility that traditional term life insurance cannot match.

Furthermore, universal life insurance provides a level of customization that is rare in other insurance products. Policyholders can adjust the death benefit, which is the amount paid to beneficiaries upon the insured's passing, to match their evolving needs. This feature ensures that the insurance coverage remains appropriate as life circumstances change, such as when a family expands or financial goals shift. The ability to customize and adjust makes universal life a versatile tool for managing personal finances and ensuring long-term financial security.

In summary, universal life insurance stands out for its flexibility, adjustable premiums, and the potential for significant cash value accumulation. This type of policy empowers individuals to take control of their insurance needs, adapt to changing financial situations, and potentially build a substantial financial asset over time. With its customizable features and long-term benefits, universal life insurance is an attractive option for those seeking a comprehensive and adaptable life insurance solution.

Life Insurance for San Diego Community College District Employees

You may want to see also

Whole Life: Permanent, fixed premiums, guaranteed death benefit

Whole life insurance is a type of permanent life insurance that offers a range of unique benefits. One of its key advantages is the guarantee of a death benefit, which means that no matter when the insured individual passes away, the beneficiary will receive the full death benefit amount. This is a significant advantage over term life insurance, which only provides coverage for a specified period. With whole life, the coverage is permanent and remains in force for the entire life of the insured, providing long-term financial security for the policyholder's loved ones.

In terms of premiums, whole life insurance offers fixed rates that are determined at the time of policy issuance. This means that the policyholder will pay the same premium amount each year, providing stability and predictability in their insurance expenses. Unlike term life, where premiums can vary based on the term length, whole life premiums remain constant, making it easier for individuals to plan and budget for the future. This fixed-rate structure also ensures that the policyholder's loved ones will not face unexpected increases in insurance costs, providing peace of mind.

Another important aspect of whole life insurance is its accumulation of cash value. As the policyholder pays premiums, a portion of the money goes towards building a cash reserve, which grows tax-deferred. This cash value can be borrowed against or withdrawn, providing a source of funds that can be used for various purposes, such as paying for college tuition, starting a business, or covering unexpected expenses. The ability to access cash value makes whole life insurance a versatile financial tool, allowing individuals to make the most of their premiums and build a financial safety net.

Furthermore, whole life insurance offers a level of flexibility that is not always present in other types of life insurance. Policyholders can choose to increase or decrease the death benefit amount over time, providing the option to adjust coverage as their financial situation changes. Additionally, some whole life policies offer the flexibility to convert the coverage to a different type of policy, such as a term life policy, if the individual's needs evolve. This adaptability ensures that whole life insurance can be tailored to the specific needs and goals of the policyholder.

In summary, whole life insurance stands out for its permanent nature, fixed premiums, and guaranteed death benefit. These features provide long-term financial security, stability in insurance costs, and the potential for cash value accumulation. By offering a comprehensive and adaptable solution, whole life insurance ensures that individuals can protect their loved ones and build a financial safety net that remains in force throughout their lives. It is a valuable option for those seeking a reliable and permanent life insurance solution.

Life Insurance Industry: Stability and Future Outlook

You may want to see also

Variable Life: Investment-linked, offers potential for higher returns, adjustable

Variable life insurance is a unique and flexible type of life insurance that combines the security of a death benefit with the potential for investment growth. Unlike traditional life insurance, where the cash value is fixed, variable life insurance offers a dynamic approach, allowing policyholders to potentially earn higher returns on their premiums. This type of policy is an investment-linked product, providing an opportunity for individuals to grow their money over time.

In a variable life insurance policy, a portion of your premium is invested in a separate account, often referred to as an investment account. This account is similar to a mutual fund, where your money is professionally managed and invested in various assets such as stocks, bonds, and other securities. The performance of these investments directly impacts the cash value of your policy. If the investments perform well, your policy's cash value can grow, potentially providing higher returns compared to traditional life insurance.

One of the key advantages of variable life insurance is its adjustability. Policyholders have the freedom to customize their policy to fit their financial goals and risk tolerance. They can choose how much of their premium to allocate to the investment account, allowing for a personalized approach to wealth accumulation. Additionally, policyholders can make adjustments to their death benefit, investment strategy, and premium payments as their financial situation changes. This flexibility ensures that the policy remains tailored to the individual's needs over time.

The investment aspect of variable life insurance provides an opportunity for long-term wealth building. With proper management and a well-diversified investment strategy, policyholders can potentially earn higher returns compared to traditional fixed-rate investments. However, it's important to note that the investment component carries risks, and the performance of the investments can vary. Policyholders should carefully consider their risk tolerance and consult with a financial advisor to ensure the investment strategy aligns with their financial objectives.

Variable life insurance is an attractive option for those seeking a more dynamic and personalized approach to life insurance. It offers the potential for higher returns through investment-linked growth while providing a customizable and adjustable policy. As with any financial decision, it is crucial to understand the risks and benefits, and seeking professional advice can help individuals make informed choices regarding their life insurance options.

Life Insurance: Weight Discrimination and Your Options

You may want to see also

Frequently asked questions

There are primarily three types of life insurance policies: Term Life, Permanent Life (also known as Whole Life), and Universal Life. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. It is generally more affordable but offers no cash value accumulation. Permanent life insurance, on the other hand, provides lifelong coverage and includes a savings component, allowing policyholders to build cash value over time. Universal life insurance offers flexibility in premium payments and death benefits, allowing policyholders to adjust the coverage as needed.

Determining the appropriate coverage amount involves considering several factors. Start by evaluating your financial obligations, such as mortgage payments, outstanding debts, future education expenses, and the cost of living for your dependents. It's essential to ensure that your life insurance policy can cover these expenses if something happens to you. Additionally, consider your income and the number of years you plan to support your family. A common rule of thumb is to purchase life insurance equal to 10 times your annual income. However, consulting with a financial advisor can provide personalized guidance based on your unique circumstances.

Term life insurance is a straightforward policy that provides coverage for a specific period, as mentioned earlier. It is typically more affordable and offers a fixed premium rate for the duration of the term. If you die during the term, the beneficiary receives the death benefit. Term life is ideal for those seeking temporary coverage, such as during a mortgage period or when starting a family. Whole life insurance, or permanent life, offers lifelong coverage and includes a savings component. It has a fixed premium and a cash value account that grows over time, allowing you to borrow against it or withdraw funds. Whole life provides long-term financial security and can be a valuable asset.

Yes, many term life insurance policies offer conversion options, allowing you to switch from a term policy to a permanent policy without a medical examination. This conversion privilege is often available during the initial term period and may vary depending on the insurance company and policy type. Converting to a permanent policy can provide the security of lifelong coverage and the potential for cash value accumulation. However, it's essential to review the terms and conditions of your specific policy to understand the conversion process and any associated costs or requirements.